Personal Loan Rates: Unlock the Best Deals Today

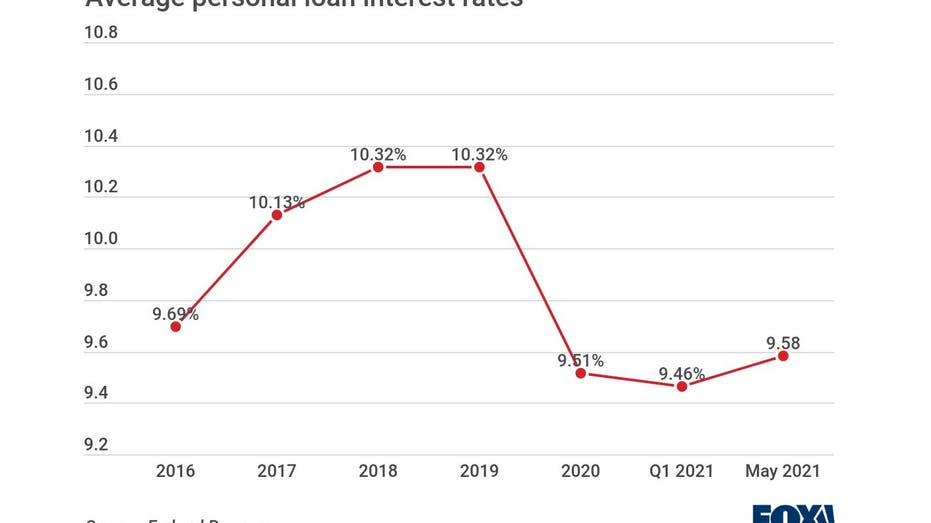

Personal loan rates can vary greatly based on several factors. Understanding these rates is crucial before applying for a loan.

Personal loans offer flexibility and can be used for various needs like emergencies, home improvements, or business startups. But, knowing the rates is essential to avoid high costs. At Personal Loans®, you can access competitive rates from a network of lenders. This service is free, with no hidden fees or upfront costs. Loans range from $250 to $35,000, with funds available as soon as the next business day. By comparing rates, you can find the best option for your financial situation. Read on to learn more about personal loan rates and how to secure the best deal.

Understanding Personal Loan Rates

Personal loan rates can be confusing. They differ between lenders and loan types. Knowing how these rates work helps you make better financial decisions. This guide explains personal loan rates in simple terms.

What Are Personal Loan Rates?

Personal loan rates are the interest charges on borrowed money. These rates are expressed as an annual percentage rate (APR). The APR includes both the interest rate and any additional fees. Lenders charge these rates for lending money.

For example, if you borrow $1,000 with a 10% APR, you will pay $100 in interest over a year. The APR is a crucial factor to consider when comparing loan offers. It affects the total cost of the loan.

How Are Personal Loan Rates Determined?

Several factors influence personal loan rates. Here are the main factors:

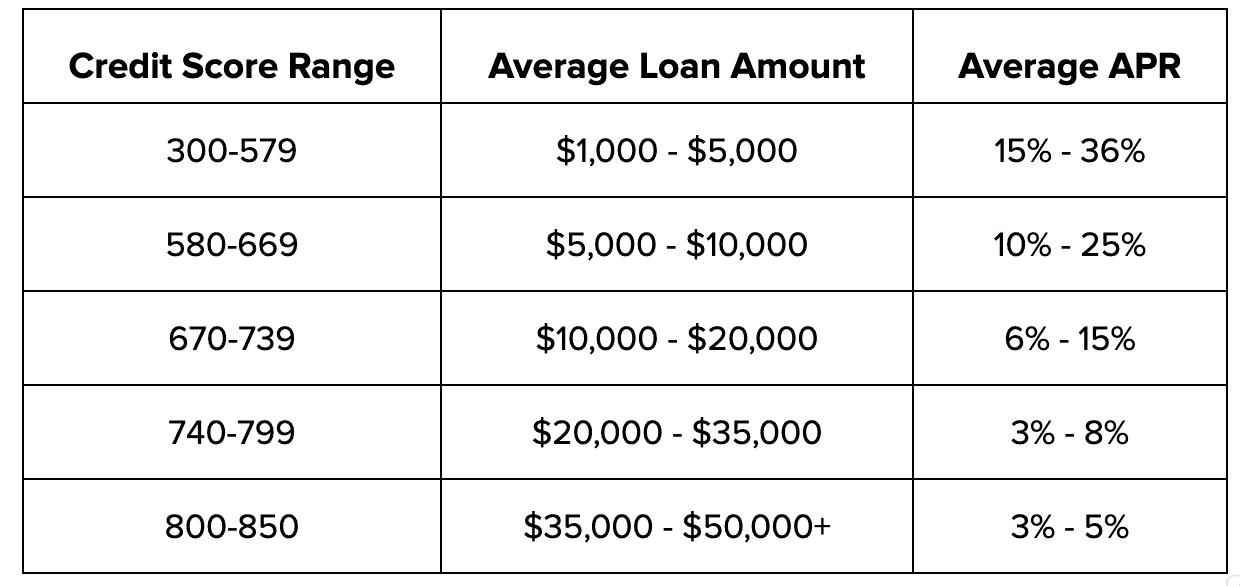

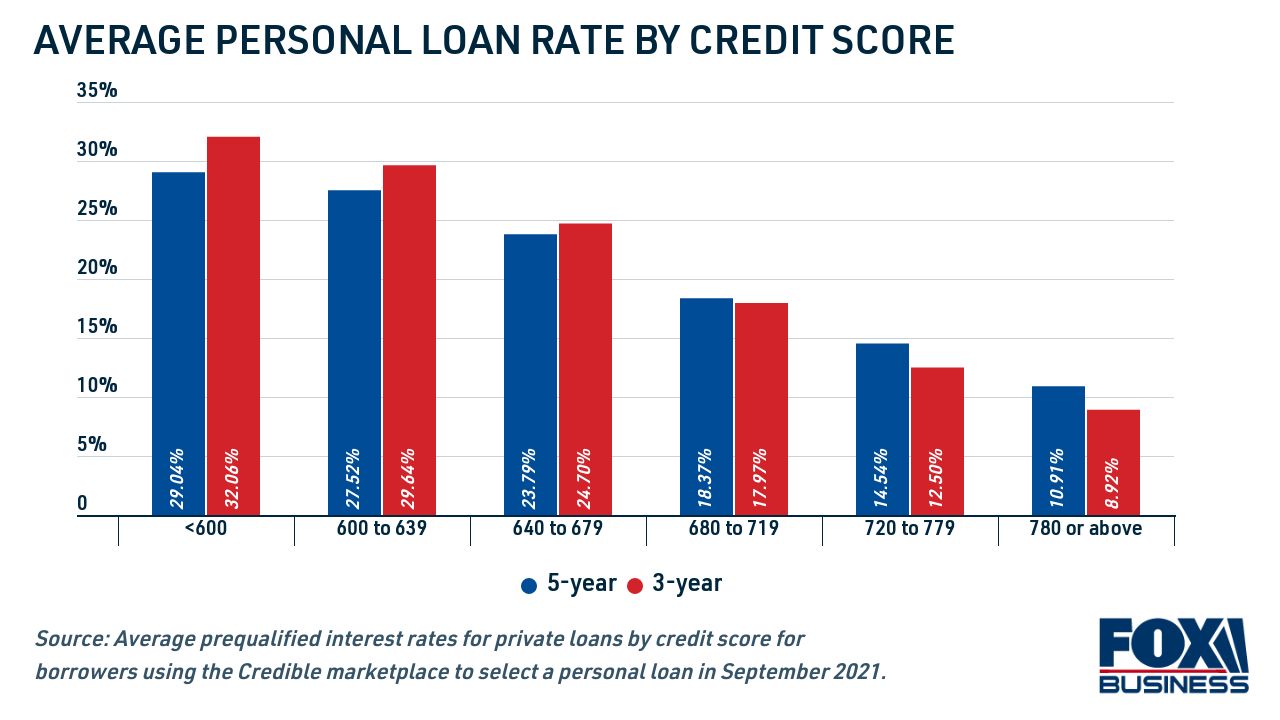

- Credit Score: A higher credit score usually means lower rates. Lenders see you as a lower risk.

- Loan Amount: Larger loans might come with lower rates. Lenders may offer discounts for higher amounts.

- Loan Term: Shorter terms often have lower rates. Longer terms may have higher rates but lower monthly payments.

- Income: Higher income can lead to better rates. Lenders want to ensure you can repay the loan.

- Debt-to-Income Ratio: Lower ratios are better. They show you manage your debt well.

Each lender has its own criteria for setting rates. It’s wise to compare multiple offers. Personal Loans® offers competitive rates from a wide network of lenders. You can review loan offers before accepting any.

Here’s a quick look at the typical APR range:

| Loan Amount | APR Range |

|---|---|

| $250 to $35,000 | 5.99% to 35.89% |

Personal Loans® also provides flexible terms, ranging from 3 months to 72 months. This flexibility allows you to choose the best option for your needs.

Understanding these factors helps you get the best rates. Always read the terms before accepting a loan offer.

Key Features That Affect Personal Loan Rates

Understanding the key features that affect personal loan rates is crucial for making informed borrowing decisions. Various factors influence these rates, and knowing them can help you secure better terms. Below are some vital elements that impact personal loan rates:

Credit Score

Your credit score plays a significant role in determining personal loan rates. Lenders use it to gauge your creditworthiness. A higher credit score often means lower interest rates. Conversely, a lower score might result in higher rates.

To improve your credit score:

- Pay bills on time

- Keep credit card balances low

- Limit new credit applications

Loan Amount And Term

The loan amount and term also affect your interest rate. Borrowing larger amounts might lead to higher rates. Shorter loan terms usually come with lower rates compared to longer terms, which might be more expensive.

Consider the following:

- Borrow only what you need

- Choose a shorter term if possible

- Understand the trade-offs between term length and monthly payments

Type Of Lender

The type of lender you choose can significantly impact your loan rates. Banks, credit unions, and online lenders offer different interest rates and terms. Online lenders often have competitive rates and quick approval processes.

To find the best lender:

- Compare offers from multiple lenders

- Check for any hidden fees

- Consider the lender’s reputation and customer service

By understanding these key factors, you can make informed decisions and potentially secure better personal loan rates. For a more detailed look, visit Personal Loans®.

Comparing Personal Loan Rates

Understanding the differences in personal loan rates can save you money. This guide will help you compare rates effectively. Learn about traditional banks vs. online lenders, fixed vs. variable rates, and secured vs. unsecured loans.

Traditional Banks Vs. Online Lenders

Traditional banks often offer stability and a personal touch. They may have stricter loan requirements and longer approval times. Traditional bank loans might come with additional fees.

Online lenders provide convenience and speed. They offer competitive rates and quick approval processes. Online lenders often have more flexible requirements for borrowers. Their services include a wide range of loan amounts from $250 to $35,000, as featured on Personal Loans®.

| Feature | Traditional Banks | Online Lenders |

|---|---|---|

| Loan Requirements | Stricter | More Flexible |

| Approval Time | Longer | Quicker |

| Fees | Additional Fees | Competitive Rates |

Fixed Vs. Variable Rates

Fixed rates remain the same throughout the loan term. This makes budgeting easier as your monthly payments stay constant. Fixed rates are suitable for those who prefer stability.

Variable rates can fluctuate based on market conditions. This means your monthly payments can change. Variable rates often start lower than fixed rates but can increase over time. They might be ideal for short-term loans or for those expecting rates to decrease.

| Rate Type | Characteristics |

|---|---|

| Fixed Rate | Stable, predictable payments |

| Variable Rate | Fluctuates with market conditions |

Secured Vs. Unsecured Loans

Secured loans require collateral, such as a car or home. These loans often have lower interest rates because they pose less risk to lenders. Secured loans are a good option if you have valuable assets and want lower rates.

Unsecured loans do not require collateral. They are based on your creditworthiness. Unsecured loans can have higher interest rates but offer the benefit of not risking your assets. They are ideal for those who do not have collateral or prefer not to use it.

- Secured Loans: Lower rates, requires collateral

- Unsecured Loans: Higher rates, no collateral needed

By understanding these key differences, you can make an informed decision. Whether you choose traditional banks or online lenders, fixed or variable rates, or secured versus unsecured loans, you can find a loan that suits your needs.

Steps To Secure The Best Personal Loan Rates

Securing the best personal loan rates can save you a significant amount of money over the life of the loan. By following these steps, you can increase your chances of obtaining favorable terms and rates that suit your financial needs.

Improving Your Credit Score

Your credit score plays a crucial role in determining the interest rate you receive on a personal loan. A higher credit score often results in lower interest rates. Here are some ways to improve your credit score:

- Pay your bills on time. Late payments can negatively impact your score.

- Reduce your debt. Lowering your credit card balances can boost your score.

- Check your credit report for errors. Dispute any inaccuracies to ensure your score is accurate.

- Avoid opening new credit accounts. Multiple new accounts can lower your average account age and impact your score.

Shopping Around For The Best Deal

Different lenders offer different rates and terms. It’s essential to shop around to find the best deal. Here’s how:

- Visit Personal Loans® to connect with a network of lenders.

- Compare offers from multiple lenders. Look at the APR, loan terms, and any fees.

- Use online tools and calculators to estimate your monthly payments and total loan cost.

- Consider both traditional banks and online lenders. Each may offer different benefits and rates.

Negotiating Loan Terms

Once you’ve found a potential lender, don’t hesitate to negotiate the loan terms. Here are some tips:

- Ask for a lower interest rate. If you have a strong credit score, lenders may be willing to offer a better rate.

- Negotiate the loan term. A longer term might lower your monthly payments but increase the total interest paid.

- Request a waiver of fees. Some lenders may waive origination or application fees to secure your business.

- Review all terms before signing. Ensure you understand all conditions, including late payment fees and prepayment penalties.

By taking these steps, you can improve your chances of securing the best personal loan rates, saving you money and making your loan more manageable.

Pros And Cons Of Different Personal Loan Rates

Choosing the right personal loan rate can impact your financial health. Understanding the pros and cons helps in making an informed decision.

Pros Of Low-interest Rates

Low-interest rates offer several advantages:

- Reduced monthly payments

- Lower overall cost of the loan

- Increased affordability for higher loan amounts

These benefits can make a significant difference in your budget. Lower rates mean you pay less in interest over the life of the loan. This can save you a substantial amount of money.

Cons Of Low-interest Rates

While low-interest rates are attractive, they may come with drawbacks:

- Stricter eligibility criteria

- Potentially higher fees

- Limited loan options

Low rates might be reserved for borrowers with excellent credit. This could exclude those with lower credit scores. Additionally, some lenders might offset low rates with higher fees.

When Higher Rates Might Be Worth It

In some cases, accepting a higher interest rate can be beneficial:

- Faster loan approval

- Less stringent credit requirements

- Access to larger loan amounts

Higher rates often come with more flexible terms. This can be crucial during emergencies or when immediate funding is needed. Evaluating the urgency and purpose of the loan helps in choosing the right rate.

For more information on personal loans, visit Personal Loans®.

Ideal Scenarios For Different Types Of Personal Loan Rates

Personal loan rates can vary widely based on the purpose of the loan. Understanding the ideal scenarios for different types of personal loan rates helps you make informed decisions. Whether you need a loan for debt consolidation, home improvement, or emergency expenses, the right rate can save you money. Let’s explore the best rates for various needs.

Best Rates For Debt Consolidation

Debt consolidation loans can simplify your finances and potentially reduce your overall interest costs. Personal Loans® offers competitive rates, making it easier to manage multiple debts. Here are some factors to consider:

- Credit Score: Higher scores typically qualify for lower rates.

- Loan Amount: Larger loans may offer better rates due to lower risk.

- Loan Term: Shorter terms often have lower rates.

With loan amounts ranging from $250 to $35,000, you can consolidate various types of debt through Personal Loans®. The APR ranges from 5.99% to 35.89%, depending on your creditworthiness.

Rates For Home Improvement Loans

Home improvement projects can add value to your property. Securing a loan with a favorable rate is crucial. Personal Loans® connects you with lenders offering flexible terms and competitive rates. Consider these points:

- Project Scope: Larger projects may qualify for lower rates.

- Equity in Home: Higher equity can lead to better loan rates.

- Credit Score: Good credit helps secure lower interest rates.

Loans for home improvements can range from $250 to $35,000, with terms from 3 to 72 months. The APR for these loans varies based on your credit score and the loan amount.

Rates For Emergency Expenses

Emergencies require quick access to funds. Personal Loans® provides fast connections to lenders, ensuring you get the money you need swiftly. Key considerations for emergency loans include:

- Speed: Funds can be received as soon as the next business day.

- Loan Amount: Smaller amounts are easier to manage and get approval.

- Interest Rate: Ensure you understand the total cost of the loan.

Emergency loans through Personal Loans® range from $250 to $35,000, with APRs from 5.99% to 35.89%. Quick online applications and fast fund transfers make these loans ideal for urgent needs.

Conclusion: Unlocking The Best Personal Loan Deals

Finding the best personal loan deals requires understanding personal loan rates. Comparing rates can help save money and reduce stress.

Finding the best personal loan deals can be a daunting task. With so many options, it is crucial to understand what to look for. Personal Loans® offers a streamlined process to connect borrowers with a wide network of lenders. This ensures competitive rates and flexible terms.Summary Of Key Points

- Loan Amounts: From $250 to $35,000.

- No Hidden Fees: Free service with no upfront costs.

- Fast Connection: Quick online form to connect with lenders.

- Speed of Funds: Funds can be received as soon as the next business day.

- Wide Network: Access to an extensive network of lenders.

- Flexible Terms: Loan terms vary from 3 to 72 months.

- Competitive APR: Ranges from 5.99% to 35.89%.

Final Tips For Securing The Best Rates

To secure the best personal loan rates, follow these tips:

- Check Your Credit Score: Higher scores often get better rates.

- Compare Offers: Review multiple offers before making a decision.

- Read the Terms: Understand all loan terms and conditions.

- Ask Questions: Clarify any doubts with the lender.

- Consider Loan Purpose: Choose a loan that matches your needs.

- Plan for Repayment: Ensure you can meet the repayment terms.

Using these tips, you can make an informed decision. Personal Loans® helps you find the best deals. Visit Personal Loans® to start your application today.

Frequently Asked Questions

What Are Current Personal Loan Rates?

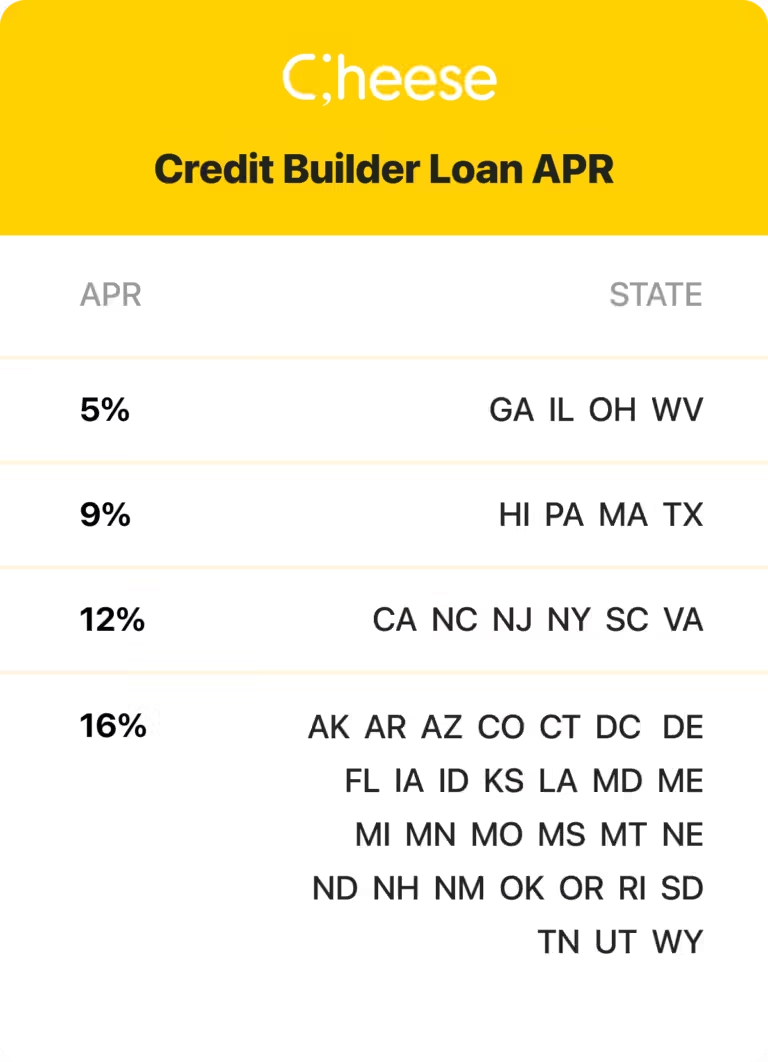

Current personal loan rates vary based on credit score, loan amount, and lender. Rates typically range from 5% to 36%.

How To Get The Best Personal Loan Rate?

To get the best personal loan rate, improve your credit score, compare lenders, and consider loan terms and fees.

Do Personal Loan Rates Vary By Lender?

Yes, personal loan rates vary by lender. Each lender has its own criteria and rate ranges.

Are Personal Loan Rates Fixed Or Variable?

Personal loan rates can be fixed or variable. Fixed rates remain the same, while variable rates can change over time.

Conclusion

Understanding personal loan rates can save you money. Comparing offers is crucial. Use services like Personal Loans® to find the best rates. Their wide lender network offers competitive rates and flexible terms. It’s free and easy to use. Borrow confidently, knowing your data is secure. Make informed financial decisions today.