Personal Loans With Low Interest: Unlock Affordable Financing

Personal loans with low interest rates can be a financial lifesaver. They provide a way to manage expenses without high fees.

If you’re looking for a personal loan, it’s crucial to find one with favorable terms. Many people face unexpected expenses. Medical bills, home repairs, or even starting a new business can be costly. With a personal loan, you can cover these needs without draining your savings. But not all loans are created equal. Some come with high interest rates that make repayment difficult. That’s where PersonalLoans.com comes in. They connect borrowers with lenders offering loans from $250 to $35,000. Their platform ensures you get competitive rates and quick approval. Plus, there are no hidden fees. Whether you need funds for an emergency or a big purchase, PersonalLoans.com can help you find the right loan. Explore PersonalLoans.com today and discover how easy it is to get a personal loan with low interest.

Introduction To Personal Loans With Low Interest

Personal loans can be a lifeline during financial crunches. With the right low-interest personal loan, you can manage your finances more effectively. This guide will provide you with essential information on personal loans with low interest rates. Let’s explore the key elements you need to know.

Understanding Personal Loans

Personal loans are funds borrowed from a lender, which you repay over time with interest. These loans can range from $250 to $35,000 and can be used for various purposes such as emergencies, home improvements, or business startups. PersonalLoans.com is a platform that connects you with a wide network of lenders, offering flexible loan options.

| Loan Amounts | $250 to $35,000 |

|---|---|

| Loan Terms | 3 months to 72 months |

| APR Range | 5.99% to 35.89% |

The Importance Of Low-interest Rates

Choosing a loan with a low-interest rate is crucial. It reduces the total amount you repay over the loan term. This can save you significant money and make repayments more manageable. PersonalLoans.com offers competitive rates through its vast network of lenders, making it easier to find a loan that fits your needs.

Purpose Of This Guide

This guide aims to provide clear, concise information about personal loans with low interest rates. By understanding your options, you can make informed decisions and secure the best loan for your situation.

- Learn about the features of personal loans

- Understand the significance of low-interest rates

- Find out how PersonalLoans.com can help you

With the right knowledge, you can navigate the loan landscape and find the best deals. PersonalLoans.com is here to connect you with the right lenders, ensuring you get the most competitive rates available.

Key Features Of Low-interest Personal Loans

Personal loans with low interest rates offer numerous advantages. They can save you money and provide flexible terms to fit your needs. Understanding these key features can help you make an informed decision.

Competitive Interest Rates

Low-interest personal loans come with competitive interest rates. This means you pay less in interest over the life of the loan. For example, PersonalLoans.com offers APRs ranging from 5.99% to 35.89%. This broad range allows you to find a rate that fits your financial situation.

Flexible Repayment Terms

These loans often include flexible repayment terms. You can choose from 3 months to 72 months to repay your loan. This flexibility allows you to select a term that matches your budget and financial goals.

Minimal Fees And Charges

With minimal fees and charges, these loans can be cost-effective. PersonalLoans.com does not charge any upfront costs or hidden fees. The only fees you might encounter are those disclosed by the lender before you accept the loan offer.

Quick Approval Process

The approval process is usually quick. On PersonalLoans.com, you can complete an online form and connect with funding options within minutes. If approved, you might receive the funds as soon as the next business day. This speedy process is ideal for urgent financial needs.

Credit Score Requirements

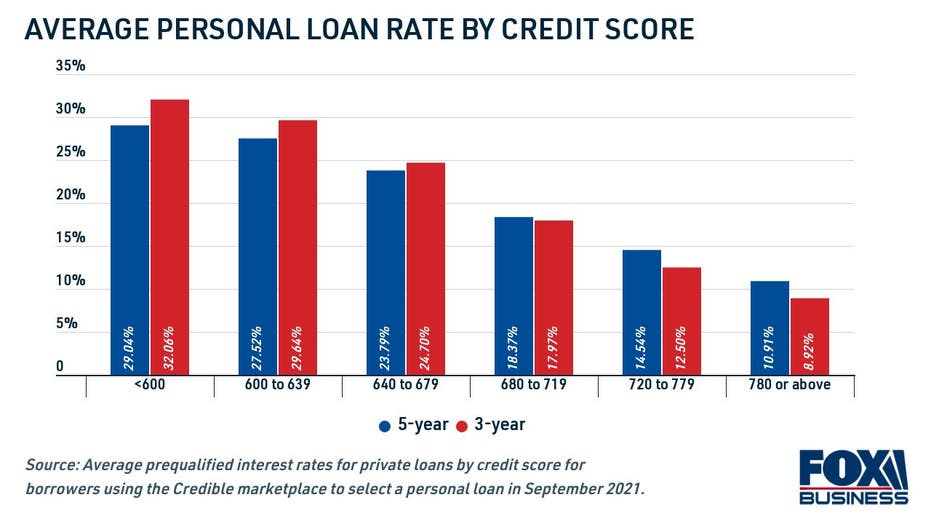

Credit score requirements vary, but low-interest personal loans generally favor good credit. Lenders may perform credit checks to determine your creditworthiness. PersonalLoans.com connects you with a wide network of lenders, increasing your chances of finding a loan that suits your credit profile.

For more information, visit PersonalLoans.com.

Benefits Of Low-interest Personal Loans

Low-interest personal loans offer numerous benefits, making them an attractive option for many. They provide significant cost savings and improved financial management. Here are some key benefits:

Cost Savings Over Time

With a low-interest personal loan, borrowers save money on interest payments. This can lead to substantial cost savings over the life of the loan.

For example, a loan with a 5.99% APR will cost less in interest compared to one with a 35.89% APR. The lower the interest rate, the more you save over time.

Lower Monthly Payments

Low-interest loans generally come with lower monthly payments. This makes it easier to manage your monthly budget and avoid financial strain.

Borrowers can allocate more funds to other essential expenses or savings, leading to better financial stability.

Easier Debt Management

Low-interest personal loans help in managing debts more effectively. They often provide better terms and lower interest rates compared to credit cards or other high-interest debt.

This makes it easier to pay off debts without accruing additional interest, leading to faster debt resolution.

Access To Larger Loan Amounts

Borrowers with low-interest loans often qualify for larger loan amounts. This is because lower interest rates reduce the risk for lenders, making them more willing to lend higher amounts.

At PersonalLoans.com, you can access loan amounts ranging from $250 to $35,000, which can be used for various purposes like home improvements or business startups.

Improved Financial Planning

Low-interest personal loans contribute to better financial planning. With predictable and manageable payments, borrowers can plan their finances more effectively.

This allows for setting realistic financial goals and achieving them without the stress of high-interest rates.

| Benefit | Description |

|---|---|

| Cost Savings | Save money on interest payments over time. |

| Lower Monthly Payments | Manageable monthly payments for better budgeting. |

| Easier Debt Management | Pay off debts faster with lower interest rates. |

| Access to Larger Loans | Qualify for higher loan amounts with low interest. |

| Improved Financial Planning | Plan finances effectively with predictable payments. |

By opting for a low-interest personal loan, you can enjoy these benefits and achieve better financial health. Visit PersonalLoans.com to explore loan options tailored to your needs.

Pricing And Affordability

PersonalLoans.com connects you with lenders offering personal loans with competitive rates. Knowing what to expect in terms of pricing and affordability can help you make informed decisions. Here, we break down the key factors that influence the cost of your loan.

Interest Rate Comparison

Interest rates can significantly affect the overall cost of your loan. PersonalLoans.com offers APR ranges from 5.99% to 35.89%. Here’s a quick comparison:

| Loan Amount | Interest Rate (Low) | Interest Rate (High) |

|---|---|---|

| $250 | 5.99% | 35.89% |

| $5,000 | 5.99% | 35.89% |

| $35,000 | 5.99% | 35.89% |

Understanding Apr (annual Percentage Rate)

The Annual Percentage Rate (APR) represents the annual cost of your loan, including interest and fees. A lower APR means lower overall costs. For instance, a loan with a 5.99% APR will cost much less over time compared to one with a 35.89% APR.

Hidden Fees To Watch Out For

While PersonalLoans.com itself has no hidden fees, individual lenders might charge fees like:

- Origination Fees

- Late Payment Fees

- Prepayment Penalties

These fees will be disclosed before you accept any loan offer. Always review the terms carefully.

Sample Cost Analysis

Let’s break down a sample cost analysis for a $5,000 loan over 24 months.

| Loan Amount | APR | Monthly Payment | Total Cost |

|---|---|---|---|

| $5,000 | 5.99% | $220.47 | $5,291.28 |

| $5,000 | 20.00% | $254.96 | $6,119.04 |

| $5,000 | 35.89% | $303.63 | $7,287.12 |

As seen, the APR greatly influences the total cost of your loan. Lower APR results in lower monthly payments and total cost.

By understanding these factors, you can find a personal loan that fits your budget and needs.

Pros And Cons Of Low-interest Personal Loans

Choosing low-interest personal loans can be a smart financial decision. They often come with benefits such as lower monthly payments and reduced overall costs. However, it’s important to understand all aspects before committing to one. Below, we explore the advantages and potential drawbacks of low-interest personal loans, and how to balance them with other factors.

Advantages Of Low-interest Loans

- Lower Monthly Payments: Reduced interest rates mean you pay less each month, freeing up cash for other expenses.

- Lower Total Cost: Over the life of the loan, you save money by paying less interest.

- Flexible Loan Amounts: Personal loans from platforms like PersonalLoans.com range from $250 to $35,000, catering to various financial needs.

- Fast Approval: Complete an online form and get connected to lenders within minutes, often receiving funds by the next business day.

- No Hidden Fees: Transparent fee structures ensure you know exactly what you’re paying for, with no surprises.

Potential Drawbacks

- Qualification Requirements: Low-interest rates may be reserved for those with higher credit scores.

- Origination Fees: Some lenders may charge fees for processing the loan, which could offset savings from the low interest rate.

- Variable Rates: Some loans may have variable interest rates, which can increase over time, leading to higher payments.

- Repayment Terms: Loans with longer terms may seem attractive but could lead to paying more interest over time.

Real-world Usage Scenarios

| Scenario | Low-Interest Loan Benefit |

|---|---|

| Home Improvement | Lower interest rates reduce the cost of borrowing for renovations. |

| Debt Consolidation | Combining high-interest debts into one low-interest loan can save money. |

| Emergency Expenses | Quick access to funds at a low cost can provide peace of mind. |

| Business Startup | Lower borrowing costs help manage initial expenses more effectively. |

Balancing Interest Rates With Other Factors

When considering a low-interest personal loan, it’s essential to balance the interest rate with other factors:

- Loan Terms: Shorter terms mean higher payments but less interest paid overall.

- Fees: Always check for origination or other fees that might add to the cost.

- Credit Requirements: Ensure your credit score meets the lender’s criteria for low-interest rates.

- Repayment Flexibility: Look for options that allow early repayment without penalties.

Platforms like PersonalLoans.com offer a range of loan options, making it easier to find a loan that fits your needs while offering competitive rates.

Ideal Users For Low-interest Personal Loans

Personal loans with low interest rates offer significant benefits. They are suitable for various individuals with different financial needs. These loans can save money on interest, making them an attractive option. Below, we will identify the best candidates for these loans, the situations where they shine, and alternatives for those who may not qualify.

Best Candidates For Low-interest Loans

Individuals with a strong credit history often benefit the most. A high credit score signals lenders that you are a low-risk borrower. This can help secure lower interest rates. Here are some specific groups who are ideal candidates:

- Creditworthy Borrowers: Those with a credit score of 700 or above.

- Stable Income Earners: Individuals with a consistent and reliable income.

- Existing Debt Managers: People who manage their existing debts well.

Situations Where Low-interest Loans Shine

Low-interest personal loans are particularly useful in specific scenarios. These loans can provide financial relief and opportunities when used wisely. Consider the following situations:

- Debt Consolidation: Combining multiple high-interest debts into one lower-interest loan.

- Home Improvements: Financing major renovations or upgrades at a lower cost.

- Emergency Expenses: Covering unexpected expenses like medical bills without high-interest penalties.

Alternatives For Those Who May Not Qualify

Not everyone qualifies for low-interest personal loans. For those who do not, there are alternative solutions. These options can provide financial assistance when needed:

| Alternative | Description |

|---|---|

| Credit Unions | Credit unions often offer personal loans with reasonable rates. |

| Secured Loans | Using collateral to secure a loan can lead to lower interest rates. |

| Family and Friends | Borrowing from personal connections can be a low-cost option. |

Conclusion: Making The Most Of Low-interest Personal Loans

Low-interest personal loans can be a valuable financial tool. They offer affordable borrowing options for various needs such as emergencies, home improvements, or business startups. With platforms like PersonalLoans.com, accessing competitive rates and flexible terms has never been easier.

Summary Of Key Points

- Loan Amounts range from $250 to $35,000.

- Loan Terms span from 3 months to 72 months.

- APR Range is from 5.99% to 35.89%.

- No Hidden Fees: The service is free with no upfront costs.

- Fast Approval: Online form completion with quick connection to funding options.

- Direct Deposit: Funds can be received as soon as the next business day.

- Wide Lender Network: Access to a large network of lenders.

Tips For Finding The Best Loan

- Compare Offers: Use platforms like PersonalLoans.com to compare different lenders.

- Check APR and Fees: Understand the APR and any fees disclosed by the lender.

- Review Terms: Carefully review the loan terms, including repayment options.

- Credit Score Impact: Be aware of how credit checks may affect your credit score.

- Read Reviews: Look for reviews or feedback from other borrowers.

Final Thoughts And Recommendations

Making informed decisions about low-interest personal loans can save money. Platforms like PersonalLoans.com offer transparency, competitive rates, and flexible terms, ensuring borrowers find the best fit for their needs. Always review all loan offers carefully and choose the one that aligns with your financial situation.

Frequently Asked Questions

What Is A Low Interest Personal Loan?

A low interest personal loan has a lower annual percentage rate (APR) than the average. This results in cheaper monthly payments and less overall interest.

How Do I Qualify For Low Interest Personal Loans?

To qualify, maintain a good credit score, stable income, and low debt-to-income ratio. Lenders assess these factors to offer low interest rates.

Where Can I Find Low Interest Personal Loans?

You can find them at banks, credit unions, and online lenders. Compare rates and terms from different lenders to find the best option.

Are There Any Fees For Low Interest Personal Loans?

Yes, some lenders may charge origination fees, prepayment penalties, or late payment fees. Always read the loan agreement carefully.

Conclusion

Choosing a personal loan with low interest can save you money. PersonalLoans.com connects you to numerous lenders. You can find flexible loan options here. Explore their offerings for emergencies, home improvements, and more. With competitive rates and quick approval, it’s an excellent choice. Visit PersonalLoans.com to learn more and apply today.