Solosuit For Small Business: Simplifying Legal Disputes

Dealing with debt as a small business owner can be overwhelming. Legal disputes and debt settlements add to the stress.

SoloSuit offers a practical solution for navigating these challenges. It’s an automated software designed to assist with debt disputes and lawsuits. SoloSuit helps you respond to debt lawsuits and settle debts outside of court. This can save you time and reduce stress. With step-by-step guidance and attorney-reviewed responses, SoloSuit ensures accuracy and efficiency. Small business owners across the U.S. Can benefit from this service. SoloSuit might be the tool you need to manage debt more effectively and focus on growing your business. Try SoloSuit today and take control of your financial future.

Introduction To Solosuit For Small Business

Small businesses face numerous challenges, including managing finances and dealing with debt. Solosuit offers an innovative solution specifically designed to help small business owners navigate debt disputes. This service can be a vital tool for maintaining financial health and ensuring business continuity.

Understanding Solosuit

Solosuit is an automated software that assists users with debt disputes. It helps small businesses respond to debt lawsuits and settle debts outside of court. The software is user-friendly, providing step-by-step guidance through the entire process.

One key feature is the ability to reply to a debt lawsuit. Solosuit helps businesses compile and file a response to a lawsuit within 14-30 days of receiving a complaint. An attorney reviews each response to ensure accuracy before filing.

Another important feature is the settle a debt option. Solosuit negotiates with collectors to settle debts for less than the face value, helping businesses save money and avoid court proceedings.

Purpose And Importance For Small Businesses

Debt disputes can be overwhelming for small business owners. Solosuit provides automated assistance, making the process simpler and less stressful. This automated guidance is crucial for businesses that may not have the resources to hire a full-time legal team.

By ensuring responses are reviewed by an attorney, Solosuit increases the chances of a favorable outcome. This feature provides peace of mind and reduces the risk of costly errors.

Settlement negotiation is another significant benefit. Solosuit helps businesses settle debts for less than the full amount owed, freeing up funds for other essential business operations. This can be especially important for small businesses working with limited budgets.

Solosuit is available nationwide, making it accessible to small businesses in all 50 states. This broad coverage ensures that more businesses can benefit from its services, regardless of location.

Overall, Solosuit is a valuable tool for small businesses facing debt disputes. It offers automated assistance, attorney review, and settlement negotiation, all designed to help businesses navigate financial challenges more effectively.

Key Features Of Solosuit

SoloSuit offers several features that make it a valuable tool for small businesses. These features streamline legal processes, making debt disputes easier to handle. Below are some of the key features of SoloSuit:

Automated Legal Document Generation

SoloSuit provides automated assistance in generating legal documents. This feature helps users compile and file responses to debt lawsuits quickly. The process involves step-by-step guidance, ensuring that all necessary information is included. An attorney reviews the responses before filing, adding an extra layer of accuracy.

User-friendly Interface

SoloSuit’s interface is designed to be user-friendly. It simplifies the process of navigating debt disputes. The platform offers clear instructions and easy-to-follow steps, making it accessible even for those with limited legal knowledge. This ease of use is particularly beneficial for small business owners who may not have a legal background.

Access To Legal Guidance And Support

Although SoloSuit is not a law firm, it provides valuable legal support. Users have access to attorney reviews for their legal documents. This ensures that the responses are accurate and comply with legal standards. Additionally, SoloSuit offers nationwide coverage, making it accessible to businesses across the United States.

Integration With Existing Business Tools

SoloSuit integrates well with existing business tools. This integration allows for seamless workflow management. Small businesses can easily incorporate SoloSuit into their current operations, enhancing efficiency without disrupting existing processes. This feature is especially useful for businesses that handle multiple legal matters simultaneously.

| Feature | Description |

|---|---|

| Automated Legal Document Generation | Step-by-step guidance and attorney review for debt lawsuit responses. |

| User-Friendly Interface | Easy to navigate, even for users with limited legal knowledge. |

| Access to Legal Guidance and Support | Attorney-reviewed documents and nationwide coverage. |

| Integration with Existing Business Tools | Seamless integration with current business operations. |

Pricing And Affordability

One of the standout features of SoloSuit is its pricing and affordability. Small businesses often face budget constraints, and SoloSuit offers a cost-effective solution to manage debt disputes. This section will break down the pricing structure, cost-effectiveness, and comparison with traditional legal services.

Subscription Plans

SoloSuit offers different subscription plans to cater to various needs and budgets. These plans are designed to provide flexibility and value to small businesses. While specific pricing details are not provided, the subscription model ensures that businesses can choose a plan that fits their financial situation.

| Plan | Features |

|---|---|

| Basic | Reply to a Debt Lawsuit, Attorney Review |

| Premium | Basic Features + Settle a Debt, Settlement Negotiation |

Cost-effectiveness For Small Businesses

SoloSuit provides an affordable alternative to traditional legal services, making it an excellent choice for small businesses. It automates the debt dispute process, reducing the need for expensive legal consultations. Automated Assistance and Attorney Review ensure accuracy and efficiency, saving both time and money.

- Lower costs compared to hiring a lawyer.

- Automated processes reduce administrative expenses.

- Flexible subscription plans to suit different budgets.

Comparison With Traditional Legal Services

Compared to traditional legal services, SoloSuit offers significant advantages. Traditional legal services often come with high hourly rates and additional fees. In contrast, SoloSuit’s subscription plans provide a more predictable and manageable cost structure.

- Traditional Legal Services: High hourly rates, unpredictable costs.

- SoloSuit: Subscription-based, predictable costs.

Additionally, SoloSuit’s Automated Assistance and Attorney Review streamline the process, ensuring that responses are accurate and timely. This efficiency is particularly beneficial for small businesses that need to manage their resources wisely.

Pros And Cons Of Solosuit

SoloSuit is an automated software designed to help users navigate debt disputes. It assists in responding to debt lawsuits and settling debts outside of court. While SoloSuit offers many benefits, it also has its limitations. This section discusses the pros and cons of using SoloSuit for small businesses.

Advantages Based On Real-world Usage

- Automated Assistance: SoloSuit provides step-by-step guidance, making the process easier to follow.

- Attorney Review: Responses are reviewed by an attorney, ensuring accuracy and legal compliance.

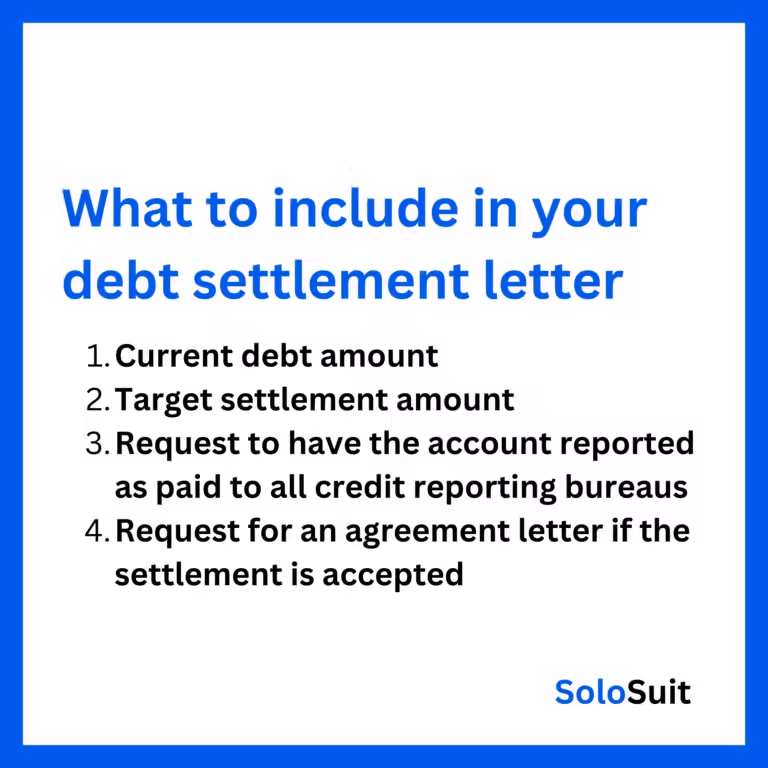

- Settlement Negotiation: SoloSettle helps users negotiate with collectors to settle debts for less than the full amount owed.

- Nationwide Coverage: The service is available in all 50 states, making it accessible to a wide audience.

Challenges And Limitations

- Not a Law Firm: SoloSuit is not a law firm and does not provide legal advice, which can be a limitation for those needing comprehensive legal support.

- Pricing Details: Information about pricing is not explicitly mentioned, which may cause uncertainty for potential users.

- Refund or Return Policies: Details on refunds or return policies are not provided, which could be a concern for users seeking flexibility.

Ideal Users And Scenarios

SoloSuit offers valuable solutions for small businesses and startups. This software is designed to help users manage debt disputes efficiently. It is particularly useful in specific scenarios and for particular users. Below are the ideal users and scenarios for SoloSuit.

Small Businesses Facing Frequent Legal Disputes

Small businesses often encounter legal disputes, especially related to debts. SoloSuit helps these businesses manage these issues without needing a full-time legal team. Automated assistance provides step-by-step guidance, making it easier to respond to debt lawsuits promptly. This can be crucial in maintaining the business’s financial health.

Startups Needing Cost-effective Legal Solutions

Startups usually have tight budgets and cannot afford expensive legal services. SoloSuit offers a cost-effective solution by providing automated software to handle debt disputes. The attorney review feature ensures all responses are accurate and legally sound. This helps startups save money while still managing their legal obligations effectively.

Scenarios Where Solosuit Excels

- Responding to Debt Lawsuits: SoloSuit assists in compiling and filing responses within 14-30 days of receiving a complaint.

- Debt Settlement Negotiations: The SoloSettle feature helps negotiate with collectors to settle debts for less than the owed amount.

- Nationwide Availability: SoloSuit is available in all 50 states, making it accessible for businesses across the country.

Using SoloSuit in these scenarios can significantly reduce the stress and financial burden associated with legal disputes. Businesses can focus more on growth and less on legal challenges.

Frequently Asked Questions

What Is Solosuit For Small Business?

Solosuit is a legal tool designed to help small businesses handle debt collection lawsuits efficiently and affordably.

How Does Solosuit Benefit Small Businesses?

Solosuit simplifies the legal process, saving small businesses time and money by providing easy-to-use legal templates.

Is Solosuit Easy To Use For Small Businesses?

Yes, Solosuit is user-friendly. Small business owners can quickly create necessary legal documents without legal expertise.

Can Solosuit Help With Debt Collections?

Yes, Solosuit assists small businesses in managing and responding to debt collection lawsuits effectively.

Conclusion

SoloSuit offers a practical solution for small businesses facing debt disputes. Its automated software guides you through responding to debt lawsuits and settling debts. This tool can help you manage financial challenges effectively. Using SoloSuit can save you time and stress. Explore SoloSuit today by visiting their website to learn more.