Quick Credit Repair Methods: Boost Your Score Fast

Repairing your credit quickly might seem daunting. But simple, effective methods exist.

Credit health is vital for financial stability. Poor credit can limit opportunities, increase interest rates, and cause stress. Fortunately, you can take control and improve your credit score faster than you think. This blog will guide you through quick credit repair methods. Our tips are practical and easy to implement. Whether you’re dealing with maxed-out credit cards, late payments, or other issues, these methods can help you get back on track. Stay tuned to discover actionable steps to boost your credit score quickly and efficiently. For businesses looking for an innovative financing solution, check out the Revenued Business Card Visa® Commercial Card. Learn more about it here.

Introduction To Quick Credit Repair Methods

Repairing your credit quickly is essential for financial stability and access to better financial products. A good credit score can open doors to lower interest rates, better loan terms, and higher credit limits. Let’s explore some quick credit repair methods that can help you improve your credit score efficiently.

Understanding Credit Scores And Their Importance

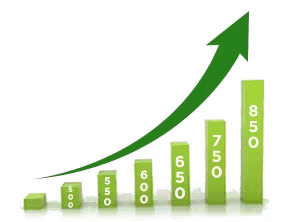

Credit scores are numerical representations of your creditworthiness. They range from 300 to 850, with higher scores indicating better credit health. Major credit bureaus like Equifax, Experian, and TransUnion calculate these scores based on your credit history.

A good credit score is crucial. It determines your eligibility for loans, credit cards, and even rental agreements. Lenders use credit scores to assess risk. A higher score means lower risk and better terms for you.

Why Quick Credit Repair Is Necessary

Quick credit repair is necessary for several reasons:

- Immediate Financial Relief: Improving your credit score can help you qualify for better financial products quickly.

- Lower Interest Rates: A higher credit score can lead to lower interest rates on loans and credit cards.

- Improved Loan Terms: Better credit scores can offer you more favorable loan terms and conditions.

- Increased Credit Limits: Higher credit scores often result in higher credit limits, providing more financial flexibility.

Quick credit repair methods can help you achieve these benefits faster, improving your financial health and stability.

Key Features Of Effective Credit Repair Methods

Effective credit repair methods can help improve your credit score quickly and efficiently. These methods include taking immediate actions to boost your credit score, using credit report dispute processes, leveraging secured credit cards, and seeking credit counseling. Understanding these features will guide you toward better financial health.

Immediate Actions To Improve Credit Scores

Taking immediate actions can significantly impact your credit score. Here are some steps you can take right away:

- Pay off outstanding debts.

- Reduce your credit card balances.

- Make all payments on time.

- Check for errors in your credit report.

Utilizing Credit Report Dispute Processes

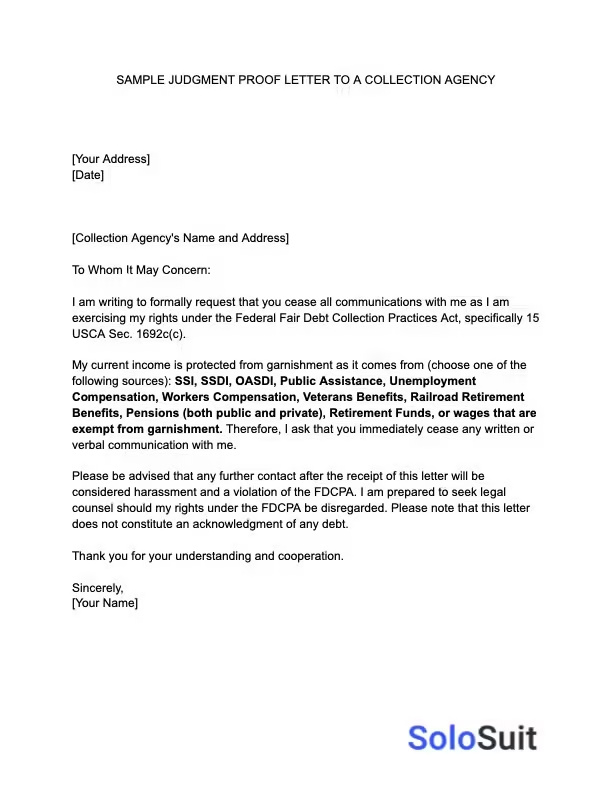

Errors in credit reports can negatively impact your credit score. Utilize the credit report dispute processes to correct these errors:

- Request a copy of your credit report from the three major bureaus.

- Identify and document any discrepancies.

- Submit a dispute with the credit bureau and provide supporting evidence.

- Follow up until the error is resolved.

Leveraging Secured Credit Cards For Quick Improvement

Secured credit cards can help quickly improve your credit score:

- Apply for a secured credit card.

- Deposit a cash collateral to secure the card.

- Use the card responsibly and make timely payments.

- Maintain low balances to improve your credit utilization ratio.

The Role Of Credit Counseling In Repairing Credit

Credit counseling plays a crucial role in repairing credit:

- Seek advice from a certified credit counselor.

- Develop a personalized debt management plan.

- Learn effective budgeting and financial management skills.

- Receive ongoing support to maintain financial health.

Incorporating these key features into your credit repair strategy can lead to quick and effective improvements in your credit score.

Pricing And Affordability Of Credit Repair Services

Understanding the pricing and affordability of credit repair services is essential. Whether you opt for DIY methods or professional help, knowing the costs involved can help you make informed decisions.

Cost Breakdown Of Popular Credit Repair Services

Here is a cost breakdown of popular credit repair services:

| Service Provider | Initial Fee | Monthly Fee | Additional Costs |

|---|---|---|---|

| CreditRepair.com | $99.95 | $69.95 | None |

| Lexington Law | $89.95 | $89.95 | Optional add-ons |

| Sky Blue Credit | $79.00 | $79.00 | None |

These prices represent common charges for credit repair services. Initial fees usually cover setup and document review. Monthly fees cover ongoing services and support.

Comparing Diy Methods Vs. Professional Services

Deciding between DIY methods and professional services depends on your needs and budget.

- DIY Methods: Typically free, but time-consuming. You must understand credit laws and negotiate with creditors yourself.

- Professional Services: Costs vary, but they save time. Professionals handle negotiations and legal aspects.

Consider your comfort level and availability of time before choosing a method.

Assessing The Value For Money In Credit Repair

Assessing value for money involves weighing costs against benefits. Professional services offer expertise and convenience. DIY methods save money but require effort.

Look for services that provide:

- Transparent pricing with no hidden fees.

- High success rates.

- Positive user reviews.

- Comprehensive support, including personalized advice.

Assessing these factors helps determine the best value for your investment in credit repair.

Pros And Cons Of Quick Credit Repair Methods

Quick credit repair methods can be a viable solution for improving your credit score swiftly. However, it’s crucial to understand both their benefits and potential pitfalls. This section will explore the advantages and risks associated with fast credit repair methods and how to balance speed with sustainability.

Advantages Of Fast Credit Repair

There are several benefits to opting for quick credit repair methods:

- Speed: Improve your credit score within a short period, often within weeks.

- Immediate Benefits: Access better loan rates and credit card offers quickly.

- Financial Relief: Reduce stress and financial burdens associated with poor credit scores.

These methods can be particularly useful in urgent situations, such as preparing for a major purchase or qualifying for a loan.

Potential Drawbacks And Risks

While fast credit repair methods offer several advantages, they also come with certain risks:

- Temporary Fix: Quick fixes may not address the underlying issues causing poor credit.

- High Costs: Professional services can be expensive, leading to further financial strain.

- Scams: The market has many fraudulent services that promise unrealistic results.

It’s important to research and choose reputable services to avoid falling victim to scams.

Balancing Speed And Sustainability In Credit Repair

For long-term success, balance speed with sustainable credit repair practices:

- Evaluate Your Needs: Assess whether you need immediate improvement or can work on gradual repair.

- Combine Methods: Use quick fixes for urgent needs while adopting long-term strategies for sustained improvement.

- Monitor Progress: Regularly check your credit report to ensure improvements are maintained.

By combining fast and sustainable methods, you can achieve and maintain a healthy credit score over time.

Specific Recommendations For Ideal Users

Quick credit repair methods can be effective for many individuals. Identifying the right users for these methods ensures optimal results. Here are some specific recommendations for ideal users:

Who Benefits Most From Quick Credit Repair?

Individuals with minor credit issues benefit significantly from quick credit repair methods. These methods are ideal for those who have:

- Late payments on their credit report.

- Errors or inaccuracies in their credit history.

- Recent credit card balances that have been paid off.

Business owners using the Revenued Business Card Visa® Commercial Card find these methods useful. They need a quick credit boost to access better financing options.

Scenarios Where Quick Credit Repair Is Most Effective

Quick credit repair is most effective in the following scenarios:

- Preparing for a major purchase like a home or car.

- Improving eligibility for lower interest rates on loans.

- Correcting errors on a credit report that are lowering the score.

For business owners, having a dynamic spending limit based on business performance and revenue growth can be crucial. Quick credit repair helps maintain a good credit score, ensuring better business financing options.

Long-term Strategies To Maintain Improved Credit Scores

While quick credit repair is effective, maintaining an improved credit score requires long-term strategies:

- Regularly monitor your credit report for errors.

- Pay bills on time to avoid late payment penalties.

- Keep credit card balances low to maintain a good credit utilization ratio.

- Diversify credit types by having a mix of installment loans and revolving credit.

Using the Revenued Business Card Visa® Commercial Card with its real-time access to funding and transaction control can help manage finances better. This supports maintaining a healthy credit score over time.

Conclusion: Achieving And Maintaining A Healthy Credit Score

In our journey to understand quick credit repair methods, it’s clear that maintaining a healthy credit score is vital. Let’s review the key takeaways and final tips to ensure ongoing credit health.

Summary Of Key Takeaways

| Key Point | Importance |

|---|---|

| Monitor Credit Reports Regularly | Identify and correct errors immediately. |

| Pay Bills on Time | Timely payments have a significant impact on credit scores. |

| Keep Credit Utilization Low | Aim to use less than 30% of your credit limits. |

| Limit New Credit Applications | Frequent applications can negatively affect your score. |

| Use a Revenued Business Card | Flexible financing options without traditional loans. |

Final Tips For Ongoing Credit Health

- Check Credit Reports Annually: Use free services to get your annual credit report.

- Automate Payments: Set up automatic payments to avoid late fees.

- Stay Informed: Keep up with changes in credit scoring practices.

- Use Credit Wisely: Only borrow what you can repay comfortably.

- Seek Professional Help: If needed, consult a financial advisor.

By following these steps and using tools like the Revenued Business Card, you can achieve and maintain a healthy credit score. Stay proactive and vigilant in managing your credit to secure a better financial future.

Frequently Asked Questions

What Is The Fastest Way To Repair Credit?

The fastest way to repair credit is to pay down debts. Ensure all your bills are paid on time and dispute any errors on your credit report.

How Can I Improve My Credit Score Quickly?

To improve your credit score quickly, reduce your credit card balances. Keep your credit utilization ratio low and pay your bills on time.

Can Paying Off Debt Improve Credit Score?

Yes, paying off debt can improve your credit score. It lowers your credit utilization rate and shows responsible financial behavior.

Does Checking My Credit Score Hurt It?

No, checking your own credit score does not hurt it. This is considered a soft inquiry and has no impact on your score.

Conclusion

Quick credit repair methods can greatly improve your financial health. Always stay proactive and monitor your credit regularly. Consider using tools and services, like the Revenued Business Card Visa® Commercial Card, for immediate access to working capital. This card provides flexible funding and real-time access. With consistent efforts and smart financial tools, you can achieve a healthier credit score. Remember, small steps lead to big improvements. Stay informed, stay diligent, and watch your credit score rise.