Personal Loans For Home Improvement: Transform Your Space Today

Home improvement projects can be exciting but often come with a hefty price tag. Many homeowners turn to personal loans to fund these upgrades.

Personal loans for home improvement offer a straightforward way to secure funds without tapping into home equity. These loans provide the financial flexibility needed to tackle various renovation projects. Whether you want to modernize your kitchen, upgrade your bathroom, or add a new room, a personal loan can help make your vision a reality. Personal loans typically come with fixed interest rates and set repayment terms, making it easier to budget for your project. Plus, they can often be obtained more quickly than other types of financing. Discover how you can benefit from a personal loan for home improvement and start planning your dream renovation today. For more information, visit Upstart Personal Loans.

Introduction To Personal Loans For Home Improvement

Planning a home improvement project can be exciting yet challenging. Renovations require substantial funds, and not everyone has instant access to large sums of money. This is where personal loans for home improvement come into play. These loans offer a practical solution to finance your home renovations without straining your finances.

What Are Personal Loans For Home Improvement?

Personal loans for home improvement are unsecured loans specifically designed to cover the costs of renovating or upgrading your home. Unlike a home equity loan, they do not require you to use your home as collateral. This means you can borrow the needed funds based on your creditworthiness.

These loans typically come with fixed interest rates and repayment terms, making it easier to budget for your project. Whether you need to remodel your kitchen, add an extra room, or upgrade your bathroom, a personal loan can help you achieve your goals without upfront payments.

The Purpose Of Home Improvement Loans

The primary purpose of a home improvement loan is to provide homeowners with the necessary funds to enhance their living spaces. These loans can be used for a variety of purposes, including but not limited to:

- Kitchen Remodels: Upgrade appliances, cabinets, and countertops.

- Bathroom Renovations: Install new fixtures, tiles, and plumbing.

- Room Additions: Expand your living space with an extra room.

- Outdoor Enhancements: Improve your patio, garden, or landscaping.

- Energy Efficiency Improvements: Install solar panels or energy-efficient windows.

These upgrades not only make your home more comfortable but can also increase its market value. By choosing a personal loan, you can spread the cost of these improvements over time, making them more manageable.

In conclusion, personal loans for home improvement offer a flexible and accessible way to finance your home renovation projects. By understanding their purpose and benefits, you can make informed decisions and transform your home into your dream space.

Key Features Of Home Improvement Personal Loans

Home improvement personal loans offer a range of benefits. These loans can help you renovate your home without straining your finances. Here are the key features of these loans:

Flexible Loan Amounts

Home improvement personal loans come with flexible loan amounts. You can borrow as little or as much as you need. This flexibility allows you to fund small repairs or major renovations.

Competitive Interest Rates

These loans offer competitive interest rates. This means you can get the funds you need at a cost that fits your budget. Lower interest rates translate to lower monthly payments.

Quick Approval Process

One of the best features is the quick approval process. Many lenders offer fast approval, sometimes within a day. This allows you to start your home improvement projects without delay.

No Collateral Required

Home improvement personal loans typically require no collateral. This means you do not have to put your home or other assets at risk. It makes the loan process easier and less stressful.

Benefits Of Using Personal Loans For Home Improvement

Personal loans for home improvement can offer numerous benefits. They provide the financial flexibility needed to enhance your living space. Whether you need to upgrade your kitchen, add a new room, or renovate your bathroom, personal loans can be an excellent solution.

Increase Property Value

Home improvements funded by personal loans can significantly increase your property value. Renovations like modern kitchens, updated bathrooms, and additional rooms attract potential buyers. A higher property value means a better return on investment when you sell your home.

Enhance Living Comfort

Renovating your home can greatly enhance your living comfort. Upgrading old fixtures, improving insulation, or adding new amenities can make your home more enjoyable. Personal loans allow you to make these enhancements without waiting for years to save up.

Tailored To Fit Your Budget

Personal loans are flexible and can be tailored to fit your budget. You can choose loan amounts and repayment terms that suit your financial situation. This flexibility ensures you don’t strain your finances while improving your home.

Immediate Access To Funds

One of the significant benefits of personal loans is the immediate access to funds. Once approved, you receive the money quickly, allowing you to start your home improvement projects right away. This quick access helps you avoid delays and take advantage of seasonal discounts or urgent repairs.

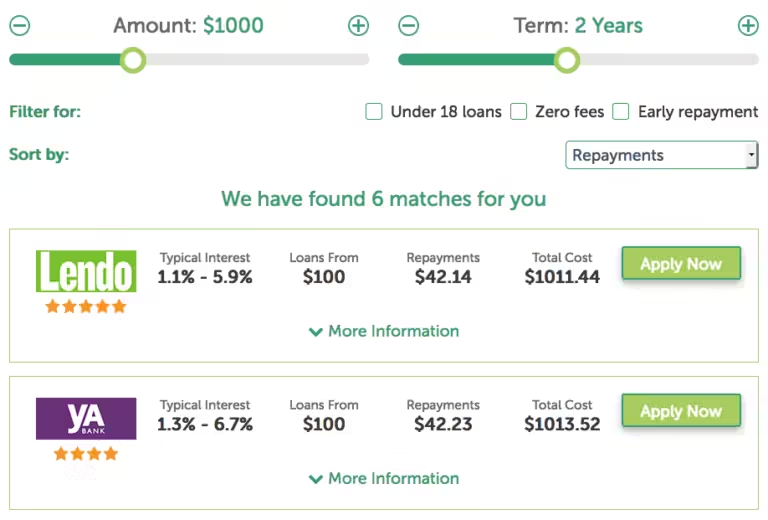

Pricing And Affordability Breakdown

Understanding the costs associated with personal loans for home improvement is crucial. This section will break down the key elements of pricing and affordability. We will cover interest rates, loan terms, repayment plans, and additional fees to consider.

Understanding Interest Rates

Interest rates significantly impact the total cost of a loan. Personal loans often come with fixed interest rates, meaning the rate remains the same throughout the loan term. This stability helps in planning your monthly budget.

The interest rate you receive depends on several factors, including:

- Your credit score

- Loan amount

- Repayment term

Higher credit scores usually lead to lower interest rates. Always compare rates from different lenders to find the best deal.

Loan Terms And Repayment Plans

Loan terms refer to the duration you have to repay the loan. Personal loans for home improvement typically range from 2 to 7 years.

Consider the following when evaluating loan terms:

- Shorter terms mean higher monthly payments but lower total interest.

- Longer terms reduce monthly payments but increase total interest paid.

Choose a term that balances your monthly budget and total loan cost effectively.

Additional Fees To Consider

Besides interest rates, be aware of additional fees that may apply. These can include:

- Origination fees: A one-time fee charged by the lender for processing the loan.

- Prepayment penalties: Fees for paying off the loan early.

- Late payment fees: Charges for missing a payment deadline.

Understanding these fees helps you avoid unexpected costs and manage your loan better.

For more information on personal loans and their features, visit the Upstart Personal Loans website.

Pros And Cons Of Personal Loans For Home Improvement

Personal loans for home improvement can be a convenient way to finance your renovation projects. They come with various benefits, but there are also some drawbacks to consider. Understanding both sides can help you make an informed decision.

Advantages Of Personal Loans

- Quick Access to Funds: Personal loans provide fast access to the money you need for home improvement.

- No Collateral Required: Unlike home equity loans, personal loans do not require you to use your home as collateral.

- Fixed Interest Rates: Many personal loans offer fixed interest rates, making it easier to budget your monthly payments.

- Flexible Use of Funds: You can use the loan amount for any home improvement project, from kitchen remodels to bathroom upgrades.

Potential Drawbacks To Consider

- Higher Interest Rates: Personal loans often come with higher interest rates compared to home equity loans or lines of credit.

- Impact on Credit Score: Applying for a personal loan can temporarily lower your credit score due to the hard inquiry on your credit report.

- Repayment Terms: Some personal loans have shorter repayment terms, which can lead to higher monthly payments.

Specific Recommendations For Ideal Users Or Scenarios

Personal loans for home improvement can be a great financial tool. They offer quick access to funds and can help you achieve your renovation dreams. Knowing who benefits most from these loans and when to use them is key.

Best Candidates For Personal Loans

Personal loans suit individuals with stable incomes and good credit scores. They are ideal for those who need a lump sum for home upgrades. If you plan a major renovation, a personal loan can provide the necessary funds.

- Homeowners with stable income

- Individuals with good credit scores

- People who need quick access to funds

Scenarios Where Personal Loans Are Most Beneficial

Personal loans are beneficial for urgent repairs like fixing a leaky roof or replacing a broken furnace. They are also useful for large projects like kitchen remodels or adding new rooms.

| Scenario | Benefit of Personal Loan |

|---|---|

| Urgent Repairs | Quick access to funds |

| Large Renovations | Lump sum amount |

| Home Extensions | Flexible use of funds |

Alternatives To Personal Loans For Home Improvement

While personal loans are great, there are other options. Home equity loans or lines of credit offer lower interest rates. Credit cards can be used for smaller projects.

- Home Equity Loans

- Home Equity Lines of Credit (HELOC)

- Credit Cards

Each option has its pros and cons. Choose based on your needs and financial situation.

Conclusion: Transform Your Space Today

Personal loans for home improvement can be a great way to enhance your living space. With the right funding, you can make those dream renovations a reality. Let’s explore how you can benefit and take the next step towards transforming your home.

Summarizing The Benefits

Using a personal loan for home improvement offers several advantages:

- Increased Home Value: Improvements can raise the market value of your home.

- Flexible Use: Funds can be used for various projects like kitchen upgrades, bathroom renovations, or landscaping.

- Fixed Interest Rates: Many personal loans offer fixed rates, providing predictable monthly payments.

- Quick Access to Funds: Personal loans often have faster approval and funding times compared to other financing options.

Encouragement To Take The Next Step

Now that you understand the benefits, it’s time to act. Consider the improvements you want to make and how they will enhance your living space. Whether it’s a new kitchen, an upgraded bathroom, or a beautiful garden, a personal loan can help you achieve your goals.

Visit Upstart Personal Loans to explore your financing options. Transform your home into a space you love. Start today and enjoy the results for years to come.

Frequently Asked Questions

What Is A Personal Loan For Home Improvement?

A personal loan for home improvement is a loan taken for home upgrades. It allows you to borrow a fixed amount and repay it over time.

Can I Use Personal Loans For Home Improvements?

Yes, personal loans can be used for various home improvement projects. They offer flexibility and quick funding.

Are Personal Loans For Home Improvement Tax-deductible?

No, personal loans for home improvements are generally not tax-deductible. Consult a tax advisor for specific advice.

How Do I Qualify For A Home Improvement Loan?

To qualify, you need a good credit score, stable income, and manageable debt levels. Lenders may have specific requirements.

Conclusion

Personal loans for home improvement offer flexibility. They can fund your projects. With Upstart Personal Loans, you get competitive rates. The application process is straightforward. Improve your home without financial stress. Consider all terms before deciding. Ensure the loan fits your budget. Home improvement can be affordable and stress-free.