Payment Technology Trends: Shaping the Future of Transactions

In today’s fast-paced world, payment technology is constantly evolving. Businesses need to stay ahead of the curve to thrive.

This blog post explores the latest payment technology trends, ensuring you understand the advancements shaping the financial landscape. The payment industry has seen remarkable transformations over the past few years. From contactless payments to blockchain technology, the innovations are endless. These advancements not only enhance transaction speed but also improve security and customer satisfaction. As businesses adapt to these changes, they can streamline operations and boost revenue. Understanding these trends is crucial for anyone involved in finance or business management. Dive into our comprehensive guide to discover how modern payment solutions, like those from Nayax Ltd, can revolutionize your business. Learn how to integrate these technologies seamlessly and reap the benefits. For more information on advanced payment solutions, visit Nayax Ltd.

Introduction To Payment Technology Trends

Payment technology is changing rapidly. Businesses must keep up to stay competitive. New trends are shaping the future of transactions. These trends offer better efficiency, security, and customer satisfaction.

Understanding The Evolution Of Payment Technology

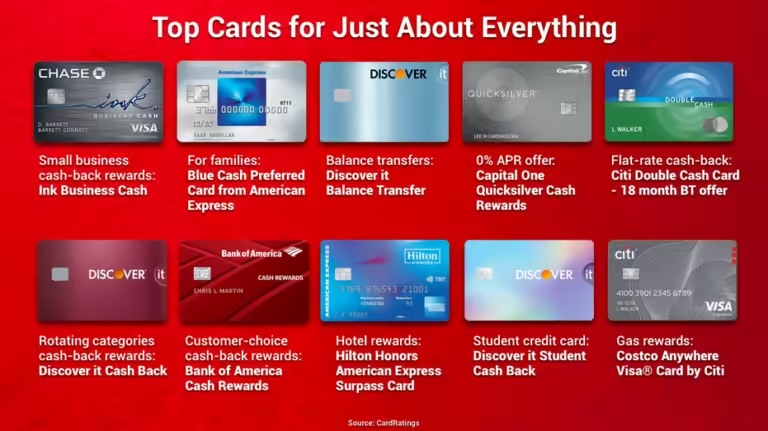

Payment technology has evolved significantly over the years. Initially, cash and checks were the primary methods. Then came credit and debit cards, which offered more convenience. Today, cashless payment solutions are leading the charge.

Companies like Nayax Payment Solutions are at the forefront of this evolution. They provide a range of customizable solutions for various industries. These include vending, office coffee services, car washes, OEM, laundry, transportation, and more. This flexibility helps businesses streamline operations and enhance customer experience.

The Importance Of Staying Updated With Payment Trends

Staying updated with payment trends is crucial. It helps businesses maximize revenue and reduce costs. For instance, Nayax’s NOVA Market Integration can increase sales by 65-70%. Additionally, their advanced analytics provide detailed sales and operational data. This allows for better decision-making.

Businesses that embrace new payment technologies see significant benefits. These include a 10x increase in sales and a 72% shift to cashless transactions. Furthermore, operational efficiency improves, and customer loyalty is enhanced. Nayax Payment Solutions offers a satisfaction guarantee and customized pricing based on specific needs. This ensures businesses get the best value for their investment.

| Feature | Benefit |

|---|---|

| Cashless Payment Solutions | Supports various cashless payment methods |

| Customizable Solutions | Tailored for different business types |

| NOVA Market Integration | Increases sales by 65-70% |

| Advanced Analytics | Provides detailed sales and operational data |

For more details, visit Nayax Ltd.

Key Features Shaping The Future Of Transactions

The future of payment technology is being shaped by innovative features. These features are making transactions faster, more secure, and user-friendly. Below, we explore the key trends that are transforming how we pay and receive money.

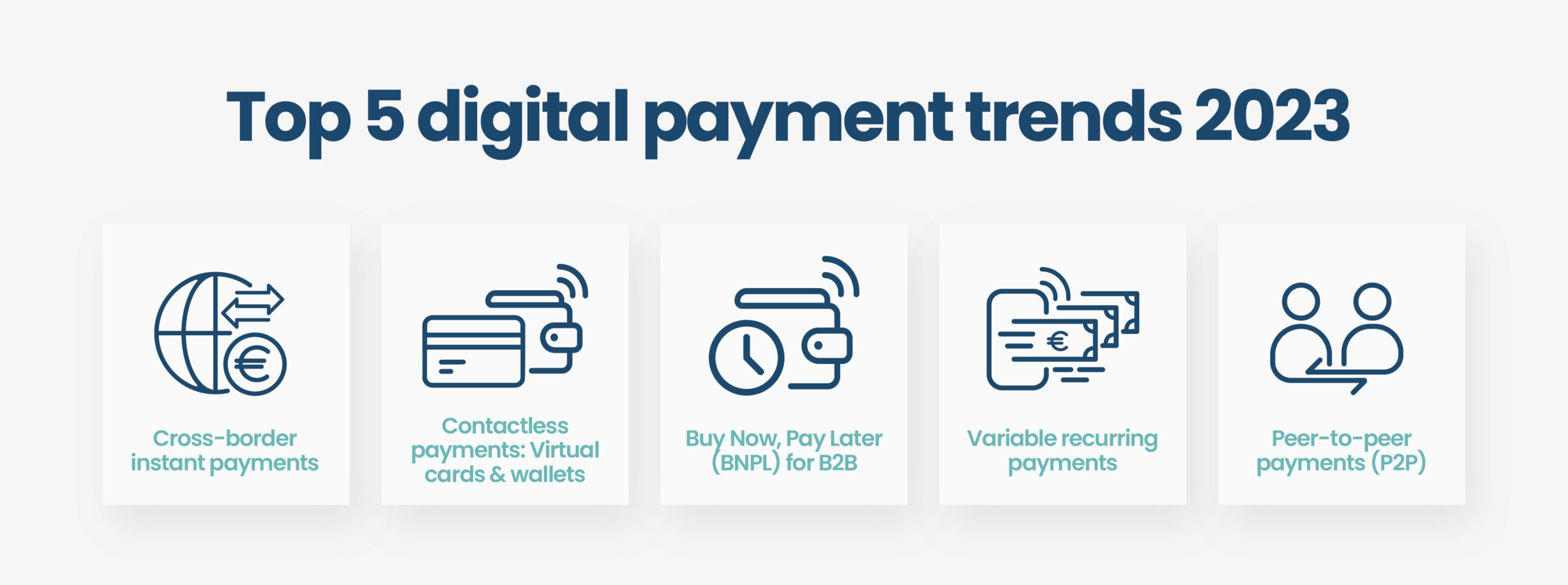

Contactless Payments: Convenience And Speed

Contactless payments are gaining popularity due to their convenience and speed. Users can simply tap their card or smartphone to complete a transaction. This method reduces the time spent at checkouts and enhances the shopping experience. Nayax Payment Solutions supports various cashless methods, ensuring quick and secure transactions.

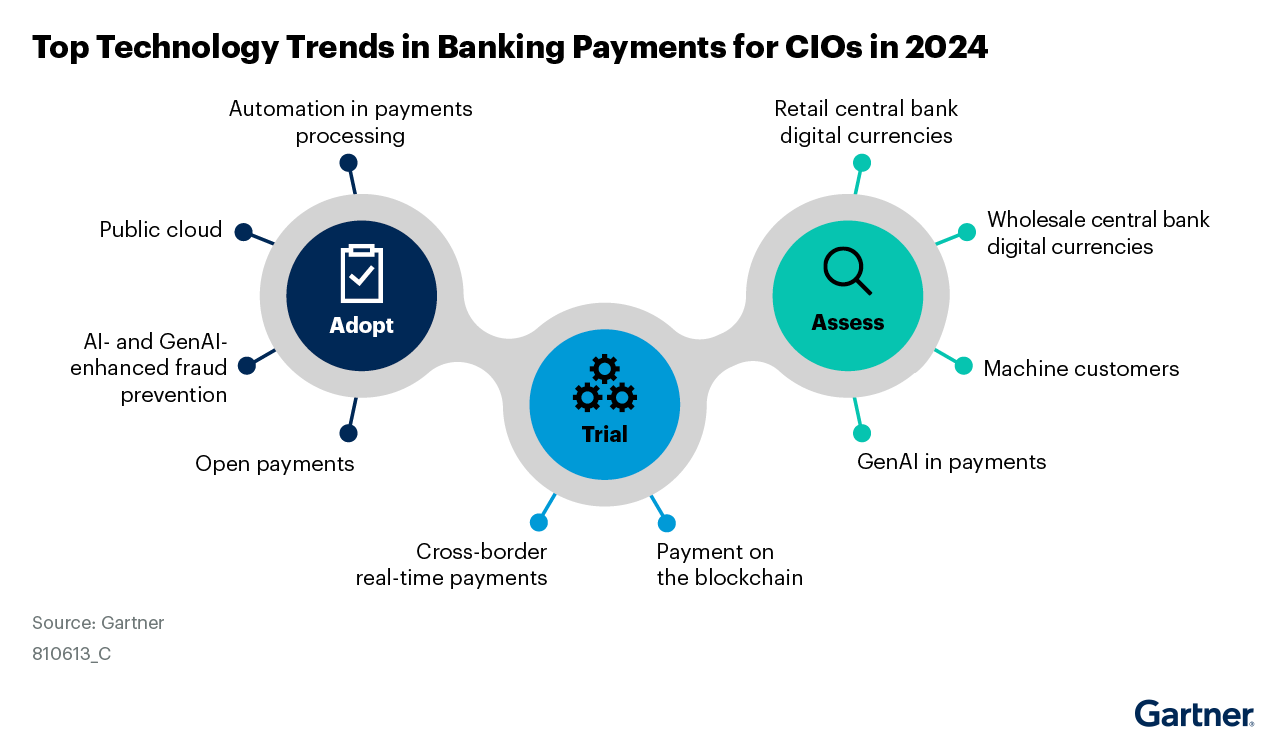

Cryptocurrency And Blockchain: Decentralizing Transactions

Cryptocurrency and blockchain are reshaping the financial landscape. These technologies offer a decentralized approach to transactions. This means no intermediary is required, reducing costs and increasing transparency. Blockchain ensures all transactions are secure and verifiable. Businesses using Nayax can benefit from integrating such modern payment methods.

Biometric Authentication: Enhancing Security

Biometric authentication is an advanced method for securing payments. It uses unique biological traits like fingerprints or facial recognition. This adds an extra layer of security, making it harder for unauthorized users to access accounts. Nayax’s solutions can be customized to include biometric authentication for enhanced security.

Mobile Wallets: Seamless Integration

Mobile wallets offer a seamless way to store and use various payment methods. They allow users to make transactions using their smartphones. This integration provides a hassle-free experience for users. Nayax supports mobile wallets, enabling businesses to cater to tech-savvy customers.

Ai And Machine Learning: Personalizing Payment Experiences

AI and machine learning are personalizing payment experiences. They analyze user behavior to offer tailored recommendations and services. This helps in enhancing customer satisfaction and loyalty. Nayax’s advanced analytics leverage AI to provide detailed sales and operational data, helping businesses make informed decisions.

| Main Feature | Benefit |

|---|---|

| Cashless Payment Solutions | Supports various cashless methods, ensuring quick transactions. |

| Customizable Solutions | Tailored for diverse business types, enhancing efficiency. |

| Advanced Analytics | Provides detailed data for informed decision-making. |

| NOVA Market Integration | Increases sales by 65-70%, boosting revenue. |

- Year on Year Growth: Achieves 50% growth annually.

- Sales Increase: 10x increase in sales, 72% cashless.

- Operational Efficiency: Streamlines transactions, reduces costs.

- Customer Loyalty: Enhances experience and loyalty.

For more information, visit Nayax Ltd and explore how their solutions can benefit your business.

Pricing And Affordability Of Emerging Payment Technologies

As the digital landscape evolves, businesses are investing in emerging payment technologies to enhance customer experience and streamline operations. Understanding the pricing and affordability of these technologies is crucial for businesses of all sizes. This section breaks down the costs involved, affordability for different business scales, and how to evaluate the return on investment (ROI).

Costs Involved In Implementing New Payment Systems

Implementing new payment systems can involve various costs. These include:

- Initial Setup Costs: This includes hardware, software, and installation fees.

- Subscription Fees: Ongoing costs for using the payment system, often on a monthly or annual basis.

- Transaction Fees: Charges per transaction processed through the system.

- Maintenance and Support: Costs for regular updates, troubleshooting, and customer support.

- Customization Costs: Additional fees for tailor-made solutions to meet specific business needs.

For example, Nayax Payment Solutions offers customizable solutions with tailored pricing based on specific business needs. Businesses can contact Nayax for a personalized quote.

Affordability For Small Businesses Vs. Large Enterprises

The affordability of emerging payment technologies varies between small businesses and large enterprises:

| Small Businesses | Large Enterprises |

|---|---|

| More sensitive to initial setup and ongoing subscription costs. | Can leverage economies of scale for better pricing. |

| Need cost-effective solutions with low transaction fees. | Can afford higher initial investments for long-term benefits. |

| Seek solutions that offer rapid ROI. | Benefit from advanced analytics and integration features. |

Nayax provides cashless payment solutions that cater to both small and large businesses, enhancing customer loyalty and operational efficiency.

Evaluating The Return On Investment (roi)

Evaluating ROI involves assessing the benefits gained from the payment system against the costs incurred. Key factors to consider include:

- Increased Sales: For instance, Nayax’s solutions can lead to a 10x increase in sales and 72% of sales being cashless.

- Operational Efficiency: Streamlining transactions and reducing operational costs.

- Customer Loyalty: Enhancing customer experience and retaining clients, leading to year-on-year growth of 50%.

- Advanced Analytics: Using detailed sales and operational data to make informed business decisions.

Businesses should weigh these benefits against the costs to determine the overall value of implementing new payment technologies.

For personalized pricing and tailored solutions, businesses can contact Nayax Ltd. Their comprehensive payment solutions are designed to simplify transactions, maximize customer loyalty, and drive more revenue while lowering operational costs.

Pros And Cons Of Modern Payment Technologies

Modern payment technologies have transformed the way we handle transactions. While these advancements offer numerous benefits, they also come with certain drawbacks. In this section, we will explore the advantages and disadvantages of these technologies.

Advantages: Speed, Security, And Efficiency

One of the primary advantages of modern payment technologies is speed. Transactions are processed almost instantly, reducing wait times for customers and businesses. This is particularly beneficial for high-traffic environments such as retail stores and online markets.

Security is another significant benefit. Advanced encryption and authentication methods help protect sensitive data, reducing the risk of fraud and unauthorized access. For instance, Nayax Payment Solutions use robust security protocols to safeguard transactions.

Efficiency is enhanced through streamlined processes and reduced manual intervention. This leads to lower operational costs and increased accuracy. Businesses can benefit from detailed analytics provided by solutions like Nayax, which offer insights into sales and operational data.

Disadvantages: Privacy Concerns And Accessibility Issues

Despite the benefits, modern payment technologies also present privacy concerns. The collection and storage of personal data can be a target for cyber-attacks. Users may feel uneasy about sharing their information, even with secure platforms.

Accessibility issues can also arise. Not all customers have access to the latest technology or are comfortable using it. This can exclude certain demographics from using modern payment methods. Additionally, some regions may lack the necessary infrastructure to support these technologies.

Real-world Usage Scenarios And Feedback

In real-world scenarios, businesses like vending machines, car washes, and food trucks have adopted modern payment solutions like Nayax. These solutions offer cashless payment options, enhancing customer convenience and boosting sales. According to Nayax, businesses see a 10x increase in sales with 72% of transactions being cashless.

Feedback from users highlights the ease of use and increased operational efficiency. Advanced analytics provided by Nayax help businesses track performance and make informed decisions. Customizable solutions cater to various business types, ensuring that specific needs are met.

Recommendations For Businesses And Consumers

In the rapidly evolving world of payment technologies, it is crucial for both businesses and consumers to stay updated and make informed decisions. Here are some tailored recommendations for adopting and integrating modern payment solutions effectively.

Ideal Scenarios For Adopting New Payment Technologies

Businesses should consider adopting new payment technologies when:

- Expanding to new markets: Ensuring payment methods cater to local preferences can boost sales.

- Handling high transaction volumes: Advanced systems like Nayax Payment Solutions can streamline processes and reduce errors.

- Enhancing customer experience: Offering cashless payment options can increase customer satisfaction and loyalty.

Consumers should consider new payment methods when:

- Looking for convenience: Mobile payments and contactless options provide speed and ease.

- Seeking security: Modern solutions often include robust security measures to protect financial data.

- Wanting rewards: Some payment methods offer loyalty programs and rewards.

Tips For Businesses To Integrate Modern Payment Solutions

To integrate modern payment solutions like Nayax Payment Solutions, businesses should:

- Assess Needs: Evaluate business-specific needs and select suitable payment technologies.

- Consult Experts: Seek guidance from payment solution providers to customize integration.

- Train Staff: Ensure staff are well-trained to handle new payment methods efficiently.

- Monitor Performance: Use advanced analytics to track sales and operational data.

Adopting a comprehensive solution like Nayax can lead to a 10x increase in sales and streamline operations, making it a wise choice for various business types.

Guidance For Consumers On Using Emerging Payment Methods Safely

Consumers can use emerging payment methods safely by following these tips:

- Verify Authenticity: Only use trusted payment apps and platforms.

- Enable Security Features: Utilize features like two-factor authentication and biometric security.

- Monitor Transactions: Regularly check bank statements for any unauthorized transactions.

- Educate Yourself: Stay informed about the latest security practices and potential threats.

By adopting these practices, consumers can enjoy the convenience of modern payment methods while minimizing risks.

Frequently Asked Questions

What Are The Latest Payment Technology Trends?

The latest trends include contactless payments, mobile wallets, and cryptocurrency. These technologies enhance convenience and security for users. Businesses are rapidly adopting them.

How Do Contactless Payments Work?

Contactless payments use NFC technology to transmit data between a card or mobile device and a payment terminal. They are fast and secure.

Why Are Mobile Wallets Becoming Popular?

Mobile wallets offer convenience and security. They store card information digitally and facilitate quick payments. Users appreciate their ease of use.

What Is The Role Of Blockchain In Payments?

Blockchain provides a secure and transparent way to conduct transactions. It reduces fraud and enhances trust in digital payments.

Conclusion

Payment technology trends continue to evolve rapidly. Businesses must adapt to stay competitive. Exploring comprehensive solutions like Nayax Payment Solutions can help. With features like cashless payments, advanced analytics, and customizable options, Nayax supports various business types. This can increase sales and enhance customer loyalty. Learn more about how Nayax can streamline your transactions and grow your business by visiting Nayax Ltd. Stay ahead by embracing these innovative payment technologies.