Perpay Reviews: Honest Insights and User Experiences

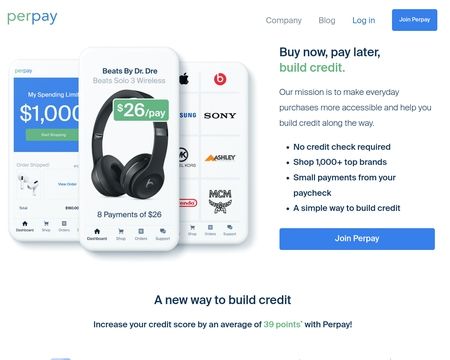

Are you curious about how Perpay can help you manage finances better? Perpay is a unique service that combines shopping with credit-building.

It offers a marketplace and a credit card, making everyday purchases more accessible. Perpay is designed to simplify your financial life. With Perpay, you can shop for top brands, pay over time without fees, and improve your credit score. Payments are deducted directly from your paycheck, making it hassle-free. This service reports to major credit bureaus, helping you build your credit score. Users have reported an average credit score increase of 36 points in just three months. Explore the benefits and see if Perpay is the right fit for you. Check out the full details and user reviews here.

Introduction To Perpay

Perpay is transforming the way people manage their finances. With a unique blend of shopping convenience and credit-building features, Perpay offers a solution for those who want to buy now and pay later while improving their credit score. This post will delve into what makes Perpay stand out and who can benefit from using its services.

What Is Perpay?

Perpay is a financial service designed to make everyday purchases more accessible. It offers a marketplace where users can shop for top brands in electronics, home goods, apparel, and more. Additionally, Perpay provides a credit card that allows users to earn rewards and build their credit score over time.

One of the standout features is the automatic payment system. Payments are deducted directly from the user’s paycheck, simplifying the repayment process and ensuring timely payments. This setup is beneficial for users aiming to improve their credit scores without the hassle of managing multiple payments.

Purpose And Target Audience

The primary purpose of Perpay is to offer a straightforward, no-interest payment solution. It targets consumers who wish to make purchases without the burden of immediate full payment. The service is particularly beneficial for individuals looking to build or improve their credit score.

Perpay is ideal for consumers residing in the United States, excluding New Hampshire residents. The service is especially useful for those who may find traditional credit options challenging to navigate. By using Perpay, users can make necessary purchases, manage their payments efficiently, and see positive changes in their credit scores.

| Main Features | Benefits |

|---|---|

| Perpay Marketplace | Access to $1,000 credit for top brand shopping |

| Perpay Credit Card | Earn 2% rewards to use on the marketplace |

| Automatic Payments | Simplified payment process with paycheck deductions |

| Credit Building | Average credit score increase of 36 points in 3 months |

In summary, Perpay is a valuable service for consumers aiming to manage their finances better and improve their credit scores. With no interest or fees, automatic payments, and a rewards program, Perpay offers a comprehensive solution for modern financial needs.

Key Features Of Perpay

Perpay is a financial service designed to make shopping more accessible and to help users build credit. Below are some key features that make Perpay stand out.

Buy Now, Pay Later

Perpay offers a Buy Now, Pay Later feature, allowing users to access up to $1,000 in credit for shopping. This credit can be used for a variety of top brands in electronics, home goods, apparel, and more. Payments are automatically deducted from the user’s paycheck, making it convenient and stress-free.

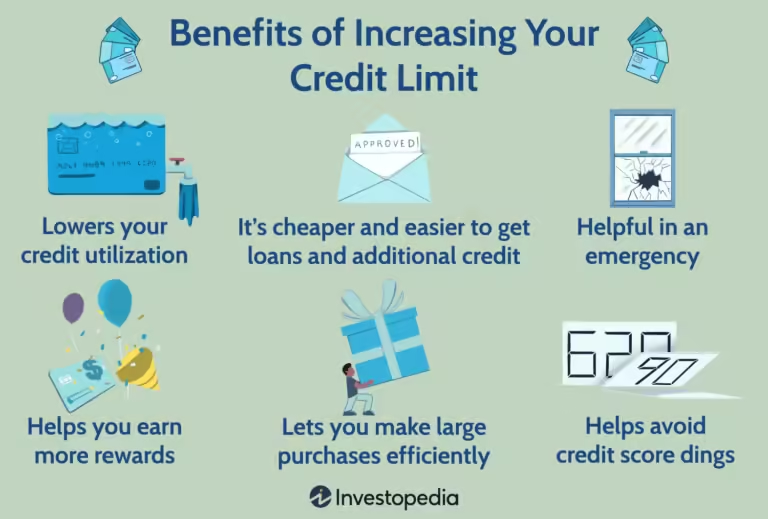

Credit Building

One of the standout features of Perpay is its Credit Building benefit. Users can significantly improve their credit score with on-time payments. On average, users see a 36-point increase in their credit score within the first three months. Perpay reports transactions to Experian®, Equifax®, and TransUnion®, which helps in building a positive credit history.

Shopping Platform Integration

Perpay integrates a comprehensive Shopping Platform that allows users to shop from a wide range of categories. This platform offers products from top brands in electronics, home goods, apparel, and more. Additionally, users can earn 2% rewards on purchases made with the Perpay Credit Card, which can be used for future shopping on the Perpay Marketplace.

The Perpay Credit Card can be used anywhere Mastercard is accepted, adding to its convenience. The automatic payment deduction from the user’s paycheck simplifies the repayment process, ensuring timely payments and aiding in credit building.

| Feature | Description |

|---|---|

| Buy Now, Pay Later | Access up to $1,000 in credit for shopping. Payments deducted from paycheck. |

| Credit Building | Improve credit score with on-time payments. Average increase of 36 points in three months. |

| Shopping Platform Integration | Shop top brands and earn 2% rewards on purchases with the Perpay Credit Card. |

These key features make Perpay a valuable tool for those looking to shop conveniently while building their credit. The automatic payment deductions, no interest or fees, and rewards program add to its appeal.

Pricing And Affordability

Understanding the pricing and affordability of Perpay is crucial for potential users. This section will break down the cost structure, payment plans, and affordability for different users.

Cost Structure

Perpay offers a transparent and straightforward cost structure. Here are the key details:

- Perpay Marketplace: Unlock up to $1,000 credit for shopping.

- Perpay Credit Card: Subject to credit approval, users earn 2% rewards as Perpay Marketplace credits.

- Fees: Certain fees may apply for the Perpay+ service. Check the Marketplace Terms and Conditions for more details.

Payment Plans

Perpay provides flexible payment plans to suit different financial situations:

- Automatic Payments: Payments are automatically deducted from the user’s paycheck, ensuring timely repayments.

- No Interest or Fees: Users can pay over time without incurring interest or fees, making it easier to manage finances.

Affordability For Different Users

Perpay aims to be affordable for a wide range of users:

- Credit Building: Users can improve their credit score, with an average increase of 36 points within the first three months, making it beneficial for those looking to boost their credit.

- Convenience: Automatic paycheck deductions simplify the payment process, making it easier for users to manage their finances.

- Rewards Program: Earn 2% rewards on the Perpay Credit Card to shop more on the marketplace, adding value for frequent shoppers.

Overall, Perpay’s pricing and affordability make it an attractive option for users seeking a simple and effective financial service.

Pros And Cons Of Perpay

Perpay offers various benefits and some limitations. It is essential to weigh both before committing. Below, we delve into the pros and cons of using Perpay for your financial needs.

Advantages Of Using Perpay

- No Interest or Fees: Users can pay over time without incurring interest or fees.

- Credit Score Improvement: On-time payments can positively impact your credit score.

- Convenience: Automatic paycheck deductions simplify the payment process.

- Rewards Program: Earn 2% rewards on the Perpay Credit Card to shop more on the marketplace.

- Access to Top Brands: Shop electronics, home goods, apparel, and more with $1,000 credit.

Common Drawbacks And Limitations

- Eligibility Restrictions: Available only to eligible U.S. consumers; the credit card is not available in New Hampshire.

- Credit Approval: The Perpay Credit Card is subject to credit approval.

- Possible Fees: Fees may apply for the Perpay+ service; check the Marketplace Terms and Conditions.

- No Refund Policy: Refund or return policies are not specified.

- Impact on Alternative Credit Profile: Information from Clairity may affect your credit profile with this alternative credit bureau.

User Reviews And Experiences

Perpay users have shared various reviews and experiences. Some praise the service, while others point out areas of improvement. Here, we explore both positive and negative user feedback to give you a balanced view.

Positive User Testimonials

Many users appreciate Perpay’s fast shipping and exceptional customer service. These aspects make shopping through Perpay a pleasant experience.

- One user mentioned, “Perpay’s marketplace has a vast selection. I received my order quickly!”

- Another user said, “Customer service resolved my issue promptly. Very satisfied!”

Additionally, users often highlight the credit score improvements they achieve. On average, users see a 36-point increase within three months.

- “My credit score improved by 40 points in just two months,” shared a happy customer.

- “The automatic payments are convenient and help me stay on track,” noted another user.

Negative User Feedback

Despite many positive reviews, some users have shared their concerns. The most common issues involve payment processing and account management.

- One user reported, “I faced difficulties with payment processing. It took longer than expected.”

- Another user mentioned, “Managing my account was not as intuitive as I hoped.”

Some users also pointed out that the Perpay Credit Card is not available in all states. This limitation affects their overall experience.

- “I was disappointed to find out the credit card is not available in my state,” said a user from New Hampshire.

Overall User Satisfaction

Overall, Perpay users are quite satisfied with the service. The combination of a marketplace and credit-building opportunities makes it appealing.

| Aspect | User Rating |

|---|---|

| Fast Shipping | 4.5/5 |

| Customer Service | 4.7/5 |

| Credit Score Improvement | 4.6/5 |

| Payment Processing | 3.8/5 |

| Account Management | 3.9/5 |

While some areas need improvement, the majority of users find Perpay beneficial. The service’s unique features and benefits make it a popular choice for many.

Recommendations For Ideal Users

Perpay offers a unique financial service for those seeking to make everyday purchases more accessible and improve their credit score. With features such as the Perpay Marketplace and Perpay Credit Card, it caters to a variety of users. However, it is essential to understand who can benefit the most from Perpay and who might want to consider other options.

Best Scenarios For Using Perpay

- Those with limited credit history: Users looking to build their credit score can benefit from Perpay’s automatic payment deductions and credit reporting to major bureaus.

- Users aiming for convenience: Automatic payments from paychecks simplify the payment process, making it easier to manage finances.

- Shoppers of top brands: Access to a $1,000 credit limit on the Perpay Marketplace allows users to shop for electronics, home goods, apparel, and more.

- Individuals avoiding interest and fees: Perpay does not charge interest or fees, making it an attractive option for cost-conscious users.

- Reward seekers: The Perpay Credit Card offers 2% rewards on purchases, which can be used to shop more on the marketplace.

Who Should Avoid Perpay

- Residents of New Hampshire: The Perpay Credit Card is not available to New Hampshire residents.

- Individuals looking for immediate large credit amounts: The $1,000 credit limit may not be sufficient for those needing higher credit for larger purchases.

- Users preferring traditional credit cards: If you prefer a wider range of credit card options with various reward programs, Perpay may not be the best fit.

- People seeking comprehensive refund or return policies: Details on refund or return policies are not specified, which might be a concern for some users.

Frequently Asked Questions

What Is Perpay?

Perpay is a service that allows users to shop now and pay later. It helps users manage their finances by breaking down purchases into smaller, manageable payments.

How Does Perpay Work?

Perpay works by allowing users to shop from partnered retailers. Users make small, manageable payments over time, instead of paying the full amount upfront.

Is Perpay Safe To Use?

Yes, Perpay is safe to use. It uses secure payment methods and protects your personal information. It follows strict security protocols to ensure your data is safe.

What Are The Benefits Of Using Perpay?

Using Perpay offers benefits like manageable payments, no interest fees, and access to a wide range of products. It helps improve your financial flexibility.

Conclusion

Perpay offers a seamless way to shop and build credit. Its automatic payments and no interest make it user-friendly. The rewards program adds extra value. Many users see significant credit score improvements. Consider exploring Perpay’s features for better financial health. Check out more details here.