Solosuit Credit Card Reporting: Simplify Your Debt Management

Credit card debt is a common issue for many. Solosuit offers a solution.

Solosuit Credit Card Reporting is here to help you manage and settle your credit card debts efficiently. Their automated tool, SoloSettle, guides users through responding to debt lawsuits and negotiating settlements outside of court. With professional attorney reviews and streamlined processes, Solosuit ensures you can address your debt effectively and affordably. This service is available across all 50 states, providing a wide reach and support for many. Learn how Solosuit can assist you in managing your credit card debt by visiting their site here. Ready to take control of your finances? Let’s dive into how Solosuit’s features can benefit you.

Introduction To Solosuit Credit Card Reporting

Managing credit card debt can be overwhelming. Solosuit Credit Card Reporting offers a streamlined solution. This tool helps individuals handle debt disputes effectively. Let’s explore Solosuit and its purpose in credit card reporting.

What Is Solosuit?

Solosuit is a software tool designed to help users navigate debt disputes. It assists individuals in responding to debt lawsuits and settling debts outside of court. Solosuit provides guidance on compiling responses, attorney review, and filing.

The main features include:

- Reply to a Debt Lawsuit: Offers guidance on responding to debt lawsuits.

- Settle a Debt: Assists in arranging settlements with collectors.

With Solosuit, users can handle debt disputes efficiently and cost-effectively.

Purpose Of Solosuit Credit Card Reporting

The primary purpose of Solosuit Credit Card Reporting is to help users manage and settle credit card debt. This tool aims to provide an automated and professional approach to resolving debt disputes.

Key benefits include:

- Automated Assistance: Streamlines the process of responding to debt lawsuits.

- Professional Review: Ensures responses are reviewed by an attorney.

- Cost-Effective: Helps settle debts for less than the owed amount.

Solosuit covers services in all 50 states, making it widely accessible.

For more information, visit the SoloSuit website.

Key Features Of Solosuit Credit Card Reporting

Solosuit Credit Card Reporting offers a range of features designed to help individuals manage their credit card debts effectively. Below, we explore the key aspects that make this tool indispensable for anyone navigating debt disputes.

Automated Dispute Filing

Automated Dispute Filing streamlines the process of challenging inaccuracies on your credit report. The software automatically compiles necessary documents and submits them to relevant credit bureaus. This saves time and ensures precision.

User-friendly Interface

Solosuit’s interface is designed with simplicity in mind. The user-friendly interface guides users step-by-step, making it easy for anyone to navigate through the process of debt management. Clear instructions and a clean layout enhance user experience.

Real-time Reporting

With Real-Time Reporting, users can track the status of their disputes and settlements as they happen. This feature provides immediate updates, keeping users informed about the progress of their cases.

Comprehensive Debt Management Tools

The platform offers a suite of comprehensive debt management tools to help users manage and settle their debts. This includes tools for calculating settlements, tracking payments, and organizing debt information.

Secure Data Handling

Security is a top priority for Solosuit. Secure data handling ensures that all user information is encrypted and protected against unauthorized access. This guarantees the confidentiality and integrity of sensitive data.

Pricing And Affordability

SoloSuit offers a practical and cost-effective solution for those dealing with credit card debt disputes. Understanding the pricing and affordability of SoloSuit’s services is crucial. Let’s delve into the details under the following subheadings:

Subscription Plans

SoloSuit provides various subscription plans tailored to meet the needs of individuals facing debt lawsuits. While specific pricing details are not disclosed, the platform emphasizes affordability. Users can expect a range of plans that cater to different financial situations. Here is a general idea:

- Basic Plan: Includes essential features for responding to debt lawsuits.

- Advanced Plan: Offers additional tools for settling debts outside of court.

- Premium Plan: Comprehensive services with professional attorney review and filing.

Value For Money

SoloSuit aims to provide value for money by streamlining the debt dispute process. The platform automates responses to debt lawsuits, saving users time and effort. Key benefits include:

- Automated assistance in responding to lawsuits.

- Professional review of responses by an attorney.

- Assistance in settling debts for less than the owed amount.

Considering the wide coverage across all 50 states and the professional review included, SoloSuit offers a cost-effective solution for debt management.

Comparison With Competitors

When compared to competitors, SoloSuit stands out in several ways:

| Feature | SoloSuit | Competitors |

|---|---|---|

| Automated Assistance | Yes | Limited |

| Attorney Review | Included | Additional Cost |

| Wide Coverage | All 50 States | Varies |

| Cost-Effective | Yes | Often Higher |

With SoloSuit, users gain access to a self-help tool that is both affordable and comprehensive, making it a preferred choice for managing credit card debt disputes.

Pros And Cons Of Solosuit Credit Card Reporting

Solosuit Credit Card Reporting provides a way to manage debt disputes. It helps individuals navigate through debt lawsuits and settle debts. However, every tool has its pros and cons. Here is an in-depth look at the advantages and potential drawbacks of using Solosuit.

Advantages Of Using Solosuit

- Automated Assistance: Solosuit offers automated help for responding to debt lawsuits and settling debts. This makes the process faster and more efficient.

- Professional Review: All responses are reviewed by an attorney before filing. This ensures accuracy and adherence to legal standards.

- Cost-Effective: Solosuit provides a realistic approach to settling debts. Often, users can settle debts for less than the owed amount.

- Wide Coverage: Solosuit services are available in all 50 states. This broadens the accessibility for users across the United States.

Potential Drawbacks

- No Specific Pricing Details: The pricing details are not provided in the available information. Users may find it difficult to gauge costs upfront.

- Not a Law Firm: Solosuit is not an attorney or law firm. It does not provide legal advice and offers no guarantees on case outcomes.

- Limited Refund or Return Policies: The provided information does not mention specific refund or return policies. This could be a concern for some users.

Understanding the pros and cons of Solosuit Credit Card Reporting can help users make informed decisions. It is essential to weigh these factors carefully before opting for this service.

Ideal Users And Scenarios

Understanding who should use SoloSuit and the best use cases for SoloSuit credit card reporting can help maximize its benefits. This section provides insight into the ideal users and scenarios for SoloSuit, ensuring you get the most out of this powerful tool.

Who Should Use Solosuit?

SoloSuit is designed for individuals facing debt issues. Specifically, it helps those who:

- Have received a debt lawsuit and need to respond within 14-30 days.

- Seek to settle their debts outside of court.

- Wish to resolve debts for less than the face value owed.

- Need professional review of their responses before filing.

SoloSuit is beneficial for users across the United States. It offers automated assistance, making debt resolution more accessible and cost-effective.

Best Use Cases For Solosuit Credit Card Reporting

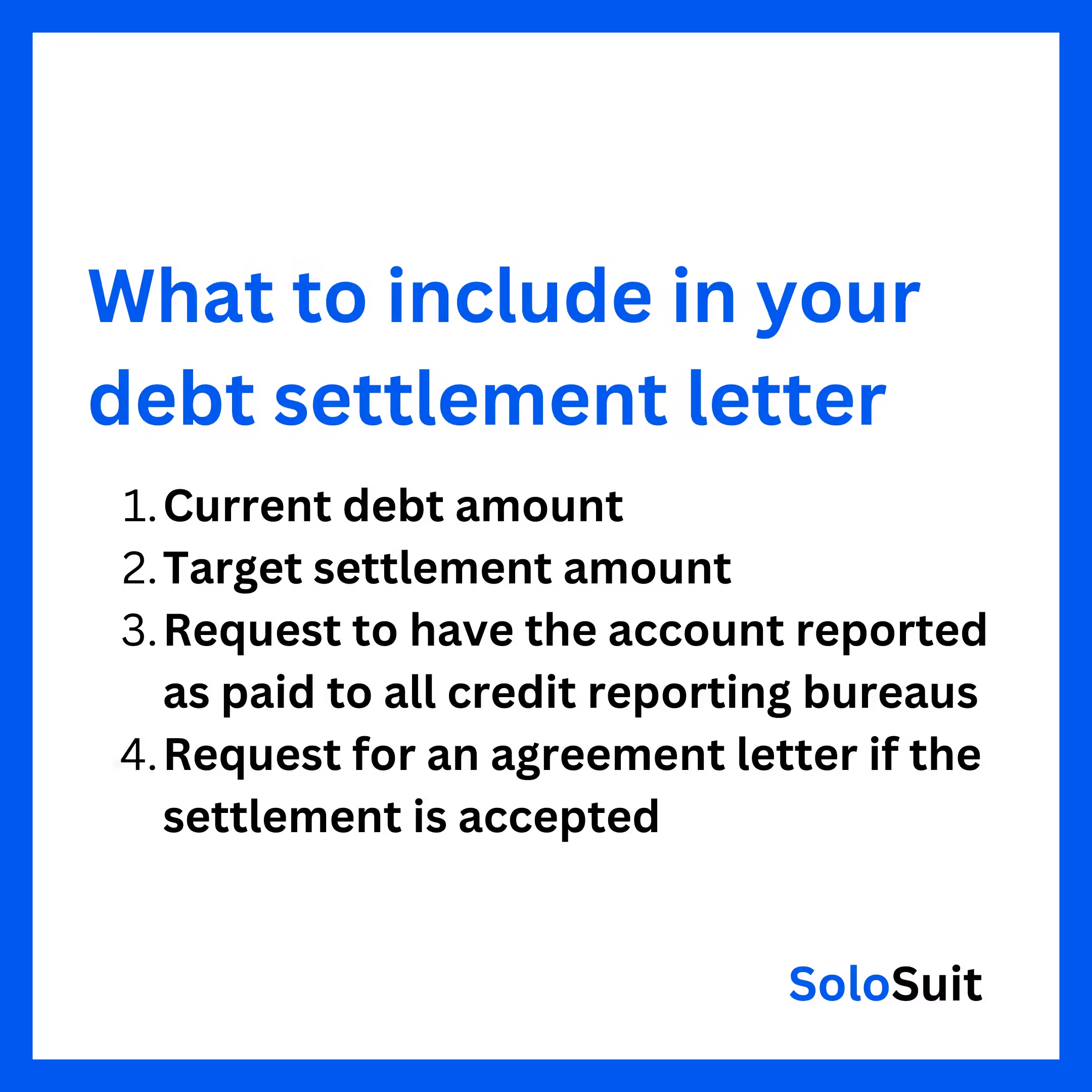

There are several scenarios where SoloSuit proves to be particularly effective:

- Responding to Debt Lawsuits: SoloSuit guides users through the process of replying to debt lawsuits. It ensures timely and accurate responses, reducing legal risks.

- Settling Debts: SoloSuit assists in arranging debt settlements with collectors. This helps in resolving debts outside of court, often for less than the owed amount.

- Seeking Cost-Effective Solutions: SoloSuit provides a realistic and affordable approach. It helps users settle debts without incurring heavy legal fees.

- Needing Wide Coverage: SoloSuit services are available in all 50 states. This makes it a versatile solution for debt issues across the country.

SoloSuit is not a law firm or attorney, and it does not offer legal advice. Instead, it is a self-help tool that provides legal information and automated assistance.

Frequently Asked Questions

What Is Solosuit Credit Card Reporting?

Solosuit Credit Card Reporting helps you manage and dispute credit card debts. It simplifies the process and ensures accuracy.

How Does Solosuit Help With Debt Disputes?

Solosuit guides you through creating legal documents to dispute debts. It makes the process straightforward and less stressful.

Is Solosuit Credit Card Reporting Accurate?

Yes, Solosuit ensures accuracy by using reliable data sources. It helps maintain correct credit card information.

Can Solosuit Improve My Credit Score?

Solosuit can help by resolving disputes and correcting errors. This can positively impact your credit score over time.

Conclusion

SoloSuit Credit Card Reporting offers significant help for those facing debt issues. The tool simplifies responding to debt lawsuits and settling debts. With SoloSuit, you can handle debts more efficiently. To learn more, visit SoloSuit. Take control of your credit card debt today with SoloSuit’s automated assistance.