Quick Personal Loans: Fast Solutions for Urgent Financial Needs

In today’s fast-paced world, unexpected expenses can arise at any moment. Quick personal loans can offer a solution.

These loans provide fast access to funds for emergencies, home improvements, or business ventures. PersonalLoans.com is a reliable platform that connects borrowers with a network of lenders, offering loans ranging from $250 to $35,000. With competitive rates, flexible loan terms, and a simple online application, it’s an ideal choice for those in need of quick funds. The service is free to use, ensuring no hidden costs. Whether you need money for an urgent situation or a planned expense, PersonalLoans.com helps you find the right loan to meet your needs. Start your application today by visiting PersonalLoans.com.

Introduction To Quick Personal Loans

Personal loans are a simple way to get funds quickly. They help cover emergency expenses, home improvements, or business startups. Quick personal loans are easy to apply for and can be received within a day. Let’s dive into understanding them better.

Understanding Quick Personal Loans

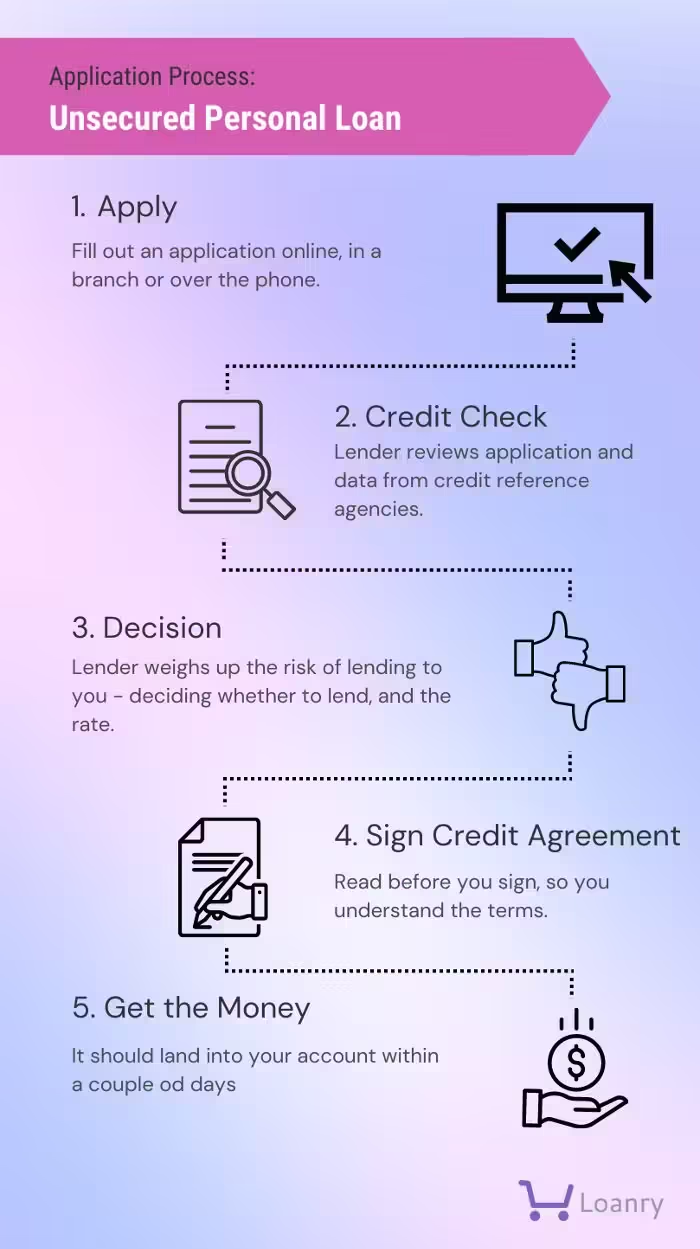

Quick personal loans are a type of unsecured loan. This means you don’t need collateral to get the loan. They are designed to provide fast access to funds. You can use the money for various purposes.

At PersonalLoans.com, you can borrow amounts ranging from $250 to $35,000. The loan terms range from 3 to 72 months. The APR ranges between 5.99% to 35.89%. This makes it a flexible and accessible option for many.

| Loan Amount | Loan Term | APR Range |

|---|---|---|

| $250 to $35,000 | 3 to 72 months | 5.99% to 35.89% |

Purpose And Importance Of Quick Personal Loans

Quick personal loans serve various purposes:

- Emergencies: Cover unexpected expenses like medical bills.

- Home Improvements: Fund renovations or repairs.

- Business Startups: Get initial capital for a new business.

These loans are important for several reasons:

- Fast Funding: Receive funds as soon as the next business day.

- No Hidden Fees: The service is free with no upfront costs.

- Extended Lender Network: Access to a wide range of lenders.

Using PersonalLoans.com, you benefit from competitive rates and a fast and easy application process. The platform uses advanced data encryption to protect your personal information. This ensures that your data is safe and secure.

For more information, visit PersonalLoans.com.

Key Features Of Quick Personal Loans

Quick personal loans offer a range of features designed to meet your financial needs swiftly and efficiently. Below, we explore the key features that make these loans an attractive option for many borrowers.

Speed And Efficiency

One of the most significant advantages of quick personal loans is their speed and efficiency. Applicants can often receive funds as soon as the next business day after approval. This rapid processing time is crucial for those facing emergencies or time-sensitive financial needs.

Minimal Documentation Required

Quick personal loans require minimal documentation compared to traditional loans. This streamlined process makes it easier for borrowers to gather the necessary information and submit their applications without extensive paperwork.

- Basic personal details

- Proof of income

- Bank account information

Flexible Repayment Options

Borrowers benefit from flexible repayment options with quick personal loans. Loan terms can range from 3 to 72 months, providing the flexibility to choose a repayment schedule that fits your financial situation.

| Loan Amount | APR | Repayment Term | Monthly Payment | Total Payment |

|---|---|---|---|---|

| $8,500 | 6.99% | 2 years | $380.53 | $9,132.68 |

| $10,000 | 8.34% | 3 years | $314.93 | $11,337.64 |

| $15,000 | 10.45% | 4 years | $383.69 | $18,417.05 |

| $20,000 | 8.54% | 5 years | $410.72 | $24,646.98 |

| $30,000 | 7.99% | 6 years | $525.85 | $37,861.25 |

Online Application Process

The online application process for quick personal loans is straightforward and convenient. Borrowers can complete the application form from the comfort of their homes. PersonalLoans.com provides a free service that connects you with a network of lenders, ensuring competitive rates and fast funding.

- Visit PersonalLoans.com

- Fill out the online application form

- Get connected with potential lenders

- Review and accept loan offers

Using advanced data encryption technology, PersonalLoans.com ensures your personal information remains secure throughout the application process.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of quick personal loans is crucial. These loans offer flexibility and fast access to funds. However, it’s important to understand the costs involved to make an informed decision.

Interest Rates And Fees

Interest rates for quick personal loans on PersonalLoans.com range from 5.99% to 35.89% APR. The exact rate depends on your creditworthiness and loan amount. Let’s look at some sample loan terms:

| Loan Amount | APR | Term | Monthly Payment | Total Payment |

|---|---|---|---|---|

| $8,500 | 6.99% | 2 years | $380.53 | $9,132.68 |

| $10,000 | 8.34% | 3 years | $314.93 | $11,337.64 |

| $15,000 | 10.45% | 4 years | $383.69 | $18,417.05 |

| $20,000 | 8.54% | 5 years | $410.72 | $24,646.98 |

| $30,000 | 7.99% | 6 years | $525.85 | $37,861.25 |

Comparison With Traditional Loans

How do quick personal loans compare to traditional loans? Here are some key differences:

- Approval Time: Quick personal loans offer faster approval, often within a day.

- Interest Rates: Traditional loans typically have lower interest rates.

- Loan Amounts: Both options provide a range of amounts, but quick loans may have lower maximums.

- Fees: Traditional loans often come with more fees like origination fees and closing costs.

Hidden Costs To Watch For

Quick personal loans may have hidden costs. Here are some to watch out for:

- Late Payment Fees: Missing a payment can result in significant late fees.

- Prepayment Penalties: Some lenders charge for paying off the loan early.

- Variable Interest Rates: Rates might increase over time, raising your monthly payment.

- Origination Fees: Some lenders may charge a fee to process your loan.

It’s important to read the terms and conditions carefully. Always compare offers from multiple lenders to find the best deal.

Pros And Cons Of Quick Personal Loans

Quick personal loans offer a swift solution for financial needs. They have their advantages and disadvantages, which you should consider before applying. Below, we explore the pros and cons to help you make an informed decision.

Advantages: Quick Access To Funds

One of the biggest advantages of quick personal loans is the speed of funding. With platforms like PersonalLoans.com, you can receive funds as soon as the next business day if approved. This is crucial during emergencies when you need money fast.

- Funds available as soon as next business day

- Helps in emergencies

- Fast approval process

Advantages: Convenience And Flexibility

Quick personal loans are also known for their convenience and flexibility. Services like PersonalLoans.com offer a simple online application process. You can apply from the comfort of your home and get connected to a network of lenders.

- Simple online application

- Flexible loan amounts from $250 to $35,000

- Loan terms ranging from 3 to 72 months

Disadvantages: Higher Interest Rates

Despite the benefits, quick personal loans often come with higher interest rates. The APR can range from 5.99% to 35.89%. This means you might end up paying more in interest over the life of the loan.

| Loan Amount | APR | Monthly Payment | Total Payment |

|---|---|---|---|

| $8,500 | 6.99% | $380.53 | $9,132.68 |

| $10,000 | 8.34% | $314.93 | $11,337.64 |

| $15,000 | 10.45% | $383.69 | $18,417.05 |

| $20,000 | 8.54% | $410.72 | $24,646.98 |

| $30,000 | 7.99% | $525.85 | $37,861.25 |

Disadvantages: Risk Of Debt Cycle

Another significant disadvantage is the risk of falling into a debt cycle. Higher interest rates and flexible repayment terms can sometimes lead to taking out more loans to pay off existing debts.

- Higher interest rates increase total debt

- Potential for multiple loans

- Debt cycle can affect credit score

Understanding these pros and cons can help you decide if a quick personal loan is right for you. Always read the terms carefully and consider your financial situation.

Specific Recommendations For Ideal Users

Quick personal loans can be a lifesaver in many situations. They provide fast access to funds when you need them most. Here are some specific recommendations for ideal users of quick personal loans.

Best Scenarios To Use Quick Personal Loans

- Emergencies: When unexpected expenses arise, such as medical bills or car repairs, quick personal loans can provide immediate relief.

- Home Improvement: If you need to make urgent repairs or upgrades to your home, these loans offer fast funding.

- Business Startups: Quick personal loans can provide the necessary capital to kickstart your new business venture.

- Debt Consolidation: Combine multiple debts into one manageable payment with a lower interest rate.

Who Should Avoid Quick Personal Loans

- High-Interest Debt: If you already have high-interest debt, avoid adding more through quick personal loans.

- Unstable Income: If your income is unstable, you might struggle to make consistent payments.

- Long-Term Financial Issues: These loans are not a solution for ongoing financial problems. They are best for short-term needs.

- Low Credit Score: If your credit score is low, you might face higher interest rates, making the loan more expensive.

Frequently Asked Questions

What Are Quick Personal Loans?

Quick personal loans are fast, unsecured loans that provide funds quickly. They are typically used for emergencies or urgent needs.

How Do Quick Personal Loans Work?

Quick personal loans work by applying online or in-person. Approval is fast, and funds are disbursed quickly, often within a day.

Are Quick Personal Loans Safe?

Quick personal loans can be safe if you choose a reputable lender. Always read the terms carefully and understand the interest rates.

Can I Get A Quick Personal Loan With Bad Credit?

Yes, some lenders offer quick personal loans to those with bad credit. However, interest rates may be higher.

Conclusion

Quick personal loans can be a great solution for urgent needs. They offer fast access to funds and flexible repayment terms. PersonalLoans.com connects you with a network of lenders, ensuring competitive rates and no hidden fees. The application process is simple and secure, making it easy to get the money you need quickly. If you need a reliable personal loan, consider exploring your options with PersonalLoans.com. With their extensive lender network, you can find a loan that fits your needs. Make informed financial choices with ease and confidence.