Personal Loan Application Process: Simplified Steps to Approval

Navigating the personal loan application process can seem overwhelming. But it doesn’t have to be.

Understanding each step helps simplify the journey, making it easier to secure the funds you need. Whether it’s for unexpected bills, home improvements, or a family getaway, knowing how to apply for a personal loan is crucial. In this guide, we’ll walk you through the essentials of applying for a personal loan. From preparing your documents to understanding loan terms, you’ll learn everything needed to make the process smooth and efficient. Ready to get started? Let’s dive in and explore the personal loan application process, ensuring you are well-prepared and confident in your financial decisions. For more details, visit Personal Loans®.

Introduction To Personal Loan Applications

Applying for a personal loan can be a daunting process for many. Knowing what to expect and understanding the steps involved can make it much easier. Personal Loans® offers a free online service to connect borrowers with a network of lenders, providing a seamless and convenient way to obtain personal loans ranging from $250 to $35,000.

Understanding Personal Loans

A personal loan is a type of unsecured loan that you can use for various personal expenses. Unlike secured loans, personal loans do not require collateral. This makes them an attractive option for many borrowers. The application process with Personal Loans® is straightforward, allowing you to connect with lenders in minutes through an easy-to-complete online form.

- Loan Amounts: $250 to $35,000

- APR Range: 5.99% to 35.89%

- Loan Terms: 3 months to 72 months (61 days to 96 months in some cases)

- Funding Time: As soon as the next business day upon approval

Purpose Of Personal Loans

Personal loans can be used for a variety of purposes. This flexibility makes them ideal for many financial needs. Here are some common use cases for personal loans:

- Emergency Expenses: Cover unexpected costs such as medical bills or car repairs.

- Home Improvement: Fund renovations or repairs to your home.

- Business Startup: Get the capital needed to start a new business venture.

- Unexpected Bills: Handle surprise expenses that arise suddenly.

- Family Getaways: Plan and finance a vacation for your family.

| Loan Term | Example Amount | APR | Monthly Payment | Total Payment |

|---|---|---|---|---|

| 2 Years | $8,500 | 6.99% | $380.53 | $9,132.68 |

| 3 Years | $10,000 | 8.34% | $314.93 | $11,337.64 |

| 4 Years | $15,000 | 10.45% | $383.69 | $18,417.05 |

| 5 Years | $20,000 | 8.54% | $410.72 | $24,646.98 |

| 6 Years | $30,000 | 7.99% | $525.85 | $37,861.25 |

Personal Loans® offers a user-friendly and secure platform to help you find the best loan options. With competitive rates and flexible terms, you can meet your financial needs conveniently and efficiently.

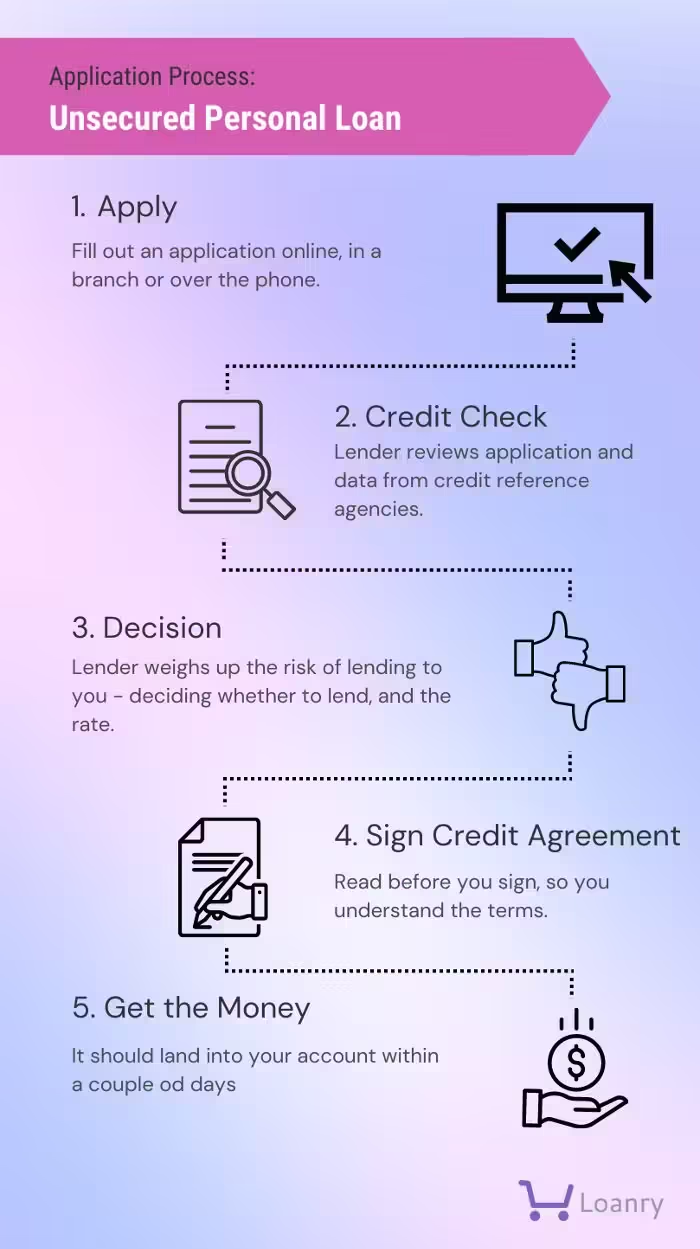

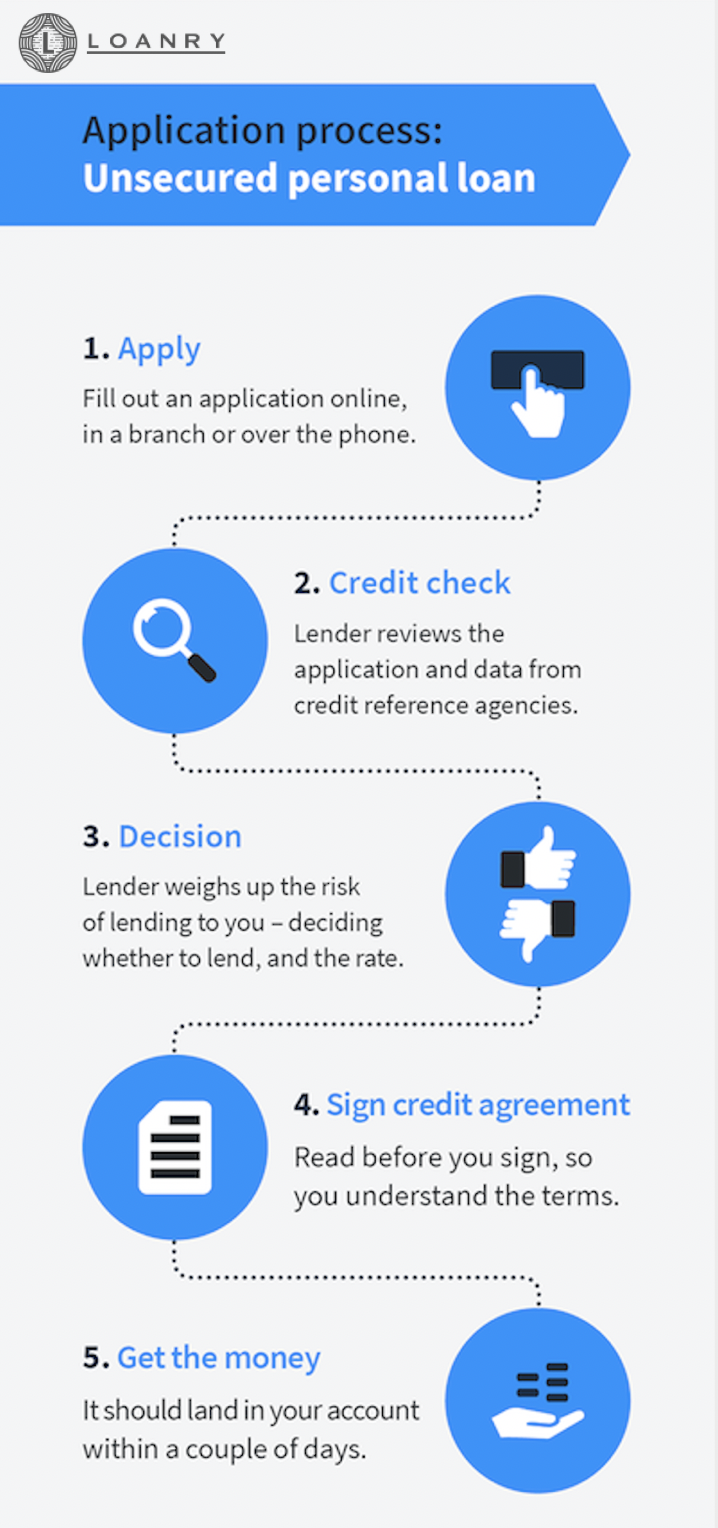

Key Steps In The Personal Loan Application Process

Applying for a personal loan can seem daunting, but breaking it down into manageable steps can simplify the process. Here’s a step-by-step guide to help you navigate the personal loan application process efficiently.

Assessing Your Financial Situation

Start by evaluating your current financial status. Calculate your monthly income, expenses, and debts. This helps determine how much you can afford to borrow and repay.

Consider using a budgeting tool or spreadsheet to get a clear picture. Assess your credit score, as it significantly affects loan approval and interest rates. A higher score can lead to better loan terms.

Researching Lenders And Loan Options

Next, explore various lenders and loan products. PersonalLoans.com offers a wide range of loan amounts, from $250 to $35,000, with APRs ranging from 5.99% to 35.89%.

Check different loan terms, which can range from 3 months to 72 months. Use online comparison tools to find competitive rates and flexible terms. Read reviews and check lender reputations to ensure reliability.

Gathering Necessary Documentation

Before applying, gather essential documents. Commonly required documents include:

- Proof of identity (e.g., driver’s license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements

- Employment verification

Having these documents ready can speed up the application process. Ensure all information is accurate and up-to-date.

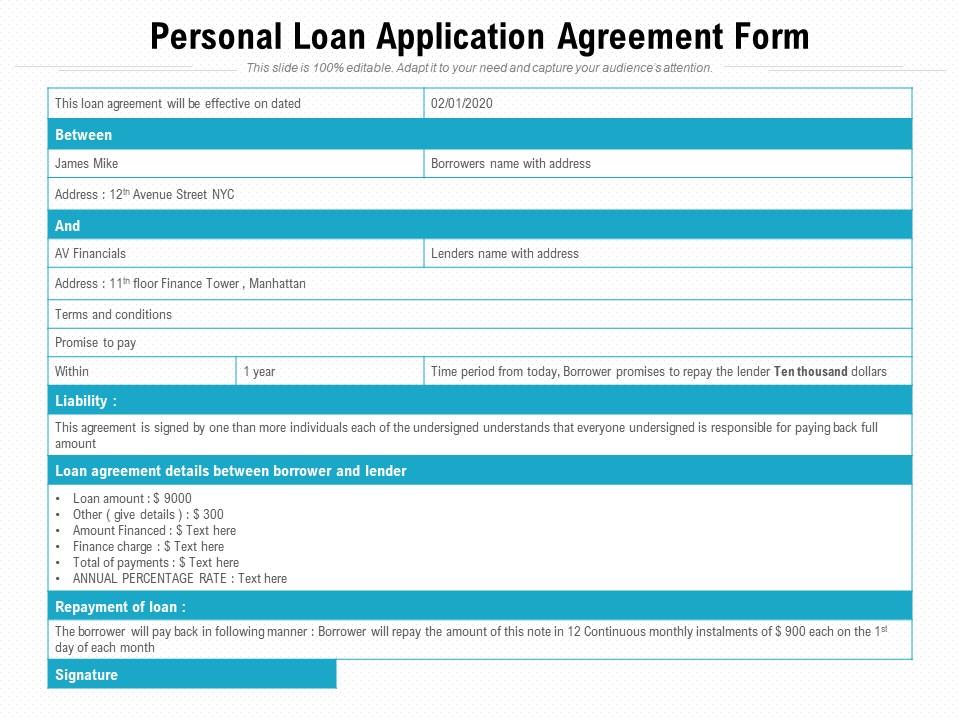

Submitting The Application

Once you have your documents, you can complete the online application. PersonalLoans.com provides a simple, fast, and convenient online form.

Fill in required details, review your information, and submit the application. Upon submission, PersonalLoans.com connects you with a network of lenders. You may receive loan offers within minutes.

Review the loan terms carefully before accepting any offer. Pay attention to the APR, repayment terms, and any fees. Once approved, you could receive funds as soon as the next business day.

By following these key steps, you can navigate the personal loan application process with confidence. Visit PersonalLoans.com for more information and to start your application.

Unique Features Of Modern Loan Applications

Modern loan applications offer a variety of unique features designed to simplify and expedite the borrowing process. These features make it easier for individuals to obtain the necessary funds quickly and conveniently. Below are some of the standout aspects of contemporary loan applications.

Online Application Platforms

Many lenders now provide online application platforms, allowing borrowers to apply for loans from the comfort of their homes. This eliminates the need for lengthy paperwork and in-person visits to financial institutions. For example, Personal Loans® offers a simple, online form that connects users with lenders in minutes.

- Available 24/7

- Quick and easy to complete

- Secure data encryption technology

These platforms ensure that users can apply anytime, providing a more convenient and accessible experience.

Instant Pre-approval Tools

Instant pre-approval tools are another significant feature of modern loan applications. These tools provide immediate feedback on potential loan eligibility, enabling borrowers to make informed decisions quickly. With Personal Loans®, users can receive pre-approval in minutes, streamlining the entire process.

- Immediate eligibility feedback

- Helps in quick decision-making

- Reduces uncertainty for borrowers

By knowing their loan options upfront, borrowers can plan their finances more effectively.

Flexible Repayment Options

Flexible repayment options are a crucial aspect of modern loan applications. Personal Loans® offers a range of loan terms from 3 months to 72 months, and in some cases, up to 96 months. This flexibility allows borrowers to choose a repayment plan that fits their financial situation.

| Loan Term | Loan Amount | APR | Monthly Payment | Total Payment |

|---|---|---|---|---|

| 2 Years | $8,500 | 6.99% | $380.53 | $9,132.68 |

| 3 Years | $10,000 | 8.34% | $314.93 | $11,337.64 |

| 4 Years | $15,000 | 10.45% | $383.69 | $18,417.05 |

| 5 Years | $20,000 | 8.54% | $410.72 | $24,646.98 |

| 6 Years | $30,000 | 7.99% | $525.85 | $37,861.25 |

These options provide borrowers with the flexibility to manage their repayment schedules according to their financial capabilities.

Pricing And Affordability Of Personal Loans

Applying for a personal loan involves understanding the pricing and affordability. Interest rates and fees vary among lenders. Ensure to compare options for the best deal.

Personal loans can be a great financial tool for various needs. Understanding the costs involved is crucial for making an informed decision. This section delves into the pricing and affordability of personal loans, covering interest rates, fees, and how to compare loan offers.Understanding Interest Rates

Interest rates significantly impact the overall cost of a loan. Personal Loans® offers an APR range from 5.99% to 35.89%. The APR includes both the interest rate and any fees associated with the loan. A lower APR means less interest to pay over the loan term.| Loan Amount | APR | Monthly Payment | Total Cost |

|---|---|---|---|

| $8,500 | 6.99% | $380.53 | $9,132.68 |

| $10,000 | 8.34% | $314.93 | $11,337.64 |

| $15,000 | 10.45% | $383.69 | $18,417.05 |

| $20,000 | 8.54% | $410.72 | $24,646.98 |

| $30,000 | 7.99% | $525.85 | $37,861.25 |

Fees And Additional Costs

While Personal Loans® does not charge service fees, lenders may have their own fees. Common fees include:- Origination Fees: Charged by some lenders, typically 1% to 6% of the loan amount.

- Late Payment Fees: Applied if payments are not made on time.

- Prepayment Penalties: Fees for paying off the loan early, although not all lenders charge this.

Comparing Loan Offers

Comparing offers can help you find the best terms. Personal Loans® provides the ability to review multiple offers from different lenders. Consider the following when comparing:- APR: A lower APR means lower overall costs.

- Loan Term: Shorter terms generally mean higher monthly payments but less interest paid over time.

- Fees: Check for any additional fees that could increase the cost of the loan.

- Monthly Payment: Ensure the monthly payment fits within your budget.

Pros And Cons Of Personal Loans

Personal loans can be a useful tool for managing financial needs. They provide quick access to funds, but they also come with some considerations. Below, we explore the advantages and potential drawbacks of personal loans to help you make an informed decision.

Advantages Of Personal Loans

- Fast Funding: Get money as soon as the next business day upon approval.

- Flexible Use: Use loans for emergencies, home improvements, and more.

- Competitive Rates: Access to a wide network of lenders offering competitive rates.

- Convenient Process: Simple online application available 24/7.

- No Hidden Fees: Personal Loans® does not charge service fees.

- Review Offers: Opportunity to review and compare offers before accepting.

Potential Drawbacks To Consider

- Interest Rates: APR ranges from 5.99% to 35.89%, which can be high.

- Origination Fees: Lenders may charge fees, disclosed before loan acceptance.

- Repayment Terms: Loan terms range from 3 months to 72 months, impacting monthly payments.

- Variable Approval: Not all applicants may qualify for the desired loan amount.

- Impact on Credit: Missing payments can negatively affect credit scores.

Understanding the pros and cons of personal loans will help you decide if this financial tool is right for your needs. For more information, visit Personal Loans® and explore your options.

Recommendations For Ideal Loan Applicants

Applying for a personal loan can seem daunting. However, following certain recommendations can make the process smoother. Ideal loan applicants often have specific traits and follow best practices that enhance their approval chances. By understanding these recommendations, you can increase the likelihood of securing a personal loan, such as those offered by Personal Loans®.

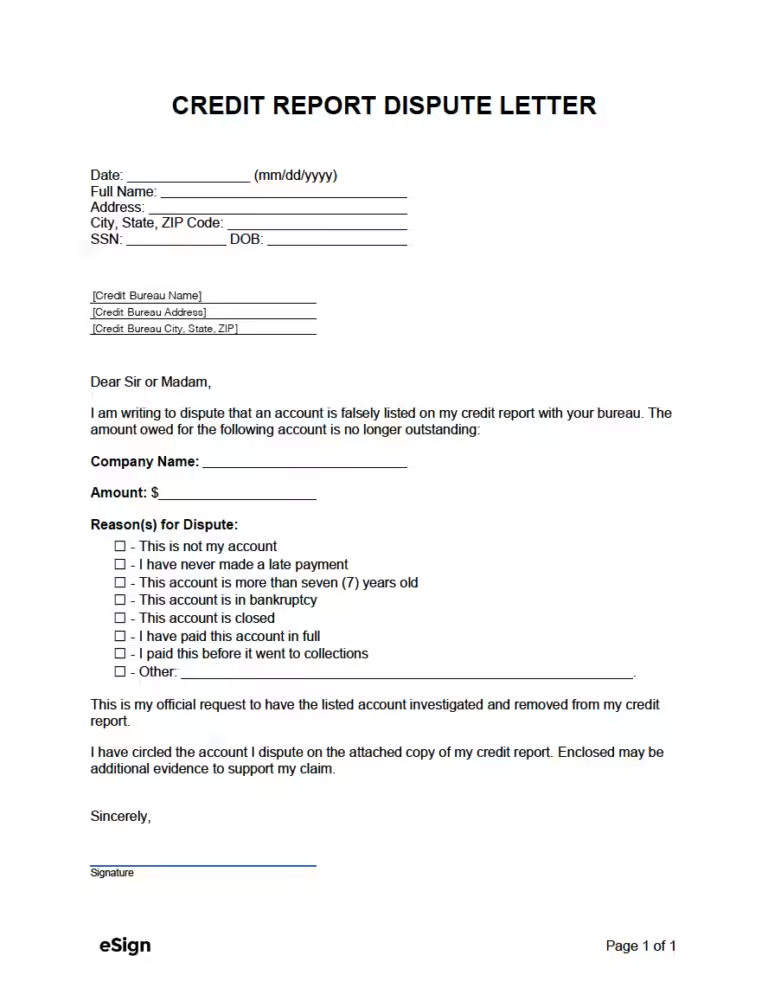

Best Practices For Increasing Approval Chances

Here are some best practices to follow to improve your chances of loan approval:

- Maintain a Good Credit Score: Lenders prefer applicants with a high credit score. It shows financial responsibility and reliability.

- Stable Income: A steady income assures lenders that you can repay the loan. Provide proof of income during the application.

- Reduce Existing Debt: Lowering your current debt-to-income ratio can make you more attractive to lenders.

- Complete All Application Details: Ensure all required fields are filled accurately in the online form. Missing information can delay the process.

- Review Your Credit Report: Correct any errors in your credit report before applying. This can prevent misunderstandings with lenders.

Ideal Scenarios For Personal Loan Use

Understanding the ideal scenarios for utilizing a personal loan can help you decide whether it’s the right choice for you:

| Scenario | Description |

|---|---|

| Emergency Expenses | Personal loans can cover unexpected medical bills or urgent home repairs. |

| Home Improvement | Use the funds to remodel your home, adding value and improving living conditions. |

| Business Startup | Finance your new business venture and cover initial setup costs. |

| Family Getaways | Plan and fund a memorable family vacation without financial strain. |

| Debt Consolidation | Combine multiple debts into one, often at a lower interest rate. |

Following these recommendations can increase your chances of loan approval and ensure you use the funds effectively. Applying for a loan through Personal Loans® is simple and can provide quick access to the funds you need.

Frequently Asked Questions

What Is The First Step In Applying For A Personal Loan?

The first step is to check your credit score. A good score improves your chances of approval.

How Long Does The Personal Loan Approval Process Take?

The approval process typically takes a few days. Some lenders offer instant decisions for qualified applicants.

What Documents Are Needed For A Personal Loan Application?

Common documents include identification, proof of income, and bank statements. Requirements vary by lender.

Can I Apply For A Personal Loan Online?

Yes, many lenders offer an online application process. This is convenient and often faster.

Conclusion

Applying for a personal loan can be simple and fast. By following the steps outlined, you can secure the funds you need. Remember to compare different loan options and terms carefully. Always read the fine print before accepting any offer. For a convenient and quick application process, consider using Personal Loans®. They connect you with a network of lenders, making it easier to find the right loan for your needs. Stay informed, and make the best financial decision for your situation.