Personal Loan Lenders: Top Choices for Fast Approval

Looking for a personal loan can be daunting. With so many lenders, where do you start?

PersonalLoans.com is here to simplify the process. They connect you with a network of lenders, offering loans from $250 to $35,000. The service is free, with no hidden fees. It provides a hassle-free online application, making it easy to find a loan that fits your needs. Whether it’s for emergencies, home improvements, or any other expense, PersonalLoans.com helps you get the funds quickly, sometimes by the next business day. The platform ensures transparency and security, giving you peace of mind. Start exploring your options with PersonalLoans.com today and find the perfect loan for your financial needs. Explore PersonalLoans.com now to learn more!

:max_bytes(150000):strip_icc()/how-to-get-a-personal-loan-online-7569494-final-1014065af49f4ef4830d0714ca4ab7b0.png)

Introduction To Personal Loan Lenders

Personal loan lenders play a crucial role in helping individuals meet their financial needs. They provide access to funds for various purposes, including emergencies, home improvements, or debt consolidation. Understanding the basics of personal loans and the importance of fast approval can help borrowers make informed decisions.

What Are Personal Loans?

Personal loans are unsecured loans that borrowers can use for a variety of purposes. Unlike secured loans, they do not require collateral. This makes them a flexible option for many. Personal loans can range from small amounts like $250 to larger sums up to $35,000.

Borrowers can use these loans for:

- Medical emergencies

- Home renovations

- Debt consolidation

- Unexpected expenses

One of the key advantages is the straightforward application process. Services like PersonalLoans.com simplify this by connecting borrowers with a network of lenders.

Importance Of Fast Approval In Personal Loans

Fast approval is essential for those in urgent need of funds. Quick access to money can make a significant difference in emergencies. Lenders who offer fast approval processes are highly valued.

Benefits of fast approval:

- Immediate financial relief

- Quick resolution of urgent issues

- Less stress and anxiety

PersonalLoans.com stands out with its ability to connect borrowers with lenders swiftly. Approved borrowers can receive funds as soon as the next business day. This speed and efficiency make it a preferred choice for many.

For a quick and seamless loan experience, visit PersonalLoans.com and explore your options.

Key Features Of Top Personal Loan Lenders

Finding the right personal loan lender can make a significant difference. The best lenders offer key features that ensure a smooth borrowing experience. Below are important aspects to consider when choosing a top personal loan lender.

Speed Of Approval Process

Top lenders understand that borrowers need funds quickly. PersonalLoans.com stands out with its fast online form that connects you with lenders swiftly. If approved, you could receive funds as soon as the next business day.

Flexible Repayment Terms

Flexible repayment terms are crucial for managing loan repayments. The best lenders offer terms ranging from 61 days to 96 months. PersonalLoans.com provides this flexibility, making it easier to find a repayment plan that fits your budget.

Competitive Interest Rates

Interest rates can significantly impact the total cost of your loan. PersonalLoans.com offers competitive rates from a wide variety of lenders. APR ranges from 5.99% to 35.89%, ensuring you get a fair deal.

Minimal Documentation Required

Borrowers prefer lenders that require minimal documentation. PersonalLoans.com has a hassle-free loan request process. This reduces the paperwork and speeds up the approval process.

Customer Service And Support

Reliable customer service is essential for any lender. PersonalLoans.com provides excellent support with transparent reviews of loan offers before acceptance. Their team is available to assist you with any queries or issues you may have.

By considering these key features, you can choose a personal loan lender that meets your needs and ensures a smooth borrowing experience.

Top Personal Loan Lenders For Fast Approval

Finding the right personal loan lender can be daunting. Speed of approval is crucial for many borrowers. Here are the top personal loan lenders known for fast approval times.

Lender 1: Overview And Key Features

PersonalLoans.com connects borrowers with lenders offering loans from $250 to $35,000. This service is free and offers a quick online form to get started.

| Feature | Details |

|---|---|

| Loan Amounts | $250 to $35,000 |

| Approval Time | Next business day |

| Rates | 5.99% to 35.89% APR |

| Service Fee | Free |

- Quick and easy online form

- Competitive rates from various lenders

- No obligation to accept loan offers

- Secure data encryption

Lender 2: Overview And Key Features

Lender Name offers personal loans with a focus on fast approval and customer convenience. Their platform is user-friendly and provides a seamless loan application process.

| Feature | Details |

|---|---|

| Loan Amounts | Up to $50,000 |

| Approval Time | Same day |

| Rates | 6.99% to 29.99% APR |

| Service Fee | Varies by lender |

- Fast same-day approval

- High loan amounts available

- Transparent rate information

- Secure application process

Lender 3: Overview And Key Features

Lender Name specializes in providing quick personal loans with minimal paperwork. Their service aims to meet urgent financial needs efficiently.

| Feature | Details |

|---|---|

| Loan Amounts | Up to $30,000 |

| Approval Time | Within hours |

| Rates | 7.99% to 32.99% APR |

| Service Fee | Depends on loan terms |

- Quick approval within hours

- Flexible loan amounts

- Competitive rates

- Minimal paperwork

Pricing And Affordability Breakdown

Understanding the pricing and affordability of personal loans is crucial. This helps borrowers make informed decisions. Here’s a detailed breakdown of the costs associated with personal loans from PersonalLoans.com.

Interest Rates Comparison

Interest rates can vary significantly. They depend on factors like credit score and loan amount. At PersonalLoans.com, the APR ranges from 5.99% to 35.89%. This broad range covers various borrower profiles. Below is a table comparing interest rates:

| Credit Score | APR Range |

|---|---|

| Excellent (720-850) | 5.99% – 12.99% |

| Good (690-719) | 13.00% – 19.99% |

| Fair (630-689) | 20.00% – 27.99% |

| Poor (300-629) | 28.00% – 35.89% |

Fees And Charges

While the service at PersonalLoans.com is free, lenders may charge various fees:

- Origination Fee: Typically ranges from 1% to 8% of the loan amount.

- Late Payment Fee: Charged if a payment is missed.

- Prepayment Penalty: Some lenders charge a fee for early loan payoff.

All fees will be disclosed before you accept a loan offer. Always read the terms carefully.

Total Cost Of The Loan

The total cost of a loan includes interest and any fees. Here’s an example breakdown for a $10,000 loan:

| Loan Amount | Interest Rate | Origination Fee | Term | Total Cost |

|---|---|---|---|---|

| $10,000 | 15% | 3% | 36 months | $11,618 |

In this example, the borrower pays $1,618 in interest and $300 in origination fees. The total cost is $11,618.

By understanding these elements, you can better manage your personal loan and make more informed financial decisions. Visit PersonalLoans.com for more details.

Pros And Cons Of Using Personal Loan Lenders

Personal loan lenders offer quick access to funds, which can be helpful in emergencies. But high interest rates and fees can make repayment challenging. Borrowers should weigh the benefits and drawbacks before deciding.

Personal loans can be a helpful financial tool. They provide quick access to funds for various needs. Understanding the pros and cons of using personal loan lenders like PersonalLoans.com is essential.Advantages Of Fast Approval Lenders

PersonalLoans.com offers several advantages:- Quick Application Process: The online form is fast and straightforward.

- Speedy Fund Disbursement: Funds can be received as soon as the next business day if approved.

- Flexible Loan Amounts: Borrowers can access loans ranging from $250 to $35,000.

- Competitive Rates: A wide variety of lenders offer competitive rates.

- No Obligation: There is no obligation to accept loan offers.

- Free Service: The service is free to use with no hidden fees.

Drawbacks To Consider

There are some potential drawbacks:- APR Variability: APR can range from 5.99% to 35.89%, depending on the lender.

- Fees from Lenders: Lenders may charge origination fees or other fees.

- Loan Terms: Loan terms can vary from 61 days to 96 months.

- Marketing Communications: Borrowers may receive additional marketing communications.

User Experiences And Reviews

Here are some user experiences:| User | Experience |

|---|---|

| John | Quick approval and funds received the next day. Very satisfied! |

| Maria | Competitive rates but found the fees a bit high. |

| Alex | The application was easy, but the marketing emails are frequent. |

Specific Recommendations For Ideal Users

Finding the right personal loan lender can be challenging. PersonalLoans.com simplifies this process by connecting borrowers with a network of lenders. Here are some specific recommendations based on your needs:

Best For Emergency Funds

PersonalLoans.com provides an excellent solution for emergency funds. With loan amounts ranging from $250 to $35,000, you can handle unexpected expenses quickly. The fast online form allows you to connect with lenders, and if approved, you can receive funds as soon as the next business day. This quick turnaround is crucial in emergencies.

| Feature | Details |

|---|---|

| Loan Amounts | $250 to $35,000 |

| Approval Time | Next Business Day |

| Application Process | Fast online form |

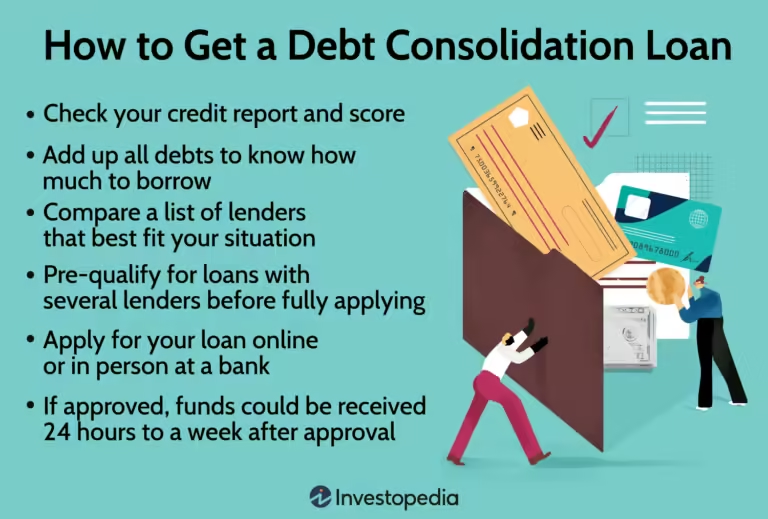

Best For Debt Consolidation

PersonalLoans.com is also ideal for debt consolidation. The flexible loan amounts and competitive rates help you manage and consolidate your existing debts. By combining multiple debts into a single loan, you simplify your payments and can potentially lower your interest rates.

- Loan amounts: $250 to $35,000

- Competitive rates from a variety of lenders

- No obligation to accept loan offers

Best For Home Improvement

PersonalLoans.com caters to those looking to improve their homes. Whether it is a small renovation or a large project, the flexible loan amounts can accommodate your needs. The service provides a hassle-free loan request process with no hidden fees or upfront costs.

- Flexible loan amounts for various home improvement projects

- Transparent review of loan offers

- Safe and secure with advanced data encryption technology

For more details, visit PersonalLoans.com.

Frequently Asked Questions

What Is A Personal Loan Lender?

A personal loan lender provides funds that you repay over time. They can be banks, credit unions, or online lenders.

How Do Personal Loans Work?

Personal loans are borrowed funds repaid in monthly installments. Interest rates and terms vary by lender.

What Are The Benefits Of Personal Loans?

Personal loans offer fixed interest rates and predictable payments. They can be used for various purposes, like debt consolidation or home improvements.

How To Choose A Personal Loan Lender?

Compare interest rates, fees, and repayment terms. Check lender reputation and customer reviews for the best choice.

Conclusion

Finding the right personal loan lender can be challenging. PersonalLoans.com offers a simple and quick solution. With flexible loan amounts and a hassle-free process, it suits various needs. The service is free, transparent, and secure. Check out the options here to find the best loan for you. Explore your choices and make an informed decision.