Personal Loans For Debt Consolidation: Simplify Your Finances Today

Managing multiple debts can be overwhelming. High-interest rates and numerous payments can make financial stability seem out of reach.

Personal loans for debt consolidation offer a practical solution. These loans allow you to combine your debts into a single, manageable payment. Debt consolidation through personal loans can simplify your finances. By merging various debts into one, you can often secure a lower interest rate. This means you pay less over time and can manage your budget more effectively. PersonalLoans.com connects you with lenders who offer loans from $250 to $35,000. This service is free to use and can help you receive funds quickly. With flexible terms and competitive rates, personal loans provide a valuable tool for regaining control of your financial future. Explore Personal Loans for Debt Consolidation and take the first step toward financial freedom today.

Introduction To Personal Loans For Debt Consolidation

Managing multiple debts can be stressful and overwhelming. Personal loans for debt consolidation offer a way to simplify your financial situation. By consolidating your debts into one manageable loan, you can regain control of your finances. This article will explain how personal loans can help you consolidate debt and achieve financial stability.

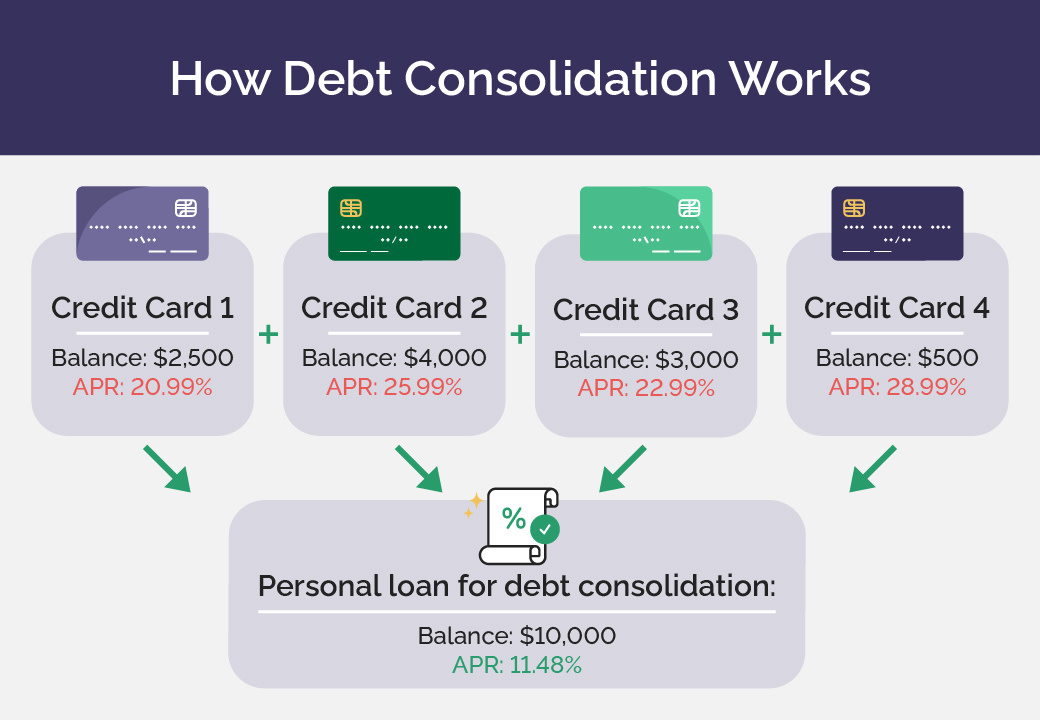

What Is Debt Consolidation?

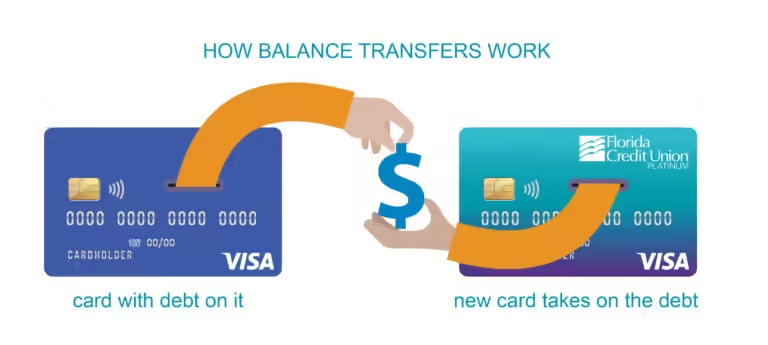

Debt consolidation is the process of combining multiple debts into one single loan. This can include credit card balances, medical bills, or other personal loans. The goal is to streamline payments and reduce the interest rates you are paying.

Here’s a quick breakdown:

- Combine multiple debts into one loan

- Make a single monthly payment

- Potentially lower your interest rate

Debt consolidation can make managing your finances easier and help you avoid missed payments.

How Personal Loans Can Help

Using a personal loan for debt consolidation has several benefits. Personal Loans® offers a range of loan amounts from $250 to $35,000, making it suitable for various debt levels. Here are some ways personal loans can help:

| Feature | Details |

|---|---|

| Loan Amounts | $250 to $35,000 |

| Loan Terms | 3 months to 72 months |

| APR Range | 5.99% to 35.89% |

| Approval Time | Funds available as soon as the next business day |

Personal Loans® connects you with a network of lenders, ensuring you find competitive rates. The application process is simple and can be completed online, making it convenient for you.

Some key benefits include:

- Free Service: No hidden fees or upfront costs

- Fast Funding: Quick access to funds

- Security: Advanced data encryption to protect your information

- Flexible: Request loans any time, day or night

With these features, personal loans can be a practical solution for debt consolidation, helping you achieve financial stability.

Key Features Of Personal Loans For Debt Consolidation

Debt consolidation through personal loans offers several advantages that can help you manage your finances more effectively. These loans provide a simplified way to combine multiple debts into a single payment, making it easier to track and pay off your obligations. Let’s explore the key features that make personal loans an attractive option for debt consolidation.

Fixed Interest Rates

Fixed interest rates ensure that your monthly payments remain consistent throughout the life of the loan. This predictability helps you budget more effectively and avoid surprises. With rates ranging from 5.99% to 35.89%, you can find a loan that fits your financial situation.

Flexible Repayment Terms

Personal loans for debt consolidation often come with flexible repayment terms. You can choose repayment periods from 3 months to 72 months, allowing you to select a timeline that suits your budget and financial goals. This flexibility helps you manage your cash flow and ensures you can meet your monthly obligations comfortably.

No Collateral Required

One of the significant benefits of personal loans for debt consolidation is that they typically do not require collateral. This means you don’t have to risk your assets, such as your home or car, to secure the loan. It’s a safe option that provides peace of mind while you work towards becoming debt-free.

Streamlined Application Process

The application process for personal loans is often simple and straightforward. You can complete an online form quickly, and funds may be received as soon as the next business day. This fast funding is essential when you need to consolidate your debts urgently.

| Feature | Details |

|---|---|

| Loan Amounts | $250 to $35,000 |

| Loan Terms | 3 months to 72 months |

| APR Range | 5.99% to 35.89% |

| Approval Time | Next business day |

| Application Process | Online form |

These features make personal loans a viable solution for those looking to consolidate their debts efficiently. With competitive rates, flexible terms, and a streamlined process, you can take control of your finances and work towards a debt-free future.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of personal loans for debt consolidation is crucial. This section will break down the key elements of interest rates, fees, and the total cost over the loan term. By the end, you’ll have a clearer picture of what you might pay.

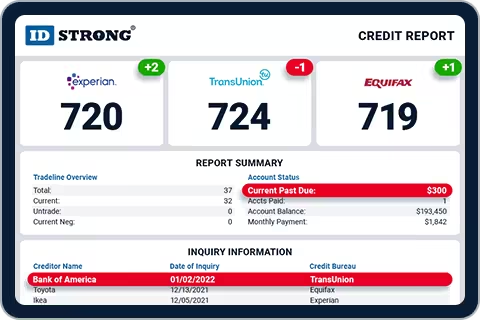

Interest Rates Comparison

Interest rates can significantly impact the affordability of your loan. Personal Loans® offers an APR range from 5.99% to 35.89%. This wide range depends on factors like:

- Loan Amount: Higher amounts might get lower rates.

- Credit Score: Better scores usually mean better rates.

- Loan Term: Shorter terms might have lower rates.

Comparing these rates with other lenders helps find the best deal. Here’s a quick comparison:

| Lender | APR Range |

|---|---|

| Personal Loans® | 5.99% – 35.89% |

| Lender A | 6.99% – 29.99% |

| Lender B | 8.00% – 36.00% |

Fees And Additional Charges

While Personal Loans® offers a free service, lenders may charge different fees:

- Origination Fee: A one-time fee for processing the loan.

- Late Payment Fee: Charged if payments are late.

- Prepayment Penalty: Some lenders might charge if you pay off the loan early.

These fees can add to the overall cost. Always check the specific terms from your lender.

Total Cost Over The Loan Term

The total cost of your loan is more than just the interest rate. Consider all elements:

- Interest Paid: Based on the APR and loan term.

- Fees: Include origination, late payment, and prepayment penalties.

For example, a $10,000 loan at 10% APR for 36 months would cost:

Total Interest: $1,616 Origination Fee: $300 Total Cost: $11,916

Always calculate the total cost to understand the full financial impact.

By comparing interest rates, fees, and the total cost, you can make an informed decision. This ensures the loan fits your budget and helps you consolidate debt efficiently.

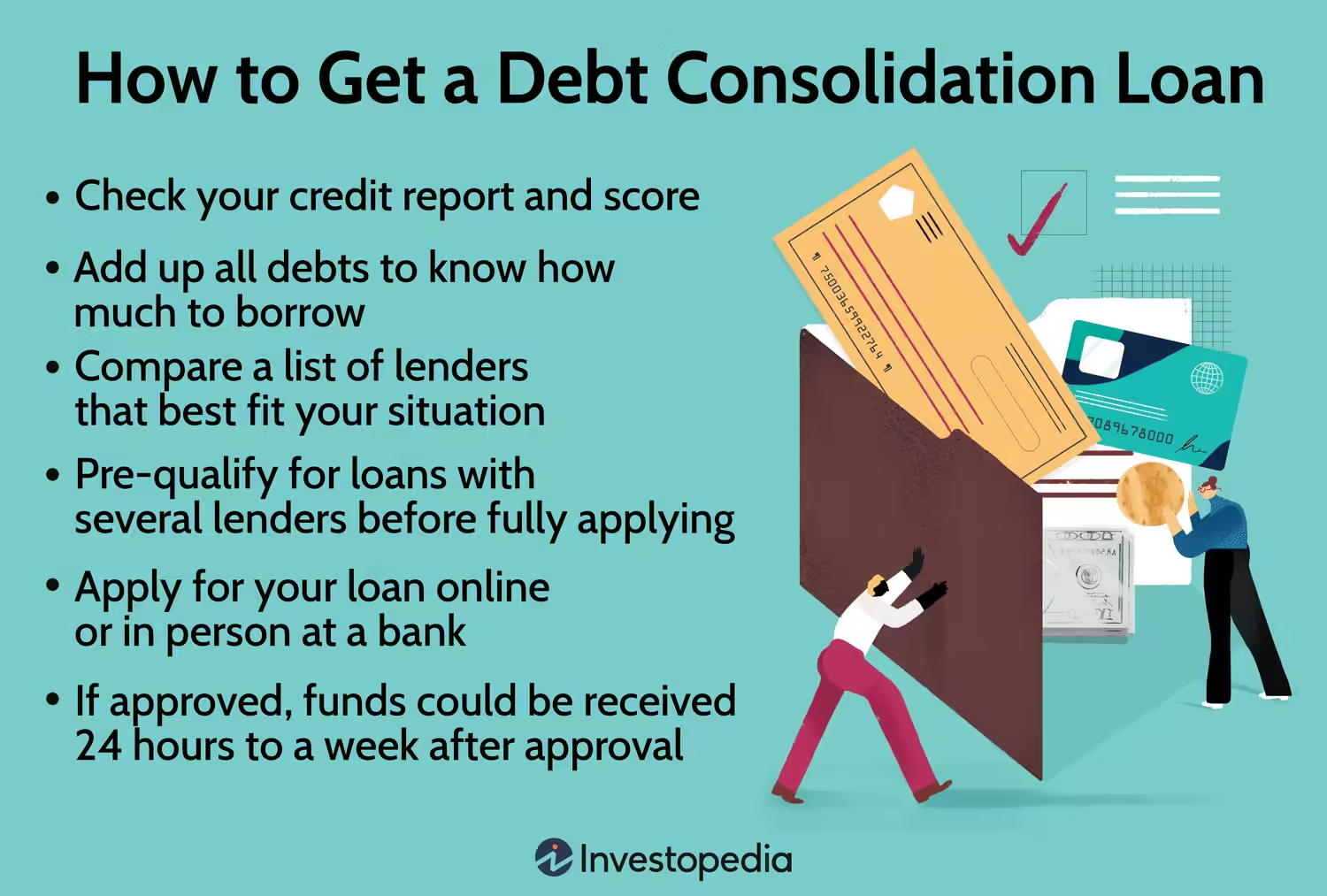

:max_bytes(150000):strip_icc()/debtconsolidation.asp-final-18e80676e0af4379a7962bfc4a0874de.png)

Pros And Cons Of Using Personal Loans For Debt Consolidation

Using personal loans for debt consolidation can be a smart move. Yet, it’s important to weigh the pros and cons. Understanding the benefits and potential drawbacks will help you make an informed decision.

Advantages Of Personal Loans

Personal loans offer several advantages for debt consolidation:

- Fixed Interest Rates: With fixed rates, your monthly payments remain predictable.

- Flexible Loan Amounts: Borrow between $250 and $35,000 to cover various needs.

- Quick Funding: Receive funds as soon as the next business day.

- Consolidate Multiple Debts: Combine various debts into a single loan, simplifying payments.

- Improved Credit Score: Timely payments can boost your credit score over time.

- No Collateral Needed: Most personal loans are unsecured, meaning no assets are required.

Potential Drawbacks

While personal loans have many benefits, there are also potential drawbacks:

- High Interest Rates: Rates can range from 5.99% to 35.89%, depending on creditworthiness.

- Origination Fees: Some lenders may charge fees for processing the loan.

- Debt Cycle Risk: Borrowers may fall into a cycle of debt if not managed properly.

- Credit Check Impact: Lenders may perform credit checks, potentially affecting your credit score.

- Repayment Terms: Loan terms can range from 3 to 72 months, affecting monthly payments and total interest paid.

Understanding both the pros and cons of personal loans for debt consolidation can help you decide if it’s the right choice for you. For more information, visit personalloans.com.

Specific Recommendations For Ideal Users

Personal loans for debt consolidation can be a smart financial move for many. They offer a simple way to manage multiple debts under one payment. But, who exactly benefits the most from these loans? Let’s explore this through specific recommendations.

Best Candidates For Debt Consolidation Loans

Debt consolidation loans are ideal for individuals with:

- Multiple High-Interest Debts: If you have several credit card debts or loans with high interest rates, consolidating them into a single loan with a lower rate can save you money.

- Good to Excellent Credit Scores: Those with higher credit scores often qualify for better loan terms and lower interest rates.

- Steady Income: A stable income ensures you can make consistent payments on your new loan.

- Desire for Simplified Payments: Managing one payment instead of multiple can reduce stress and simplify your finances.

These candidates stand to benefit the most from the streamlined payment process and potential savings on interest.

Scenarios Where Personal Loans Are Most Beneficial

Personal loans can be particularly beneficial in several scenarios:

| Scenario | Benefit |

|---|---|

| High Credit Card Debt | Lower interest rates compared to credit cards, potentially saving money. |

| Medical Bills | Consolidate various medical bills into one, easier-to-manage payment. |

| Home Improvements | Finance renovations without tapping into home equity. |

| Emergency Expenses | Quick access to funds to cover unexpected costs. |

| Business Startups | Secure initial funding to get a business off the ground. |

In each of these scenarios, personal loans provide a flexible and often cost-effective solution. The streamlined online application process means you can access funds quickly, sometimes by the next business day.

Using a service like Personal Loans®, which connects you with a network of lenders, can simplify the process. This service offers loan amounts from $250 to $35,000, with terms ranging from 3 months to 72 months. The APR ranges from 5.99% to 35.89%, making it a competitive option for many borrowers.

Additionally, Personal Loans® provides a secure and straightforward application process. You can request loans at any time, day or night, and there are no hidden fees or upfront costs.

Frequently Asked Questions

What Is Debt Consolidation?

Debt consolidation is the process of combining multiple debts into one loan. This simplifies repayment and can lower interest rates.

How Do Personal Loans Help With Debt Consolidation?

Personal loans can pay off multiple debts at once. This creates a single monthly payment, often with a lower interest rate.

Are There Risks With Debt Consolidation?

Yes, there are risks with debt consolidation. They include potential higher interest rates and longer repayment terms.

Can I Use A Personal Loan For Credit Card Debt?

Yes, you can use a personal loan to pay off credit card debt. This can help reduce your interest payments.

Conclusion

Choosing a personal loan for debt consolidation can simplify your finances. It can help reduce multiple payments into one. This can lower stress and make managing debt easier. PersonalLoans.com offers a range of loan options, fitting various needs. From $250 to $35,000, find the right loan for you. Enjoy fast approval and funding, often by the next business day. Start simplifying your debt today with PersonalLoans.com. Visit PersonalLoans.com to explore your options. Secure a loan that fits your budget and lifestyle.