Payment Processing For Businesses: Streamline Your Transactions Today

In today’s fast-paced business world, efficient payment processing is crucial. It ensures smooth transactions and boosts customer satisfaction.

Payment processing for businesses involves handling electronic transactions for goods and services. It’s more than just swiping a card; it’s about security, speed, and reliability. Companies like Nayax offer comprehensive solutions that simplify this process. With features like integrated points of sale and AI-based data analytics, Nayax helps businesses improve efficiency and drive revenue. Available in over 50 countries, Nayax supports various business types, from vending machines to food trucks. Discover how Nayax can streamline your payment processing and enhance your business operations. Learn more about their services here.

Introduction To Payment Processing For Businesses

Payment processing plays a vital role in the success of any business. It ensures that transactions are secure, efficient, and seamless. A reliable payment processing system can enhance customer satisfaction and streamline business operations.

Understanding The Basics Of Payment Processing

Payment processing involves handling transactions between a customer and a business. It includes authorizing credit card payments, ensuring the transfer of funds, and managing the settlement process. A comprehensive payment solution like Nayax simplifies these tasks, making it easier for businesses to handle payments.

Nayax offers an end-to-end solution with features such as:

- Open Operating Systems: Ensures compatibility with various devices.

- API-First Approach: Allows seamless integration with other systems.

- AI-Based Data Analytics: Provides valuable insights to improve business operations.

- Integrated Points of Sale: Enhances the overall customer experience.

- Smart Management System: Helps streamline management tasks.

Importance Of Streamlined Transactions

Streamlined transactions are crucial for any business. They reduce wait times, minimize errors, and enhance customer satisfaction. With Nayax, businesses can achieve:

- Simplified Payments: Easy and secure payment processing.

- Increased Efficiency: Smart management system to lower operational costs.

- Higher Revenue: Marketing and loyalty solutions to retain customers.

Streamlined transactions also help in maintaining a positive brand image. Nayax supports various business types such as vending, car wash, laundry, and more, ensuring that every sector can benefit from efficient payment processing.

| Main Features | Benefits |

|---|---|

| Comprehensive End-to-End Solution | Simplifies Payments and Transactions |

| Open Operating Systems | Maximizes Compatibility |

| AI-Based Data Analytics | Improves Revenue Potential |

| Integrated Points of Sale | Enhances Customer Experience |

| Smart Management System | Increases Efficiency |

With a global presence in over 50 countries, Nayax is trusted by businesses worldwide to manage over 1 million devices. This ensures that your business can scale effectively and serve repeat customers.

Book a free consultation via the Nayax website to learn more about how their payment processing solutions can benefit your business.

Key Features Of Effective Payment Processing Systems

Effective payment processing systems are crucial for businesses aiming to streamline operations and enhance customer experience. These systems offer various features to ensure smooth, secure, and efficient transactions. Below, we explore some of the key features that make payment processing systems like Nayax stand out.

Multiple Payment Methods

Offering multiple payment methods is essential. It allows customers to pay using their preferred method. Nayax supports a wide range of payment options, including:

- Credit Cards

- Debit Cards

- Mobile Payments

- Contactless Payments

This flexibility can lead to higher customer satisfaction and increased sales.

Security And Fraud Prevention

Security is a top priority for businesses. Nayax incorporates advanced security and fraud prevention measures to protect transactions. Key security features include:

- End-to-End Encryption

- AI-Based Fraud Detection

- Compliance with PCI DSS

These measures help to safeguard sensitive data and build trust with customers.

Integration With Existing Systems

Seamless integration with existing systems is crucial for operational efficiency. Nayax offers an API-First Approach to ensure easy integration with:

- Point of Sale (POS) Systems

- Inventory Management Systems

- Customer Relationship Management (CRM) Software

This integration helps streamline processes and reduces manual entry errors.

Real-time Transaction Tracking

Real-time transaction tracking is vital for businesses to monitor their operations. Nayax provides real-time transaction tracking through:

- Live Dashboards

- Instant Notifications

- Detailed Reporting

These tools allow businesses to respond quickly to any issues and make informed decisions.

User-friendly Interface

A user-friendly interface is essential for both customers and staff. Nayax’s interface is designed to be intuitive and easy to navigate. Key features include:

- Simple and Clean Design

- Easy Setup and Configuration

- Accessible Customer Support

This ensures a smooth experience for users, reducing the learning curve and enhancing efficiency.

How Payment Processing Systems Benefit Businesses

Payment processing systems have become an essential part of modern business operations. They streamline transactions, enhance financial management, and improve overall business performance. With platforms like Nayax, businesses can achieve greater efficiency and customer satisfaction. Let’s explore the specific benefits of these systems.

Increased Sales And Customer Satisfaction

A reliable payment processing system like Nayax can boost sales. Customers appreciate the convenience of multiple payment options. This flexibility encourages more purchases. Moreover, a smooth transaction process enhances customer satisfaction. Happy customers are likely to return, driving more revenue.

Reduced Transaction Errors

Manual transactions often lead to errors. These errors can be costly. Payment processing systems minimize these risks. Nayax’s AI-Based Data Analytics further reduces human error. Automated systems ensure accuracy, saving time and money.

Enhanced Financial Management

Effective financial management is crucial for business growth. Nayax offers integrated points of sale and smart management systems. These features provide real-time financial data. Businesses can make informed decisions and manage cash flow better.

Improved Cash Flow

Cash flow is the lifeblood of any business. Payment processing systems ensure faster transactions. Quick payments mean improved cash flow. With Nayax, businesses can maintain a steady cash flow, supporting day-to-day operations and growth plans.

Below is a summary of Nayax’s key features and benefits:

| Feature | Benefit |

|---|---|

| Comprehensive End-to-End Solution | Simplify Payments and Transactions |

| Open Operating Systems | Maximize Customer Loyalty |

| API-First Approach | Drive More Revenue |

| AI-Based Data Analytics | Lower Operational Costs |

| Integrated Points of Sale | Increase Efficiency |

| Smart Management System | Scale Business |

For more information, visit the Nayax website.

Pricing And Affordability Of Payment Processing Solutions

Choosing the right payment processing solution can significantly impact your business’s bottom line. Understanding the pricing and affordability of these solutions is crucial for making informed decisions. Nayax Ltd offers various models to fit different business needs.

Understanding Different Pricing Models

Payment processing solutions typically follow three main pricing models:

- Flat-rate pricing: A fixed percentage per transaction.

- Interchange-plus pricing: The cost includes the interchange fee plus a markup.

- Tiered pricing: Transactions are categorized into different tiers with varying rates.

Nayax’s pricing may involve a combination of these models, tailored to your business type and volume.

Cost-benefit Analysis

Analyzing costs versus benefits is essential in selecting a payment processor. Consider the following:

| Cost Factors | Potential Benefits |

|---|---|

| Transaction Fees | Enhanced Revenue Potential |

| Monthly Fees | Improved Operational Efficiency |

| Setup Costs | Smart Management System |

Nayax’s comprehensive end-to-end solution and AI-based data analytics can drive more revenue and lower operational costs, making it a valuable investment.

Hidden Fees And Charges

Watch out for hidden fees that might not be immediately apparent. These can include:

- Chargeback fees: Costs incurred when a customer disputes a charge.

- PCI compliance fees: Fees for meeting security standards.

- Early termination fees: Charges for ending the contract early.

Nayax offers a free consultation, which can help clarify any potential hidden costs, ensuring transparency and affordability.

Pros And Cons Of Popular Payment Processing Systems

Understanding the pros and cons of payment processing systems is crucial for businesses. Choosing the right system can enhance revenue, improve efficiency, and ensure customer satisfaction. Let’s explore the strengths and weaknesses of some popular payment processing systems through real-life case studies.

Case Study: System A

System A offers a wide range of features that appeal to many businesses.

| Pros | Cons |

|---|---|

|

|

For example, a local coffee shop using System A experienced seamless transactions but faced challenges during international orders.

Case Study: System B

System B is known for its robust security features and user-friendly interface.

| Pros | Cons |

|---|---|

|

|

For instance, a small retail store benefited from the security features but found the setup process lengthy.

Case Study: System C

System C is designed to help merchants scale their business by improving revenue potential and operational efficiency.

| Pros | Cons |

|---|---|

|

|

For example, a food truck business using System C saw an increase in efficiency and customer loyalty but found the initial consultation process time-consuming.

Choosing The Right Payment Processing System For Your Business

Selecting the right payment processing system is crucial for your business. It can impact your revenue, customer satisfaction, and operational efficiency. With numerous options available, making an informed choice is essential. Below are key considerations to help you make the best decision for your business.

Assessing Your Business Needs

Begin by assessing your specific business needs. Different businesses have different requirements. Consider the following:

- Business Type: Vending, Car Wash, Food Truck, etc.

- Transaction Volume: High or low transaction frequency.

- Customer Base: Local or global customers.

- Payment Methods: Credit cards, mobile payments, etc.

Understanding these aspects helps narrow down suitable payment processing systems. For example, Nayax supports various business types including vending, car wash, and food trucks.

Evaluating System Features

Next, evaluate the features of different payment processing systems. Key features to consider include:

| Feature | Description |

|---|---|

| Comprehensive End-to-End Solution | A complete system from transaction initiation to completion. |

| Open Operating Systems | Compatibility with various platforms and devices. |

| API-First Approach | Ease of integration with other systems. |

| AI-Based Data Analytics | Insights and analytics to improve decision-making. |

| Integrated Points of Sale | Seamless integration with POS systems. |

| Smart Management System | Tools to enhance operational efficiency. |

| Marketing & Loyalty Solutions | Features to boost customer loyalty and marketing efforts. |

For example, Nayax offers a comprehensive end-to-end solution, open operating systems, and AI-based data analytics.

Considerations For Future Growth

Lastly, consider the future growth of your business. Your payment processing system should scale with your business. Key factors include:

- Scalability: Can the system handle increased transaction volumes?

- Global Reach: Does the system support international transactions?

- Customer Loyalty: Can it help in building repeat consumers?

For instance, Nayax is available in over 50 countries and supports over 1 million managed devices, making it suitable for businesses planning to expand globally.

Choosing the right payment processing system involves assessing your needs, evaluating features, and considering future growth. With systems like Nayax, businesses can simplify payments, maximize customer loyalty, and drive more revenue.

Conclusion: Streamline Your Transactions Today

Streamlining payment processing is essential for business growth. Nayax Ltd offers a comprehensive solution designed to enhance efficiency and revenue. This section recaps key points and provides final recommendations.

Summary Of Key Points

- Comprehensive End-to-End Solution: Nayax simplifies payments and transactions.

- Open Operating Systems: Flexible and integrative systems.

- API-First Approach: Seamless integration with existing systems.

- AI-Based Data Analytics: Optimize operations with smart data insights.

- Integrated Points of Sale: Centralized sales management.

- Smart Management System: Increase efficiency in operations.

- Marketing & Loyalty Solutions: Boost customer loyalty and drive revenue.

- Global Presence: Operates in over 50 countries with 1 million managed devices.

Final Recommendations

To maximize the benefits of Nayax Ltd, follow these steps:

- Evaluate Your Needs: Identify the specific needs of your business.

- Book a Consultation: Schedule a free consultation through their website.

- Integrate the System: Use Nayax’s API-first approach for seamless integration.

- Utilize Data Analytics: Leverage AI-based analytics to optimize operations.

- Enhance Customer Loyalty: Implement marketing and loyalty solutions to retain customers.

By implementing these steps, businesses can simplify transactions, increase efficiency, and drive more revenue. Nayax Ltd offers a robust solution to achieve these goals. Visit their website for more information.

Frequently Asked Questions

What Is Payment Processing?

Payment processing is the procedure of handling transactions between customers and businesses. It ensures secure and quick payments.

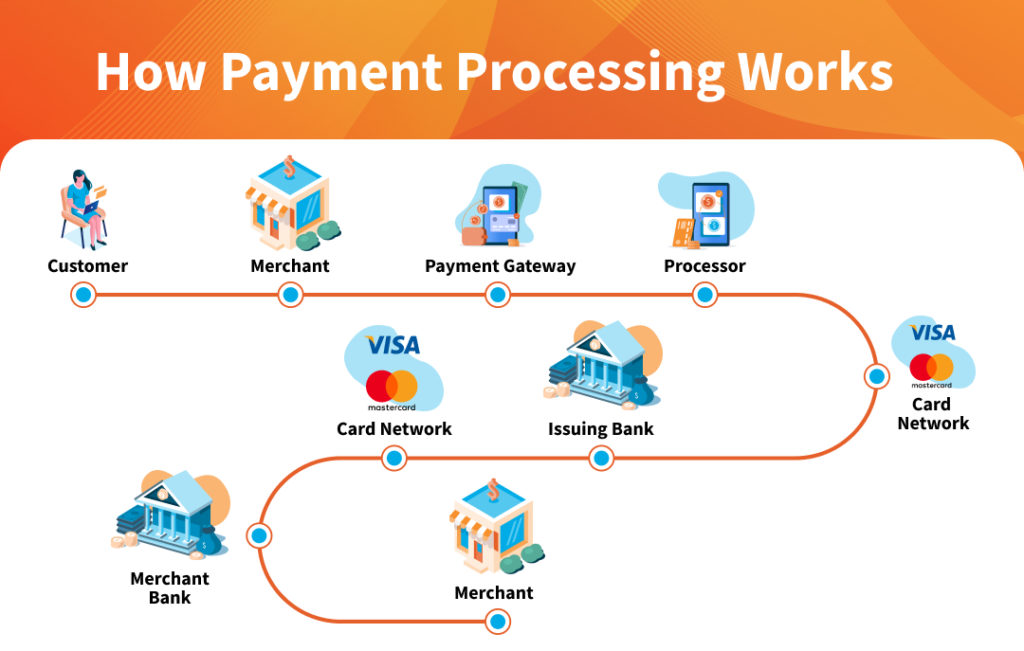

How Does Payment Processing Work?

Payment processing works by transmitting transaction details between the customer’s bank and the business’s bank. This ensures secure payment.

Why Is Payment Processing Important For Businesses?

Payment processing is crucial for businesses as it ensures secure, quick, and efficient transactions, enhancing customer satisfaction.

What Are The Types Of Payment Processing?

There are various types of payment processing, including credit card processing, online payments, and mobile payments.

Conclusion

Nayax offers a reliable solution for payment processing. Businesses can streamline transactions, improve revenue, and enhance operational efficiency. The comprehensive features cater to various industries, ensuring smooth operations and increased customer loyalty. To learn more about Nayax and how it can benefit your business, visit the Nayax website. Simplify your payment processes today and drive growth with a trusted global partner.