Real-Time Expense Tracking: Maximize Savings and Financial Control

Tracking expenses can be a daunting task. But it doesn’t have to be.

Real-time expense tracking is a modern solution that offers transparency and control over your finances. Whether you manage a small business or your personal budget, staying on top of expenses in real time can make a huge difference. It helps in preventing overspending, ensuring compliance, and making informed financial decisions. With tools like Emburse, you can automate and streamline this process. Emburse’s software is designed to help users manage travel and expenses efficiently, providing insights and analytics that are crucial for better financial planning. If you want to save time, improve compliance, and gain better control over your finances, real-time expense tracking with Emburse could be the answer. For more details, visit the Emburse website.

Introduction To Real-time Expense Tracking

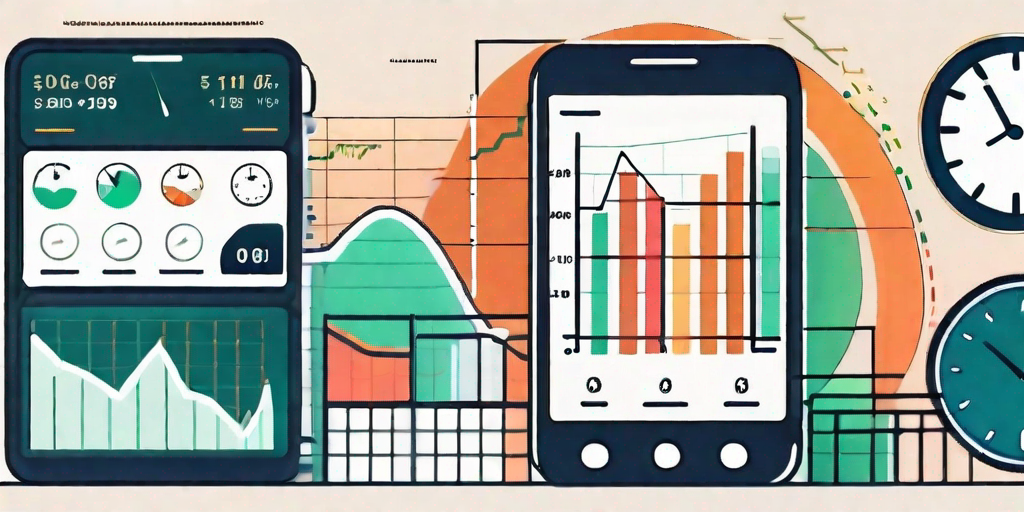

In today’s fast-paced world, managing finances efficiently is crucial. Real-time expense tracking helps individuals and businesses stay on top of their financial activities. This approach ensures that every expense is monitored and recorded as it happens, providing an up-to-date view of financial health.

What Is Real-time Expense Tracking?

Real-time expense tracking involves monitoring and recording expenses as they occur. This method leverages technology to automatically update financial records, offering immediate insights into spending patterns. Tools like Emburse Travel and Expense Management Software make this process seamless, integrating travel, payments, and analytics into one platform.

With Emburse, you can manage travel expenses, automate invoice processing, and gain valuable insights through advanced analytics. These features help streamline processes and ensure compliance, making financial management more efficient.

The Importance Of Tracking Expenses In Real-time

Tracking expenses in real-time offers several key benefits:

- Enhanced Financial Control: Real-time tracking helps maintain control over finances by providing immediate visibility into spending.

- Improved Budget Adherence: By monitoring expenses as they happen, you can ensure adherence to budgets and financial policies.

- Data-Driven Decisions: Real-time insights empower users to make informed decisions, optimizing financial planning and reducing waste.

- Time-Saving Automation: Automation of repetitive tasks saves time and enhances efficiency, allowing users to focus on more strategic activities.

- Enhanced Compliance: Proactive controls and compliance measures ensure adherence to financial regulations and policies.

Emburse’s comprehensive software solutions cater to these needs, offering future-proof solutions designed to adapt and evolve with changing business requirements.

For more information, visit the Emburse website.

Key Features Of Real-time Expense Tracking Tools

Real-time expense tracking tools offer numerous features to help individuals and businesses manage their finances efficiently. Below are some of the key features that make these tools indispensable.

Instant Expense Logging

With real-time expense tracking tools, you can log expenses instantly using mobile apps or web interfaces. This ensures that all transactions are recorded as they happen, reducing the risk of forgetting or misplacing receipts.

Automatic Categorization Of Expenses

These tools automatically categorize expenses based on predefined rules. This feature saves time and ensures that all expenses are correctly classified, making it easier to analyze spending patterns.

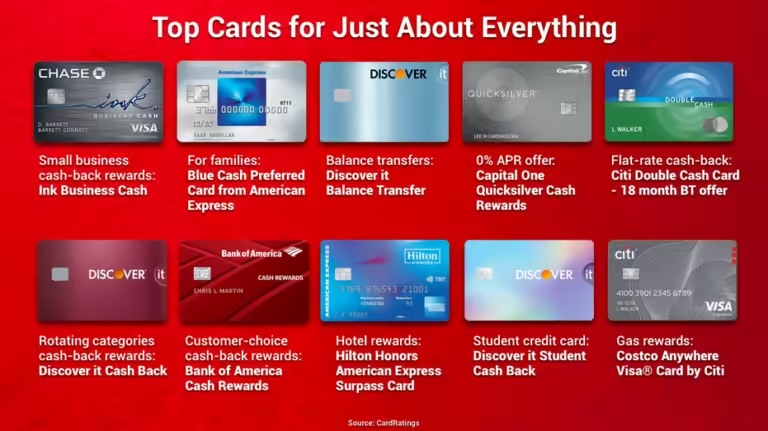

Integration With Bank Accounts And Credit Cards

Real-time expense tracking tools can integrate seamlessly with bank accounts and credit cards. This allows for automatic import of transactions, ensuring that your financial records are always up to date.

Real-time Notifications And Alerts

Receive real-time notifications and alerts for transactions, low balances, or any suspicious activity. This helps in maintaining control over your finances and preventing fraud.

Detailed Financial Reports And Analytics

Generate detailed financial reports and analytics with real-time data. This feature provides valuable insights into spending habits and helps in making informed financial decisions.

| Feature | Description |

|---|---|

| Instant Expense Logging | Log expenses instantly using mobile apps or web interfaces. |

| Automatic Categorization | Automatically categorize expenses based on predefined rules. |

| Bank & Credit Card Integration | Integrate with bank accounts and credit cards for automatic import of transactions. |

| Real-Time Notifications | Receive notifications for transactions, low balances, or suspicious activity. |

| Financial Reports & Analytics | Generate detailed financial reports and analytics with real-time data. |

Benefits Of Using Real-time Expense Tracking

Real-time expense tracking offers numerous advantages for individuals and businesses. It helps to keep finances in check, manage budgets efficiently, and make informed financial decisions. Below are some key benefits of using real-time expense tracking.

Enhanced Financial Awareness And Control

Using real-time expense tracking, like Emburse, provides immediate visibility into your spending habits. This immediate insight helps you understand where your money goes, allowing you to make informed financial decisions. You stay aware of your financial status at all times, avoiding surprises and maintaining control over your finances.

Improved Budget Management

Real-time expense tracking helps create and stick to budgets. With Emburse’s tailored solutions, you can monitor expenses against your budget in real-time. This monitoring ensures that you stay within your spending limits and make adjustments as needed. Improved budget management leads to better financial health and reduces the risk of overspending.

Reduction In Unnecessary Spending

Tracking expenses in real-time highlights unnecessary purchases. By identifying these spending patterns, you can cut back on wasteful expenses. Emburse’s advanced analytics provide insights that help in making cost-saving decisions. Reducing unnecessary spending frees up funds for more important financial goals.

Increased Savings Over Time

With better control and reduced unnecessary spending, you can increase your savings. Real-time tracking helps set savings goals and monitor progress. Emburse’s insights and analytics empower you to make data-driven decisions, leading to more significant savings over time. Consistent tracking and adjustments contribute to long-term financial growth.

Simplified Financial Planning

Real-time expense tracking simplifies the financial planning process. It provides a clear picture of your financial situation, helping you plan for the future with confidence. Emburse offers tools that streamline processes and ensure compliance, making financial planning more straightforward. Simplified planning reduces stress and allows for better preparation for financial milestones.

For more information about Emburse’s travel and expense management software, visit the Emburse website.

Pricing And Affordability Of Real-time Expense Tracking Tools

Understanding the pricing and affordability of real-time expense tracking tools is essential for businesses and individuals. With various options available, it is crucial to evaluate the costs and benefits to make an informed decision. Here, we will explore the differences between free and paid options, perform a cost-benefit analysis, and review the subscription plans and features offered by these tools.

Overview Of Free Vs. Paid Options

Real-time expense tracking tools come in both free and paid versions. Free tools offer basic functionalities that can be sufficient for personal use or small businesses. However, paid options provide more advanced features and better support.

| Feature | Free Tools | Paid Tools |

|---|---|---|

| Expense Tracking | Basic | Advanced |

| Support | Limited | 24/7 Support |

| Integrations | Few | Extensive |

| Data Insights | Minimal | Comprehensive |

| Compliance Features | Basic | Enhanced |

Cost-benefit Analysis

When evaluating the cost-benefit of real-time expense tracking tools, it is vital to consider both direct and indirect benefits. Paid tools like Emburse offer several advantages:

- Time-Saving: Automation of repetitive tasks saves time and improves efficiency.

- Enhanced Compliance: Proactive controls ensure compliance and reduce risks.

- Advanced Analytics: Data insights empower better financial planning and uncover savings.

- Robust Security: Enhanced security measures protect sensitive data.

While free tools may have no direct cost, they often lack the advanced features that can lead to significant long-term savings and operational improvements.

Subscription Plans And Features

Subscription plans for real-time expense tracking tools vary widely. Emburse, for instance, offers tailored solutions to meet unique organizational needs. Here are some typical features included in paid plans:

- Comprehensive Travel Management

- Advanced Expense Management

- Automated Payments & Invoice Processing

- Data-Driven Insights & Analytics

For specific pricing details and to find the right plan, customers are encouraged to contact Emburse directly. Customized solutions ensure that businesses only pay for the features they need, making these tools both effective and economical.

To learn more, visit the Emburse website.

Pros And Cons Of Real-time Expense Tracking Tools

Real-time expense tracking tools, such as those offered by Emburse, can be invaluable for managing personal and business finances. While they provide many benefits, they also come with some limitations. Understanding both sides can help you make an informed decision.

Advantages Of Real-time Expense Tracking

Real-time expense tracking offers several advantages that can greatly enhance financial management:

- Improved Accuracy: Real-time updates reduce the chances of errors in financial records.

- Immediate Insights: Quick access to data helps in making prompt and informed decisions.

- Enhanced Compliance: Automation ensures adherence to company policies and legal requirements.

- Time-Saving: Reduces the need for manual data entry, thus saving valuable time.

- Better Budget Control: Constant monitoring helps in keeping expenses within budget.

Potential Drawbacks And Limitations

Despite the numerous benefits, real-time expense tracking tools can have some limitations:

- Cost: High-quality tools, like Emburse, may come with a significant price tag.

- Learning Curve: Users might need time to get accustomed to the new system.

- Privacy Concerns: Sensitive financial data stored online may be vulnerable to breaches.

- Dependency on Technology: Reliance on software means issues can arise if the system goes down.

Understanding these pros and cons can guide you in choosing the right expense tracking tool for your needs. For more information on the comprehensive solutions offered by Emburse, visit their website.

Recommendations For Ideal Users And Scenarios

Real-time expense tracking is crucial for effective financial management. Discover who benefits the most and the best use cases for real-time expense tracking.

Who Can Benefit Most From Real-time Expense Tracking?

- Small Business Owners: Gain instant insights into daily expenditures.

- Frequent Travelers: Manage travel expenses efficiently.

- Corporate Finance Teams: Ensure compliance and control over expenses.

- Freelancers: Track income and expenses for accurate invoicing.

- Non-Profit Organizations: Maintain transparency and accountability.

Best Use Cases For Real-time Expense Tracking

| Scenario | Benefits |

|---|---|

| Travel Management | Mobile solutions for policy adherence and expense tracking. |

| Invoice Automation | Control costs and gain cash flow visibility. |

| Compliance Monitoring | Ensure compliance with proactive controls. |

| Data-Driven Decision Making | Use insights to uncover savings and plan better. |

| Security and Risk Management | Robust security measures to protect data. |

Emburse’s travel and expense management software offers tailored solutions for various organizational needs. This ensures efficiency, compliance, and financial control.

Frequently Asked Questions

What Is Real-time Expense Tracking?

Real-time expense tracking involves monitoring and recording expenses as they occur. This helps maintain accurate financial records instantly.

Why Is Real-time Expense Tracking Important?

It provides immediate insight into spending habits. This ensures better budget management and financial planning.

How Does Real-time Expense Tracking Work?

It uses software or apps to log expenses automatically. Transactions are recorded instantly, offering up-to-date financial data.

What Are The Benefits Of Real-time Expense Tracking?

It helps prevent overspending, improves budgeting, and provides accurate financial insights. Additionally, it saves time and reduces manual errors.

Conclusion

Real-time expense tracking makes managing finances easier. It offers clear insights. Emburse provides powerful tools for this. Stay compliant and control costs effortlessly. Make data-driven decisions with ease. Explore Emburse for efficient travel and expense management. For more details, visit the Emburse website.