Reliable Credit Reporting: Your Guide to Accurate Scores

Reliable credit reporting is crucial for maintaining a healthy financial profile. Understanding your credit score can open doors to better financial opportunities.

In today’s fast-paced world, having access to reliable credit reporting tools is more important than ever. Whether you’re looking to apply for a loan, a credit card, or simply want to keep track of your financial health, knowing where you stand with your credit score is essential. Zable UK offers a range of services designed to help individuals build or improve their credit scores. Through their user-friendly app, you can easily track spending, report rent payments, and monitor your credit score. This comprehensive approach ensures you have all the tools you need to manage your finances effectively. Discover more about Zable’s offerings and how they can help you achieve your financial goals by visiting their official website here.

Introduction To Credit Reporting

Understanding credit reporting is crucial for personal finance management. It helps in building or improving credit scores, which can significantly affect your financial opportunities. This section will explore the basics of credit reporting, its importance, and how it impacts your financial health.

What Is Credit Reporting?

Credit reporting involves collecting and maintaining an individual’s credit history. Credit bureaus like Equifax, Experian, and TransUnion gather data from various financial institutions. This data includes loans, credit cards, and payment histories.

These bureaus compile the data into a credit report. Lenders use these reports to assess creditworthiness. A credit report contains personal information, credit accounts, credit inquiries, and public records. Monitoring your credit report can help you identify errors and protect against identity theft.

Importance Of Accurate Credit Scores

Accurate credit scores are vital for many reasons. They affect your ability to get loans, credit cards, and sometimes even jobs. A high credit score can lead to better loan terms and lower interest rates. Conversely, a low credit score can limit your financial options.

Maintaining an accurate credit score is essential. It ensures you get the best financial opportunities available. Using services like Zable can help you build and improve your credit score. Zable offers tools for spending tracking, rent reporting, and credit monitoring.

Here are some key benefits of Zable’s services:

- Credit Cards for Bad Credit: Helps build credit scores with responsible use.

- Personal Loans: Quick approval process, often within an hour.

- Free Credit Score: Access to Equifax credit score with insights into credit history.

- Spend Tracking: Monitor all accounts and spending in one place.

- Rent Reporting: Build credit history by reporting rent payments.

Zable also offers fast and friendly support, enhancing your experience. Their services aim to make credit management easier and more accessible.

For more information, visit the Zable website or download the Zable app.

Key Features Of Reliable Credit Reporting

Reliable credit reporting is crucial for managing your personal finances. Accurate and timely credit reports help you understand and improve your financial health. Here are the key features of reliable credit reporting:

Data Accuracy And Verification

Accurate data is the foundation of reliable credit reporting. Ensuring that all information is correct and verified reduces the risk of errors. Zable UK uses advanced verification methods to maintain high data accuracy. This includes:

- Cross-checking data with multiple sources

- Regular audits to identify discrepancies

- Immediate correction of any identified errors

Regular verification ensures your credit report reflects your true financial behavior. This can help you build or improve your credit score effectively.

Timely Updates And Reporting

Timely updates are essential for keeping your credit report current. Zable UK ensures that your credit information is updated regularly. This means:

- Frequent updates to reflect recent transactions

- Immediate reporting of changes in credit status

- Real-time notifications for significant updates

With timely updates, you can track your credit status more accurately. This helps in making informed financial decisions.

Comprehensive Credit Histories

Comprehensive credit histories provide a complete picture of your financial behavior. Zable UK includes all relevant information in your credit report. This comprehensive approach covers:

- Credit card usage and payment history

- Personal loans and repayment records

- Rent payments and other significant financial activities

Having a detailed credit history helps lenders make better decisions. It also helps you understand your financial strengths and areas for improvement.

For more information on Zable UK’s credit reporting features, visit their website.

How Reliable Credit Reporting Benefits You

Reliable credit reporting is essential for your financial well-being. It plays a significant role in various aspects of your financial life. Here’s how it can benefit you:

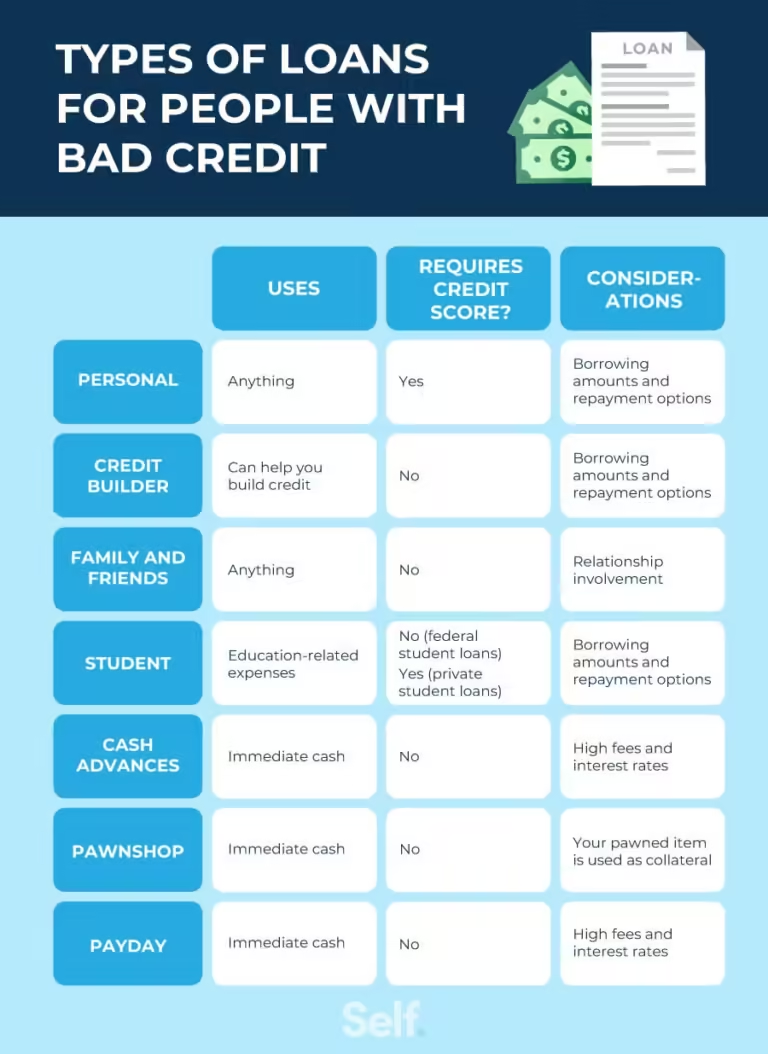

Better Loan And Credit Card Approvals

Reliable credit reporting improves your chances of getting approved for loans and credit cards. Services like Zable UK offer credit cards and personal loans designed to help build or improve your credit score. This increases your approval odds by up to 35% using your banking history.

With a better credit report, lenders see you as a trustworthy borrower. This can lead to quicker approvals and better terms. For example, Zable offers a quick approval process with most customers receiving their loan in under an hour.

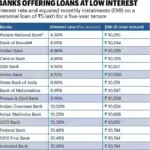

Lower Interest Rates

A good credit report can help you secure lower interest rates on loans and credit cards. Zable’s personal loans have an APR ranging from 9.9% to 49.9%, with an example rate of 32.5% APR representative for a £7,500 loan over 36 months.

Lower interest rates mean you pay less in interest over time, saving you money. This can make a significant difference, especially for large loans or long-term credit card balances.

Improved Financial Planning

Reliable credit reporting helps you plan your finances better. Zable provides tools for spending tracking, rent reporting, and credit monitoring through their app. These tools allow you to monitor all your accounts and spending in one place.

Understanding your credit score and financial habits helps you make informed decisions. You can set realistic financial goals, budget effectively, and avoid debt.

Access to a free Equifax credit score and insights into your credit history is also provided by Zable. This helps you keep track of your financial progress and take steps to improve your credit score.

| Feature | Benefit |

|---|---|

| Credit Cards for Bad Credit | Helps build credit scores with responsible use |

| Personal Loans | Quick approval process, most customers receive their loan in under an hour |

| Free Credit Score | Access to Equifax credit score with insights into credit history |

| Spend Tracking | Monitor all accounts and spending in one place |

| Rent Reporting | Build credit history by reporting rent payments |

Reliable credit reporting is crucial for better financial health. With tools and features like those offered by Zable, you can improve your credit score and achieve your financial goals more effectively.

Common Issues In Credit Reporting

Credit reporting plays a crucial role in personal finance management. However, there are several common issues that can arise. These issues can affect your credit score and financial health. Addressing these problems can help you maintain a reliable credit report.

Errors And Discrepancies

Errors in credit reports are more common than you might think. These mistakes can include incorrect personal information, wrong account details, or inaccurate payment history. Such errors can lower your credit score unjustly.

It’s essential to regularly check your credit report for discrepancies. If you find any errors, dispute them with the credit bureau. This can help ensure your credit report accurately reflects your financial activities.

Identity Theft And Fraud

Identity theft is a severe issue that can wreak havoc on your credit report. Fraudsters can open accounts in your name, making charges and damaging your credit score.

To protect yourself, monitor your credit report for any unfamiliar accounts or activities. Zable offers tools for credit monitoring, which can help you detect and address fraudulent activities quickly.

Outdated Information

Outdated information can also negatively impact your credit score. This can include old accounts that are no longer active or debts that have been paid off but still appear as outstanding.

Regularly reviewing your credit report can help you spot and remove outdated information. Keeping your credit report up-to-date ensures it accurately reflects your current financial status.

| Common Issues | Impact | Solution |

|---|---|---|

| Errors and Discrepancies | Lower credit score | Dispute with credit bureau |

| Identity Theft and Fraud | Severe credit damage | Monitor credit report |

| Outdated Information | Inaccurate credit history | Review and update credit report |

By addressing these common issues, you can maintain a reliable and accurate credit report. This will help you build a better financial future.

Pricing And Affordability Of Credit Reporting Services

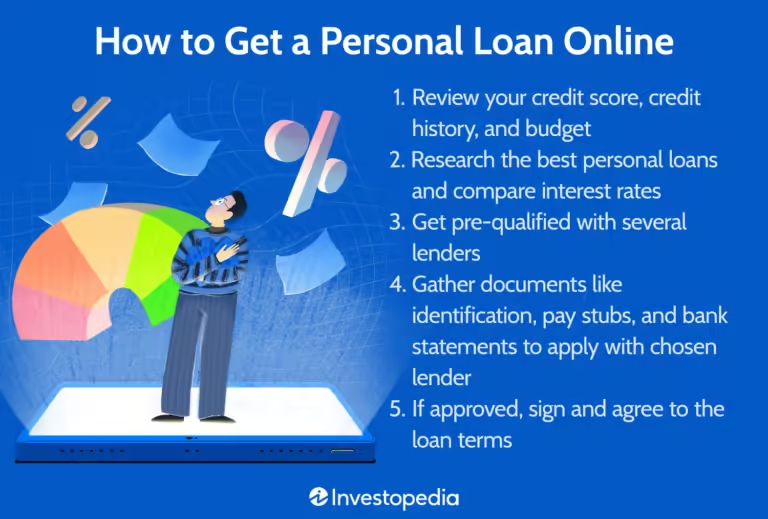

Understanding the cost of credit reporting services is crucial. Different services offer various pricing models. Some provide free access, while others have subscription plans. Let’s explore these options.

Free Vs. Paid Credit Reports

Many credit reporting services offer both free and paid versions. Free reports usually include basic information. They are useful for a quick credit check.

Paid credit reports come with additional features. These might include detailed credit history, alerts for credit changes, and identity theft protection. Investing in a paid report can offer more comprehensive insights. This can help in making better financial decisions.

Subscription Plans And Their Benefits

Subscription plans offer ongoing access to credit information. These plans usually provide regular updates and detailed reports. They also include tools for monitoring and improving credit scores.

Below is a table summarizing the benefits of typical subscription plans:

| Plan Type | Features | Cost |

|---|---|---|

| Basic |

|

£10/month |

| Premium |

|

£20/month |

Choosing the right plan depends on individual needs. For those serious about monitoring their credit, a premium plan might be worth the investment.

For more information on credit card and personal loan options, visit Zable UK.

Pros And Cons Of Different Credit Reporting Agencies

Understanding the pros and cons of different credit reporting agencies is crucial. Each agency has unique benefits and drawbacks. Knowing these can help you make informed decisions about managing your credit.

Major Credit Bureaus: Equifax, Experian, And Transunion

The three major credit bureaus in the UK are Equifax, Experian, and TransUnion. Each provides comprehensive credit reports and scores. Let’s look at them in detail:

| Credit Bureau | Strengths | Weaknesses |

|---|---|---|

| Equifax |

|

|

| Experian |

|

|

| TransUnion |

|

|

Pros Of Using Established Agencies

Using established credit reporting agencies like Equifax, Experian, and TransUnion comes with significant advantages:

- Comprehensive Data: They collect data from various sources, providing a complete credit picture.

- Trusted by Lenders: These agencies are widely trusted, making your credit report more credible.

- Advanced Tools: They offer various tools like credit monitoring and fraud alerts, enhancing your credit management.

- Accessibility: Many services, like Zable, provide free credit score access from these bureaus.

Cons And Limitations

Despite their benefits, established credit reporting agencies have some limitations:

- Cost: Accessing full reports often requires a paid subscription.

- Data Breaches: Occasional data breaches can compromise your personal information.

- Customer Service: Customer service can be slow or unresponsive at times.

- Dispute Processes: Disputing errors can be complex and time-consuming.

Understanding these pros and cons can help you make better decisions about which credit reporting agency to use. Each has its strengths and weaknesses, so choose the one that best fits your needs.

How To Ensure Accurate Credit Scores

Ensuring accurate credit scores is crucial for maintaining financial health. A reliable credit score affects your ability to secure loans, credit cards, and even rental agreements. Here are some effective strategies to ensure your credit scores are accurate and up-to-date.

Regular Monitoring And Review

Regularly monitoring your credit report is essential. This helps you stay informed about your financial status. Review your report from all three major credit bureaus: Equifax, Experian, and TransUnion.

- Check for inaccuracies in personal information, such as name and address.

- Verify that all credit accounts listed are yours.

- Look for any unauthorized transactions or accounts.

Zable offers tools for spending tracking and rent reporting. These features can help you keep an eye on your financial activities and ensure everything is reported accurately.

Disputing Errors Effectively

If you find any errors on your credit report, it’s important to dispute them promptly. Errors can negatively impact your credit score.

- Gather evidence to support your dispute, such as bank statements or payment receipts.

- Contact the credit bureau where the error appears.

- Submit a formal dispute letter along with your evidence.

- Follow up to ensure the error is corrected.

Zable provides free access to your Equifax credit score with insights into your credit history. This feature can help you identify and rectify any discrepancies quickly.

Utilizing Credit Monitoring Tools

Credit monitoring tools can alert you to changes in your credit report. These tools provide real-time updates, allowing you to take immediate action if something unusual occurs.

Zable offers a comprehensive app that includes credit monitoring. With this app, you can:

- Track spending across all accounts in one place.

- Receive alerts for any significant changes in your credit report.

- Report rent payments to build your credit history.

Using these tools can help you maintain an accurate and up-to-date credit score.

For more information, visit the Zable website or download the Zable app.

Recommendations For Ideal Users

Reliable credit reporting is crucial for various users. Zable UK offers valuable services through its credit cards and personal loans. Here are the ideal users who can benefit from Zable’s offerings.

Individuals Seeking Loans Or Mortgages

Individuals planning to apply for loans or mortgages need a strong credit score. Zable’s credit cards can help build or improve credit scores. With responsible use, users can enhance their credit history.

Zable’s personal loans come with a quick approval process. Most users receive their loan within an hour. This quick access to funds can be vital for those needing urgent financial assistance.

| Feature | Benefit |

|---|---|

| Credit Cards for Bad Credit | Build credit scores with responsible use |

| Personal Loans | Quick approval process |

| Free Credit Score | Access to Equifax credit score |

Credit Card Applicants

Applicants for credit cards often seek ways to improve their creditworthiness. Zable’s credit cards are designed for those with bad credit. They offer an opportunity to build a positive credit history.

Using the Zable app, users can track their spending and monitor their credit scores. This helps in managing finances effectively and staying on top of their credit status.

- Instant virtual card access with Apple Pay or Google Pay

- Spending tracking for better financial management

- No impact on credit score when checking eligibility

Businesses Evaluating Creditworthiness

Businesses often need to assess the creditworthiness of potential partners or clients. Zable provides tools for rent reporting, which can enhance credit history. This is beneficial for businesses evaluating an individual’s financial reliability.

With over 123,000 positive reviews on Trustpilot, App Store, and Google Play, Zable is a trusted source for accurate credit reporting. Businesses can rely on Zable’s data for informed decision-making.

- Access to comprehensive credit scores

- Insights into credit history and spending patterns

- Enhanced approval odds using banking history

Frequently Asked Questions

What Is Reliable Credit Reporting?

Reliable credit reporting refers to accurate and timely information about an individual’s credit history. It ensures lenders make informed decisions.

Why Is Credit Reporting Important?

Credit reporting is crucial for lenders to assess creditworthiness. It impacts loan approvals, interest rates, and financial opportunities.

How Can I Improve My Credit Report?

To improve your credit report, pay bills on time. Reduce outstanding debt and regularly check for errors.

What Factors Affect Credit Reporting?

Factors affecting credit reporting include payment history, credit utilization, length of credit history, and new credit inquiries.

Conclusion

Reliable credit reporting ensures better financial decisions. Zable UK offers great tools for this. Their credit cards and loans can help build your credit score. Use their app for tracking and monitoring. Fast approval and no credit impact on checks make it easy. For more details, visit the Zable UK website.