Personalized Loan Options: Tailored Solutions for Your Needs

Finding the right loan can be a daunting task. Personalized loan options might be the answer.

In today’s fast-paced world, financial needs are unique and varied. Some people need funds for education, others for home improvements. This is where personalized loan options come into play. They cater to your specific needs, providing flexibility and tailored solutions. With personalized loans, you can find terms that fit your budget and financial goals. It’s about making borrowing easier and more efficient. Upstart Personal Loans offer just that. They provide a user-friendly platform that connects you with the right loan options, making the process seamless and straightforward. Ready to explore personalized loan options? Check out Upstart here.

Introduction To Personalized Loan Options

Personalized loan options are tailored financial solutions designed to meet individual needs. Unlike traditional loans, these loans offer terms that fit unique circumstances. They help borrowers get the best possible terms and rates, making debt more manageable.

Understanding Personalized Loans

Personalized loans are customized based on various factors. These factors include credit score, income, and financial history. Lenders use this information to offer loan terms that suit the borrower’s situation. This approach ensures that each borrower gets a loan that fits their needs.

- Credit Score: Lenders assess credit scores to determine risk.

- Income: Regular income ensures the ability to repay.

- Financial History: Past financial behavior impacts loan terms.

Upstart Personal Loans, for example, use advanced technology to provide personalized loan options. This online platform connects borrowers with suitable lenders, offering a user-friendly experience. Visit Upstart Personal Loans for more details.

The Importance Of Tailored Financial Solutions

Tailored financial solutions are essential for managing debt effectively. They offer several benefits, including better interest rates and flexible repayment terms. Personalized loans also ensure that borrowers do not take on more debt than they can handle.

| Benefit | Description |

|---|---|

| Better Interest Rates | Lower rates reduce the overall cost of the loan. |

| Flexible Repayment Terms | Options to adjust repayment schedules to suit financial situations. |

| Manageable Debt | Ensures that borrowers can repay without financial strain. |

Upstart Personal Loans provide an excellent example of tailored financial solutions. Their platform offers various tools to help borrowers make informed decisions. With Upstart, you can find a loan that fits your unique needs and financial situation.

Key Features Of Personalized Loan Options

Personalized loan options offer a range of features tailored to individual financial needs. These features ensure that borrowers receive the best possible terms and conditions based on their unique situations. Here, we explore the key features of personalized loan options.

Customized Interest Rates

Customized interest rates are a standout feature of personalized loan options. Lenders evaluate your financial profile to offer rates that match your creditworthiness. This means you could benefit from lower rates if you have a strong credit history, potentially saving a significant amount on interest over the loan’s lifespan.

Flexible Repayment Terms

Another key feature is the flexible repayment terms. Personalized loans allow you to choose a repayment schedule that fits your budget. This flexibility helps in managing your monthly finances better, ensuring you can meet other financial obligations without stress.

Variety Of Loan Types

Personalized loan options also include a variety of loan types. Whether you need a loan for debt consolidation, home improvement, or unexpected expenses, there are specific loans tailored for each need. This variety ensures that you get a loan that perfectly matches your requirements.

Credit Score Considerations

Lenders offering personalized loans take into account your credit score when determining loan terms. A higher credit score can lead to better terms, such as lower interest rates and longer repayment periods. This consideration ensures that your financial responsibility is rewarded.

Benefits Of Personalized Loan Options

Personalized loan options can provide numerous advantages to borrowers. They tailor financial solutions to individual needs, offering flexibility and better management opportunities.

Financial Flexibility

Personalized loans offer significant financial flexibility. Borrowers can choose loan terms that fit their budget and financial goals. This flexibility helps in managing monthly repayments effectively.

- Choose from various repayment terms.

- Adjustable interest rates based on credit profile.

- Possibility to refinance or adjust terms if financial situations change.

Financial flexibility ensures borrowers are not burdened by rigid repayment structures, allowing them to maintain better financial stability.

Better Financial Management

Personalized loans contribute to better financial management. With tailored loan amounts and terms, borrowers can plan their finances more accurately.

- Set realistic repayment goals.

- Monitor and control budget effectively.

- Prevent over-borrowing by customizing loan amounts.

This approach helps in creating a structured financial plan, making it easier to handle expenses and savings simultaneously.

Improved Loan Approval Chances

Personalized loan options can lead to improved loan approval chances. Lenders assess individual financial situations and tailor loan offers accordingly.

| Factors | Impact on Approval |

|---|---|

| Credit Score | Higher chance with tailored interest rates. |

| Income | Custom loan amounts based on income stability. |

| Debt-to-Income Ratio | Better terms for manageable debt levels. |

These personalized considerations increase the likelihood of loan approval, providing access to necessary funds.

Pricing And Affordability

Understanding the pricing and affordability of Upstart Personal Loans is crucial for making an informed decision. This section will delve into the key aspects, such as interest rates, hidden fees, and cost-effectiveness.

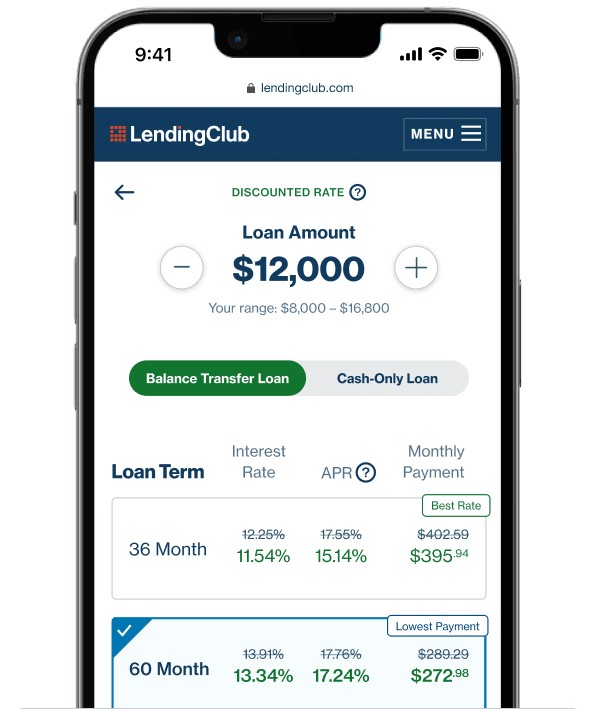

Interest Rates Comparison

Interest rates play a significant role in the cost of a loan. Upstart Personal Loans offer competitive rates compared to traditional banks. Let’s look at a comparison:

| Lender | Interest Rate (APR) |

|---|---|

| Upstart | 6.18% – 35.99% |

| Traditional Banks | 7.99% – 24.99% |

Upstart’s rates are personalized based on your credit score, income, and other factors. This customization can lead to more affordable loans for many borrowers.

Hidden Fees And Charges

Transparency is essential when evaluating loan options. Upstart Personal Loans are known for their clear fee structure. Here are some potential fees you might encounter:

- Origination Fee: 0% – 8% of the loan amount

- Late Payment Fee: $15 or 5% of the unpaid amount

- Prepayment Penalty: None

Understanding these fees helps you avoid unexpected costs and better manage your loan repayment.

Cost-effectiveness Analysis

Evaluating the cost-effectiveness of a loan involves looking at the total cost over its lifespan. Consider the following factors:

- Interest Rate: A lower rate can save money over time.

- Loan Term: Longer terms may lower monthly payments but increase total cost.

- Additional Fees: Factor in any origination or late fees.

Using Upstart’s personalized rates, many borrowers can find loans that are more affordable in the long run.

Pros And Cons Of Personalized Loan Options

Personalized loan options offer tailored financial solutions to meet unique needs. These loans can provide many benefits but may also present some challenges. Understanding the pros and cons can help you make an informed decision.

Advantages Of Personalized Loans

- Customized Terms: Personalized loans allow you to choose terms that fit your financial situation.

- Competitive Interest Rates: These loans often come with lower interest rates compared to standard loans.

- Flexibility: You can select the repayment period and schedule that best suits you.

- Improved Credit Score: Timely repayments on personalized loans can help improve your credit score.

- Quick Approval: Many personalized loan providers offer fast approval processes.

Potential Drawbacks To Consider

- High Fees: Some personalized loans may come with high origination or processing fees.

- Strict Eligibility Criteria: These loans may have stringent requirements for approval.

- Variable Interest Rates: Some personalized loans may have variable interest rates, which can fluctuate over time.

- Limited Availability: Not all lenders offer personalized loan options.

- Potential for Over-Borrowing: The flexibility of these loans may lead to borrowing more than you need.

Recommendations For Ideal Users

Personalized loan options, such as Upstart Personal Loans, cater to a wide range of users. These loans offer tailored solutions based on individual financial profiles. Understanding who benefits most from these loans is essential for making informed decisions.

Best Scenarios For Personalized Loans

Personalized loans work best in several scenarios. Here are a few examples:

- Consolidating Debt: If you have multiple debts, combining them into one personalized loan can simplify payments.

- Home Renovations: For those planning home improvements, a personalized loan provides the funds needed to enhance your living space.

- Unexpected Expenses: Personalized loans are ideal for covering unforeseen costs, such as medical bills or urgent repairs.

- Credit Score Improvement: If you aim to build or improve your credit score, a personalized loan can help manage your credit responsibly.

Who Should Avoid Personalized Loans

Not everyone benefits from personalized loans. Here are some cases where they may not be ideal:

- High Interest Rates: If your credit score is low, you may face higher interest rates. This can make the loan more expensive.

- Unstable Income: Those with inconsistent income might struggle to make regular payments. This can lead to financial strain.

- Existing Financial Strain: If you are already under significant financial pressure, taking on more debt may not be wise.

- Short-Term Needs: For very short-term needs, other options like credit cards might be more suitable.

Frequently Asked Questions

What Are Personalized Loan Options?

Personalized loan options are tailored loan solutions to fit individual financial needs and credit profiles. They offer customized terms, interest rates, and repayment plans.

How Do I Qualify For Personalized Loans?

To qualify for personalized loans, you typically need a good credit score, stable income, and manageable debt levels. Lenders assess your financial profile.

Are Personalized Loan Options Better Than Standard Loans?

Personalized loan options can be better as they offer tailored terms and rates. They suit individual financial situations more effectively than standard loans.

Can I Get A Personalized Loan With Bad Credit?

Yes, some lenders offer personalized loan options for bad credit. They may have higher interest rates and stricter terms.

Conclusion

Choosing the right loan can be challenging. Personalized loan options simplify this process. Upstart Personal Loans offer tailored solutions to meet your needs. They provide ease, flexibility, and clear terms. Need more information? Visit the Upstart website by clicking on this link: Upstart Personal Loans. Take control of your finances today with a loan that fits you perfectly.