Personal Credit Health Assessment: Boost Your Financial Future

Understanding your personal credit health is crucial. It affects your financial future and borrowing power.

Many people overlook the importance of a personal credit health assessment. This simple step can help you understand your credit score, identify potential issues, and improve your financial stability. By regularly assessing your credit health, you can better manage your finances, qualify for better loans, and secure lower interest rates. Knowing your credit status empowers you to make informed financial decisions. Ready to take control of your credit health? Start your journey with a comprehensive personal credit health assessment today. Explore more about improving your credit at Freecash and boost your financial well-being.

Introduction To Personal Credit Health Assessment

Maintaining a good credit score is essential. It impacts many areas of life. A Personal Credit Health Assessment is a useful tool. It helps you understand your creditworthiness. This assessment provides a detailed analysis of your credit profile.

Understanding Credit Health

Credit health reflects your financial behavior. It shows how well you manage credit. Several factors contribute to credit health:

- Payment history

- Credit utilization

- Length of credit history

- Types of credit used

- Recent credit inquiries

Each factor plays a role in your credit score. A higher score means better credit health. Regularly checking your credit health helps you stay informed. It allows you to make adjustments when needed.

The Importance Of Assessing Your Credit

Assessing your credit is crucial. It affects loan approvals, interest rates, and even job opportunities. Here are some reasons why you should assess your credit:

- Identify Errors: Mistakes on your credit report can lower your score. Regular assessments help spot and fix these errors.

- Monitor Progress: Tracking your credit health shows improvement areas. It encourages better financial habits.

- Plan for the Future: Good credit health is essential for future financial plans. It ensures you get the best terms and rates.

Using tools like Freecash can simplify this process. They offer insights into your credit profile. Their assessments are user-friendly and detailed.

Key Features Of A Personal Credit Health Assessment

A Personal Credit Health Assessment provides vital insights into your financial well-being. It helps you understand and improve your credit status. Here are the key features of this assessment:

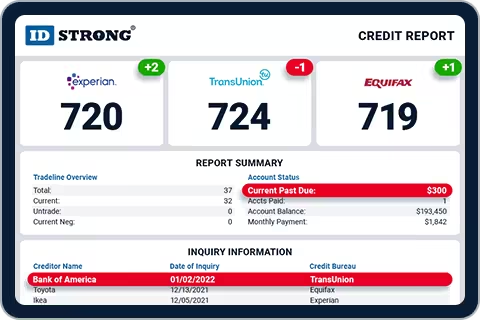

Comprehensive Credit Report Analysis

A Comprehensive Credit Report Analysis involves a detailed examination of your credit report. It includes:

- Credit history: Past and current credit accounts

- Payment history: Timeliness of your payments

- Credit inquiries: Recent credit checks

- Public records: Bankruptcies, liens, and judgments

This analysis helps identify any discrepancies or errors that might be affecting your credit score.

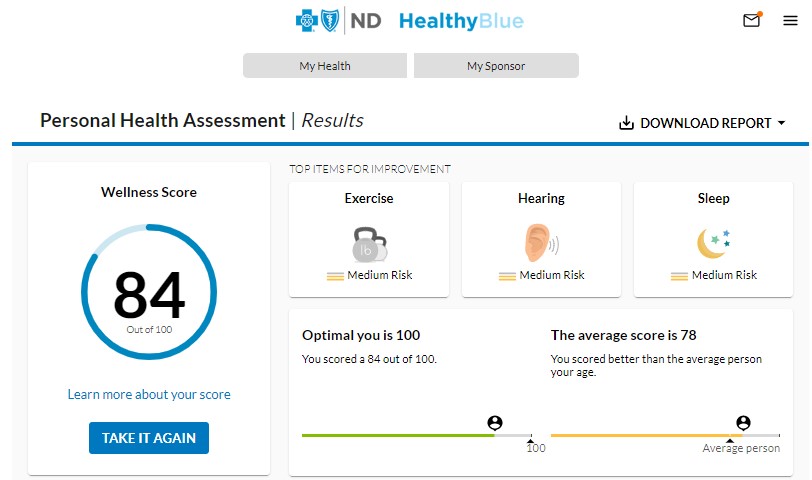

Credit Score Monitoring

Credit Score Monitoring tracks your credit score over time. It alerts you to:

- Changes in your score

- New credit inquiries

- Potential fraud or identity theft

Regular monitoring helps you stay informed and take action when necessary.

Personalized Improvement Recommendations

Personalized Improvement Recommendations provide tailored advice to improve your credit health. These suggestions may include:

- Paying bills on time

- Reducing credit card balances

- Limiting new credit applications

Following these recommendations can help you boost your credit score.

Debt Management Insights

Debt Management Insights offer strategies to manage and reduce your debt. These insights include:

| Strategy | Description |

|---|---|

| Debt consolidation | Combining multiple debts into one payment |

| Debt snowball | Paying off smallest debts first |

| Debt avalanche | Paying off highest-interest debts first |

Effective debt management helps you reduce financial stress and improve your credit profile.

For more information, visit the Freecash website.

Pricing And Affordability Of Credit Health Assessment Tools

Understanding your credit health is crucial. But what about the costs involved? Let’s explore the pricing and affordability of these tools.

Free Vs. Paid Options

Many credit health assessment tools are available. Some are free, while others are paid.

Free options often provide basic services. They might include:

- Basic credit score checks

- Simple reports

- Limited features

Paid options usually offer more comprehensive services. These can include:

- Detailed credit reports

- Credit monitoring

- Personalized recommendations

Cost-benefit Analysis

Is it worth paying for these tools? Let’s do a cost-benefit analysis.

| Feature | Free Options | Paid Options |

|---|---|---|

| Credit Score Checks | Basic | Detailed |

| Credit Reports | Limited | Comprehensive |

| Credit Monitoring | Minimal | Extensive |

| Personalized Advice | None | Available |

Free options are good for a quick check. Paid tools offer more value, especially if you need detailed information.

Consider your needs. If you require frequent monitoring, paid options may be better. For a one-time check, free tools might suffice.

Pros And Cons Of Personal Credit Health Assessment

Understanding the pros and cons of a personal credit health assessment can help you manage your finances better. Knowing your credit health can provide many advantages, but there are also some potential drawbacks to consider. Let’s dive into both aspects.

Advantages Of Regular Credit Assessments

Regular credit assessments offer several benefits:

- Awareness of Financial Standing: It helps you stay informed about your current credit status.

- Improves Credit Scores: By monitoring and correcting errors, you can improve your credit score.

- Early Detection of Fraud: Regular checks can help you spot and address fraudulent activities quickly.

- Better Loan Approval Rates: A good credit score increases your chances of loan approvals.

Potential Drawbacks And Limitations

Despite the benefits, there are some limitations:

- Possible Negative Impact: Frequent hard inquiries can lower your credit score.

- Cost of Services: Professional credit assessments may require a fee.

- Time-Consuming: Regular monitoring and follow-ups can be time-consuming.

- Privacy Concerns: Sharing personal information with credit agencies might raise privacy issues.

Who Should Use Personal Credit Health Assessment Tools?

Personal credit health assessment tools are essential for anyone wanting to improve their financial stability. These tools help you understand your credit score, track spending habits, and identify areas for improvement. Understanding who can benefit from these tools is crucial.

Ideal Users

Not everyone needs a personal credit health assessment tool, but many can benefit. Below are some ideal users:

- Individuals with fluctuating finances: Those who experience variable income or expenses.

- Young adults: Those new to managing their finances.

- Families: Households aiming to track and improve credit health.

- Small business owners: Entrepreneurs managing both personal and business finances.

- Retirees: Those planning for or currently in retirement.

Specific Scenarios For Usage

There are specific scenarios where personal credit health assessment tools are particularly useful:

- Applying for a loan: Understand credit health before applying for a mortgage, car loan, or personal loan.

- Improving credit score: Identify weak points and areas needing improvement to boost your credit score.

- Managing debt: Track and manage multiple debts effectively, ensuring timely payments.

- Planning major purchases: Assess financial readiness for significant expenses like buying a house or car.

- Monitoring financial health: Regularly check credit status to avoid unexpected issues.

These tools are valuable for many, making them an essential part of financial planning and stability.

Conclusion: Boosting Your Financial Future With A Personal Credit Health Assessment

Understanding your credit health is crucial for a secure financial future. A Personal Credit Health Assessment gives you insights into your creditworthiness. This knowledge can help you make better financial decisions. Let’s explore the benefits and steps to get started.

Recap Of Benefits

- Improved Credit Score: Regular assessment can help identify and correct errors.

- Better Loan Approval Rates: Lenders prefer borrowers with good credit health.

- Lower Interest Rates: Good credit can lead to better loan terms.

- Financial Planning: Helps in budgeting and managing debts effectively.

These benefits can collectively enhance your financial well-being. Consistent credit health monitoring helps in maintaining a good credit score.

Steps To Get Started

- Obtain Your Credit Report: Request a copy from major credit bureaus.

- Review the Report: Check for any inaccuracies or discrepancies.

- Dispute Errors: Contact the bureau to correct any mistakes.

- Monitor Your Score: Use tools and services to keep track of your credit score.

- Maintain Good Habits: Pay bills on time and keep credit card balances low.

These steps will help you begin your journey towards better credit health. Regular assessments are key to a strong financial future.

Frequently Asked Questions

What Is A Personal Credit Health Assessment?

A personal credit health assessment evaluates your creditworthiness. It reviews your credit score, payment history, and debt levels.

How Can I Improve My Credit Health?

You can improve your credit health by paying bills on time, reducing debt, and regularly checking your credit report.

Why Is Credit Health Important?

Credit health is important because it affects loan approvals, interest rates, and financial opportunities.

How Often Should I Check My Credit Report?

You should check your credit report at least once a year to ensure accuracy and monitor your credit health.

Conclusion

Assessing your personal credit health is crucial. It helps manage finances better. Regular checks ensure you’re on track. Stay informed about your credit score. It affects loan approvals and interest rates. Tools like Freecash can assist. Visit Freecash to learn more. Keep improving your credit health. Your financial future depends on it.