Secure Credit Monitoring: Protect Your Financial Future Today

In today’s digital world, protecting your financial information is crucial. Secure credit monitoring helps safeguard against fraud and identity theft.

EverSafe® is a financial wellness tool designed to keep your finances secure. It targets seniors and caregivers, offering a “second set of eyes” to monitor your credit, bills, and real estate. With smart alerts, comprehensive monitoring, and round-the-clock support, EverSafe ensures your financial safety. The service even includes a Trusted Advocate Feature, allowing you to designate trusted individuals to help monitor your accounts. The specialized protection for seniors, created by experts in aging and fraud, provides deeper security. Try EverSafe® now and enjoy peace of mind with its 30-day free trial. Safeguard your financial future today!

Introduction To Secure Credit Monitoring

In today’s digital age, protecting your credit is more important than ever. Secure credit monitoring services offer a vital layer of defense against fraud and identity theft. One such service, EverSafe®, provides comprehensive monitoring to safeguard your financial health.

What Is Secure Credit Monitoring?

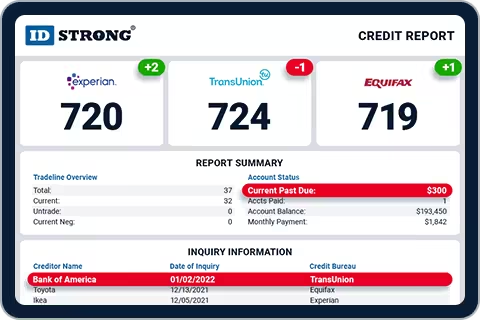

Secure credit monitoring involves tracking your credit reports for any unusual or suspicious activity. Services like EverSafe® notify you of changes in your credit files across all three bureaus. This includes alerts for new accounts, changes in account balances, and potential identity theft.

EverSafe® goes beyond basic credit monitoring by also keeping an eye on your account balances, real estate title changes, and more. It acts as a “second set of eyes” to ensure nothing slips through the cracks. This makes it especially useful for seniors and caregivers.

Importance Of Credit Monitoring For Financial Security

Credit monitoring is crucial for maintaining financial security. It helps prevent financial exploitation by alerting you to unusual spending, use of dormant credit cards, and missing deposits. This early detection allows you to address issues before they cause significant damage.

EverSafe® offers several features to enhance your financial security:

- Smart Alerts: Notifications for unusual activity and suspicious vendors.

- Personal Detection and Alert System: Analyzes daily transactions for erratic activity.

- Trusted Advocate Feature: Allows trusted individuals to assist in monitoring.

- Round-the-Clock Support: Access to fraud remediation experts.

- Consolidated Family Dashboard: Monitors all family finances in one place.

By using EverSafe®, you can ensure peace of mind and protect your family’s financial security. The service is designed to be user-friendly and offers specialized protection for seniors, making it an ideal choice for those in need of comprehensive financial monitoring.

Key Features Of Secure Credit Monitoring

Secure credit monitoring is essential to protect your financial health. EverSafe® offers a range of features designed to keep your finances safe and secure. Here are the key features of EverSafe® that you should know about.

Real-time Alerts And Notifications

EverSafe® provides Smart Alerts to notify you of unusual spending, dormant credit card use, missing deposits, and suspicious vendors. This real-time alert system ensures you are immediately aware of any potential threats to your finances.

Comprehensive Credit Report Access

With EverSafe®, you get comprehensive monitoring of your credit files from all three credit bureaus. This includes tracking account balances, real estate title changes, and other critical financial activities.

Identity Theft Protection

EverSafe® offers a Personal Detection and Alert System that analyzes daily transactions to identify erratic activity. This system helps in preventing identity theft by alerting you to any suspicious behavior.

Additionally, the Trusted Advocate Feature allows you to designate trusted individuals who can receive alerts and assist in monitoring your finances.

Credit Score Tracking And Analysis

EverSafe® provides continuous tracking and analysis of your credit score. This helps you understand your credit health and take proactive steps to improve it.

With EverSafe®, you also benefit from round-the-clock support from fraud remediation experts, including former law enforcement professionals. This ensures that you have access to professional help whenever you need it.

The Consolidated Family Dashboard is another valuable feature, allowing you to monitor all family finances in one place. It provides notices about unpaid bills, changes in interest rates, and more.

EverSafe® offers specialized protection for seniors with enhanced algorithms designed by experts in aging and fraud. This ensures deeper protection against financial exploitation.

How Secure Credit Monitoring Benefits You

Secure credit monitoring offers numerous advantages to safeguard your financial health. Using tools like EverSafe®, you can stay protected from fraud and make better financial decisions. Here are some key benefits you can enjoy:

Early Detection Of Fraudulent Activities

Secure credit monitoring helps in the early detection of fraudulent activities. With EverSafe®, you receive smart alerts for unusual spending and suspicious vendors. This lets you act quickly before significant damage occurs. The system continuously tracks your account balances and credit files from all three bureaus. It even monitors real estate title changes.

Better Financial Decision Making

Access to comprehensive monitoring enables better financial decision making. EverSafe® provides a consolidated family dashboard that shows all your finances in one place. You get notices about unpaid bills and changes in interest rates. This helps you manage your family’s finances more effectively.

Additionally, the personal detection and alert system analyzes daily transactions to identify erratic activity. It ensures you stay informed about your financial health at all times.

Peace Of Mind And Stress Reduction

Secure credit monitoring offers peace of mind and stress reduction. EverSafe® provides round-the-clock support with fraud remediation experts, including former law enforcement professionals. This ensures you have access to expert support whenever needed.

Moreover, the trusted advocate feature allows you to designate trusted individuals to receive alerts and assist in monitoring. This is especially useful for seniors and caregivers, offering specialized protection against age-related financial issues.

By using EverSafe®, you can prevent financial exploitation, ensuring your family’s financial security with continuous monitoring and alerts. To learn more, visit EverSafe®.

Pricing And Affordability Of Secure Credit Monitoring Services

Secure credit monitoring services help protect your financial health. Understanding their costs and benefits is crucial. This section explores the pricing and affordability of these services, focusing on EverSafe®.

Cost Breakdown Of Different Service Plans

EverSafe® offers a variety of service plans. Here’s a detailed breakdown:

| Plan | Features | Monthly Cost |

|---|---|---|

| Basic Plan | Smart Alerts, Comprehensive Monitoring | $9.99 |

| Plus Plan | Basic Plan Features + Trusted Advocate Feature | $14.99 |

| Premium Plan | All Features + Round-the-Clock Support | $19.99 |

EverSafe® also offers a 30-Day Free Trial, allowing users to test the service before committing.

Value For Money Analysis

EverSafe® provides significant value for its cost. Here are some key points:

- Smart Alerts notify you of any unusual activities.

- Comprehensive Monitoring covers account balances, credit files, and more.

- Round-the-Clock Support ensures immediate help from fraud experts.

These features ensure your financial security, making EverSafe® a worthwhile investment.

Free Vs. Paid Services: What You Need To Know

Free credit monitoring services offer basic features. However, paid services like EverSafe® provide more comprehensive protection.

- Free Services:

- Basic alerts

- Limited monitoring

- No expert support

- Paid Services:

- Advanced alerts

- Comprehensive monitoring

- Access to fraud experts

While free services offer some protection, paid services provide extensive security and peace of mind.

Pros And Cons Of Using Secure Credit Monitoring

Secure credit monitoring services, like EverSafe®, offer a range of benefits and some limitations. Understanding these can help you make an informed decision about protecting your financial wellness.

Advantages Of Secure Credit Monitoring

Using a service such as EverSafe® comes with several advantages:

- Smart Alerts: Receive notifications for unusual spending, use of dormant credit cards, and more. These alerts can help you catch suspicious activity early.

- Comprehensive Monitoring: Tracks account balances, credit files from all three bureaus, and real estate title changes. This ensures a holistic view of your financial health.

- Personal Detection and Alert System: Analyzes daily transactions to identify erratic activity. This helps in quickly detecting any anomalies.

- Trusted Advocate Feature: Allows you to designate trusted individuals to receive alerts. This is particularly useful for seniors and their caregivers.

- Round-the-Clock Support: Access to fraud remediation experts, including former law enforcement professionals. This ensures you have expert help whenever needed.

- Consolidated Family Dashboard: Monitors all family finances in one place. This feature provides notices about unpaid bills, changes in interest rates, and more.

- Specialized Protection for Seniors: Enhanced algorithms designed by aging and fraud experts. This offers deeper protection for senior users.

Potential Drawbacks And Limitations

While EverSafe® offers numerous benefits, there are some potential drawbacks and limitations to consider:

- Cost: While there is a 30-day free trial, the service is paid after that. Ensure you are comfortable with the pricing before committing.

- Refund Policy: The refund policy is not explicitly mentioned. You may need to contact EverSafe® directly for details on refunds.

- Dependency on Alerts: Relying solely on alerts may lead to complacency. It’s important to remain vigilant about your finances.

- Complexity for Non-Tech-Savvy Users: Some features might be complex for those not comfortable with technology. Although age-friendly, some users may still need assistance.

Secure credit monitoring services like EverSafe® provide significant benefits in protecting your financial wellness. However, it’s essential to be aware of any potential limitations to make the best decision for your needs.

Specific Recommendations For Ideal Users

EverSafe® offers a robust financial wellness tool designed to protect against fraud, identity theft, and age-related financial issues. It’s essential to understand who would benefit most from secure credit monitoring and in what scenarios these services are particularly advantageous.

Who Should Consider Secure Credit Monitoring?

Secure credit monitoring is not just for one type of person. Various users can benefit from the comprehensive services offered by EverSafe®.

- Seniors: EverSafe® is specifically designed to protect older adults from financial exploitation with enhanced algorithms.

- Caregivers: Caregivers can monitor their loved ones’ finances, ensuring no unusual activity goes unnoticed.

- Families: The consolidated family dashboard allows for monitoring all family finances in one place, making it easier to manage accounts.

- Individuals with Multiple Accounts: Those with several credit cards, savings accounts, or real estate properties can benefit from comprehensive monitoring.

Best Scenarios For Utilizing Secure Credit Monitoring Services

Understanding when to use secure credit monitoring services can maximize their benefits. Here are some ideal scenarios:

- Unusual Spending Patterns: EverSafe® sends smart alerts for unusual spending, dormant credit card usage, and suspicious vendors.

- Financial Management for Seniors: Specialized protection designed by aging and fraud experts offers deeper security for older adults.

- Real Estate Protection: Tracks real estate title changes, providing alerts for any unauthorized activity.

- Family Financial Oversight: The family dashboard helps in managing and monitoring all family finances, ensuring no bills go unpaid.

- Fraud and Identity Theft Concerns: Round-the-clock support from fraud remediation experts helps in resolving issues and creating recovery plans.

EverSafe® is ideal for those wanting to ensure their financial security and peace of mind, particularly in managing multiple accounts or protecting older adults.

Frequently Asked Questions

What Is Secure Credit Monitoring?

Secure credit monitoring involves tracking your credit reports and scores for unusual activity. It helps prevent identity theft.

Why Is Credit Monitoring Important?

Credit monitoring helps detect fraud early. It alerts you to unauthorized activities, protecting your credit score.

How Does Credit Monitoring Work?

Credit monitoring services notify you of changes in your credit report. This includes new accounts or hard inquiries.

Can Credit Monitoring Prevent Identity Theft?

While it can’t prevent identity theft, credit monitoring can detect it early. This minimizes potential damage to your credit.

Conclusion

Safeguarding your credit is essential. EverSafe® offers comprehensive and reliable monitoring. Protect your finances from fraud and identity theft. Enjoy peace of mind with smart alerts and expert support. Plus, the 30-day free trial makes it easy to start. Try EverSafe® today. Learn more at EverSafe.