Personalized Credit Card Offers: Unlock Exclusive Benefits

Credit cards are essential tools in today’s financial world. Personalized credit card offers make it easier to find the right card for you.

Imagine getting a credit card offer tailored specifically to your needs. Personalized offers consider your spending habits, credit score, and financial goals. This means you get a card that fits your lifestyle and helps you manage your finances better. With the right card, you can enjoy benefits like cashback, rewards, and low-interest rates. Personalized credit card offers not only save you time but also enhance your financial well-being. If you’re looking for a tailored credit card offer, check out Possible Finance. Their Possible Loan and Possible Card provide quick access to funds and help build credit history, even for those with bad credit.

Introduction To Personalized Credit Card Offers

In today’s fast-paced world, credit card companies are shifting towards personalized credit card offers to better meet customer needs. By tailoring offers to individual financial profiles, these companies aim to provide the most suitable and beneficial options for each user.

What Are Personalized Credit Card Offers?

Personalized credit card offers are tailored specifically to an individual’s financial situation. They consider various factors like credit score, spending habits, and income. This approach ensures that the card features and benefits align closely with the user’s needs and preferences.

| Feature | Personalized Offer | Standard Offer |

|---|---|---|

| Credit Limit | Based on income and spending habits | Generic limit for all applicants |

| Interest Rate | Variable, based on credit score | Fixed rate for all |

| Rewards | Customized to spending categories | Standard rewards for all |

The Purpose And Benefits Of Personalization

The main goal of personalized credit card offers is to provide users with the best possible financial tools. By understanding each customer’s unique profile, credit card companies can offer:

- Better Interest Rates: Lower rates based on good credit history.

- Higher Credit Limits: Limits that reflect income and spending capacity.

- Customized Rewards: Rewards that match spending habits.

For example, Possible Financial Inc. offers the Possible Card with a $400 or $800 credit limit. This card features 0% interest forever and no late fees. The monthly fee is either $8 or $16, and it helps build credit history.

Another product, the Possible Loan, allows users to borrow up to $500 with no penalty fees and fair repayment plans. These offers are designed to provide quick access to funds and an opportunity to improve credit scores.

Key Features Of Personalized Credit Card Offers

Personalized credit card offers bring a unique touch to your financial needs. These offers cater to your specific preferences and financial habits, providing numerous benefits. Let’s explore some key features:

Tailored Rewards Programs

With personalized credit card offers, you can enjoy tailored rewards programs. These programs align with your spending patterns, offering rewards where you spend the most. For instance, you might earn more points on groceries, travel, or dining, making your card truly rewarding.

Customizable Credit Limits

Customizable credit limits are another standout feature. Cards like the Possible Card offer an instant credit limit of $400 or $800. This flexibility ensures you have the right credit limit for your needs, without the burden of high interest rates.

Exclusive Access To Events And Offers

Personalized credit cards often provide exclusive access to events and offers. Cardholders may receive invitations to special events, early access to sales, or unique promotions. This adds an extra layer of value to your credit card, making it more than just a payment tool.

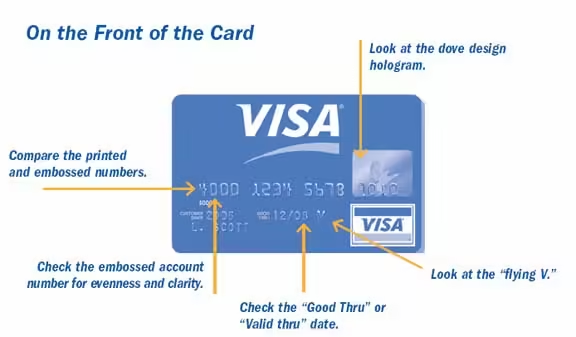

Enhanced Security Features

Security is paramount with personalized credit card offers. Enhanced security features protect your transactions and personal information. This includes advanced fraud detection, zero liability on unauthorized purchases, and real-time alerts for suspicious activities.

In summary, personalized credit card offers cater to your unique needs. They provide tailored rewards, customizable credit limits, exclusive access, and enhanced security features, ensuring a comprehensive and secure financial experience.

Pricing And Affordability Of Personalized Credit Cards

Personalized credit cards, such as those offered by Possible Finance, are designed to provide tailored financial solutions. Understanding their pricing and affordability is crucial to making an informed decision. Let’s delve into the details.

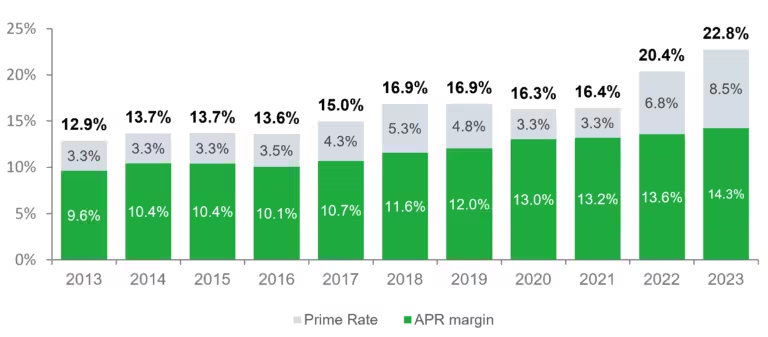

Annual Fees And Interest Rates

The Possible Card stands out with its transparent fee structure. It charges a monthly fee of $8 or $16 depending on the chosen credit limit of $400 or $800, respectively. Unlike many traditional credit cards, it has 0% interest forever and no late fees.

In contrast, standard credit cards often have varying annual fees and interest rates. These can range from $0 to $500 annually and interest rates from 15% to 25% APR, making the Possible Card an appealing alternative for those seeking predictable costs.

Comparing Costs With Standard Credit Cards

Comparing personalized credit cards like the Possible Card with standard credit cards highlights significant differences:

| Feature | Possible Card | Standard Credit Card |

|---|---|---|

| Monthly Fee | $8 or $16 | Varies; typically no monthly fee |

| Annual Fee | None | $0 – $500 |

| Interest Rate | 0% | 15% – 25% APR |

| Late Fees | None | $25 – $40 |

The Possible Card’s structure is designed to be straightforward and manageable, especially for those looking to avoid debt traps and high-interest rates.

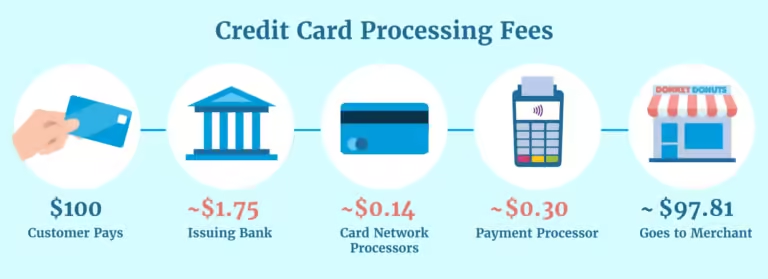

Hidden Charges To Watch Out For

One of the significant advantages of the Possible Card is its commitment to no hidden fees. Users can enjoy peace of mind knowing there are no surprise charges. This transparency is a stark contrast to some standard credit cards, which may have hidden fees such as:

- Balance transfer fees

- Foreign transaction fees

- Cash advance fees

- Over-limit fees

These hidden charges can accumulate quickly, making it essential to understand the complete fee structure before committing to any credit card.

For more details on personalized credit card options, visit Possible Finance.

Pros And Cons Of Personalized Credit Card Offers

Personalized credit card offers are tailored to an individual’s financial profile. These offers aim to provide the best possible fit for the user’s needs. While they offer numerous benefits, they also come with certain drawbacks. Let’s explore the advantages and limitations of these tailored credit card offers.

Advantages Of Personalization

- Better Fit for Needs: Personalized offers match your spending habits and financial goals.

- Enhanced Rewards: Tailored credit cards often come with rewards that align with your lifestyle, maximizing your benefits.

- Improved Approval Odds: Offers based on your credit profile increase the chances of approval.

- Credit Building: Products like Possible Card help build credit history, especially for those with bad credit.

- Transparent Fees: Transparent fee structures, such as the $8 or $16 monthly fee for the Possible Card, ensure no hidden charges.

Potential Drawbacks And Limitations

- Limited Options: Personalized offers may limit your choices, focusing only on select products.

- Data Privacy Concerns: Sharing personal financial data can raise privacy issues.

- State-Specific Availability: Eligibility and approval may vary by state, as seen with Possible Finance products.

- Monthly Fees: Products like Possible Card come with monthly fees, which may not suit everyone.

- Eligibility Restrictions: Not everyone will qualify for these offers, and specific licenses and regulations may apply.

Real-world Usage Feedback

Users often praise the quick access to funds and the ability to build credit history. For instance, the Possible Loan provides up to $500 instantly with a fair repayment plan. Customers appreciate the absence of late or penalty fees and the simple application process via the Possible App.

However, some users express concerns about the monthly fees associated with the Possible Card. Despite this, the 0% interest rate and no late fees make it an attractive option for many. The transparent pricing and no hidden charges further enhance user satisfaction.

Overall, personalized credit card offers from Possible Finance provide a practical solution for those looking to build or improve their credit history. They offer quick access to funds and a transparent fee structure, making them a viable option for many users.

For more information, visit Possible Finance.

Ideal Users And Scenarios For Personalized Credit Cards

Personalized credit card offers can cater to various user needs and financial scenarios. These tailored solutions provide significant advantages for specific users and situations. Let’s explore who benefits the most and the scenarios where personalized offers truly shine.

Who Benefits The Most From Personalized Credit Cards?

Personalized credit cards are ideal for individuals with unique financial needs. Below is a table highlighting key user groups:

| User Group | Benefits |

|---|---|

| Individuals with Bad Credit | Benefit from credit-building opportunities and no credit checks, such as with the Possible Card. |

| Students | Can start building credit with low fees and easy approval processes. |

| Freelancers | Enjoy quick access to funds for managing cash flow issues. |

| Small Business Owners | Benefit from instant credit limits and transparent fee structures. |

Scenarios Where Personalized Offers Shine

Personalized credit card offers excel in various scenarios. Here are a few examples:

- Emergency Expenses: Quick access to funds in minutes helps manage unexpected costs.

- Building Credit: On-time payments on a Possible Card can improve credit history.

- Debt Management: Transparent fees and no interest help avoid debt traps.

- Frequent Travelers: Personalized cards with travel rewards or no foreign transaction fees.

Tips For Maximizing Benefits

To get the most out of personalized credit card offers, consider these tips:

- Monitor Your Credit: Regularly check your credit score to track improvements.

- Pay on Time: Ensure on-time payments to build a positive credit history.

- Understand Fees: Be aware of any monthly fees, such as the $8 or $16 fee for the Possible Card.

- Utilize Benefits: Make the most of any special rewards or offers available.

By understanding who benefits the most, recognizing the ideal scenarios, and following these tips, users can maximize the advantages of personalized credit card offers.

Frequently Asked Questions

What Are Personalized Credit Card Offers?

Personalized credit card offers are tailored deals based on your financial profile and spending habits. They aim to match your needs and preferences.

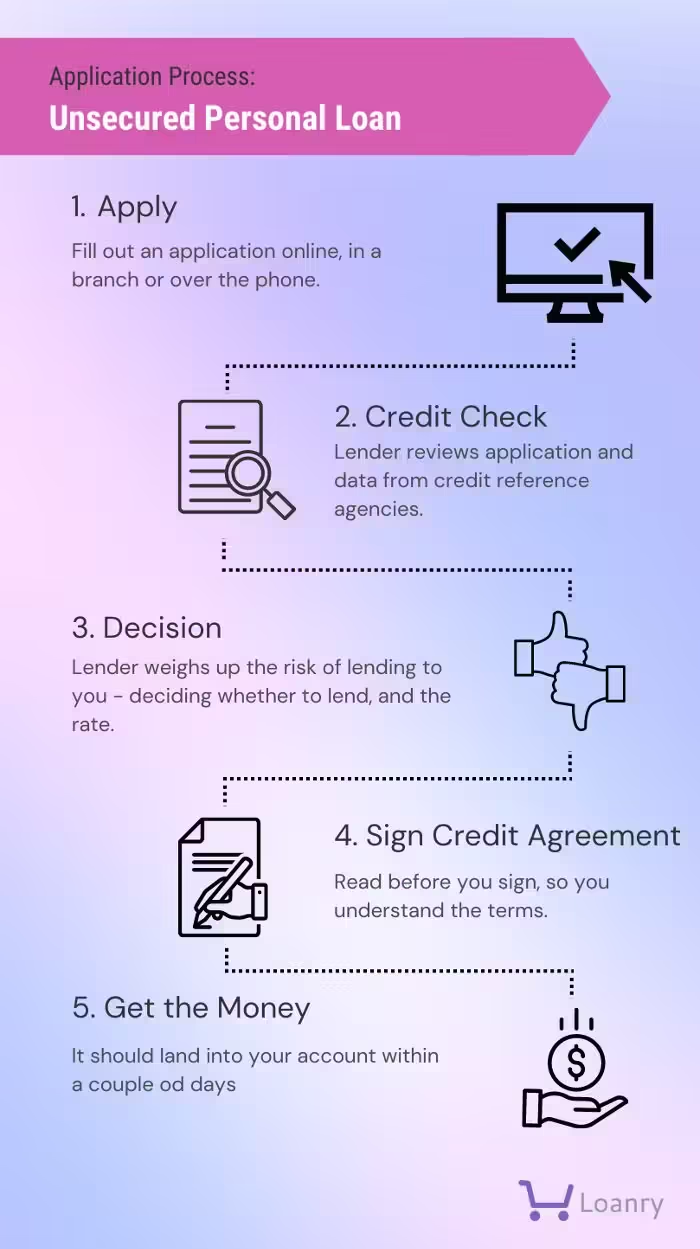

How Do I Get Personalized Credit Card Offers?

You can receive personalized offers by maintaining a good credit score, regularly updating your financial information, and opting in for promotional communications.

Why Are Personalized Credit Card Offers Beneficial?

Personalized offers can provide better rewards, lower interest rates, and customized benefits that match your spending patterns and financial needs.

Can Personalized Credit Card Offers Affect My Credit Score?

Receiving offers won’t affect your credit score. However, applying for multiple cards in a short time can impact your score.

Conclusion

Choosing the right credit card can be a game-changer for your financial health. Personalized credit card offers provide tailored benefits to meet your specific needs. They offer better rates, rewards, and perks that suit your lifestyle. Explore options like the Possible Loan and Possible Card to make informed decisions. These products offer quick access to funds and help build credit. For more details, visit the Possible Finance website. Take control of your financial future with the right credit card. It’s easier than you think!