Promotional Credit Card Offers: Maximize Your Rewards Today

Promotional credit card offers can provide great benefits for savvy consumers. They often include perks like cashback, travel rewards, and introductory APR periods.

Are you looking to make the most out of your credit card? Promotional offers can be a game-changer. These deals range from cashback to travel points and zero-interest periods. But with so many options, which one should you choose? Understanding these offers can help you save money and get the most value. One such option is the Possible Card by Possible Finance. Designed for those with bad credit, it offers instant credit limits, no late fees, and helps build your credit history. Plus, it comes with a simple monthly fee and no hidden costs. Let’s explore how these promotional credit card offers can benefit you and improve your financial health. Learn more about the Possible Card and Possible Loans at Possible Finance.

Introduction To Promotional Credit Card Offers

Promotional credit card offers can be a fantastic way to get the most value from your credit card. These offers can help you save money, earn rewards, and even improve your financial health. Understanding these offers is crucial for making informed financial decisions.

What Are Promotional Credit Card Offers?

Promotional credit card offers are special deals provided by credit card companies to attract new customers or reward existing ones. These offers may include:

- Introductory 0% APR: No interest on purchases or balance transfers for a set period.

- Bonus Rewards: Earn extra points, miles, or cash back for spending a certain amount.

- Sign-Up Bonuses: Receive a bonus after meeting a minimum spending requirement.

- No Annual Fees: Waived annual fees for the first year or longer.

These offers are designed to provide significant benefits if used wisely. They can help you save money on interest, earn valuable rewards, and manage your finances more effectively.

Why You Should Care About Promotional Offers

Caring about promotional credit card offers can lead to several benefits:

| Benefit | Description |

|---|---|

| Save Money | 0% APR offers can save you on interest payments. |

| Earn Rewards | Bonus rewards and sign-up bonuses add extra value. |

| Improve Credit | Using your card responsibly can build your credit history. |

| Access to Funds | Promotional offers can provide quick access to needed funds. |

For those with bad credit, products like the Possible Card offer an effective solution. This card provides a credit limit of $400 or $800 without a credit check or deposit. It also charges no interest or late fees, only a small monthly fee. This makes it easier to build credit history and improve financial health.

Understanding and utilizing promotional credit card offers can significantly impact your financial well-being. Make sure to read the terms and conditions of each offer to make the best choice for your needs.

Key Features Of Promotional Credit Card Offers

Promotional credit card offers can provide great benefits, especially for those seeking to maximize rewards, save on interest, or manage debt. Understanding the key features of these offers can help you make the best choice for your financial situation. Let’s explore some of the essential features below.

Welcome Bonuses: A Head Start On Rewards

Many credit cards offer welcome bonuses to attract new customers. These bonuses usually require you to spend a certain amount within the first few months of opening your account. In return, you receive a significant number of rewards points, cashback, or miles. This can be a great way to get a head start on earning rewards.

- Spend $500 in the first 3 months to earn 20,000 points.

- Receive $200 cashback after spending $1,000 in 90 days.

Cashback Offers: Get Money Back On Purchases

Cashback credit cards reward you by returning a percentage of your spending as cash. This feature is beneficial for everyday expenses such as groceries, gas, and dining out. The cashback rate can vary, so it’s essential to choose a card that aligns with your spending habits.

| Category | Cashback Rate |

|---|---|

| Groceries | 3% |

| Gas | 2% |

| Dining | 1% |

Travel Rewards: Earn Points For Your Next Trip

Travel rewards cards allow you to earn points or miles for every dollar spent, which can be redeemed for flights, hotel stays, and other travel-related expenses. These cards often come with additional perks like free checked bags, priority boarding, and access to airport lounges.

- Earn 2 miles per dollar on travel purchases.

- Redeem points for free hotel stays.

- Get access to exclusive travel deals.

Zero Percent Apr: Save On Interest Charges

Promotional offers with 0% APR can help you save money on interest charges, especially if you plan to make a large purchase or need to carry a balance. These offers usually last between 12 to 18 months, giving you time to pay off your balance without incurring interest.

- 0% APR on purchases for the first 15 months.

- Pay off your balance without interest charges.

- Plan for large expenses with no added cost.

Balance Transfer Offers: Manage Your Debt Effectively

Balance transfer offers can help you manage existing credit card debt by transferring your balance to a new card with a lower interest rate, often 0% APR for a promotional period. This can reduce your monthly payments and help you pay off debt faster.

- Transfer balances with 0% APR for 18 months.

- Pay a small balance transfer fee.

- Reduce your debt faster with lower interest rates.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of promotional credit card offers is crucial. This section will provide a detailed breakdown of the costs, interest rates, and hidden fees. Knowing these can help you make informed decisions and avoid unexpected charges.

Annual Fees: Understanding The Costs

Annual fees can significantly impact the overall cost of a credit card. For the Possible Card, there are no hidden annual fees. Instead, the Possible Card charges a monthly fee of $8 or $16, depending on the credit limit.

To compare, a card with a $16 monthly fee will cost $192 annually. This is a predictable and straightforward charge, helping you manage your budget without surprise costs.

Interest Rates: What You Need To Know

Interest rates are a crucial part of any credit card offer. The Possible Card stands out because it offers 0% interest, forever. This means you won’t accrue interest on your balance, which can save you a significant amount in the long term.

Traditional credit cards often have interest rates ranging from 15% to 25%, which can quickly add up. With the Possible Card, you avoid these extra costs, making it a more affordable option.

Hidden Fees To Watch Out For

Hidden fees can catch many cardholders off guard. The Possible Card prides itself on transparency, with no late fees and no penalty fees. This lack of hidden charges means what you see is what you get, providing peace of mind.

While other cards might have fees for late payments, balance transfers, or foreign transactions, the Possible Card keeps things simple. This simplicity can help you avoid unexpected charges and better manage your finances.

In summary, the Possible Card offers an affordable, transparent option with predictable costs, 0% interest, and no hidden fees. This makes it an excellent choice for those looking to build their credit history without the worry of unexpected charges.

Pros And Cons Of Promotional Credit Card Offers

Promotional credit card offers can help save money through low interest rates and rewards. Yet, they may lead to overspending and debt if not managed wisely.

Promotional credit card offers can be enticing with their attractive features. However, they come with their own sets of advantages and drawbacks. It’s essential to weigh both sides before making a decision.Advantages Of Promotional Credit Cards

Promotional credit cards often come with low or 0% interest rates for an introductory period. This feature can save you money on interest payments.

- No interest on purchases for a set period.

- Balance transfer options with low fees.

- Rewards programs offering cashback, points, or travel miles.

These cards can also help you build your credit score by making timely payments.

Some promotional credit cards offer additional perks like travel insurance, purchase protection, and extended warranties.

Potential Drawbacks To Consider

Despite the advantages, there are potential drawbacks to consider:

- High-interest rates after the promotional period ends.

- Balance transfer fees can add up.

- Limited-time offers that may not be suitable for long-term use.

It’s crucial to read the fine print and understand the terms and conditions.

Real-world Usage: User Experiences

Many users have found promotional credit cards beneficial for short-term financial needs. For example, Possible Loans and Possible Card offer quick access to funds with no late fees or penalties. They are especially useful for those with bad credit.

One user shared their experience with Possible Card:

“I needed funds urgently. The Possible Card gave me instant access with no interest. The monthly fee was manageable, and my credit score improved over time.”

Another user highlighted the flexible repayment plans offered by Possible Loans:

“The installment plan made it easier to repay the loan without stress. No hidden fees or penalties, just straightforward terms.”

While promotional credit cards have their downsides, many users find them valuable for managing short-term financial challenges.

For more information on Possible Finance, visit Possible Finance.

Who Should Consider Promotional Credit Card Offers?

Promotional credit card offers can be enticing with their attractive features. However, they may not be the best fit for everyone. Understanding who benefits the most from these offers can help you make a more informed decision.

Ideal Users: Who Benefits The Most

Promotional credit card offers are particularly advantageous for specific groups of people. Below is a list of ideal users:

- Individuals with good credit scores: They can maximize the benefits of promotional offers.

- Frequent travelers: Credit cards with travel rewards can be very beneficial.

- Shopaholics: Those who often make large purchases can benefit from cashback offers.

- Individuals looking to consolidate debt: Balance transfer options can help manage and reduce debt.

- People who can pay off their balance each month: This avoids interest and maximizes rewards.

Specific Scenarios: When These Offers Make Sense

There are specific scenarios where promotional credit card offers can make more sense:

| Scenario | Benefit |

|---|---|

| Large Upcoming Purchase | Leveraging introductory 0% APR to spread the cost. |

| Travel Plans | Earning travel rewards or points can lead to free flights or hotel stays. |

| Debt Consolidation | Using a balance transfer offer to reduce interest payments. |

| Credit Building | Using cards like the Possible Card to build or improve credit history. |

| Frequent Spending | Maximizing cashback or rewards on everyday purchases. |

Understanding your financial goals and habits can help you choose the right promotional credit card offer. For example, the Possible Card offers no late fees and helps build credit history, making it a good option for those with bad credit.

Tips For Maximizing Your Rewards

Promotional credit card offers can be a great way to earn rewards. Whether you are looking to earn points, cashback, or travel miles, understanding how to maximize your rewards is essential. Below are some actionable tips to help you make the most of these offers.

How To Choose The Right Card For You

Choosing the right card is the first step to maximizing rewards. Here are some points to consider:

- Spending Habits: Analyze where you spend the most. Choose a card that offers higher rewards in those categories.

- Annual Fees: Weigh the benefits of the rewards against the card’s annual fee.

- Sign-Up Bonus: Look for cards with generous sign-up bonuses, but ensure you can meet the spending requirements.

- Interest Rates: If you carry a balance, prioritize cards with lower interest rates over rewards.

Strategies For Earning More Points

Once you have the right card, focus on strategies to earn more points:

- Maximize Category Bonuses: Use your card for purchases in categories that offer higher rewards.

- Utilize Sign-Up Bonuses: Meet the spending requirements within the specified period to earn sign-up bonuses.

- Shop Through Card Portals: Many cards have online shopping portals that offer extra points.

- Pay Bills: Use your card to pay utilities, subscriptions, and other regular bills to earn more points.

Avoiding Common Pitfalls

While earning rewards, be cautious of common pitfalls:

- High Interest Rates: Rewards are not worth it if you carry a balance and incur high interest charges.

- Annual Fees: Ensure the rewards you earn outweigh the cost of the card’s annual fee.

- Overspending: Do not spend more than you can afford just to earn rewards.

- Expiration Dates: Be aware of when your points or miles expire and use them before they do.

By following these tips, you can maximize the benefits of promotional credit card offers. Remember, the goal is to earn rewards while maintaining financial health.

Frequently Asked Questions

What Are Promotional Credit Card Offers?

Promotional credit card offers provide special benefits for a limited time. These benefits include low-interest rates, cashback, or rewards points.

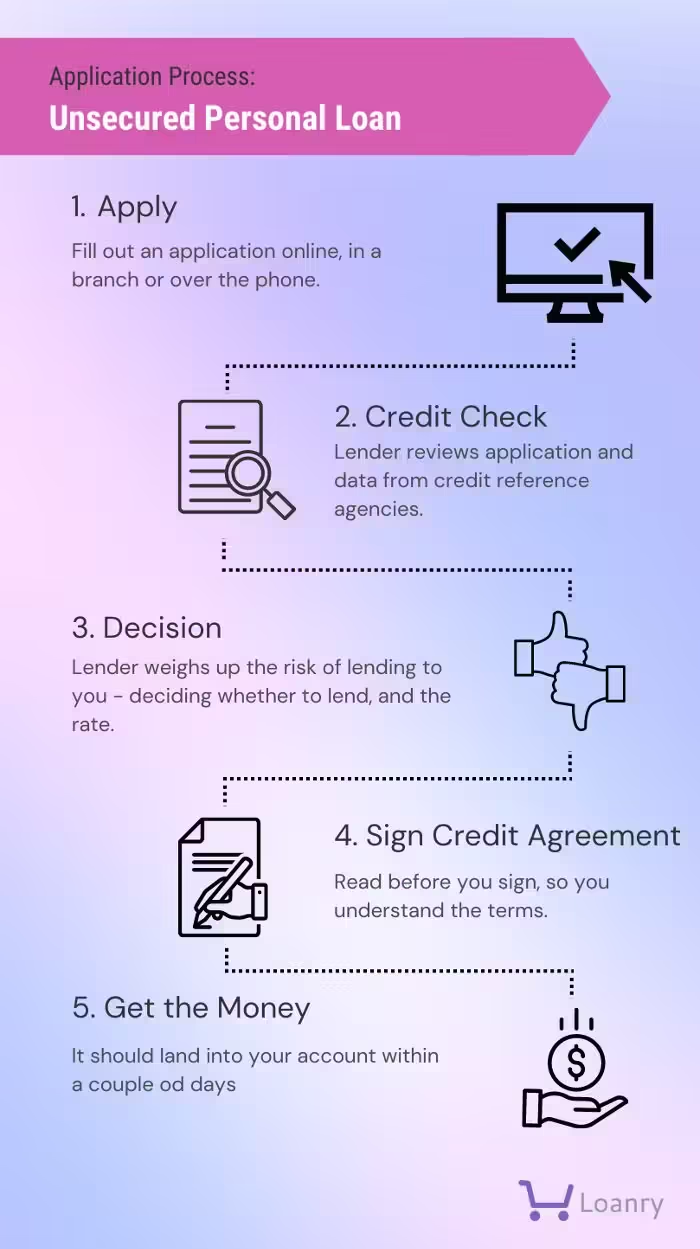

How Can I Qualify For These Offers?

To qualify, you usually need a good credit score. Meeting the credit card issuer’s specific criteria is also important.

Do Promotional Offers Have An Expiration Date?

Yes, promotional offers typically expire after a set period. This period can range from a few months to a year.

Are There Any Fees With Promotional Offers?

Some promotional offers include fees, such as annual fees or balance transfer fees. Always read the terms and conditions.

Conclusion

Promotional credit card offers can enhance your financial flexibility. By choosing the right card, you can manage your expenses better. Consider Possible Finance for accessible, fair financial solutions. Their loans and cards help build credit history and provide instant funds without hidden fees. Interested? Learn more at Possible Finance. Make informed choices and improve your financial health.