Personal Loans Online: Fast, Easy, and Hassle-Free Approval

Personal loans online provide a fast and easy way to get funds. They can help you handle emergencies, bills, or even vacations.

Applying for personal loans online has become a popular choice for many. PersonalLoans.com is one such service that connects borrowers with a network of lenders. With loan amounts ranging from $250 to $35,000, you can find a loan that fits your needs. The process is simple and straightforward, making it easy to apply anytime. Plus, PersonalLoans.com offers competitive rates and fast funding, potentially as soon as the next business day. Whether you need funds for home improvements or unexpected expenses, PersonalLoans.com can help you find the right loan. Learn more and apply today at PersonalLoans.com.

Introduction To Personal Loans Online

Personal loans online have become a popular choice for many. They offer quick access to funds with minimal hassle. Discover the benefits of using services like PersonalLoans.com.

What Are Personal Loans?

Personal loans are unsecured loans that individuals can use for various purposes. They don’t require collateral, making them a flexible option for borrowers.

| Loan Amount | Loan Terms | APR |

|---|---|---|

| $250 to $35,000 | 3 months to 72 months | 5.99% to 35.89% |

- Used for emergencies, home improvements, or vacations

- Fast funding, often as soon as the next business day

- No hidden fees or upfront costs with PersonalLoans.com

The Rise Of Online Personal Loans

The internet has changed the way we handle personal finances. Online personal loans provide convenience and speed. Services like PersonalLoans.com connect borrowers with a network of lenders.

With just a few clicks, you can apply for a loan. The process is simple and straightforward. Fill out an online form and receive offers from multiple lenders.

Security is a key concern. PersonalLoans.com uses advanced data encryption technology to protect user information.

Online personal loans are available 24/7. This flexibility allows you to apply any time, day or night.

Benefits Of Using Personalloans.com

- Free service with no obligation to accept loan offers

- Extended lender network increases your chances of approval

- Access to competitive rates from various lenders

With PersonalLoans.com, you can also receive offers for other credit-related products. These include debt relief, credit repair, and credit monitoring.

For more information, visit PersonalLoans.com.

Key Features Of Online Personal Loans

Online personal loans have become a popular choice for many borrowers. They offer convenience, speed, and flexibility that traditional loans often lack. Here are some key features of online personal loans that make them attractive to borrowers.

Speedy Application Process

One of the main advantages of online personal loans is the speedy application process. With PersonalLoans.com, you can complete the application in just a few minutes. The online form is simple and straightforward, reducing the time it takes to apply.

| Step | Description |

|---|---|

| 1 | Fill out the online form |

| 2 | Submit your application |

| 3 | Receive loan offers |

| 4 | Choose and accept a loan |

Minimal Documentation Required

Applying for an online personal loan requires minimal documentation. This makes the process faster and less cumbersome. Typically, you only need to provide basic information such as:

- Proof of identity

- Proof of income

- Bank account details

PersonalLoans.com uses advanced data encryption to protect your information, ensuring your privacy and security throughout the application process.

Flexible Loan Amounts And Terms

Online personal loans offer flexible loan amounts and terms. PersonalLoans.com connects you with lenders offering loans ranging from $250 to $35,000. You can choose loan terms from 3 months to 72 months, allowing you to find a loan that suits your needs.

Here is a quick overview:

| Loan Amount | Loan Term |

|---|---|

| $250 – $35,000 | 3 months – 72 months |

24/7 Availability

Another significant benefit of online personal loans is their 24/7 availability. You can apply for a loan at any time, day or night. This flexibility is particularly useful for those with busy schedules or urgent financial needs.

PersonalLoans.com allows you to request a loan whenever you need it, providing a convenient solution for managing your finances.

Overall, the key features of online personal loans make them an attractive option for borrowers seeking quick, flexible, and convenient funding solutions.

How Online Personal Loans Benefit Borrowers

Online personal loans have transformed the lending landscape, providing numerous benefits to borrowers. Platforms like PersonalLoans.com make it easier to access funds, offering a seamless borrowing experience. Below, we explore key advantages of online personal loans.

Convenience And Accessibility

Online personal loans offer unparalleled convenience and accessibility. Borrowers can apply for loans from the comfort of their homes. There is no need for physical visits to banks or credit unions. The process is straightforward, with a simple online form. Borrowers can request a loan any time, day or night.

This accessibility ensures that users can connect with a wide network of lenders, increasing the likelihood of finding a suitable loan offer. With loan amounts ranging from $250 to $35,000, there is flexibility to meet various financial needs.

Faster Approval Times

One of the standout features of online personal loans is the faster approval times. Traditional loans may take days or weeks for approval. In contrast, online platforms like PersonalLoans.com expedite the process. Borrowers may receive funds as soon as the next business day.

This speed is crucial during emergencies or unexpected expenses, providing quick access to needed funds without lengthy waiting periods.

Competitive Interest Rates

Borrowers benefit from competitive interest rates available through online personal loans. PersonalLoans.com connects users with a variety of lenders, each offering different terms and rates. The APR typically ranges from 5.99% to 35.89%, providing options for various credit profiles.

By comparing multiple offers, borrowers can select loans with favorable terms, ensuring affordable repayments and minimizing financial strain.

Secure And Transparent Process

Security and transparency are paramount in the online lending process. PersonalLoans.com utilizes advanced data encryption technology to protect user information. Borrowers can trust that their personal and financial details are secure.

The platform also emphasizes a transparent process. There are no hidden fees, no upfront costs, and no obligation to accept loan offers. Users can review all terms and conditions before making a decision, ensuring clarity and confidence in their borrowing choices.

| Feature | Details |

|---|---|

| Loan Amounts | $250 to $35,000 |

| Loan Terms | 3 months to 72 months |

| APR | 5.99% to 35.89% |

| Fast Funding | As soon as the next business day |

| Usage | Emergencies, home improvements, business startups, unexpected bills, vacations |

Pricing And Affordability Breakdown

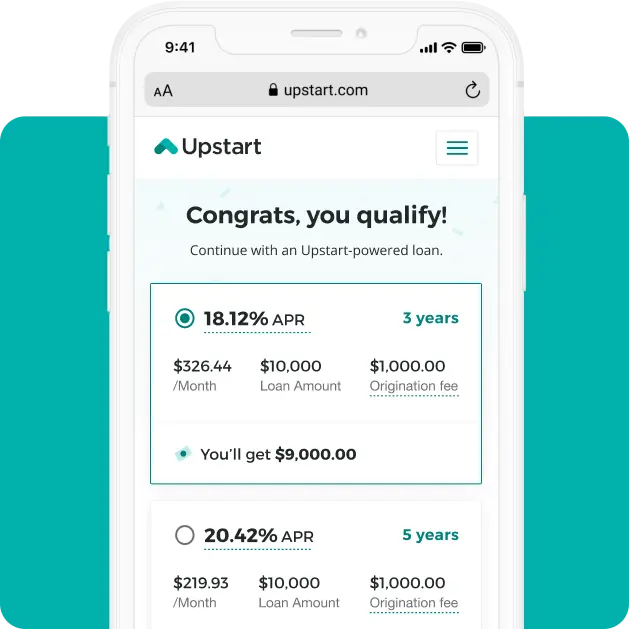

Understanding the pricing and affordability of personal loans is crucial before committing. PersonalLoans.com offers various terms and interest rates, making it easier for borrowers to find the best fit. This section will cover interest rates, fees and charges, and repayment terms, ensuring you make an informed decision.

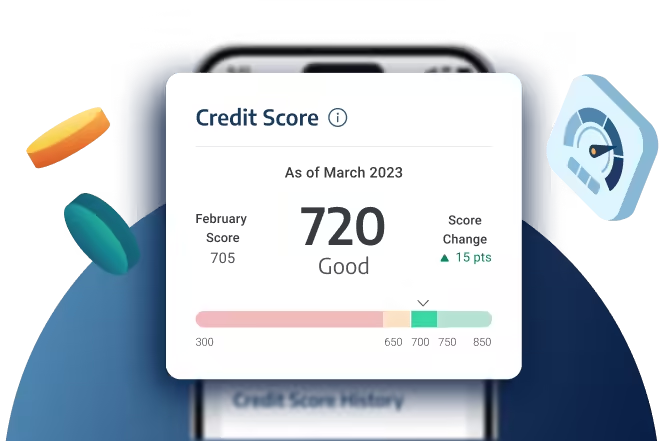

Interest Rates Comparison

Interest rates vary significantly based on loan amount, term, and credit score. PersonalLoans.com connects borrowers with lenders offering APRs from 5.99% to 35.89%. These rates are competitive, giving borrowers a range of options.

| Loan Amount | APR Range |

|---|---|

| $250 – $5,000 | 5.99% – 35.89% |

| $5,001 – $15,000 | 6.99% – 32.99% |

| $15,001 – $35,000 | 7.99% – 29.99% |

Understanding Fees And Charges

Although PersonalLoans.com is a free service, some lenders may charge fees. These fees can include origination fees, late payment fees, or prepayment penalties. It’s essential to review all fees before accepting a loan offer.

- Origination Fees: Typically 1% to 5% of the loan amount

- Late Payment Fees: Varies by lender; usually a fixed amount

- Prepayment Penalties: Some lenders may charge for early repayment

Repayment Terms And Options

PersonalLoans.com offers flexible repayment terms ranging from 3 months to 72 months. Borrowers can choose a term that fits their financial situation. Shorter terms often have higher monthly payments but lower overall interest costs. Longer terms offer lower monthly payments but may result in higher interest costs over time.

- Short-term Loans: 3 to 12 months

- Medium-term Loans: 13 to 36 months

- Long-term Loans: 37 to 72 months

Additionally, many lenders provide multiple repayment options, such as automatic withdrawals or online payments, making it easier to stay on track.

Understanding these factors will help you navigate the personal loan landscape more effectively. Always review all terms and conditions before accepting any loan offer.

Pros And Cons Of Online Personal Loans

Online personal loans provide a convenient way to access funds. They offer various benefits but also come with potential drawbacks. Let’s explore the advantages and risks associated with online personal loans.

Advantages Of Online Personal Loans

- Convenience: Apply from the comfort of your home at any time.

- Fast Funding: Receive funds as soon as the next business day.

- Free Service: No hidden fees or upfront costs.

- Flexible Loan Amounts: Borrow from $250 to $35,000.

- Competitive Rates: Access a wide variety of lenders offering competitive rates.

- Security: Advanced data encryption to protect user information.

- Simple Process: Straightforward online form simplifies the application.

Potential Drawbacks And Risks

- High APR: Interest rates can range from 5.99% to 35.89%.

- Origination Fees: Some lenders may charge fees for processing the loan.

- Credit Score Impact: Applying for multiple loans can affect your credit score.

- Scams: Be cautious of fraudulent websites and lenders.

- Repayment Terms: Ensure you can meet the terms, which range from 3 to 72 months.

Online personal loans offer numerous benefits but also come with certain risks. It’s essential to carefully review all terms and conditions before accepting any loan offer.

Ideal Users And Scenarios For Online Personal Loans

Online personal loans are a flexible financial tool. They cater to a variety of needs. Understanding who benefits the most from these loans can help you decide if they are right for you.

Who Should Consider Online Personal Loans?

- Individuals with urgent financial needs: If you need funds quickly, online personal loans can provide fast funding. You could receive the money as soon as the next business day.

- People with varied credit histories: PersonalLoans.com offers loans even if your credit score is not perfect. The extended lender network increases the likelihood of finding a match.

- Those preferring convenience: The application process is simple and straightforward. You can complete it from home anytime, day or night.

Situations Where Online Personal Loans Are Most Beneficial

| Situation | Benefit of Online Personal Loans |

|---|---|

| Emergency Expenses | Quick access to funds helps manage unexpected bills or urgent repairs. |

| Home Improvements | Financing larger projects with flexible loan terms up to 72 months. |

| Business Startups | Initial funding to kickstart your venture when traditional loans are not an option. |

| Debt Consolidation | Combining multiple debts into a single loan with a competitive interest rate. |

| Vacations | Financing your dream trip without depleting savings. |

Choosing the right loan can significantly impact your financial health. Consider your situation and the benefits of online personal loans to make an informed decision.

Frequently Asked Questions

What Are Personal Loans Online?

Personal loans online are loans that you can apply for and receive over the internet. These loans are typically unsecured, meaning no collateral is required. They’re convenient and often have quick approval times.

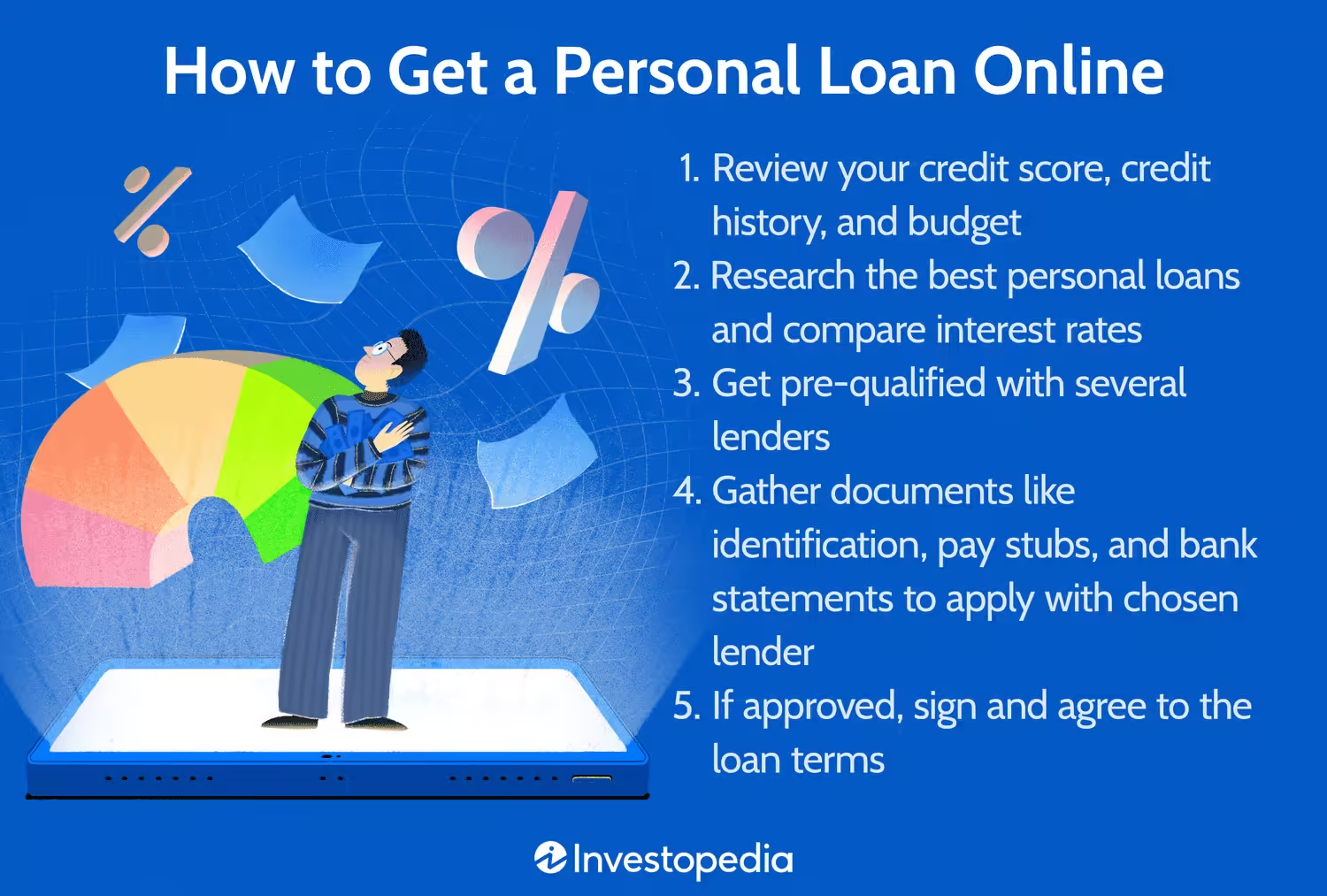

How Do I Apply For Personal Loans Online?

To apply for personal loans online, visit a lender’s website and fill out their application form. Provide necessary details like your personal information, income, and the amount you wish to borrow.

Are Online Personal Loans Safe?

Yes, online personal loans can be safe if you use reputable lenders. Always check for secure websites, read reviews, and understand the terms before applying.

What Are The Benefits Of Personal Loans Online?

Personal loans online offer convenience, fast approval, and often lower interest rates. They also allow you to compare multiple lenders easily, making it simpler to find the best deal.

Conclusion

Exploring personal loans online can simplify your financial needs. PersonalLoans.com offers a convenient way to connect with various lenders. This service is free and easy to use. Find loans ranging from $250 to $35,000 with flexible terms. Receive funds quickly and use them for any purpose. Start your journey towards financial relief today with PersonalLoans.com. Make informed choices and secure the best loan for your situation.