Secure Payment Processing: Ensure Safe Transactions Every Time

Secure payment processing is crucial for any business. It ensures transactions are safe and builds customer trust.

In today’s fast-paced digital world, businesses must prioritize secure payment solutions. Customers expect quick and safe transactions, whether shopping online or in-store. Implementing a reliable payment system like Square can significantly enhance your business operations. Square offers a comprehensive platform with both software and hardware solutions tailored to various industries. This includes restaurants, retail, and beauty services. Square ensures seamless sales and secure payment processing, providing tools to manage operations, cash flow, and customer engagement effectively. Learn more about Square’s secure payment processing here.

Introduction To Secure Payment Processing

In today’s digital age, secure payment processing is a critical aspect of any business. Ensuring that transactions are safe and efficient builds trust with customers and protects sensitive financial information. Square offers comprehensive tools to streamline secure payment processing, making it easier for businesses to manage their operations and enhance efficiency.

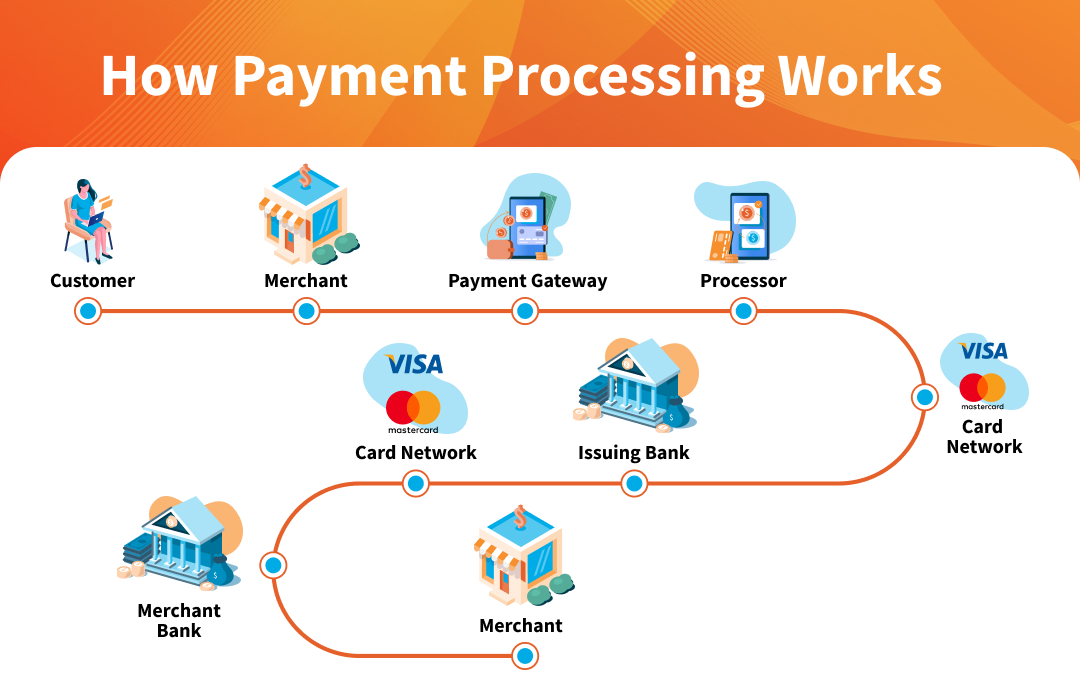

Understanding Payment Processing

Payment processing involves the entire sequence of operations that take place when a customer makes a purchase. This includes:

- Initiation of the transaction

- Authorization of the payment

- Settlement of funds

- Recording the transaction

Square provides hardware and POS systems designed to facilitate seamless sales anywhere. Their solutions include secure payment processing for click and collect, online ordering, local delivery, and shipping options.

The Importance Of Security In Transactions

Security in payment processing is paramount to protect against fraud and data breaches. Key security measures include:

- Encryption of sensitive data

- Secure authentication processes

- Compliance with industry standards

Square ensures secure payment processing by implementing advanced security protocols. Businesses can manage their operations across multiple locations and sales channels securely. Features like instant transfers and next-business-day transfers offer financial flexibility while maintaining high security standards.

Moreover, Square’s tools for team management and customer engagement help businesses optimize performance and enhance customer loyalty. Their advanced reporting capabilities provide access to powerful data, enabling confident decision-making.

By using Square, businesses can enjoy benefits such as:

| Benefit | Description |

|---|---|

| Efficiency | Automation and streamlined operations improve overall business efficiency. |

| Scalability | Manage multi-location businesses and integrate various sales channels. |

| Financial Flexibility | Quick access to funds and customized loan offers to manage cash flow. |

| Customer Loyalty | Enhance customer engagement and retention through centralized data. |

| Revenue Growth | Open new revenue streams and manage inventory effectively to boost profitability. |

Square’s secure payment processing solutions are trusted by millions of businesses globally, making it a reliable choice for enhancing efficiency and opening new revenue streams.

Key Features Of Secure Payment Processing

Secure payment processing is crucial for any business handling transactions. Square offers a robust and secure platform, ensuring safe and efficient payments. Here are the key features that make Square a reliable choice for secure payment processing.

Encryption And Data Protection

Encryption ensures that sensitive data, such as credit card numbers, remains secure. Square uses advanced encryption protocols to protect data during transactions. This means customer information is securely transmitted and stored, reducing the risk of data breaches.

Fraud Detection And Prevention

Square employs sophisticated fraud detection mechanisms to identify and prevent fraudulent activities. By analyzing transaction patterns and behaviors, Square can detect unusual activities and take immediate action. This proactive approach minimizes the risk of fraud and protects both businesses and customers.

Compliance With Security Standards

Square complies with industry security standards, including the Payment Card Industry Data Security Standard (PCI DSS). Compliance ensures that all transactions are processed securely, meeting the highest security requirements. This commitment to security builds trust and confidence among users.

User Authentication Mechanisms

Square integrates robust user authentication mechanisms to verify user identities. This includes multi-factor authentication (MFA) and secure login procedures. These measures ensure that only authorized users can access the payment system, enhancing overall security.

Square’s secure payment processing features enable businesses to handle transactions confidently. By prioritizing encryption, fraud detection, compliance, and user authentication, Square ensures a safe and efficient payment experience for all users.

Pricing And Affordability Of Secure Payment Processing Solutions

Finding a secure payment processing solution that is both effective and affordable is crucial for businesses of all sizes. Secure payment processing ensures the safety of financial transactions, protecting both businesses and customers from potential fraud and data breaches. In this section, we will explore the cost breakdown of popular solutions and compare the price versus security benefits to help you make an informed decision.

Cost Breakdown Of Popular Solutions

Understanding the cost structure of secure payment processing solutions helps businesses budget effectively. Here is a breakdown of the costs associated with some popular solutions, including Square:

| Solution | Setup Fees | Transaction Fees | Additional Costs |

|---|---|---|---|

| Square | None | 2.6% + 10¢ per transaction | Instant Transfers for a small fee, free next-business-day transfers |

| PayPal | None | 2.9% + 30¢ per transaction | Additional fees for international transactions |

| Stripe | None | 2.9% + 30¢ per transaction | Custom pricing for enterprise solutions |

Comparing Price Vs. Security Benefits

When evaluating payment processing solutions, it’s essential to compare the cost against the security benefits offered. Here’s a comparison of what you can expect from different providers:

- Square: Offers a comprehensive platform with secure payment processing, advanced reporting, and tools for operational management. The transaction fee is 2.6% + 10¢, with optional instant transfers for a small fee.

- PayPal: Known for its robust security features, including fraud detection and buyer protection. The transaction fee is higher at 2.9% + 30¢, with additional costs for international transactions.

- Stripe: Provides customizable security options and supports a wide range of payment methods. The transaction fee is 2.9% + 30¢, with enterprise solutions available at custom rates.

Choosing the right payment processing solution involves considering both the cost and the security features. Square, for example, offers a balance of affordability and comprehensive security, making it a popular choice among businesses.

Pros And Cons Of Various Secure Payment Processing Tools

Choosing the right payment processing tool can impact your business. In this section, we will explore the pros and cons of different secure payment processing tools.

Advantages Of Leading Tools

Payment processing tools offer various advantages, enhancing business operations. Here are some benefits of leading tools:

- Square: Square provides a comprehensive platform that includes both hardware and software solutions. Businesses can facilitate seamless sales anywhere with Square’s POS systems.

- Security: These tools ensure secure payment processing, protecting both the business and customers.

- Integration: Many tools offer integrations with other business software, improving efficiency.

- Customer Engagement: Tools like Square offer centralized customer data and insights to increase loyalty and value.

| Tool | Key Advantage |

|---|---|

| Square | Custom-tailored suites for various business types |

| Tool 2 | Another Key Advantage |

Limitations And Challenges

While payment processing tools offer many benefits, they also have limitations and challenges:

- Cost: Some tools charge fees for instant transfers or other services. For instance, Square offers instant transfers for a small fee.

- Complexity: Managing multiple locations and sales channels can be complex.

- Loan Offers: Customized loan offers are subject to eligibility and approval. Square requires a minimum payment every 60 days, with full repayment within 18 months.

| Challenge | Impact |

|---|---|

| Cost | Additional fees for instant transfers |

| Complexity | Managing operations across multiple locations |

| Loan Offers | Subject to eligibility and approval |

Specific Recommendations For Ideal Users Or Scenarios

Secure payment processing is crucial for businesses of all sizes. The right solution can enhance efficiency and customer trust. Here are specific recommendations for different business scenarios to help you choose the best option for your needs.

Best Solutions For Small Businesses

Small businesses need cost-effective and easy-to-use payment solutions. Square is ideal for small businesses due to its comprehensive platform and simple pricing model.

- Hardware and POS Systems: Facilitate seamless sales anywhere.

- Payment Solutions: Secure processing, online ordering, and delivery options.

- Cash Flow Management: Instant transfers for a small fee or free next-business-day transfers.

These features help small businesses manage their operations and cash flow efficiently. Square also offers customized loan options based on sales, which can be crucial for growth.

Recommendations For Large Enterprises

Large enterprises require robust solutions to manage multiple locations and sales channels. Square offers scalable tools to meet these needs.

| Feature | Benefit |

|---|---|

| Operational Management | Streamline operations across multiple locations. |

| Advanced Reporting | Access powerful data for decision-making. |

| Revenue Diversification | Open new revenue streams with inventory management. |

With Square, large enterprises can efficiently manage their teams and enhance customer engagement through centralized data. This leads to improved customer loyalty and retention.

Top Picks For E-commerce Platforms

E-commerce platforms need secure and flexible payment solutions to handle online transactions. Square provides a robust suite for e-commerce businesses.

- Online Presence: Create a branded website for online orders.

- Payment Solutions: Secure processing for shipping and local delivery.

- Inventory Synchronization: Sync inventory with Square POS.

These features ensure that e-commerce platforms can manage their online presence effectively. Additionally, Square‘s advanced reporting tools help track profit margins and make data-driven decisions.

Frequently Asked Questions

What Is Secure Payment Processing?

Secure payment processing ensures that financial transactions are safe from fraud. It involves encryption and compliance with industry standards.

Why Is Secure Payment Processing Important?

It protects sensitive financial information from theft and fraud. It also builds customer trust and ensures compliance with regulations.

How Does Encryption Secure Payments?

Encryption converts data into a secure code. This prevents unauthorized access and ensures the safe transmission of information.

What Are Common Secure Payment Methods?

Credit cards, digital wallets, and bank transfers are common secure payment methods. Each uses encryption and security protocols.

Conclusion

For secure payment processing, trust in Square. It offers reliable and efficient solutions. Square provides tailored tools for businesses of all types. Streamline operations and enhance customer loyalty. Access advanced reporting for informed decisions. Manage cash flow and employee performance with ease. Ready to upgrade your payment system? Visit Square today.