Secure Financial Tools: Empower Your Financial Future Today

In today’s digital age, financial security is more crucial than ever. Protecting your finances from fraud and identity theft is essential.

EverSafe® is here to help. It’s a comprehensive financial wellness tool designed to safeguard your money. Whether you’re managing your own finances or helping a loved one, EverSafe® provides smart alerts and monitoring. It tracks everything from spending habits to real estate title changes. This tool is especially valuable for seniors and their caregivers, offering specialized features to protect against scams and financial abuse. With EverSafe®, you get a consolidated family dashboard, personalized alerts, and round-the-clock support. Want to try it out? EverSafe® offers a 30-day free trial. Explore more about EverSafe® by visiting EverSafe.

Introduction To Secure Financial Tools

In today’s digital age, managing finances securely is essential. Secure financial tools offer protection against fraud, identity theft, and age-related financial issues. They provide peace of mind for individuals and families alike. One such tool is EverSafe. This tool monitors financial activities and alerts users to suspicious behavior. Let’s explore what secure financial tools are, their importance, and how they empower your financial future.

What Are Secure Financial Tools?

Secure financial tools are designed to safeguard your finances. They monitor transactions, alert you to unusual activities, and provide an overview of your financial health. For instance, EverSafe offers:

- Smart Alerts: Notifications for changes in spending, cash usage, dormant credit cards, and more.

- Comprehensive Monitoring: Tracks bills, account balances, banking, credit card activity, and more.

- Personalized Alerts: Creates a personal financial profile to detect irregular activity.

- Consolidated Family Dashboard: Manages all family accounts in one place.

The Importance Of Secure Financial Management

Managing finances securely is crucial. It protects against financial scams, fraud, and identity theft. Tools like EverSafe offer enhanced security and proactive alerts. These features help identify and prevent suspicious activities promptly. They also provide a holistic view of family finances across multiple institutions, ensuring you stay informed and in control.

Empowering Your Financial Future With Technology

Technology empowers us to manage our finances with ease and confidence. EverSafe, for example, offers:

- Senior-Focused Protection: Specialized algorithms cater to the needs of older adults.

- Support and Resolution: Access to experts for fraud remediation and financial issue resolution.

- Round-the-Clock Support: Assistance from former law enforcement professionals.

By leveraging these tools, you can ensure a secure financial future for yourself and your loved ones. Start with a 30-day free trial to evaluate the service and experience the benefits firsthand.

Key Features Of Secure Financial Tools

EverSafe® provides a comprehensive suite of features to ensure financial wellness. These tools are designed to protect against fraud, identity theft, and age-related financial issues. Here are the key features that make EverSafe® stand out:

Advanced Encryption And Security Protocols

EverSafe® uses advanced encryption to protect user data. Their security protocols ensure that sensitive information remains confidential and secure. This includes tracking and safeguarding family finances, providing peace of mind to seniors and caregivers.

User-friendly Interfaces For Easy Management

The EverSafe® platform offers a user-friendly interface that simplifies financial management. Users can manage all family accounts and institutions in one place via the consolidated family dashboard. This makes it easy to monitor and control finances.

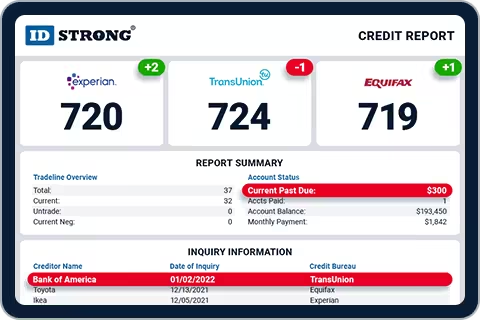

Real-time Monitoring And Alerts

EverSafe® provides real-time monitoring of financial activities. Users receive smart alerts for changes in spending, cash usage, dormant credit cards, and missing deposits. Personalized alerts detect irregular activity by creating a personal financial profile.

Comprehensive Financial Planning Tools

EverSafe® offers tools for comprehensive monitoring. This includes tracking upcoming and late bills, account balances, banking activities, credit card usage, investment and retirement activities, and home values. Users also benefit from enhanced analytics that provide deeper insights into their financial health.

Multi-device Synchronization

EverSafe® supports multi-device synchronization. Users can access their accounts and manage their finances from multiple devices. This ensures that caregivers and family members can stay informed and assist in monitoring activities effectively.

EverSafe® is designed to provide enhanced security, proactive alerts, and comprehensive financial planning tools. It is particularly beneficial for seniors, offering specialized protection and support to manage financial issues effectively.

Pricing And Affordability

When it comes to securing your finances, understanding the cost of tools like EverSafe® is crucial. This section will delve into the pricing models, compare free and paid options, and provide a cost-benefit analysis.

Overview Of Pricing Models

EverSafe® offers a 30-day free trial to new users, allowing them to experience the full range of features. Post-trial, users can choose from different paid plans. These plans are structured to meet various financial monitoring needs and offer flexible payment options.

Comparing Free Vs. Paid Options

Here’s a comparison of the free trial and paid options:

| Feature | 30-Day Free Trial | Paid Plans |

|---|---|---|

| Smart Alerts | Included | Included |

| Comprehensive Monitoring | Included | Included |

| Personalized Alerts | Included | Included |

| Consolidated Family Dashboard | Included | Included |

| “Extra Set of Eyes” Feature | Included | Included |

| Specialized Protection for Seniors | Included | Included |

| Round-the-Clock Support | Included | Included |

Cost-benefit Analysis

Investing in EverSafe® provides numerous benefits:

- Enhanced Security: Protects against fraud and identity theft.

- Comprehensive Monitoring: Covers multiple financial aspects.

- Proactive Alerts: Identifies suspicious activities promptly.

- Senior-Focused: Tailored protection for older adults.

- Support and Resolution: Expert assistance for financial issues.

The cost of paid plans is justified by the extensive features and peace of mind provided. Users can start with the free trial to gauge the service’s effectiveness.

Pros And Cons Of Secure Financial Tools

Secure financial tools like EverSafe® offer numerous benefits for managing and protecting personal finances. These tools can help users safeguard against fraud, monitor financial activities, and provide peace of mind. Below, we explore the advantages and potential drawbacks of using secure financial tools.

Advantages Of Using Secure Financial Tools

- Enhanced Security: Secure financial tools protect against financial scams, fraud, and identity theft.

- Comprehensive Monitoring: These tools provide a holistic view of family finances across multiple institutions.

- Proactive Alerts: Users receive notifications for changes in spending, cash usage, and suspicious activity.

- Senior-Focused: Specialized protection catered to the needs of older adults, including support for powers of attorney and trusts.

- Support and Resolution: Expert assistance is available to manage and resolve financial issues.

- Consolidated Family Dashboard: Manage all family accounts and institutions in one place.

- Round-the-Clock Support: Access to former law enforcement professionals for fraud remediation.

Potential Drawbacks And Limitations

- Cost: Some users may find subscription costs to be high after the free trial period.

- Complexity: The tool’s features might be overwhelming for users not tech-savvy.

- Privacy Concerns: Users may worry about sharing personal financial information with a third-party service.

- Dependency on Alerts: Users might become overly dependent on alerts and miss managing their finances proactively.

- Refund Policy: Lack of a clear refund or return policy could be a concern for some users.

User Feedback And Real-world Usage

| User Feedback | Real-World Usage |

|---|---|

| Many seniors appreciate the specialized protection features. | Users report feeling more secure with round-the-clock monitoring. |

| Caregivers value the consolidated family dashboard for managing accounts. | Families use the “Extra Set of Eyes” feature to involve trusted relatives. |

| Some users find the alerts system highly effective in preventing fraud. | Real estate title change alerts helped users catch suspicious activity. |

| Users praise the support and resolution provided by former law enforcement professionals. | Comprehensive monitoring across banking, credit cards, and investments offers peace of mind. |

EverSafe® is a powerful tool for those seeking to protect their finances. Its features cater to the needs of seniors and families, providing comprehensive monitoring and proactive alerts.

Specific Recommendations For Ideal Users

Choosing the right financial tools is essential for safeguarding your finances. Whether you are an individual user, a small business owner, or a financial advisor, specific financial tools can help you manage and protect your assets effectively. Below are tailored recommendations based on different user needs.

Best Tools For Individual Users

For individuals, EverSafe® is an excellent choice. This tool is designed to protect against fraud, identity theft, and age-related financial issues. It offers features like:

- Smart Alerts: Notifications for changes in spending, cash usage, and suspicious vendors.

- Comprehensive Monitoring: Tracks account balances, banking, credit card activity, and more.

- Personalized Alerts: Detects irregular activity based on a personal financial profile.

These features ensure that individual users have a holistic view of their finances and are promptly alerted to any suspicious activity. EverSafe® also provides round-the-clock support, making it a reliable choice for individual financial security.

Top Picks For Small Business Owners

Small business owners need tools that offer comprehensive financial monitoring and fraud protection. EverSafe® can be a valuable asset. Key features include:

- Consolidated Family Dashboard: Manages multiple accounts and institutions in one place.

- Extra Set of Eyes: Allows trusted professionals to receive alerts and assist in monitoring.

- Round-the-Clock Support: Access to former law enforcement professionals for fraud remediation.

These features help small business owners keep track of their finances and protect against potential fraud, ensuring the financial health of their business.

Recommended Tools For Financial Advisors

Financial advisors can benefit greatly from using EverSafe® to monitor and protect their clients’ finances. This tool provides:

- Specialized Protection for Seniors: Enhanced algorithms for deeper protection.

- Personalized Alerts: Detects irregular activity tailored to individual client profiles.

- Support and Resolution: Expert assistance for managing and resolving financial issues.

These features allow financial advisors to offer robust financial protection and peace of mind to their clients, especially seniors.

Frequently Asked Questions

What Are Secure Financial Tools?

Secure financial tools are software or services designed to protect your financial data. They help prevent unauthorized access, fraud, and data breaches.

How Do Secure Financial Tools Work?

They use encryption, authentication, and monitoring to safeguard your financial information. These tools ensure only authorized users can access sensitive data.

Why Are Secure Financial Tools Important?

They protect your financial data from cyber threats. Using them minimizes the risk of identity theft and financial fraud.

Which Features Should Secure Financial Tools Have?

Look for encryption, multi-factor authentication, and regular security updates. These features ensure your financial data remains protected.

Conclusion

Secure financial tools are vital for safeguarding your finances. EverSafe® offers comprehensive protection against fraud and identity theft. With smart alerts and personalized monitoring, it ensures your financial security. Seniors receive specialized protection, and family members can assist through a consolidated dashboard. EverSafe® provides round-the-clock support from former law enforcement professionals. Start your 30-day free trial today to experience enhanced financial security. Check out EverSafe® here for more details and protect your finances effectively.