Personalized Credit Solutions: Tailored Financial Freedom Awaits

Navigating the world of credit can be daunting. Personalized credit solutions offer tailored advice and strategies to help you manage your finances effectively.

In today’s financial landscape, one size does not fit all. Each individual’s credit needs and goals are unique. Personalized credit solutions address this by offering customized advice and strategies. Whether you aim to improve your credit score, manage debt, or invest in real estate, personalized solutions can guide you. They provide the tools and support to make informed decisions, tailored just for you. Discover how SubTo, an educational resource for real estate investors, can help you achieve your financial goals. With a focus on creative financing, SubTo offers the support and expertise you need. Ready to explore more? Visit Subto today.

Introduction To Personalized Credit Solutions

Personalized credit solutions offer a tailored approach to managing and improving your credit. They cater to your unique financial needs and goals. Understanding these solutions can help you make informed decisions and achieve better financial health.

What Are Personalized Credit Solutions?

Personalized credit solutions refer to customized financial services designed to meet individual needs. They involve evaluating your financial situation and providing specific advice and products that suit you. These solutions can include:

- Custom Credit Plans: Tailored strategies for improving your credit score.

- Debt Management: Personalized plans to manage and reduce debt.

- Loan Options: Custom loan products based on your creditworthiness.

The Purpose Of Tailored Financial Services

The main goal of tailored financial services is to provide support and solutions that match your unique financial situation. This approach ensures that you receive advice and products that are relevant to you.

Here are some key purposes:

- Improve Credit Score: By offering targeted strategies, you can see a significant improvement in your credit rating.

- Manage Debt Efficiently: Personalized plans help in reducing financial stress and managing debts more effectively.

- Achieve Financial Goals: Tailored services guide you towards achieving your specific financial objectives.

In conclusion, personalized credit solutions offer a more effective way to improve your financial health. By focusing on your individual needs, these services provide a clear path to better credit and financial stability.

Key Features Of Personalized Credit Solutions

Personalized credit solutions offer tailored financial services to meet individual needs. These solutions empower users with customized credit plans, flexible repayment options, and tools to improve credit scores. Personalized financial advice ensures that each user receives guidance suited to their unique financial situation.

Customized Credit Plans

SubTo offers customized credit plans that are designed to fit your specific financial needs. These plans take into account your income, expenses, and financial goals.

- Individualized credit limits

- Personalized interest rates

- Tailored repayment schedules

This approach ensures that you have a plan that works best for your financial situation, helping you manage your debt more effectively.

Flexible Repayment Options

One of the key benefits of SubTo’s personalized credit solutions is the flexible repayment options. These options allow you to choose repayment terms that best suit your financial capabilities.

- Variable repayment periods

- Adjustable monthly payments

- Early repayment without penalties

This flexibility can help you avoid financial strain and maintain a good credit standing.

Credit Score Improvement Tools

SubTo provides a variety of credit score improvement tools to help you build and maintain a good credit score. These tools include:

- Credit monitoring services

- Personalized credit reports

- Recommendations for credit-building activities

Using these tools, you can stay on top of your credit health and make informed decisions to improve your credit score over time.

Personalized Financial Advice

SubTo offers personalized financial advice tailored to your unique financial situation. This advice is designed to help you make smart financial decisions and achieve your financial goals.

| Feature | Description |

|---|---|

| Individual Consultations | One-on-one meetings with financial experts |

| Financial Planning | Customized plans for saving, investing, and spending |

| Goal Setting | Help in setting and achieving financial goals |

With SubTo’s personalized financial advice, you can confidently navigate your financial journey.

Pricing And Affordability Of Personalized Credit Solutions

Understanding the pricing and affordability of personalized credit solutions is crucial for making informed financial decisions. This section breaks down the cost structure, fees, and affordability for different income levels, helping you navigate your options with ease.

Cost Structure And Fees

Personalized credit solutions often come with a variety of costs and fees. These can include:

- Initial Setup Fees: A one-time fee to establish your personalized credit plan.

- Monthly Maintenance Fees: Ongoing costs for maintaining your account.

- Transaction Fees: Costs incurred with each transaction or use of credit.

- Consultation Fees: Fees for any professional advice or consultation services provided.

It’s essential to review each of these fees to understand the overall cost of your credit solution. Transparent pricing ensures you are aware of what you are paying for and can plan accordingly.

Affordability For Different Income Levels

Personalized credit solutions are designed to be accessible to individuals with varying income levels. Here’s a breakdown of affordability:

| Income Level | Affordability | Features |

|---|---|---|

| Low Income | High |

|

| Middle Income | Moderate |

|

| High Income | Flexible |

|

By offering various pricing structures, personalized credit solutions cater to a wide range of financial situations. This ensures that everyone, regardless of their income, can benefit from tailored financial assistance.

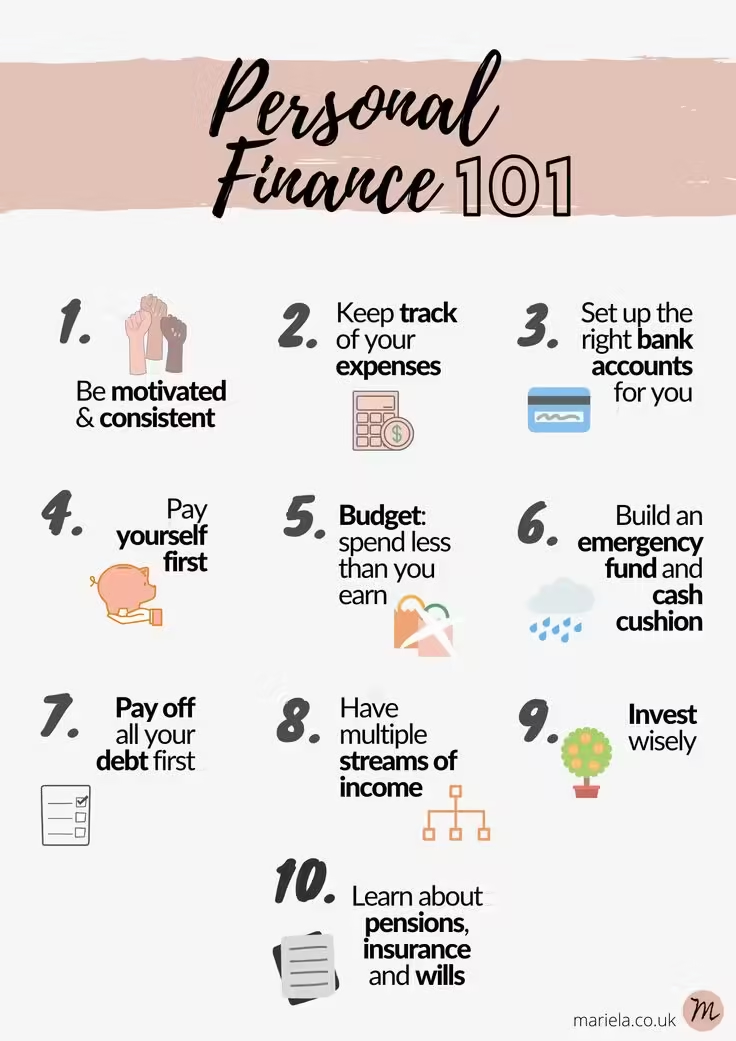

Pros And Cons Of Personalized Credit Solutions

Personalized credit solutions offer unique benefits and challenges. These solutions cater to individual financial needs, providing tailored financial products. It’s important to understand the advantages and potential drawbacks before opting for personalized credit solutions.

Advantages Of Tailored Financial Products

- Customized Financial Plans: Personalized credit solutions provide custom financial plans based on individual needs.

- Better Interest Rates: Tailored products often offer better interest rates, saving money over time.

- Flexible Repayment Terms: These solutions typically come with flexible repayment terms that fit personal financial situations.

- Enhanced Financial Management: Personalized products help in better financial management and decision-making.

- Improved Credit Scores: Responsible use of tailored credit solutions can improve credit scores.

Potential Drawbacks And Considerations

- Higher Fees: Some personalized credit solutions may have higher fees compared to standard options.

- Complex Terms: The terms and conditions can be complex and harder to understand.

- Limited Availability: Not all lenders offer personalized credit solutions, limiting options.

- Potential for Over-Borrowing: Tailored products can sometimes lead to over-borrowing and increased debt.

- Dependence on Accurate Information: The effectiveness of personalized solutions depends on providing accurate financial information.

Understanding the advantages and drawbacks of personalized credit solutions helps in making informed financial decisions. Always consider your individual financial situation and needs.

Recommendations For Ideal Users

Personalized credit solutions offer tailor-made financial services. These services benefit specific user groups. Understanding who can gain the most from personalized credit solutions helps make informed decisions. Below are recommendations for ideal users of personalized credit solutions.

Who Can Benefit Most From Personalized Credit Solutions?

SubTo is perfect for real estate investors. Both experienced and novice investors can gain from it. It provides grounded support, innovative approaches, and member leadership. These features are valuable for:

- Individuals seeking creative financing strategies.

- Investors looking for positive and supportive communities.

- People needing essential real estate documents.

- Those eager to take immediate action in real estate deals.

Ideal Scenarios For Using Tailored Financial Services

Tailored financial services are beneficial in various scenarios. Below are some ideal situations:

| Scenario | Benefit |

|---|---|

| Starting a Real Estate Career | Access to high-level investors and successful professionals. |

| Expanding Investment Portfolio | Guidance to close more deals efficiently. |

| Seeking Community Support | Be part of a supportive and encouraging environment. |

| Needing Reliable Documents | Save time with bulletproof real estate documents. |

These scenarios highlight the versatility of personalized credit solutions. They provide tangible benefits for various investor needs.

Frequently Asked Questions

What Are Personalized Credit Solutions?

Personalized credit solutions are tailored financial products designed to meet an individual’s unique credit needs. They can include customized loan terms, interest rates, and repayment options. These solutions aim to improve credit access and financial health.

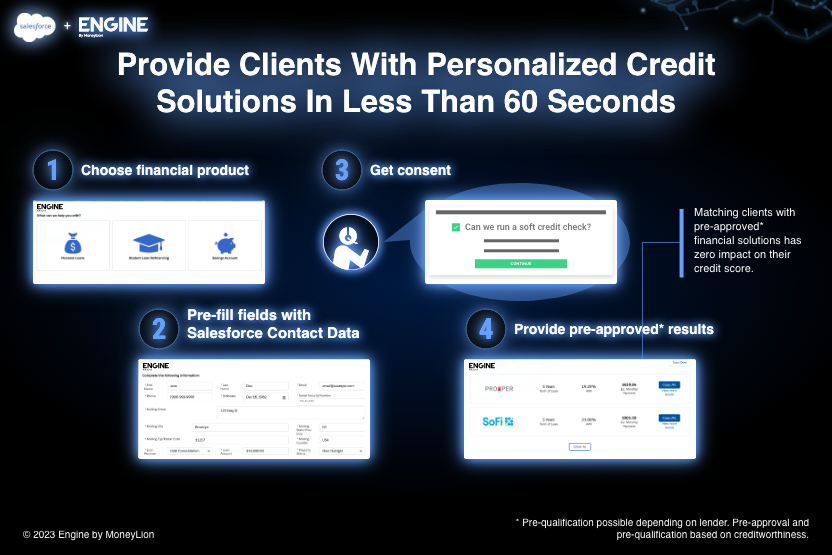

How Do Personalized Credit Solutions Work?

Personalized credit solutions assess your credit history, income, and financial goals. Based on this information, lenders offer customized loan terms. This personalized approach helps ensure the credit product suits your financial situation and repayment capacity.

Who Can Benefit From Personalized Credit Solutions?

Anyone with unique financial needs or credit challenges can benefit from personalized credit solutions. They are ideal for individuals seeking better loan terms, those with irregular income, or those looking to improve their credit score.

Are Personalized Credit Solutions Expensive?

Not necessarily. Personalized credit solutions often provide better terms than generic credit products. By tailoring the offer to your financial situation, you may get lower interest rates or more flexible repayment options, which can save you money.

Conclusion

Finding the right credit solution can transform your financial future. Personalized credit solutions cater to your unique needs, helping you achieve your financial goals. Subto offers comprehensive support for real estate investors. Their resources guide you through creative financing, ensuring success at every level. Experience community support, expert advice, and actionable strategies. Ready to explore personalized credit solutions? Check out Subto for more information. Start your journey towards financial freedom today.