Pre-Approved Credit Cards: Unlock Instant Financial Freedom

Ever wondered about pre-approved credit cards? They offer a simplified way to access credit.

With pre-approved credit cards, you can skip the lengthy application process and enjoy quick approvals. Pre-approved credit cards can be a great option for those looking to streamline their financial journey. These cards offer the convenience of bypassing the usual credit checks, making it easier and faster to get access to credit.

This can be particularly beneficial if you need immediate funds or want to avoid the hassle of traditional credit card applications. Additionally, pre-approved offers often come with attractive perks such as lower interest rates, rewards programs, or balance transfer options. Understanding the benefits and features of pre-approved credit cards can help you make an informed decision and manage your finances more efficiently. Looking to manage your debt more effectively? Consider using Mitigately, a service that helps consolidate multiple payments into one. Visit Mitigately for more information.

Introduction To Pre-approved Credit Cards

Pre-approved credit cards offer a seamless way to access credit. These cards are available to those who meet certain criteria set by credit issuers. The process is designed to be straightforward, giving potential cardholders a better chance of approval.

What Are Pre-approved Credit Cards?

Pre-approved credit cards are offers extended to individuals who meet specific credit criteria. The issuer reviews your credit report and decides if you qualify. This process does not guarantee approval, but it indicates a high likelihood.

Purpose And Benefits Of Pre-approval

The main purpose of pre-approval is to simplify the application process. It helps issuers target suitable candidates. This approach benefits both the issuer and the applicant.

Benefits of Pre-Approval:

- Increased Approval Odds: Higher chances of getting approved.

- Time-Saving: Quicker application process.

- Confidence: Applicants feel more secure applying.

How Pre-approval Works

Issuers use your credit report to determine eligibility. They send offers to those who meet their criteria. Receiving a pre-approved offer means your basic information matches their requirements.

Steps in the Pre-Approval Process:

- Credit Report Review: Issuers check your credit history.

- Criteria Match: Your profile meets their criteria.

- Offer Issued: You receive the pre-approved offer.

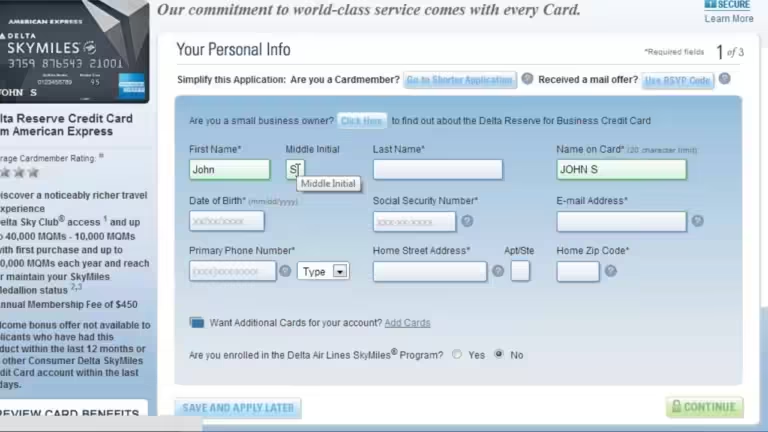

- Application Submission: Complete the application with additional details.

- Final Approval: Issuers conduct a final review and approve.

Key Features Of Pre-approved Credit Cards

Pre-approved credit cards offer a seamless way to access credit with many advantages. Understanding their key features can help you make the most of these financial tools. Below, we explore the primary benefits in detail.

Instant Approval Process

One of the standout features of pre-approved credit cards is the instant approval process. As soon as you apply, you receive a decision in seconds. This quick turnaround means you can access your credit line without waiting for days. This feature is particularly useful for individuals needing immediate funds.

No Impact On Credit Score

Another significant advantage is that pre-approved offers have no impact on your credit score. When you check your eligibility, it counts as a soft inquiry. Soft inquiries do not affect your credit score. This allows you to explore different options without worrying about your credit health.

Tailored Credit Limits And Offers

Pre-approved credit cards often come with tailored credit limits and offers. These offers are based on your credit history and financial behavior. This customization ensures you get the best possible terms. You may benefit from higher credit limits or lower interest rates.

Wide Range Of Card Options

Lastly, the variety of pre-approved credit cards available is extensive. You can choose from a wide range of card options. Whether you prefer rewards cards, balance transfer cards, or cards with low interest rates, there is something for everyone. This diversity allows you to pick a card that aligns with your financial goals.

Pricing And Affordability

Understanding the pricing and affordability of pre-approved credit cards is essential. Various fees and interest rates can impact your financial health. Below, we break down the main costs associated with pre-approved credit cards.

Annual Fees And Interest Rates

Many pre-approved credit cards charge an annual fee. This fee can range from $0 to several hundred dollars. Choosing a card with a lower annual fee can save you money.

Interest rates are another crucial factor. These rates, often expressed as APR (Annual Percentage Rate), can vary significantly. A lower APR can reduce the cost of carrying a balance.

| Card Type | Annual Fee | APR |

|---|---|---|

| Basic | $0 | 15%-20% |

| Premium | $100 | 10%-15% |

Balance Transfer Fees

Transferring a balance from one card to another may incur a balance transfer fee. This fee is typically a percentage of the amount transferred, usually around 3%-5%.

Consider this fee when deciding if a balance transfer is worth it.

- Transfer Amount: $1,000

- Fee Percentage: 3%

- Total Fee: $30

Foreign Transaction Fees

If you travel often, a card with no foreign transaction fees is beneficial. These fees can add up, often around 2%-3% per transaction. Avoiding them can save you money.

Example:

- Transaction Amount: $500

- Fee Percentage: 2%

- Total Fee: $10

Rewards And Cashback Programs

Many pre-approved credit cards offer rewards and cashback programs. These programs can provide points, miles, or cashback for purchases. Evaluating these rewards can help you maximize your benefits.

Common rewards include:

- 1% cashback on all purchases

- 2 points per dollar spent on travel

- 3 miles per dollar spent on dining

Choose a card that aligns with your spending habits to maximize value.

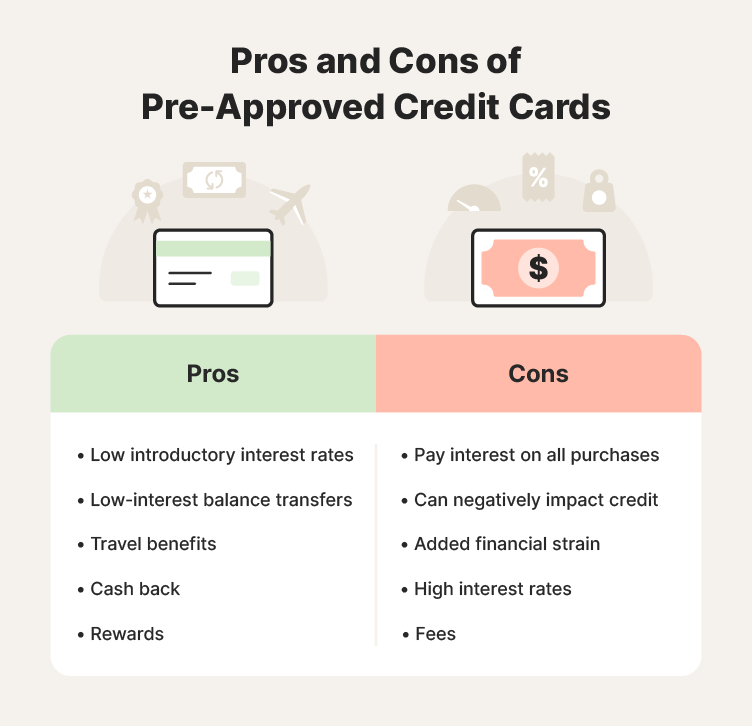

Pros And Cons Of Pre-approved Credit Cards

Pre-approved credit cards offer unique advantages and potential drawbacks. Understanding these can help you make an informed decision when considering your credit options. Here, we’ll explore the benefits and challenges of pre-approved credit cards.

Advantages Of Pre-approved Credit Cards

Pre-approved credit cards come with several advantages that make them appealing:

- Quick Approval: Since you are pre-approved, the approval process is faster.

- Better Offers: Pre-approved cards often come with better interest rates and benefits.

- Convenience: They save you the hassle of applying and waiting for approval.

- Improved Credit Score: Timely payments can help improve your credit score.

Potential Drawbacks And Considerations

Despite the benefits, there are potential drawbacks to be aware of:

- Limited Choices: Pre-approved offers may limit your options compared to traditional applications.

- Misleading Offers: Being pre-approved doesn’t guarantee final approval.

- Impact on Credit Score: If you apply and get rejected, it can negatively impact your credit score.

- High Fees: Some pre-approved cards may come with high fees or unfavorable terms.

Comparing Pre-approved Vs. Traditional Credit Cards

| Feature | Pre-Approved Credit Cards | Traditional Credit Cards |

|---|---|---|

| Approval Speed | Faster | Slower |

| Offer Quality | Often Better | Varies |

| Choice Range | Limited | Wide |

| Impact on Credit Score | Potential Negative Impact if Rejected | Varies |

Understanding the pros and cons of pre-approved credit cards helps you choose the best option for your financial situation. Whether you prefer the speed and convenience of pre-approved cards or the variety and flexibility of traditional credit cards, make sure to weigh each factor carefully.

Ideal Users And Scenarios

Pre-approved credit cards offer various benefits and are perfect for specific users and situations. Understanding who should consider these cards, the best scenarios for their use, and how to maximize their benefits can help you make an informed decision.

Who Should Consider Pre-approved Credit Cards?

- Individuals with Good Credit: Those with a solid credit history often receive pre-approved offers.

- People Seeking Convenience: Pre-approved cards simplify the application process.

- Debt-Conscious Users: If you want to consolidate debts, pre-approved cards can be helpful.

Best Scenarios For Using Pre-approved Credit Cards

| Scenario | Description |

|---|---|

| Debt Consolidation | Combine multiple debts into one manageable payment. |

| Building Credit | Use the card responsibly to improve your credit score. |

| Low-Interest Rates | Take advantage of lower interest rates on pre-approved offers. |

Tips For Maximizing Benefits

- Compare Offers: Look at different pre-approved cards to find the best terms.

- Read the Fine Print: Understand the fees, interest rates, and rewards programs.

- Use Responsibly: Avoid maxing out your credit limit to maintain a good credit score.

Frequently Asked Questions

What Are Pre-approved Credit Cards?

Pre-approved credit cards are offers by banks to customers who meet certain criteria. They are based on credit history and financial behavior. Approval is likely but not guaranteed.

How Do I Get Pre-approved?

You can get pre-approved by having a good credit score. Banks often send offers to customers with stable income and good financial records.

Do Pre-approved Cards Affect Credit Score?

No, checking pre-approved offers does not impact your credit score. It involves a soft inquiry, which does not harm your credit rating.

Are Pre-approved Cards Guaranteed?

No, pre-approved cards are not guaranteed. Final approval depends on a detailed review of your financial status and credit history.

Conclusion

Pre-approved credit cards offer ease and convenience for many. They streamline the approval process, saving time. But always read the terms carefully before accepting. To manage your finances better, consider Mitigately. It helps consolidate debts and save money. Visit Mitigately to learn more. Taking control of your finances is a step towards a brighter future. Make informed choices and enjoy financial freedom.