Quick Credit Repair: Boost Your Score Fast and Effectively

Struggling with a low credit score? Quick credit repair can help.

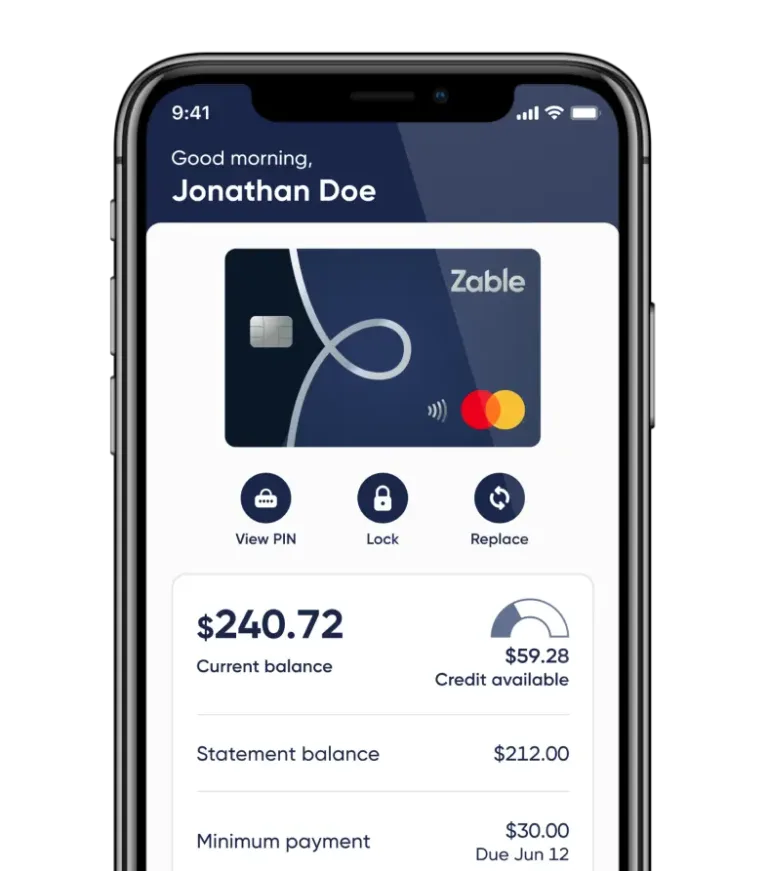

You can improve your credit score faster than you think. Credit issues can seem overwhelming, but solutions are available. Quick credit repair involves steps to boost your score quickly and effectively. It’s about understanding your credit report, fixing errors, and making smart financial moves. Whether it’s paying down debt, disputing inaccuracies, or getting a new credit card, there’s a strategy for everyone. With the right approach, you can see a significant improvement in your credit score. Ready to take control? Start your journey to better credit today with Zable UK credit cards and personal loans. They offer tools and resources to help manage your finances and build your credit score. Learn more at Zable UK.

Introduction To Quick Credit Repair

Quick credit repair can be the lifeline for many individuals. Improving your credit score can open doors to better financial opportunities and stability. Understanding how to quickly repair your credit is essential for achieving your financial goals.

Understanding The Importance Of A Good Credit Score

A good credit score is more than just a number. It represents your financial trustworthiness and ability to manage credit responsibly. Lenders use your credit score to determine the risk of lending to you. A higher score can lead to lower interest rates and better loan terms.

Having a good credit score can also impact other areas of your life. For example, it can affect your ability to rent an apartment, get a job, or even secure insurance. Therefore, maintaining a good credit score is crucial for financial health.

How Quick Credit Repair Can Make A Difference

Quick credit repair involves strategies and tools to improve your credit score in a short time. One effective method is using services like Zable Credit Cards & Personal Loans. These products help manage and build credit effectively.

Zable Credit Cards offer several features:

- Use banking history to boost approval odds by up to 35%.

- Virtual card available for instant spending via Apple Pay or Google Pay.

- Representative APR of 48.9% (variable) based on assumed borrowing of £1200.

- Eligibility checks do not affect credit score.

Zable Personal Loans provide:

- Loan approval typically within an hour.

- Representative APR of 32.5% for borrowing £7,500 over 36 months.

- Loan amounts from £1,000 to £25,000 with repayment terms of 1-5 years.

- Eligibility checks do not affect credit score.

These features ensure that you can quickly address and improve your credit score. The tools provided by Zable can help you gain financial control and insights into your credit profile.

Additionally, Zable offers free access to Equifax credit score, allowing you to monitor your progress. The spend tracking feature helps you manage all accounts in one place. Rent reporting further enhances your credit profile without traditional loans.

Using these tools and strategies, you can see significant improvements in your credit score. Quick credit repair can lead to better financial opportunities and peace of mind.

Key Features Of Effective Credit Repair Strategies

Effective credit repair strategies can significantly improve your financial health. Understanding and implementing these strategies can help you achieve a better credit score and manage your debts efficiently.

Rapid Identification And Dispute Of Errors

Identifying errors on your credit report is crucial. Mistakes can lower your credit score. Regularly review your credit reports from all three major bureaus. Look for incorrect personal information, outdated accounts, or inaccurate balances.

- Request a copy of your credit report.

- Check for inaccuracies and duplicate accounts.

- Dispute errors with the credit bureau.

Disputing errors can quickly remove negative items, boosting your score.

Strategic Debt Repayment Plans

Creating a debt repayment plan is essential. Prioritize debts with high interest rates. This approach, known as the avalanche method, saves money on interest payments.

- List all your debts.

- Order them by interest rate.

- Pay extra on the highest interest debt while making minimum payments on others.

This strategy helps you reduce debt faster and improve your credit score.

Credit Utilization Management

Managing your credit utilization ratio is key. This ratio compares your credit card balances to your credit limits. A lower ratio positively impacts your credit score.

- Keep your credit utilization below 30%.

- Pay down balances on time.

- Request higher credit limits, but avoid increasing spending.

Effective utilization management shows lenders you are a responsible borrower.

Building Positive Credit History

Building a positive credit history involves consistent, responsible borrowing. Consider using products designed to help build credit, such as Zable Credit Cards and Personal Loans.

| Product | Features |

|---|---|

| Zable Credit Cards | Boost approval odds by up to 35%, instant virtual card for spending. |

| Zable Personal Loans | Loan approval within an hour, loans from £1,000 to £25,000. |

Regular, on-time payments on these products build a solid credit history.

Utilizing Professional Credit Repair Services

Professional credit repair services can offer valuable assistance. Companies like Zable provide tools and insights to manage your credit profile effectively.

- Free access to Equifax credit score.

- Spend tracking for all accounts in one place.

- Rent reporting to enhance credit profile.

These services offer expert guidance, saving you time and effort in repairing your credit.

Pricing And Affordability Of Credit Repair Services

Understanding the pricing and affordability of credit repair services is essential for anyone looking to improve their credit score. There are various options available, from free do-it-yourself methods to professional paid services. Let’s explore the different costs and value associated with these options.

Comparing Free Vs. Paid Credit Repair Options

Free credit repair options often include:

- DIY credit repair guides

- Access to free credit reports

- Dispute templates

While these methods can be cost-effective, they require significant time and effort. Paid credit repair services, on the other hand, offer:

- Professional expertise

- Faster dispute resolution

- Comprehensive credit analysis

These services come at a cost but can save time and potentially improve your credit score more efficiently.

Cost Breakdown Of Professional Credit Repair Services

Professional credit repair services typically include:

| Service | Cost |

|---|---|

| Initial setup fee | $79 – $129 |

| Monthly fee | $69 – $119 |

| Credit report analysis | Included in monthly fee |

| Dispute letters | Included in monthly fee |

It’s important to review what each service includes to understand the full scope of their offerings.

Assessing Value For Money

When assessing the value for money of credit repair services, consider:

- Success rate: Look for customer reviews and success stories.

- Time savings: Professional services can save you significant time.

- Credit score improvement: A higher credit score can lead to lower interest rates on loans and credit cards.

Choosing a service that offers a clear plan and transparent pricing can provide peace of mind and better financial outcomes.

Pros And Cons Of Quick Credit Repair

Quick credit repair can be a tempting option for those wanting to improve their credit scores fast. Before deciding, it is essential to understand the pros and cons associated with rapid credit improvement. This section covers the advantages, potential drawbacks, and real-world usage experiences of quick credit repair.

Advantages Of Rapid Credit Improvement

- Time Efficiency: Quick credit repair can significantly reduce the time needed to see an improvement in your credit score.

- Immediate Access to Credit: Faster credit repair means you can access loans and credit cards sooner.

- Financial Opportunities: A better credit score can open up opportunities for better interest rates and loan terms.

- Improved Financial Management: Services like Zable offer tools to help manage your finances effectively.

Potential Drawbacks And Risks

- High Costs: Quick credit repair services can be expensive, with fees adding up quickly.

- Short-Term Focus: Rapid credit improvement may not address underlying financial habits, leading to future credit issues.

- Potential Scams: Not all credit repair services are legitimate, so it’s crucial to research and verify any service provider.

- Temporary Fix: Quick fixes might not provide long-term solutions, requiring continuous effort to maintain a good credit score.

Real-world Usage Experiences

Many users of quick credit repair services like Zable have shared their experiences. Here are some common themes:

| Experience | Details |

|---|---|

| Positive Impact | Users report seeing credit score improvements within a few months. |

| Easy Application Process | Zable’s online application is straightforward, and approval is quick. |

| Financial Insights | The Zable app provides valuable insights into spending and credit profiles without impacting the score. |

| Mixed Reviews on Cost | Some users find the fees reasonable, while others feel they are high. |

To sum up, quick credit repair offers both benefits and risks. Evaluating both sides will help you make an informed decision.

Specific Recommendations For Ideal Users

Quick credit repair can be a valuable resource for many individuals. Identifying the right users ensures the best outcomes. Below are specific recommendations that outline who should consider quick credit repair, the best scenarios for using these services, and tips to maximize benefits.

Who Should Consider Quick Credit Repair?

Not everyone needs quick credit repair. It is ideal for individuals in the following situations:

- Recent Credit Report Errors: If you discover errors on your credit report that negatively impact your score, quick credit repair can help correct these inaccuracies.

- Loan or Mortgage Applications: Those planning to apply for a loan or mortgage can benefit from a quick boost to their credit score to secure better interest rates.

- Rebuilding Credit: Individuals recovering from financial setbacks, such as bankruptcy or defaults, can use credit repair to rebuild their credit profiles.

Best Scenarios For Using Credit Repair Services

Quick credit repair services are most effective in these scenarios:

| Scenario | Benefit |

|---|---|

| Disputing Errors | Resolve inaccuracies on your credit report quickly. |

| Debt Settlement | Negotiate with creditors to settle debts for less than owed. |

| Credit Counseling | Receive expert advice to improve financial habits and credit score. |

Tips For Maximizing The Benefits

To get the most out of quick credit repair services, consider these tips:

- Check Your Credit Report: Regularly review your credit report for errors or outdated information.

- Pay Bills on Time: Timely payments are crucial for maintaining a good credit score.

- Limit New Credit Applications: Applying for multiple new credit accounts in a short period can negatively impact your credit score.

- Utilize Credit Cards Wisely: Keep credit card balances low and pay more than the minimum amount due.

- Use Services like Zable: Consider using products like Zable UK credit cards and personal loans, which offer quick approval and do not impact your credit score during eligibility checks.

By following these recommendations, users can effectively leverage quick credit repair services and improve their financial health.

Frequently Asked Questions

What Is Quick Credit Repair?

Quick credit repair refers to methods that improve credit scores in a short period. These methods include paying off debts, disputing errors, and improving payment history.

How Can I Repair My Credit Fast?

To repair credit fast, pay down debts, dispute credit report errors, and ensure timely bill payments. Monitoring your credit report regularly is also crucial.

What Affects My Credit Score The Most?

Payment history and credit utilization affect your credit score the most. Consistently paying bills on time and keeping credit card balances low are key.

Can Credit Repair Companies Help?

Credit repair companies can help, but ensure they are legitimate. They can assist in disputing errors and negotiating with creditors.

Conclusion

Achieving a good credit score is essential for financial health. Quick credit repair can be simple with the right tools. Consider using Zable Credit Cards and Personal Loans to help manage your finances effectively. Zable offers convenient solutions to build credit without impacting your score. For more details, visit Zable UK. Start your journey to better credit today.