Personal Loans For Debt Relief: Your Path to Financial Freedom

Are you struggling with debt and looking for a way out? Personal loans for debt relief might be the solution you need.

They can help you consolidate your debts into one manageable payment. This could make your financial life simpler and less stressful. Debt can feel overwhelming. Managing multiple payments with different interest rates is hard. Personal loans can offer a way to simplify this mess. By consolidating your debts, you can focus on a single payment each month. This can often come with a lower interest rate, saving you money over time. It’s a practical step towards regaining financial control. Curious to learn more? Check out Upstart Personal Loans here.

:max_bytes(150000):strip_icc()/how-much-does-a-debt-relief-program-cost-7371803-final-df29f16baeec4b53bd22501f7c76521e.png)

Introduction To Personal Loans For Debt Relief

Struggling with multiple debts can be overwhelming. Personal loans for debt relief offer a solution. They consolidate your debts into one manageable payment, making your financial life simpler.

Understanding Debt Relief

Debt relief involves strategies to reduce or restructure your debt. It aims to make debt repayment more manageable. Common methods include debt consolidation, settlement, and credit counseling.

| Method | Description |

|---|---|

| Debt Consolidation | Combines multiple debts into a single loan with one monthly payment. |

| Debt Settlement | Negotiates with creditors to reduce the total amount owed. |

| Credit Counseling | Offers advice and plans to manage your debt effectively. |

How Personal Loans Can Help

Personal loans can simplify your debt payments. They combine various debts into one loan. This loan often has a lower interest rate, reducing the total amount you pay.

- Lower interest rates compared to credit cards.

- Fixed monthly payments make budgeting easier.

- Improves credit score over time with consistent payments.

For instance, Upstart Personal Loans offer a user-friendly platform. Their loans can help you manage your debt efficiently. Visit their website at Upstart for more details.

Personal loans are not just for debt relief. They can also be used for emergencies, home improvements, and other significant expenses.

Key Features Of Personal Loans For Debt Relief

Personal loans can be a viable option for managing debt. They offer several key features that make them appealing. Here are some important aspects to consider:

Flexible Repayment Terms

Personal loans often come with flexible repayment terms. This allows borrowers to choose a repayment schedule that fits their budget. You can typically choose from a range of repayment periods, usually between one and seven years. This flexibility helps in managing monthly payments and overall financial planning.

Lower Interest Rates

One of the most significant benefits is the lower interest rates compared to credit cards. Personal loans usually offer fixed interest rates, which means your monthly payment remains constant throughout the loan term. Lower interest rates can save you money over time, making debt repayment more manageable.

Simplified Debt Management

Personal loans help in simplifying debt management. By consolidating multiple debts into a single loan, you only have one monthly payment to track. This can reduce the stress of managing various due dates and interest rates. Simplified debt management makes it easier to stay organized and focused on paying off your debt.

| Feature | Benefit |

|---|---|

| Flexible Repayment Terms | Choose a repayment schedule that fits your budget |

| Lower Interest Rates | Save money with fixed, lower interest rates |

| Simplified Debt Management | Consolidate debts into a single monthly payment |

These key features make personal loans a practical choice for debt relief. They provide flexibility, lower costs, and simplicity, helping you regain control of your finances.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of personal loans for debt relief is crucial. This section provides a detailed breakdown of interest rates, loan fees, and the total cost over time. By comparing these factors, you can make an informed decision about which loan suits your needs best.

Interest Rates Comparison

Interest rates can significantly affect the affordability of a personal loan. Here is a comparison of interest rates from different lenders:

| Lender | Interest Rate (APR) |

|---|---|

| Upstart Personal Loans | 6.18% – 35.99% |

| Lender B | 5.99% – 24.99% |

| Lender C | 7.00% – 29.99% |

As shown, Upstart offers competitive rates, but always compare with other lenders to find the best fit for your financial situation.

Loan Fees And Charges

Loan fees and charges can add up quickly. It’s important to understand what you’re paying for:

- Origination Fee: Up to 8% of the loan amount.

- Late Payment Fee: $15 or 5% of the unpaid amount.

- Prepayment Penalty: None with Upstart.

These fees can impact the total cost of your loan. Review them carefully before committing.

Total Cost Over Time

The total cost of a personal loan over time includes interest and fees. Here’s a simple example for a $10,000 loan over 3 years:

| Loan Details | Amount |

|---|---|

| Principal | $10,000 |

| Interest (at 12% APR) | $1,957 |

| Origination Fee (5%) | $500 |

| Total Cost | $12,457 |

This table shows how interest and fees contribute to the total repayment amount. Always calculate the total cost to understand the full financial impact.

By considering these factors, you can better evaluate the affordability of personal loans for debt relief.

Pros And Cons Of Using Personal Loans For Debt Relief

Personal loans can be an effective tool for managing and reducing debt. They help consolidate multiple debts into one manageable payment. However, they come with their own set of advantages and potential drawbacks. Let’s explore these aspects to help you make an informed decision.

Advantages Of Personal Loans

- Debt Consolidation: Personal loans allow you to combine multiple debts into a single payment.

- Lower Interest Rates: They often have lower interest rates compared to credit cards.

- Fixed Monthly Payments: This makes budgeting easier as you know exactly what you owe each month.

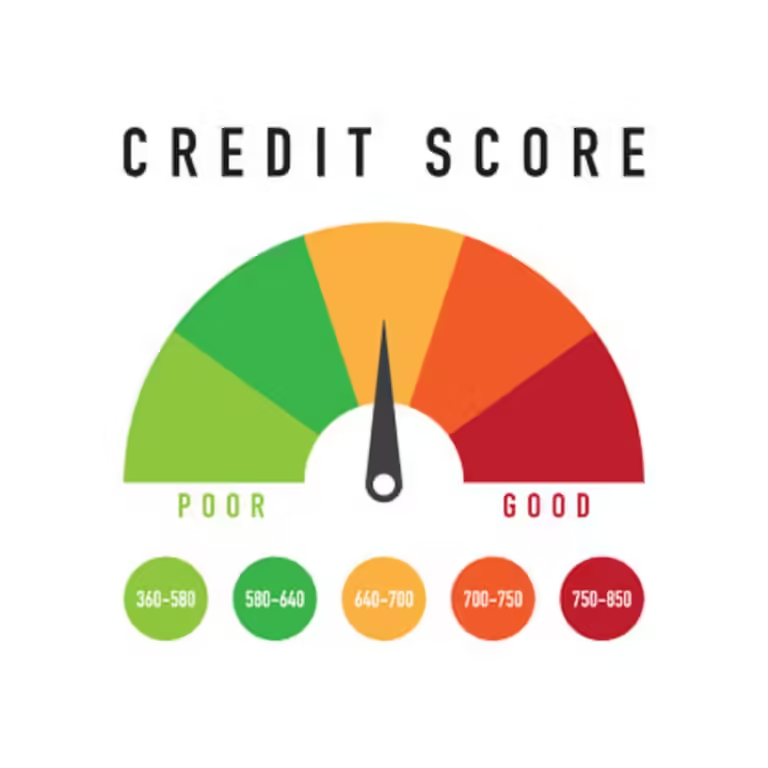

- Improves Credit Score: Timely repayments can boost your credit score over time.

- No Collateral Needed: Many personal loans are unsecured, meaning you don’t need to put up any assets.

Potential Drawbacks To Consider

- Origination Fees: Some lenders charge fees for processing the loan, which can add to your costs.

- Higher Interest Rates: If your credit score is low, you might face higher interest rates.

- Debt Cycle Risk: Without proper financial discipline, you might end up in a cycle of debt.

- Impact on Credit Score: Applying for multiple loans can negatively impact your credit score.

- Repayment Burden: Missing payments can lead to penalties and increased debt.

Specific Recommendations For Ideal Users

Personal loans can be a great solution for debt relief. They offer a way to consolidate multiple debts into one manageable payment. However, not everyone may benefit equally from these loans. Below are specific recommendations for ideal users who can make the most out of personal loans for debt relief.

When Personal Loans Make Sense

Personal loans make sense in several situations. Here are some key scenarios:

- High-Interest Debt: If you have high-interest credit card debt, a personal loan with a lower interest rate can save money.

- Fixed Monthly Payments: Personal loans offer fixed monthly payments, making budgeting easier.

- Improving Credit Score: Consistently making on-time payments on a personal loan can improve your credit score.

- Combining Multiple Debts: If you have multiple loans and credit card balances, consolidating them into one loan can simplify your finances.

Scenarios Best Suited For Personal Loans

Personal loans are best suited for specific scenarios, which include:

- Large One-Time Expenses: Ideal for covering large, unexpected expenses like medical bills or home repairs.

- Debt Consolidation: Perfect for consolidating multiple debts into one loan with a lower interest rate.

- Emergency Funds: Useful for creating a financial cushion in case of emergencies.

- Credit Card Payoff: Efficient for paying off high-interest credit card debt.

Overall, personal loans can be a practical tool for debt relief. Ideal users include those looking to consolidate high-interest debts, manage large one-time expenses, or improve their credit score through consistent payments.

For more details on personal loans, consider visiting Upstart Personal Loans.

Conclusion: Achieving Financial Freedom

Personal loans for debt relief can be a crucial step toward achieving financial freedom. They offer a practical solution to consolidate high-interest debts into one manageable monthly payment. This process simplifies your finances and can significantly reduce stress.

Summary Of Benefits

- Lower Interest Rates: Personal loans often have lower interest rates compared to credit cards.

- Single Monthly Payment: Consolidates multiple debts into one payment, making it easier to manage.

- Improved Credit Score: Regular, on-time payments can boost your credit score over time.

- Fixed Repayment Schedule: Provides a clear end date for when your debt will be paid off.

Final Thoughts On Personal Loans For Debt Relief

Personal loans for debt relief are a valuable tool for regaining control over your finances. They allow you to pay off high-interest debts more efficiently. With a clear repayment plan, you can work towards financial stability and peace of mind.

Consider exploring Upstart Personal Loans for a user-friendly and secure platform. It offers competitive rates and a straightforward application process.

By taking advantage of personal loans, you are investing in your financial future. This decision can pave the way for a debt-free life and greater financial freedom.

Frequently Asked Questions

What Is A Personal Loan For Debt Relief?

A personal loan for debt relief helps consolidate multiple debts into one. It simplifies repayment and often offers lower interest rates.

How Do Personal Loans Reduce Debt?

Personal loans reduce debt by consolidating multiple debts. This makes repayment easier and can lower overall interest rates.

Can I Use A Personal Loan For Credit Card Debt?

Yes, you can use a personal loan to pay off credit card debt. It helps simplify payments and may reduce interest.

Are Personal Loans Better Than Balance Transfers?

Personal loans can be better than balance transfers. They offer fixed rates and structured repayment plans.

Conclusion

Choosing personal loans for debt relief can be a smart move. They offer lower interest rates and help consolidate multiple debts. This simplifies payments and reduces financial stress. Evaluate your options carefully. For a reliable choice, consider Upstart Personal Loans. They provide competitive rates and easy application processes. Take control of your financial future today.