Personal Loan Benefits: Unlock Financial Freedom Today

Personal loans offer numerous advantages. They can help manage debts or fund big expenses.

Understanding these benefits can help you make informed financial decisions. In today’s fast-paced world, financial flexibility is crucial. Personal loans provide quick access to funds for emergencies, home improvements, or consolidating debts. They usually come with lower interest rates compared to credit cards, making them a smart choice for large expenses. Plus, they offer fixed repayment terms, which help in budgeting and planning. With a variety of lenders available, such as Upstart Personal Loans, finding a suitable personal loan is easier than ever. By exploring these benefits, you can take control of your finances and achieve your goals more efficiently. Let’s delve into the key advantages of personal loans.

Understanding Personal Loans

Personal loans are popular financial tools for various purposes. Whether you need funds for an emergency, debt consolidation, or a major purchase, personal loans can be an effective solution. This section will help you understand what personal loans are and how they work.

What Is A Personal Loan?

A personal loan is a type of unsecured loan. This means it does not require collateral. Financial institutions offer personal loans to individuals based on their creditworthiness. The loan amount can vary, and the borrower agrees to repay it over a fixed period with interest.

Personal loans can be used for various purposes:

- Debt consolidation

- Medical expenses

- Home improvements

- Major purchases

- Unexpected emergencies

How Personal Loans Work

Understanding how personal loans work is crucial. Here’s a breakdown:

- Application: You apply for a personal loan through a bank, credit union, or online lender. The application will require personal and financial information.

- Approval: The lender reviews your credit score, income, and other factors. If approved, they offer a loan amount and terms.

- Agreement: You agree to the loan terms, which include the interest rate, repayment period, and monthly payment amount.

- Disbursement: The lender disburses the loan amount to your bank account.

- Repayment: You repay the loan in fixed monthly installments over the agreed period. This includes both principal and interest.

It’s important to note that the interest rate on a personal loan can vary. Factors that influence the rate include your credit score and the lender’s policies.

Considering a personal loan? Upstart Personal Loans could be a great option. Their application process is straightforward, and they offer competitive rates based on your unique profile.

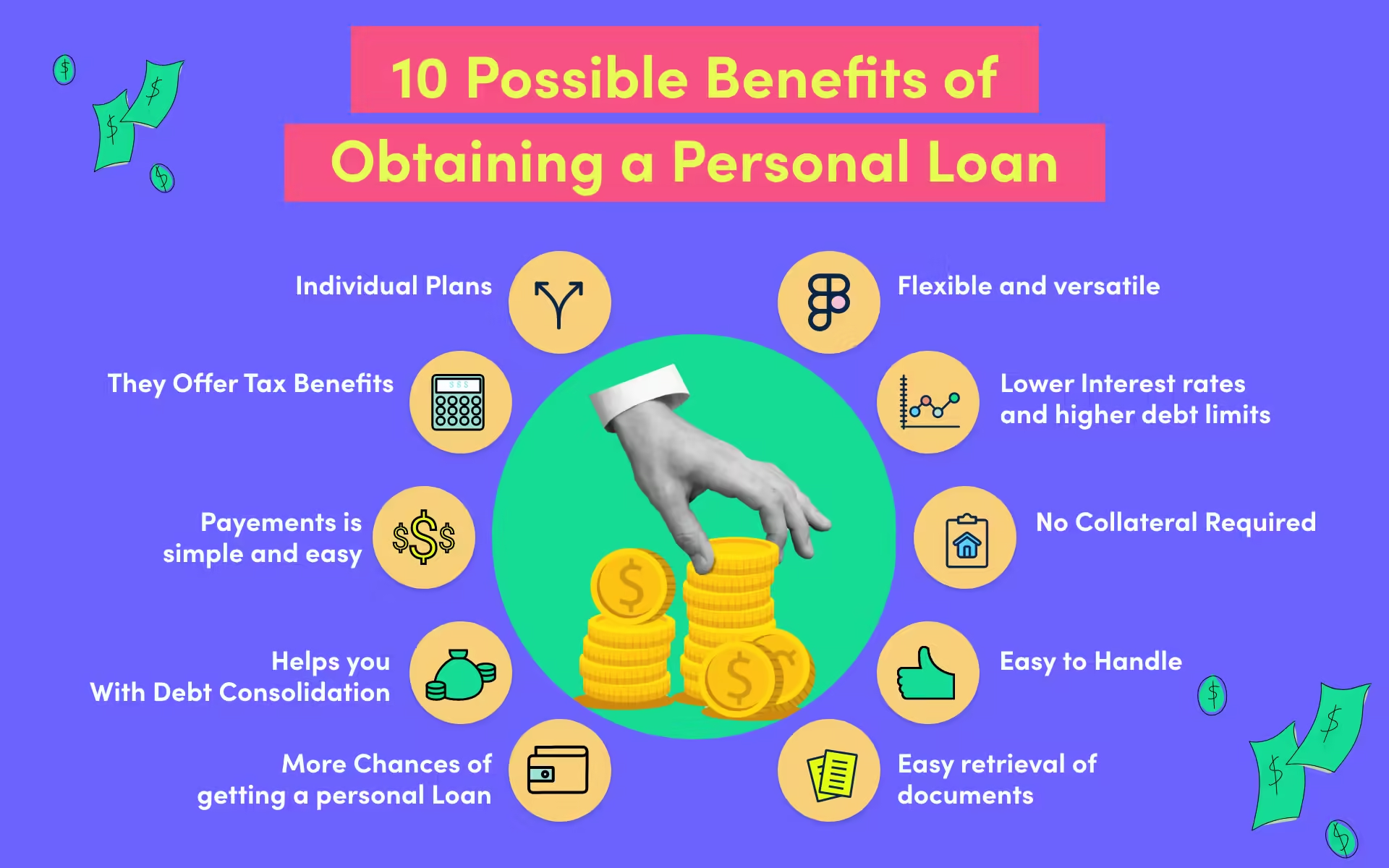

Key Benefits Of Personal Loans

Personal loans offer a range of advantages for individuals seeking financial assistance. These benefits make personal loans an attractive option for many. Below, we explore the key benefits of personal loans.

Flexible Usage

Personal loans can be used for almost any purpose. Whether you need to pay off credit card debt, finance a wedding, or cover unexpected medical expenses, a personal loan can help. This flexibility allows borrowers to address their specific financial needs without restrictions.

Quick And Easy Application Process

Applying for a personal loan is straightforward and fast. Many lenders, like Upstart Personal Loans, offer online applications that can be completed in minutes. The approval process is also swift, often providing funds within a few days. This quick turnaround is crucial for those needing immediate financial assistance.

No Collateral Required

One of the significant benefits of personal loans is that they are usually unsecured. This means you don’t need to provide any collateral, like a house or car, to secure the loan. This feature reduces the risk for borrowers and simplifies the loan process.

Lower Interest Rates

Personal loans often come with lower interest rates compared to credit cards. This can result in significant savings over time, especially for those consolidating high-interest debt. By opting for a personal loan, borrowers can reduce their overall interest payments and manage their finances more effectively.

Below is a comparison table highlighting the benefits:

| Benefit | Description |

|---|---|

| Flexible Usage | Use for various purposes without restrictions. |

| Quick and Easy Application Process | Online applications with fast approval. |

| No Collateral Required | Unsecured loans, no need for collateral. |

| Lower Interest Rates | Often lower than credit card rates, saving money. |

For more information on personal loans, visit Upstart Personal Loans.

Financial Scenarios Where Personal Loans Help

Personal loans can be a lifesaver in various financial scenarios. From consolidating debt to financing a wedding, a personal loan offers flexibility and convenience. Let’s explore some common situations where a personal loan might be beneficial.

Debt Consolidation

Dealing with multiple debts can be stressful. A personal loan can help by combining all your debts into one manageable payment. This simplifies your finances and often results in a lower interest rate, saving you money in the long run. Consider Upstart Personal Loans for consolidating your debts efficiently.

Home Renovation

Home renovations can be expensive. Whether you’re updating your kitchen or adding a new room, the costs add up quickly. A personal loan provides the funds needed to complete your project without draining your savings. With flexible repayment options, you can upgrade your home without financial strain.

Medical Emergencies

Medical emergencies are unpredictable and can be costly. A personal loan ensures you have the necessary funds to cover medical expenses. This helps you focus on recovery rather than financial stress. Quick access to funds through personal loans like Upstart Personal Loans can be a lifesaver.

Wedding Expenses

Weddings are memorable but can be costly. From venue bookings to catering, expenses add up. A personal loan can help finance your dream wedding without compromising on your special day. This allows you to enjoy the moment without worrying about the bills.

Travel Financing

Dreaming of a vacation but short on funds? A personal loan can help make your travel dreams a reality. Whether it’s a family trip or a solo adventure, you can finance your travels and repay the loan in manageable installments. This ensures you enjoy your trip without financial stress.

For more information on personal loans, visit Upstart Personal Loans.

Comparing Personal Loans To Other Credit Options

Personal loans offer a flexible and straightforward way to manage your finances. They can be a better choice compared to other credit options. Let’s explore how personal loans compare to credit cards, payday loans, and home equity loans.

Personal Loans Vs. Credit Cards

Personal loans typically come with a fixed interest rate and a set repayment schedule. This makes it easier to budget and plan your payments. In contrast, credit cards often have variable interest rates, which can fluctuate and result in higher costs over time.

Here are some key differences:

| Feature | Personal Loans | Credit Cards |

|---|---|---|

| Interest Rates | Fixed | Variable |

| Repayment Terms | Set Schedule | Flexible |

| Borrowing Limits | Higher | Lower |

| Usage | Lump Sum | Revolving Credit |

Personal Loans Vs. Payday Loans

Personal loans offer lower interest rates and longer repayment terms compared to payday loans. Payday loans are short-term and come with extremely high interest rates, which can trap borrowers in a cycle of debt.

Consider these points:

- Personal Loans: Lower interest rates, longer repayment terms, higher loan amounts.

- Payday Loans: High interest rates, short repayment terms, small loan amounts.

Personal Loans Vs. Home Equity Loans

Personal loans do not require collateral, making them an unsecured form of credit. Home equity loans are secured by your home, which means you risk losing your home if you default.

Key differences include:

- Collateral: Personal loans are unsecured; home equity loans are secured.

- Approval Process: Personal loans have a faster approval process.

- Usage: Personal loans can be used for various purposes; home equity loans are often used for home improvements.

Personal loans from Upstart provide a simple and secure way to manage your finances without the complexities of other credit options.

Understanding Personal Loan Costs

Personal loans can be a helpful financial tool. However, it is important to understand all the costs associated with them. This includes interest rates, fees, and repayment terms. Knowing these costs can help you make informed decisions.

Interest Rates And Apr

Interest rates are the percentage of the loan amount that you pay back in addition to the principal. Annual Percentage Rate (APR) includes the interest rate and any other fees. This gives a clearer picture of the loan’s total cost.

For example, if a loan has a 5% interest rate and additional fees, the APR might be 6%. Comparing APRs helps you understand which loan is cheaper overall.

Fees And Charges

Personal loans often come with various fees. These can include:

- Origination fees: Charged for processing the loan application.

- Late payment fees: Applied if you miss a payment deadline.

- Prepayment penalties: Charges for paying off the loan early.

Understanding these fees helps you avoid unexpected costs. Always read the loan agreement carefully.

Repayment Terms

Repayment terms refer to the period you have to pay back the loan. This can range from a few months to several years. Shorter terms often mean higher monthly payments. However, you will pay less interest overall.

Longer terms mean lower monthly payments, but you will pay more in interest over the life of the loan. Choose a term that fits your budget and financial goals.

For more information on personal loans, visit the Upstart Personal Loans website.

Pros And Cons Of Personal Loans

Personal loans can be a useful financial tool. They come with their own set of advantages and disadvantages. Understanding both can help you decide if a personal loan is right for you. Below, we explore the pros and cons of personal loans in detail.

Advantages Of Personal Loans

Personal loans offer several benefits that make them an attractive option for many people.

- Flexibility in Use: Personal loans can be used for various purposes, such as debt consolidation, home renovations, medical expenses, or even vacations.

- Fixed Interest Rates: Many personal loans come with fixed interest rates, which means your monthly payments remain consistent throughout the loan term.

- Unsecured Loan: Personal loans are often unsecured, meaning you do not need to provide collateral to secure the loan.

- Fast Approval: The approval process for personal loans is generally quick, allowing you to access funds in a short period.

- Improve Credit Score: Successfully repaying a personal loan can improve your credit score.

Disadvantages Of Personal Loans

While personal loans have many advantages, they also come with some drawbacks that should be considered.

- Higher Interest Rates: Personal loans can have higher interest rates compared to secured loans like mortgages or auto loans.

- Fees and Penalties: Some personal loans come with fees such as origination fees, late payment fees, and prepayment penalties.

- Impact on Credit Score: Missing payments can negatively impact your credit score, making it harder to obtain credit in the future.

- Debt Trap: Taking on too much debt through personal loans can lead to a debt trap, making it difficult to manage your finances.

Who Should Consider A Personal Loan?

Personal loans can be a great financial tool for various needs. They offer flexibility and can be tailored to individual circumstances. But who should consider taking out a personal loan? Let’s break it down into two main categories: ideal candidates and specific beneficial situations.

Ideal Candidates For Personal Loans

Certain individuals are more likely to benefit from personal loans. These include:

- People with Good Credit Scores: A good credit score often means lower interest rates.

- Individuals with Steady Income: A reliable income source ensures loan repayment ability.

- Those Seeking Debt Consolidation: Consolidating multiple debts into one can simplify finances.

- Applicants with Emergency Expenses: Personal loans can cover unexpected costs quickly.

Situations Where Personal Loans Are Beneficial

Personal loans can be particularly useful in specific situations. Here are some examples:

| Situation | Benefit of Personal Loan |

|---|---|

| Home Renovations | Finance large home improvement projects. |

| Medical Bills | Cover unexpected medical expenses. |

| Major Purchases | Buy expensive items without draining savings. |

| Special Events | Fund weddings, vacations, or other big events. |

By understanding who should consider personal loans and in what situations they are beneficial, individuals can make informed decisions. This can help them manage their finances more effectively and avoid potential pitfalls.

How To Apply For A Personal Loan

Applying for a personal loan can seem daunting, but it’s quite simple. Understanding the process and what you need can make it smoother. Here’s a step-by-step guide to help you through it.

Steps To Apply

- Research Lenders: Compare different lenders to find the best terms and rates.

- Check Eligibility: Review the lender’s eligibility criteria to ensure you qualify.

- Pre-qualification: Many lenders offer pre-qualification to check your potential loan amount and interest rate without impacting your credit score.

- Submit Application: Fill out the application form with your personal, financial, and employment details.

- Approval: If approved, review the loan offer and terms carefully before accepting.

- Receive Funds: Once accepted, the funds are usually deposited into your bank account within a few days.

Documents Required

Having the necessary documents ready can speed up the application process. Here’s what you’ll typically need:

- Identification: Government-issued ID such as a passport or driver’s license.

- Proof of Income: Recent pay stubs, tax returns, or bank statements.

- Employment Verification: Employer’s contact information or a letter of employment.

- Credit Report: Some lenders may request your credit report.

- Proof of Residence: Utility bills or lease agreement showing your current address.

Tips For A Successful Application

To increase your chances of approval, follow these tips:

- Check Your Credit Score: Ensure your credit score is accurate and in good standing.

- Reduce Existing Debt: Pay down any outstanding debts to improve your debt-to-income ratio.

- Provide Accurate Information: Double-check your application for accuracy to avoid delays.

- Choose the Right Lender: Select a lender that suits your financial needs and offers favorable terms.

- Be Honest: Provide truthful information to avoid application rejection.

Applying for a personal loan doesn’t have to be stressful. By following these steps and tips, you can navigate the process with ease and confidence.

Frequently Asked Questions

What Are The Key Benefits Of Personal Loans?

Personal loans offer quick access to funds, flexible repayment terms, and no collateral requirement. They can be used for various purposes such as debt consolidation, home improvements, or medical expenses.

How Can Personal Loans Improve Credit Scores?

Timely repayment of personal loans can boost your credit score. It shows lenders you are responsible. This improves your creditworthiness for future loans.

Are Personal Loans Good For Debt Consolidation?

Yes, personal loans can consolidate multiple debts into one. This simplifies monthly payments and potentially reduces interest rates. It helps manage finances better.

Can Personal Loans Be Used For Home Improvements?

Absolutely, personal loans are ideal for home improvements. They provide quick funds for renovations. This can increase your home’s value and enhance your living space.

Conclusion

Personal loans offer many benefits. They are versatile and easy to manage. You can use them for various needs. Debt consolidation, home improvements, and emergencies are common uses. Upstart Personal Loans provide flexible options. Visit their website for more details. Consider personal loans to meet your financial needs effectively. Secure your future today with a reliable loan option. Learn more about Upstart Personal Loans here.