Online Payment Processing: Streamline Your Business Transactions

Understanding online payment processing is essential for businesses today. It’s the backbone of modern commerce, enabling seamless transactions.

In the digital age, businesses need efficient and secure payment solutions. Online payment processing systems streamline financial transactions, ensuring quick and hassle-free payments. These systems handle credit card payments, bank transfers, and other electronic payments. They also offer security measures to protect sensitive information. As a business, choosing the right payment processing platform can save time and reduce errors. One such platform is the BILL Financial Operations Platform. BILL simplifies accounts payable, accounts receivable, and expense management. It integrates with popular accounting software, providing a comprehensive solution. Explore how BILL can enhance your financial operations and boost efficiency.

Introduction To Online Payment Processing

In today’s digital world, online payment processing has become an essential aspect of running a business. It simplifies transactions and enhances customer satisfaction. Businesses can automate billing, manage expenses, and streamline operations through platforms like BILL. Understanding the fundamentals of online payment processing is crucial for maintaining efficiency and control over financial operations.

What Is Online Payment Processing?

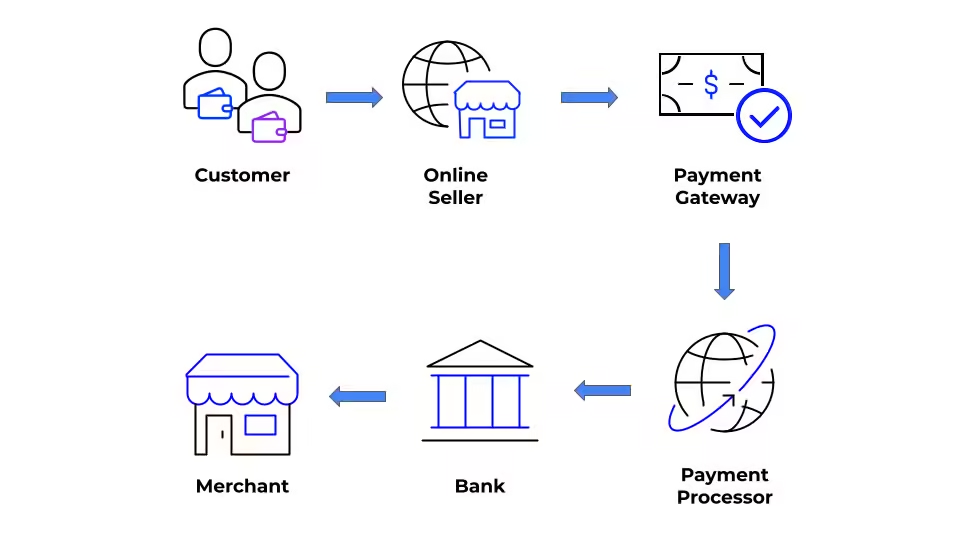

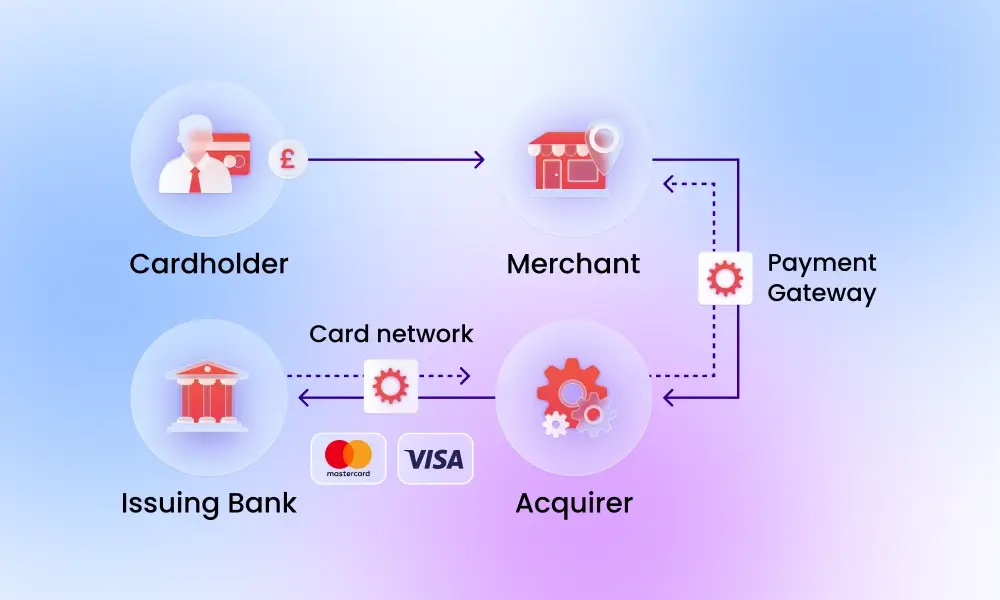

Online payment processing refers to the system that handles electronic payments for online transactions. It involves the transfer of funds from a customer’s bank account or credit card to a merchant’s account. The process includes:

- Payment Gateway: Securely authorizes and processes payment information.

- Merchant Account: Holds funds until they are transferred to the business bank account.

- Payment Processor: Facilitates the transaction between the customer, merchant, and bank.

Businesses use platforms like BILL to automate these processes, ensuring a seamless transaction experience for both the customer and the business.

Importance Of Streamlining Business Transactions

Streamlining business transactions is vital for operational efficiency and customer satisfaction. Here are some key benefits:

| Benefit | Description |

|---|---|

| Efficiency | Reduces manual entry and speeds up reconciliation. BILL users save 12 hours per month on average. |

| Control | Provides enhanced control over budgets and expenses with real-time insights. |

| Cost Savings | Users report average monthly savings of over $10,000. |

Platforms like BILL integrate with popular accounting software to provide a unified solution for managing accounts payable (AP), accounts receivable (AR), spend, and expenses. This integration helps businesses maintain a single login for all their financial operations, ensuring streamlined and efficient workflows.

With features such as credit lines ranging from $1,000 to $5 million, automated synchronization, and comprehensive expense management, BILL offers a robust solution for businesses of all sizes. The platform’s efficiency gains are evident, with customer testimonials highlighting significant time savings and increased office efficiency.

For more details and to get started, visit the BILL website or contact their sales team.

Key Features Of Online Payment Processing Tools

Online payment processing tools have become essential for businesses. They offer a range of features that enhance convenience, security, and efficiency. Understanding these key features helps businesses choose the right tool for their needs.

Secure Transactions

Security is crucial for online payment processing. BILL Financial Operations Platform ensures secure transactions with advanced encryption and fraud detection mechanisms. This protects sensitive financial data from unauthorized access.

Multiple Payment Options

Offering multiple payment options increases customer satisfaction. BILL supports various payment methods, including credit cards, ACH transfers, and digital wallets. This flexibility makes it easier for customers to complete their transactions.

User-friendly Interface

An intuitive interface is vital for user experience. BILL provides a user-friendly dashboard that simplifies managing accounts payable, accounts receivable, and expenses. Users can navigate the platform easily, even with limited technical knowledge.

Real-time Payment Tracking

Real-time payment tracking allows businesses to monitor transactions as they happen. BILL offers real-time insights into cash flow and payment statuses. This feature helps businesses stay updated and make informed financial decisions.

Integration With Accounting Software

Seamless integration with accounting software is a significant advantage. BILL integrates with popular systems like QuickBooks, Sage Intacct, Oracle Netsuite, and Microsoft Dynamics. This ensures accurate financial data synchronization and streamlined workflows.

How Online Payment Processing Benefits Businesses

Online payment processing has become crucial for modern businesses. It offers several advantages that help companies improve their efficiency and customer satisfaction. Let’s explore how online payment processing benefits businesses through enhanced security, increased convenience for customers, improved cash flow management, and reduction in transaction errors.

Enhanced Security

Online payment processing provides enhanced security for transactions. Platforms like BILL integrate with leading accounting software, ensuring secure and automated handling of accounts payable and receivable. This reduces the risk of fraud and unauthorized access.

| Security Features | Benefits |

|---|---|

| Encryption | Protects sensitive data from unauthorized access. |

| Authentication | Ensures that only authorized users can access the system. |

| Compliance | Adheres to industry standards and regulations. |

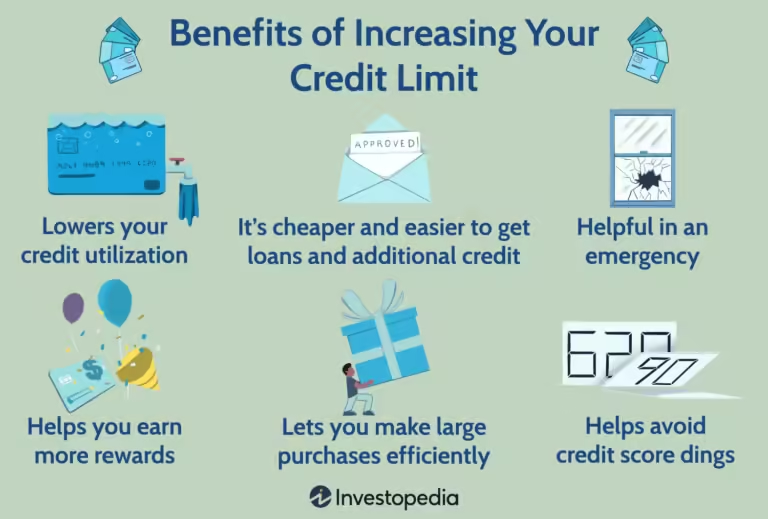

Increased Convenience For Customers

Online payment processing increases convenience for customers. They can make payments anytime and from anywhere. Platforms like BILL offer integrated solutions for easy synchronization with accounting software, enhancing user experience.

- 24/7 payment availability.

- Multiple payment options.

- Easy access to payment history and receipts.

Improved Cash Flow Management

Businesses benefit from improved cash flow management through online payment processing. BILL provides real-time insights and aggregated cash flow task lists, helping businesses manage their finances better.

- Real-time updates on account status.

- Automated billing and invoicing.

- Enhanced visibility into financial operations.

Reduction In Transaction Errors

Online payment processing significantly reduces transaction errors. Platforms like BILL automate the management of accounts payable and receivable, minimizing manual entry and human error.

Advantages include:

- Accurate data entry.

- Fewer discrepancies.

- Quick reconciliation of transactions.

By leveraging online payment processing, businesses can streamline their operations, enhance security, and provide better service to their customers.

Pricing And Affordability Of Online Payment Processing Solutions

The cost of online payment processing solutions can vary widely. Understanding the pricing models and potential hidden fees is crucial for any business. Below, we explore the different pricing structures and what you need to consider when choosing a solution.

Subscription-based Models

Many online payment processing platforms use subscription-based models. These typically charge a fixed monthly fee. For instance, the BILL Financial Operations Platform offers subscription plans with pricing details available upon request or through a demo session. This model is suitable for businesses with consistent transaction volumes.

Subscription plans usually include:

- Access to core features

- Integration with accounting software

- Support services

This model can simplify budgeting as you pay a predictable monthly fee. However, it is important to ensure the subscription covers all necessary features for your business operations.

Transaction Fees

Transaction fees are a common pricing component. These fees are typically a percentage of each transaction or a flat fee per transaction. With BILL, users report significant cost savings, averaging over $10,000 monthly, which may offset transaction fees.

Common types of transaction fees include:

- Percentage-based fees (e.g., 2.9% per transaction)

- Flat fees (e.g., $0.30 per transaction)

Understanding these fees helps in estimating the total cost based on your transaction volume. It’s essential to compare these costs across different providers to find the most cost-effective solution.

Additional Costs And Hidden Fees

Some payment processing solutions may include additional costs or hidden fees. These can significantly impact your overall expenses. BILL provides a comprehensive platform with features that may include extra charges, such as credit line costs ranging from $1,000 to $5 million.

Potential additional costs include:

- Setup fees

- Monthly minimum fees

- Chargeback fees

- International transaction fees

Always review the terms of service and ask for a detailed breakdown of all potential costs. This ensures transparency and helps you avoid unexpected charges.

In summary, understanding the pricing and affordability of online payment processing solutions involves looking at subscription models, transaction fees, and any additional costs. By doing so, you can select a solution that fits your budget and meets your business needs.

Pros And Cons Of Using Online Payment Processing Systems

Online payment processing systems offer a way for businesses to handle transactions efficiently. They provide a range of benefits but also come with certain limitations. This section explores the advantages and drawbacks of using these systems.

Advantages Of Online Payment Processing

Online payment processing systems provide several advantages for businesses of all sizes. Here are some key benefits:

- Convenience: Customers can pay anytime, anywhere, enhancing the shopping experience.

- Speed: Transactions are processed quickly, reducing waiting times and improving cash flow.

- Security: Advanced encryption technologies protect sensitive information, reducing the risk of fraud.

- Automation: Integrating with accounting software, these systems automate tasks like invoicing and reconciliation.

- Global Reach: Businesses can accept payments from customers worldwide, expanding their market.

For example, the BILL Financial Operations Platform streamlines and automates the management of accounts payable (AP), accounts receivable (AR), spend, and expenses. It integrates with leading accounting software to provide a unified solution for businesses.

Potential Drawbacks And Limitations

While online payment processing systems offer many benefits, there are some potential drawbacks:

- Fees: Transaction fees and monthly charges can add up, impacting profit margins.

- Technical Issues: Downtime or technical glitches can disrupt the payment process, causing inconvenience to customers.

- Security Risks: Despite advanced security measures, the risk of cyberattacks and data breaches remains.

- Complexity: Some systems may require a learning curve or technical expertise to set up and manage.

- Regulatory Compliance: Businesses must ensure compliance with various regulations, which can be challenging.

For instance, while using BILL, businesses might face complexity in integrating with various platforms like QuickBooks, Sage Intacct, or Microsoft Dynamics. Despite its efficiency and control benefits, understanding and managing these integrations could be a hurdle.

Online payment processing systems are essential for modern businesses but it’s important to weigh both the pros and cons. Consider your specific needs and the potential challenges to make an informed decision.

Ideal Users And Scenarios For Online Payment Processing

Online payment processing is crucial for modern businesses. It provides a secure and efficient way to handle transactions. The following sections explore ideal users and scenarios where online payment processing can be most beneficial.

Small Businesses And Startups

Small businesses and startups often operate with limited resources. Online payment processing helps them streamline their financial operations. Platforms like BILL offer tools to manage accounts payable and receivable efficiently. Here are some key benefits:

- Automation: Reduces manual entry and speeds up reconciliation.

- Cost Savings: Average monthly savings of over $10,000.

- Time Savings: Users report saving an average of 12 hours per month.

E-commerce Platforms

For e-commerce platforms, seamless payment processing is vital. It enhances the customer experience and ensures secure transactions. BILL Financial Operations Platform integrates with leading accounting software, providing a unified solution. Some advantages include:

- Integration: Connects with QuickBooks, Sage Intacct, and others.

- Control: Provides enhanced control over budgets and expenses.

- Visibility: Offers real-time insights and aggregated cash flow task lists.

Service-based Businesses

Service-based businesses need reliable payment processing to manage client payments and expenses. BILL offers features that cater to these needs:

- Spend & Expense Management: Offers credit lines from $1,000 to $5 million.

- Accountant Partner Program: Helps accounting firms automate bookkeeping and enable client bill pay.

- Efficiency: Increases operational efficiency by reducing manual processes.

In summary, online payment processing is essential for various business models. Platforms like BILL provide the necessary tools to streamline financial operations and enhance efficiency.

Conclusion: Streamlining Your Business Transactions With Online Payment Processing

Online payment processing has transformed how businesses handle transactions. It offers seamless, efficient, and secure methods to manage accounts payable (AP), accounts receivable (AR), and expenses. One such comprehensive platform is the BILL Financial Operations Platform. Designed to integrate with leading accounting software, it provides a unified solution for businesses aiming to streamline their financial operations.

Summary Of Key Points

To recap, the BILL Financial Operations Platform offers several key features:

- Accounts Payable Automation: Simplifies bill creation, approvals, and payments.

- Spend & Expense Management: Provides credit lines up to $5 million with budget tracking.

- Integrated Platform: Combines AP, AR, spend, and expense management with a single login.

- Accountant Partner Program: Helps firms automate bookkeeping and expand services.

- Integrations: Connects with QuickBooks, Sage Intacct, Oracle Netsuite, and others.

Businesses using BILL report significant benefits:

- Efficiency: Reduces manual entry and speeds up reconciliation.

- Control: Enhances control over budgets and expenses.

- Visibility: Provides real-time insights and aggregated cash flow task lists.

- Time Savings: Users save an average of 12 hours per month.

- Cost Savings: Users save over $10,000 monthly.

Final Recommendations For Businesses

For businesses seeking to improve their financial operations, adopting an online payment processing platform like BILL is crucial. Here are some recommendations:

- Evaluate Your Needs: Assess your business’s AP, AR, and expense management needs.

- Consider Integration: Ensure the platform integrates with your existing accounting software.

- Explore Features: Look for features that offer automation and real-time insights.

- Read Testimonials: Learn from other businesses’ experiences with the platform.

- Get a Demo: Request a demo to see how the platform can benefit your business.

By implementing a robust online payment processing system, businesses can achieve greater efficiency, control, and visibility in their financial operations. Visit the BILL website to get started.

Frequently Asked Questions

What Is Online Payment Processing?

Online payment processing is the method of handling electronic payments for online transactions. It involves transferring money between a buyer and seller securely. This process ensures the safe exchange of funds via credit cards, debit cards, or digital wallets.

How Does Online Payment Processing Work?

Online payment processing works by transmitting transaction details between the customer’s bank and the merchant. It involves authorization, authentication, and settlement. This ensures secure and quick payments.

What Are The Benefits Of Online Payment Processing?

The benefits of online payment processing include faster transactions, increased convenience, and enhanced security. It also supports multiple payment methods, improving customer satisfaction.

Is Online Payment Processing Secure?

Yes, online payment processing is secure. It uses encryption and tokenization to protect sensitive information. Compliance with standards like PCI DSS ensures further safety.

Conclusion

Online payment processing is vital for modern business success. It simplifies transactions and boosts efficiency. Businesses can streamline their financial operations with tools like Bill. It offers accounts payable automation, spend management, and real-time insights. Save time and cut costs with this comprehensive platform. For more details, visit Bill. Embrace this solution to enhance your financial workflow.