Responsible Credit Card Usage: Smart Tips for Financial Health

Responsible credit card usage is crucial for maintaining financial health. Misuse can lead to debt and damaged credit scores.

Understanding responsible credit card usage helps you avoid financial pitfalls. It’s about using credit cards wisely to build a strong financial foundation. This includes paying bills on time, keeping balances low, and understanding your card’s terms. By practicing these habits, you can improve your credit score and enjoy financial freedom. One helpful tool for managing credit responsibly is the Possible Loan and Possible Card from Possible Finance. These products are designed to support individuals, even with bad credit, offering quick and fair financial solutions. They help build credit history without the risk of falling into debt traps, making them a smart choice for responsible credit card usage.

Introduction To Responsible Credit Card Usage

Credit cards can be a valuable financial tool when used responsibly. They offer convenience, rewards, and the ability to build credit history. But without proper management, they can lead to debt and financial stress. This guide will help you understand how to use credit cards responsibly and enhance your financial health.

Understanding The Importance Of Credit Card Management

Responsible credit card usage is crucial for maintaining a healthy financial life. Here are some key aspects to consider:

- Budgeting: Always spend within your means. Create a budget to track your expenses and ensure you can pay your bill in full each month.

- Timely Payments: Pay your credit card bill on time to avoid late fees and interest charges. This also helps improve your credit score.

- Credit Utilization: Keep your credit utilization ratio low. This means using only a small portion of your available credit.

How Responsible Usage Impacts Financial Health

Using credit cards responsibly can positively affect your financial health in many ways:

- Improved Credit Score: On-time payments and low credit utilization can boost your credit score.

- Better Loan Terms: A good credit score can help you qualify for better loan terms and lower interest rates.

- Financial Flexibility: Managing your credit well provides flexibility in times of need, such as emergency expenses.

Possible Loan and Possible Card are excellent tools for those seeking to improve their financial health. They offer accessible credit options with fair terms, helping users avoid debt traps and build a positive credit history.

| Feature | Possible Loan | Possible Card |

|---|---|---|

| Loan Amount | Borrow up to $500 | $400 or $800 credit limit |

| Repayment Plan | 4 installments‡ | Monthly fee of $8 or $16 |

| Credit Building | On-time payments help build credit† | Helps build credit history |

| Fees | No late or penalty fees | 0% interest, no late fees |

With these features, Possible Finance products aim to support individuals in managing their finances effectively. They provide quick funding, avoid debt traps, and offer opportunities for credit improvement.

Key Features Of Credit Cards

Understanding the key features of credit cards is essential for responsible usage. Knowing these features helps make informed decisions about using credit cards effectively. Let’s delve into some of the important aspects such as credit limits, interest rates, reward programs, and the role of credit scores.

Credit Limits And How They Work

Credit limits refer to the maximum amount of money you can borrow using your credit card. This limit is determined by the card issuer based on various factors including your credit score, income, and repayment history.

| Feature | Description |

|---|---|

| Possible Card | Unlock a $400 or $800 credit limit instantly¹ |

It’s important to stay within your credit limit to avoid additional fees and maintain a good credit score. Exceeding your limit can result in declined transactions and potential penalties.

Interest Rates: What You Need To Know

Interest rates are the cost of borrowing money on your credit card. These rates can vary based on the type of card and your creditworthiness. High-interest rates can lead to significant debt if balances are not paid off in full.

The Possible Card offers a unique benefit with 0% interest forever and no late fees, making it easier to manage your finances without the burden of accumulating interest.

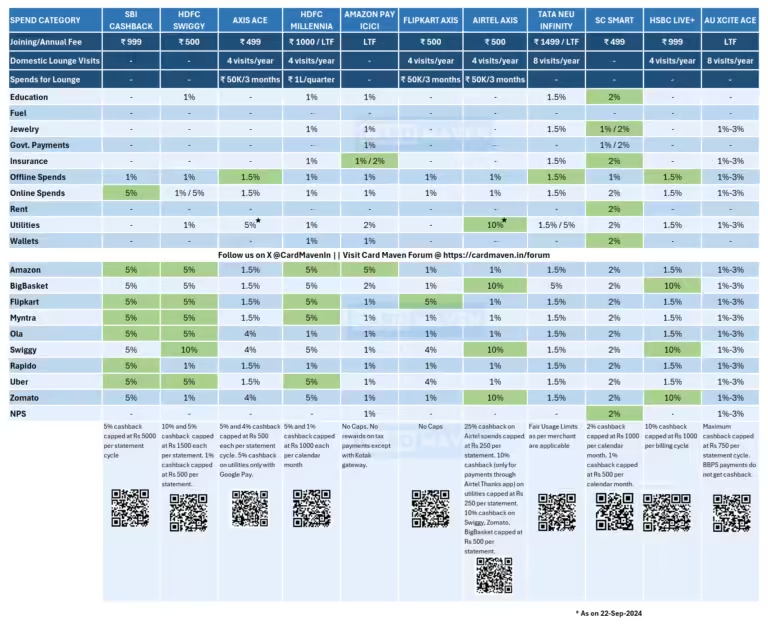

Reward Programs And Benefits

Many credit cards offer reward programs that provide benefits like cashback, travel points, or discounts. These rewards can be a great incentive if used wisely.

- Possible Card: Helps build credit history

- No interest charges

- No late fees

Utilizing these rewards can lead to significant savings and benefits over time. Always check the reward structure and ensure it aligns with your spending habits.

The Role Of Credit Scores

Your credit score plays a crucial role in determining your eligibility for credit cards and the terms offered. A higher credit score can lead to better interest rates and higher credit limits.

The Possible Card is designed to help improve your credit score. By making on-time payments, you can build and enhance your credit history, making you eligible for better financial products in the future.

Using credit cards responsibly involves understanding these key features. Keeping track of your credit limit, managing interest rates, leveraging reward programs, and maintaining a good credit score are all essential steps towards financial health.

Smart Tips For Using Credit Cards Responsibly

Credit cards offer convenience and can help build your credit score. But using them carelessly can lead to debt. Here are some smart tips for using credit cards responsibly to ensure your financial health.

Creating And Sticking To A Budget

It’s essential to create a budget before using your credit card. List your income and expenses. Allocate a specific amount for credit card spending. This helps prevent overspending.

Stick to your budget. If you set a $200 limit for monthly credit card use, don’t exceed it. Consistency in sticking to your budget helps maintain financial discipline.

Paying Off Balances In Full

Paying off your balances in full every month is crucial. It prevents interest charges from accumulating. This saves you money in the long run.

Partial payments can lead to debt. Avoid carrying a balance from one month to the next. This practice keeps you out of financial trouble and helps improve your credit score.

Avoiding Unnecessary Purchases

Use your credit card for essential purchases only. Avoid buying things you don’t need. This habit helps you stay within your budget.

Impulse buying is dangerous. It can lead to debt. Always ask yourself if a purchase is necessary before using your credit card.

Monitoring Your Statements Regularly

Regularly monitoring your credit card statements is vital. Review your statements monthly. Check for any errors or unauthorized charges.

This helps you spot issues early. It also ensures you are aware of your spending habits. Being proactive about monitoring your statements can prevent financial mishaps.

For a reliable financial solution, consider Possible Loan and Possible Card. These products are designed to provide quick and fair financial solutions.

| Feature | Possible Loan | Possible Card |

|---|---|---|

| Loan/Credit Limit | Up to $500 | $400 or $800 |

| Interest and Fees | No late or penalty fees | 0% interest, $8 or $16 monthly fee |

| Repayment Plan | 4 installments‡ | No late fees |

| Credit Building | Helps build credit history | Helps build credit history |

For more details, visit Possible Finance.

Pricing And Affordability Of Credit Cards

Understanding the pricing and affordability of credit cards is crucial for responsible usage. Credit cards can offer financial flexibility, but they come with costs that can impact your budget. It’s important to be aware of these costs and manage them effectively.

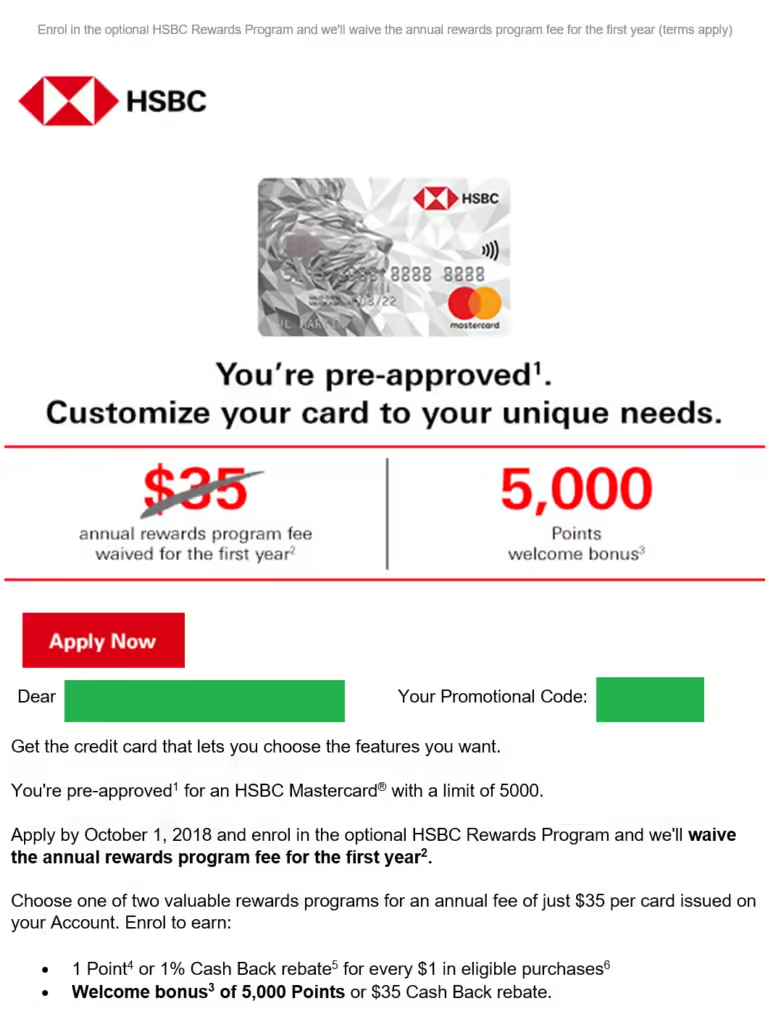

Annual Fees And How To Avoid Them

Many credit cards charge an annual fee for the benefits they offer. This fee can range from $0 to several hundred dollars. To avoid these fees, consider the following tips:

- Choose a card with no annual fee. Many credit cards, including the Possible Card, offer this benefit.

- Look for promotions. Some cards waive the annual fee for the first year.

- Negotiate with your card issuer. Sometimes, they may waive the fee if you ask.

Understanding And Managing Interest Charges

Interest charges can significantly increase the cost of using a credit card. Understanding how interest works and how to manage it is key to avoiding debt:

- Pay your balance in full each month. This way, you avoid interest charges altogether.

- Know your interest rate. Higher rates mean higher charges if you carry a balance.

- Consider cards with 0% interest offers. The Possible Card offers 0% interest forever, making it a cost-effective option.

Comparing Different Credit Card Offers

Not all credit cards are created equal. Comparing different offers can help you find the best card for your needs:

| Card Name | Annual Fee | Interest Rate | Special Features |

|---|---|---|---|

| Possible Card | $8 or $16/month | 0% interest forever | No late fees, credit building |

| Other Card | $95/year | 15.99% APR | Cashback rewards |

When comparing cards, consider the total cost, including fees and interest. Look for features that match your spending habits and financial goals.

Pros And Cons Of Using Credit Cards

Credit cards can be a double-edged sword. They offer many benefits but also come with significant risks. Understanding the pros and cons can help you use them responsibly. Let’s explore the advantages and disadvantages of using credit cards.

Advantages: Convenience, Rewards, And Building Credit

Convenience is one of the biggest advantages of credit cards. They allow you to make purchases without carrying cash. You can also use them for online shopping, which makes buying things much easier.

Rewards programs are another benefit. Many credit cards offer points, cashback, or travel miles for every dollar spent. These rewards can add up quickly and provide significant savings or benefits.

Using a credit card responsibly can help in building credit. Regular and on-time payments improve your credit score. A higher credit score can lead to better loan terms and interest rates in the future.

Disadvantages: Debt Risk And Interest Costs

The most significant disadvantage is the debt risk. It’s easy to overspend with a credit card. If you don’t pay off your balance, the debt can quickly grow.

Another major downside is the interest costs. If you carry a balance, you will have to pay interest. Credit card interest rates are often high, which can make it hard to pay off the debt.

To manage these risks, consider products like the Possible Card. The Possible Card offers a $400 or $800 credit limit with 0% interest forever and no late fees. This can help avoid debt traps while still building credit.

| Possible Card Features | Details |

|---|---|

| Credit Limit | $400 or $800 |

| Interest | 0% forever |

| Monthly Fee | $8 or $16 |

| Late Fees | None |

| Credit Building | Helps build credit history |

By understanding these advantages and disadvantages, you can make informed decisions and use credit cards to your benefit.

Specific Recommendations For Ideal Users

Using credit cards responsibly is key to maintaining good financial health. Here are tailored recommendations for different types of users. Whether you’re a student, a frequent traveler, or someone looking to improve your credit score, these tips can help you manage your credit card wisely.

Students And First-time Credit Card Users

For students and those new to credit cards, starting with a simple and manageable card is important. Consider these tips:

- Start with a low-limit card: Avoid the temptation to overspend.

- Set a budget: Track your spending and stick to a monthly budget.

- Pay in full: Aim to pay your balance in full each month to avoid interest.

- Use for essentials: Use the card for necessary expenses like groceries and transportation.

Frequent Travelers And Reward Maximizers

Travel enthusiasts and those who love earning rewards can benefit from specific credit card features. Consider these strategies:

- Choose a travel rewards card: Look for cards with travel points or miles.

- Utilize airport perks: Cards offering lounge access and free checked bags can enhance your travel experience.

- Maximize rewards: Use your card for all travel-related expenses to accumulate points faster.

- Pay attention to fees: Be mindful of foreign transaction fees and annual fees associated with some travel cards.

Individuals Looking To Improve Their Credit Score

Improving your credit score requires diligent management and a good strategy. Follow these tips:

- Pay on time: Timely payments are crucial for a better credit score.

- Keep balances low: Maintain a low balance relative to your credit limit.

- Use credit-building products: Consider using the Possible Loan and Possible Card to help build your credit history.

- Monitor your credit: Regularly check your credit report for errors and track your progress.

Using credit cards wisely can help you achieve your financial goals. Whether you’re just starting out, love to travel, or aim to improve your credit score, these tailored recommendations can guide you towards responsible credit card usage.

Conclusion: Maintaining Financial Health With Credit Cards

Using credit cards responsibly can significantly enhance your financial health. By adhering to sound financial habits, you can avoid debt traps and build a strong credit history.

Summarizing Key Points

- Understand your spending limits: Stick to a budget and avoid overspending.

- Pay on time: Timely payments prevent late fees and improve your credit score.

- Monitor your statements: Regularly check for errors and track your expenses.

- Use credit wisely: Only use credit for necessary purchases you can repay.

- Avoid multiple cards: Managing too many cards can complicate your finances.

Encouraging Responsible Financial Habits

Here are some practices to maintain financial health with credit cards:

- Budgeting: Create a monthly budget and adhere to it strictly.

- Set reminders: Use reminders to ensure timely payments.

- Limit card usage: Use one or two cards to simplify management.

- Review statements: Regularly review statements to catch any errors.

- Emergency fund: Maintain an emergency fund to avoid reliance on credit.

Using tools like the Possible Card can help you manage credit effectively. It offers features such as:

| Feature | Details |

|---|---|

| Credit Limit | $400 or $800 instantly¹ |

| Interest | 0% forever |

| Monthly Fee | $8 or $16 |

| Credit Building | Helps build credit history |

The Possible Loan also supports financial health by offering:

- Loan Amount: Borrow up to $500

- Repayment Plan: Pay over time in 4 installments‡

- No Fees: No late or penalty fees

- Credit Building: Helps build credit history with timely payments†

By integrating these responsible habits and utilizing the Possible Finance products, you can achieve and maintain financial health. For more detailed information, visit Possible Finance.

Frequently Asked Questions

How Can I Use Credit Cards Responsibly?

Use credit cards responsibly by paying your balance in full each month. Avoid unnecessary purchases and monitor your spending regularly. Set a budget and stick to it.

What Are The Benefits Of Responsible Credit Card Usage?

Responsible credit card usage helps you build a good credit score. It also provides financial flexibility and potential rewards. Avoiding debt is another key benefit.

How Do I Avoid Credit Card Debt?

Avoid credit card debt by paying your balance in full. Avoid spending more than you can afford to repay. Monitor your credit card statements regularly.

Should I Have Multiple Credit Cards?

Having multiple credit cards can be beneficial if managed properly. It offers more credit options and potential rewards. Ensure you can handle multiple payments responsibly.

Conclusion

Responsible credit card usage can greatly benefit your financial health. Always pay your balance on time. Keep track of your spending habits. Avoid maxing out your credit limits. These practices help improve your credit score. If you need financial support, consider Possible Finance. Their Possible Loan and Possible Card offer fair and accessible solutions. They cater to individuals with bad credit. Responsible usage ensures you avoid debt traps. Building a strong credit history is achievable with discipline and smart choices. Make informed decisions today for a secure financial future.