Personal Loans Near Me: Quick Approval and Low Rates

Finding the right personal loan can be a challenging task. But with the right guidance, it becomes much simpler.

When in need of quick funds, many people search for “Personal Loans Near Me.” This search often leads to a variety of options, each with its own set of benefits and terms. PersonalLoans.com is a reliable online platform that connects you with a network of lenders. Whether you need a small loan of $250 or a larger amount up to $35,000, PersonalLoans.com offers a range of choices. The process is free, secure, and efficient. You can review multiple loan offers before deciding, ensuring you find the best fit for your financial needs. Ready to explore your options? Visit PersonalLoans.com and take the first step towards securing the funds you need.

Introduction To Personal Loans Near Me

Finding a reliable source for personal loans can be challenging. PersonalLoans.com simplifies this process by connecting borrowers with a vast network of lenders. This online service offers an easy, quick, and secure way to find personal loans that suit your financial needs. Whether you need funds for emergencies, home improvements, or unexpected bills, PersonalLoans.com can assist you in finding the right loan.

What Are Personal Loans?

Personal loans are a type of unsecured loan provided by financial institutions. They do not require collateral and can be used for various purposes. Borrowers can request amounts ranging from $250 to $35,000, making them a versatile option for many financial situations.

Through PersonalLoans.com, you can access loans with competitive rates and flexible terms. This service connects you with lenders who offer loans that fit your specific needs and credit profile.

Purpose And Benefits Of Personal Loans

Personal loans serve multiple purposes and offer several benefits:

| Purpose | Benefits |

|---|---|

| Emergencies | Quick access to funds |

| Home Improvements | Enhance property value |

| Business Startups | Initial capital funding |

| Unexpected Bills | Cover unforeseen expenses |

| Vacations | Finance travel plans |

- No Hidden Fees: No upfront costs or obligations.

- Fast Funding: Receive approved funds as soon as the next business day.

- Extended Network: Greater chances of loan approval through a wide network of lenders.

- Flexible Terms: Loan terms range from 3 months to 72 months.

- Security: Advanced encryption technology ensures your information is secure.

PersonalLoans.com offers a free service to request loans, making it accessible for everyone. The process is straightforward: fill out an online form, review loan offers, and choose the best option. If approved, you can receive funds quickly and address your financial needs without delay.

For more information, visit PersonalLoans.com.

Key Features Of Personal Loans Near Me

Personal loans are a convenient solution for immediate financial needs. Services like PersonalLoans.com offer a range of features that make the borrowing process smooth and hassle-free. Here are some key features to consider:

Quick Approval Process

One of the standout features of personal loans near me is the quick approval process. Borrowers can complete a simple online form and get connected with lenders within minutes. Funds can be received as soon as the next business day, ensuring you get the money when you need it most.

Competitive Interest Rates

Personal loans through PersonalLoans.com provide access to a network of lenders offering competitive interest rates. Rates range from 5.99% to 35.89%, depending on the loan amount, term, and your creditworthiness. This wide range allows you to find a rate that works for your financial situation.

Flexible Repayment Terms

Borrowers can benefit from flexible repayment terms that range from 3 months to 72 months. This flexibility means you can choose a term that aligns with your financial goals and repayment capacity. For example:

| Loan Amount | Term | APR | Monthly Payment | Total Payments |

|---|---|---|---|---|

| $8,500 | 2 years | 6.99% | $380.53 | $9,132.68 |

| $10,000 | 3 years | 8.34% | $314.93 | $11,337.64 |

| $15,000 | 4 years | 10.45% | $383.69 | $18,417.05 |

| $20,000 | 5 years | 8.54% | $410.72 | $24,646.98 |

| $30,000 | 6 years | 7.99% | $525.85 | $37,861.25 |

No Collateral Required

A significant advantage of personal loans near me is that they are unsecured. This means no collateral is required, reducing the risk for borrowers. You can obtain a loan without needing to pledge your assets, making it a safer option for many.

By understanding these key features, you can make an informed decision about personal loans and choose the best option for your financial needs.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of personal loans is crucial. This section breaks down the key aspects of costs associated with personal loans. It covers interest rates, fees, and how personal loans compare to other types of loans.

Interest Rates And Apr

Interest rates and Annual Percentage Rates (APR) determine the overall cost of a loan. At PersonalLoans.com, the APR ranges from 5.99% to 35.89%. The rate depends on the loan amount, term, and the borrower’s creditworthiness.

| Loan Amount | Term | APR | Monthly Payment | Total Payment |

|---|---|---|---|---|

| $8,500 | 2 years | 6.99% | $380.53 | $9,132.68 |

| $10,000 | 3 years | 8.34% | $314.93 | $11,337.64 |

| $15,000 | 4 years | 10.45% | $383.69 | $18,417.05 |

| $20,000 | 5 years | 8.54% | $410.72 | $24,646.98 |

| $30,000 | 6 years | 7.99% | $525.85 | $37,861.25 |

Fees And Charges

PersonalLoans.com prides itself on having no hidden fees. There are no upfront costs, and users are under no obligation to accept a loan offer. However, users should be aware of potential late payment fees. If a payment is late, it is essential to contact the lender to discuss possible arrangements.

- No upfront costs

- No obligation to accept a loan offer

- Potential late payment fees

Comparison With Other Loan Types

Comparing personal loans to other loan types can help in making an informed decision. Here are some key differences:

- Personal Loans: Loan amounts from $250 to $35,000, with flexible terms and competitive rates.

- Credit Cards: Generally higher interest rates and fees for cash advances.

- Payday Loans: Short-term loans with very high interest rates, often up to 400% APR.

- Home Equity Loans: Lower interest rates but require collateral, typically your home.

PersonalLoans.com offers a wide variety of lenders with competitive rates and terms. This makes it a viable option for those seeking flexibility and affordability in personal finance.

Pros And Cons Of Personal Loans Near Me

Exploring personal loans near you can be beneficial. But, it’s crucial to weigh the pros and cons. This section discusses the advantages and drawbacks of opting for local lenders.

Advantages Of Choosing Local Lenders

Choosing local lenders offers several benefits. Here are some key advantages:

- Personalized Service: Local lenders often provide a more personalized experience. You can build a relationship with them, making the loan process smoother.

- Community Focused: Local lenders understand the community’s needs. They may offer better terms tailored to local borrowers.

- Convenient Access: You can easily visit their office for face-to-face discussions. This can help clarify any doubts quickly.

- Faster Processing: Local lenders may process loans faster. They often have fewer bureaucratic steps compared to larger institutions.

- Support Local Economy: Borrowing from local lenders supports the local economy. It keeps money within the community, helping it grow.

Potential Drawbacks To Consider

Despite the benefits, there are some potential drawbacks to consider:

- Limited Loan Amounts: Local lenders may offer smaller loan amounts. This can be a limitation if you need a larger sum.

- Higher Interest Rates: Interest rates might be higher compared to online lenders. It’s essential to compare rates before deciding.

- Fewer Options: The variety of loan products may be limited. Online services like PersonalLoans.com provide access to a wider network of lenders.

- Less Flexibility: Local lenders might have stricter criteria. This can make it harder for some borrowers to qualify.

- Limited Online Services: Not all local lenders offer comprehensive online services. This can be inconvenient for tech-savvy borrowers preferring digital solutions.

Overall, the decision to choose a local lender should be based on your specific needs and preferences. Weigh the pros and cons carefully before making a choice.

Who Should Consider Personal Loans Near Me?

Personal loans can be a lifeline for many individuals. They offer quick access to funds, flexible terms, and can be used for various needs. But, who exactly should think about personal loans near me? Let’s explore some ideal scenarios and the types of borrowers who benefit most.

Ideal Scenarios For Applying

- Emergency Expenses: Sudden medical bills, urgent home repairs, or unexpected travel costs.

- Debt Consolidation: Combining multiple debts into one manageable loan with potentially lower interest rates.

- Home Improvement: Renovating or upgrading your home to increase its value or comfort.

- Major Purchases: Buying appliances, furniture, or other significant items without depleting savings.

- Education Costs: Covering tuition fees, books, or other educational expenses.

Types Of Borrowers Who Benefit Most

- Individuals with Good Credit: Those with a solid credit history often receive better rates and terms.

- People Needing Fast Cash: Personal loans can provide funds as soon as the next business day.

- Self-Employed or Freelancers: Ideal for those who may not have a steady income but need funds for business or personal use.

- First-Time Borrowers: Those who are new to credit can start building their credit profile with manageable loans.

- Those Looking for Flexibility: Borrowers who need loans with flexible terms and usage.

PersonalLoans.com is a great platform to start your search. They connect you with a network of lenders offering loans from $250 to $35,000. The service is free, secure, and you can review loan offers before making a decision.

For more details, visit their website at PersonalLoans.com.

.png)

Frequently Asked Questions

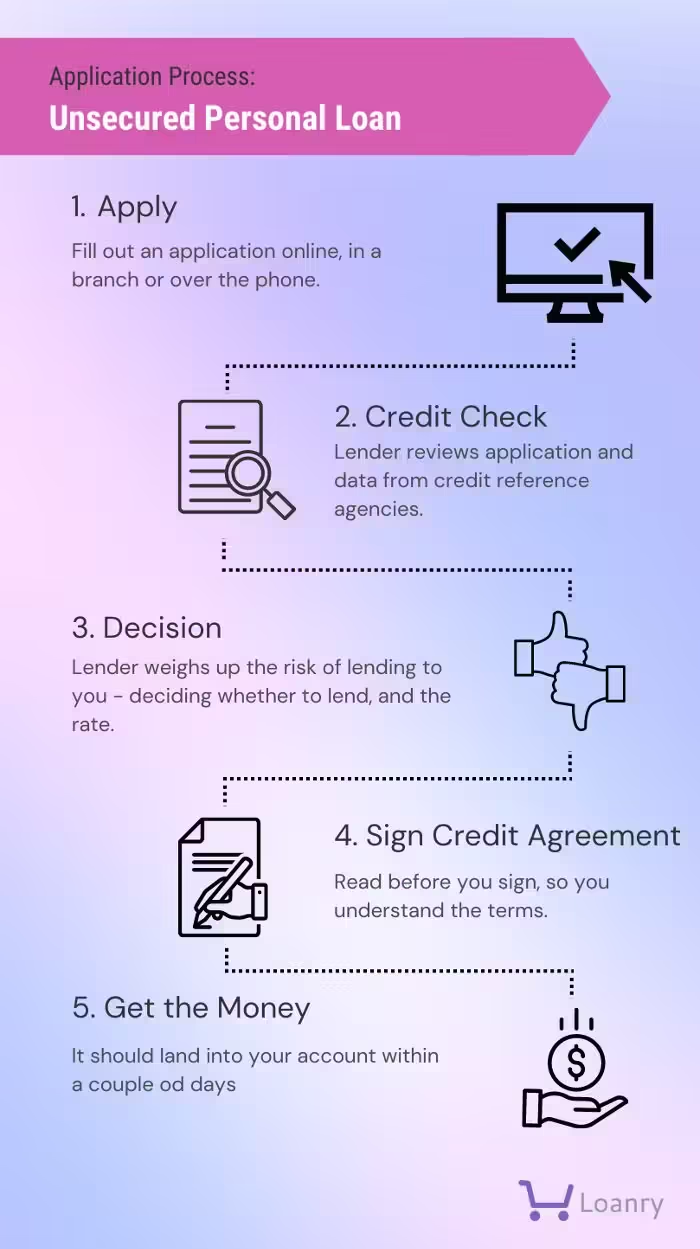

What Are Personal Loans?

Personal loans are unsecured loans that you can use for various purposes. They don’t require collateral.

How To Find Personal Loans Near Me?

Search online for local banks, credit unions, or loan providers. Compare rates and reviews.

What Are The Benefits Of Local Personal Loans?

Local personal loans may offer lower interest rates and personalized service. They can be more convenient.

Are Personal Loans Easy To Get?

Personal loans can be easy to get if you have good credit. Lenders check your credit score.

Conclusion

Finding the right personal loan can be challenging. PersonalLoans.com offers a simple solution. With loans ranging from $250 to $35,000, there’s an option for everyone. The service is free and secure, ensuring your information is safe. Funds can be received quickly, often the next business day. Explore loan options today at PersonalLoans.com. Access competitive rates and flexible terms. Reviewing loan offers before accepting ensures you make the best choice. Get started now and find the loan that fits your needs!