Online Credit Services: Unlocking Financial Freedom Today

Looking for online credit services? You’re in the right place.

Personal Loans® offers a seamless way to connect with a network of lenders for personal loans. In today’s fast-paced world, having quick access to funds is crucial. Whether it’s for an emergency, home improvement, or a new business venture, Personal Loans® can help. With loan amounts ranging from $250 to $35,000, this service is free and easy to use. You can get offers from multiple lenders, compare terms, and choose the best option for your needs. The platform ensures security with advanced data encryption and offers flexible loan terms from 3 to 72 months. Learn how Personal Loans® can simplify your financial needs by clicking the link below: Explore Personal Loans®.

Introduction To Online Credit Services

In today’s digital age, obtaining credit has become more accessible and convenient through online platforms. Online credit services have revolutionized how individuals secure loans, offering a seamless experience from the comfort of their homes. One such platform is Personal Loans®, which connects borrowers with a network of lenders for personal loans.

Understanding Online Credit Services

Online credit services operate through websites or apps, where users can apply for loans without visiting physical banks. These services offer a range of loan amounts and terms to meet various financial needs. For instance, Personal Loans® provides access to loans ranging from $250 to $35,000.

Users fill out an online form, which is then matched with potential lenders based on the information provided. The process is designed to be quick and efficient, often resulting in funds being disbursed as soon as the next business day.

The Purpose And Benefits Of Using Online Credit Services

The primary purpose of online credit services is to provide a convenient and swift solution for obtaining loans. Here are some of the key benefits:

- Free Service: Platforms like Personal Loans® offer their services at no cost to the user. There are no hidden fees or upfront costs.

- Quick Connection: The online form is easy to fill out and quickly connects users with lenders.

- Flexible Options: Borrowers can review multiple loan offers and choose the one that best suits their needs.

- Variety of Lenders: Access to a wide network of lenders ensures competitive rates and higher chances of approval.

- Security: Advanced data encryption technology is used to protect user information.

The flexibility and convenience of online credit services make them an attractive option for anyone needing quick access to funds. Whether for emergencies, home improvements, or other personal needs, these services simplify the borrowing process.

Key Features Of Online Credit Services

Online credit services provide a seamless and efficient way to access funds. They offer numerous features that make the borrowing process simpler and faster. Here are some key features of online credit services:

Convenient Access And Application Process

One of the main advantages of online credit services is the ease of access. Platforms like Personal Loans® allow you to apply for loans from the comfort of your home. The application process is straightforward, requiring only basic information. You can complete the entire process online without visiting a physical location.

Quick Approval And Funding

Online credit services offer quick approval and fast funding. Once you submit your application, you can receive a decision within minutes. For approved loans, funds can be deposited as soon as the next business day. This speed is ideal for emergencies and urgent financial needs.

Variety Of Credit Options

These services connect you with a network of lenders, providing a wide range of credit options. For example, Personal Loans® offers loan amounts ranging from $250 to $35,000. You can choose loan terms from 3 months to 72 months, depending on your needs and eligibility.

Enhanced Security Measures

Security is a top priority for online credit services. Platforms like Personal Loans® use advanced data encryption technology to protect your information. This ensures that your personal and financial data remains secure throughout the application and funding process.

Here is a summary of the main features of Personal Loans®:

| Feature | Details |

|---|---|

| Loan Amounts | $250 to $35,000 |

| Service Cost | Free to use, no hidden fees |

| Loan Terms | 3 months to 72 months |

| APR Range | 5.99% to 35.89% |

| Funding Time | Next business day |

| Security | Advanced data encryption |

Using online credit services like Personal Loans® can offer quick and secure solutions for your financial needs.

Pricing And Affordability Of Online Credit Services

Understanding the pricing and affordability of online credit services is crucial. This section covers interest rates, fees, and hidden costs. It also compares online credit services to traditional ones.

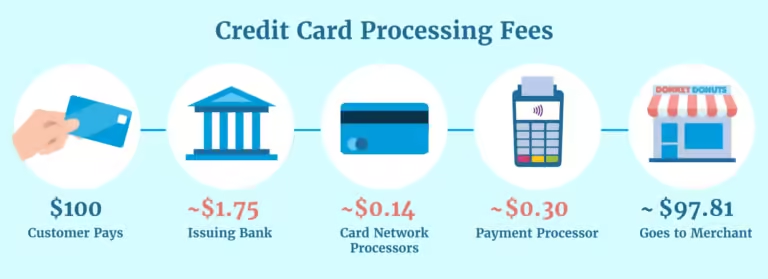

Interest Rates And Fees

Online credit services like Personal Loans® offer various loan amounts with flexible terms. The APR can range from 5.99% to 35.89% depending on the loan amount and credit score. The service is free to use, with no hidden fees or upfront costs.

| Loan Amount | APR Range | Loan Terms |

|---|---|---|

| $250 to $35,000 | 5.99% to 35.89% | 3 months to 72 months |

Comparison With Traditional Credit Services

Online credit services often offer more competitive rates than traditional banks. The application process is faster, and funds can be received as soon as the next business day. Traditional banks may take longer to process loans and often have stricter eligibility criteria.

| Feature | Online Credit Services | Traditional Credit Services |

|---|---|---|

| Application Speed | Quick, often within minutes | Longer, often days or weeks |

| Eligibility Criteria | More flexible | Stricter |

| Funds Availability | As soon as next business day | Several days |

Hidden Costs To Watch Out For

While online credit services like Personal Loans® do not charge for the service, lenders may impose fees. These can include origination fees or prepayment penalties. Always review loan terms carefully before accepting.

- Origination Fees: Charged by lenders for processing the loan.

- Prepayment Penalties: Fees for paying off the loan early.

- Late Payment Fees: Charges for missed or late payments.

Understanding these potential costs helps avoid surprises. Always contact the lender for clarification if unsure about any fees.

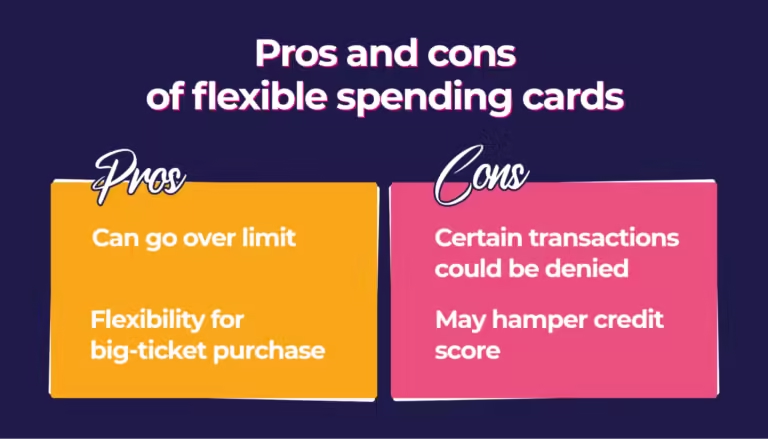

Pros And Cons Of Online Credit Services

Online credit services offer a modern approach to borrowing money. They provide convenience and speed, but there are also potential risks. Let’s explore the advantages and drawbacks of these services.

Advantages Of Using Online Credit Services

Online credit services, like Personal Loans®, have many benefits:

- Convenience: Apply from the comfort of your home.

- Speed: Funds can be received as soon as the next business day.

- Flexibility: Loan amounts range from $250 to $35,000, with terms from 3 months to 72 months.

- Free Service: No charges for using the platform.

- Wide Network: Access to a large network of direct and third-party lenders.

- Security: Advanced data encryption technology for information protection.

Potential Drawbacks And Risks

While online credit services are beneficial, they also come with potential drawbacks:

- High APR: Rates can vary from 5.99% to 35.89%, depending on factors like credit score.

- Fees: Lenders may charge origination or other fees.

- Credit Impact: Late payments can affect your credit score.

- Collection Activities: Nonpayment may lead to collection actions.

- Privacy Concerns: Although secure, sharing personal data online can be a risk.

Real-world Usage Insights

Users of Personal Loans® have shared various experiences:

| Aspect | User Feedback |

|---|---|

| Application Process | Easy and quick, with a straightforward online form. |

| Funding Speed | Funds often received by the next business day. |

| Loan Options | Wide variety of loan amounts and terms available. |

| Customer Support | Responsive and helpful. |

Overall, many users appreciate the convenience and speed of online credit services. Be mindful of the potential risks and always review loan terms carefully.

Ideal Users And Scenarios For Online Credit Services

Online credit services are perfect for busy individuals needing quick financial solutions. They also benefit small business owners seeking flexible funding options. These services offer convenience and speed, ideal for modern financial needs.

Online credit services, like PersonalLoans®, offer a convenient way to access funds quickly. These services can be a perfect fit for various users and situations, providing flexible loan options and fast processing times.Who Can Benefit The Most

Many individuals can benefit from using online credit services. Here are some ideal users:

- Individuals with Emergency Needs: Quick access to funds for unexpected expenses like medical bills or car repairs.

- Homeowners: Those looking to finance home improvements or renovations.

- Entrepreneurs: People starting or expanding a small business.

- Travel Enthusiasts: Families planning vacations or getaways.

- Individuals with Varied Credit Histories: Those seeking loans with flexible terms regardless of credit score.

Best Situations To Use Online Credit Services

There are specific scenarios where online credit services prove highly beneficial:

| Situation | How Online Credit Services Help |

|---|---|

| Emergency Expenses | Get funds as soon as the next business day. |

| Home Improvements | Flexible loan amounts and terms for various projects. |

| Business Startup | Access to a network of lenders offering business loans. |

| Debt Consolidation | Combine multiple debts into a single, manageable loan. |

| Travel Plans | Finance family vacations or personal getaways. |

Tips For Maximizing Benefits

To get the most out of online credit services, consider the following tips:

- Compare Offers: Review loan terms from different lenders to find the best rates.

- Understand the APR: Be aware of the annual percentage rate, which can range from 5.99% to 35.89%.

- Check Loan Terms: Choose terms that fit your repayment ability, ranging from 3 months to 72 months.

- Read the Fine Print: Ensure you understand any fees or charges before accepting a loan.

- Contact Customer Support: Reach out for any queries or assistance needed during the process.

By following these tips, users can optimize their experience with online credit services and make informed financial decisions.

Conclusion: Unlocking Financial Freedom With Online Credit Services

Online credit services are transforming the way people access funds. Platforms like Personal Loans® provide a seamless and efficient way to secure personal loans. This convenience and flexibility are paving the path toward financial freedom.

Recap Of Key Points

- Loan Amounts: Ranges from $250 to $35,000

- Service Cost: Free to use with no hidden fees

- Loan Terms: 3 months to 72 months

- APR Range: Generally from 5.99% to 35.89%

- Funding Time: Funds can be received as soon as the next business day

- Network Access: Connects with a large network of lenders

- Security: Advanced data encryption technology

Personal Loans® offers a user-friendly platform that connects borrowers with multiple lenders. This increases the chances of finding suitable loan options. The service is free and provides quick connections without any obligation. Borrowers can review and compare loan offers before making a decision.

Final Thoughts On The Future Of Online Credit Services

The future of online credit services looks promising. As technology advances, these platforms will continue to enhance user experience. Borrowers will benefit from faster processing times and more personalized loan options.

Security will remain a top priority. Platforms like Personal Loans® will keep improving their encryption technologies to protect user data. This ensures a secure and trustworthy environment for all transactions.

With continuous advancements, online credit services will become an integral part of personal finance. They offer convenience and flexibility, making it easier for individuals to manage their financial needs. By embracing these services, users can achieve greater financial stability and freedom.

Frequently Asked Questions

What Are Online Credit Services?

Online credit services offer financial products like loans and credit cards via the internet. These services provide quick access to credit without needing physical visits to banks.

How Do Online Credit Services Work?

Online credit services use technology to assess creditworthiness and process applications. Users submit required documents online, and approvals are often quicker than traditional methods.

Are Online Credit Services Safe?

Most online credit services use advanced security measures to protect personal information. Always ensure the service is reputable and check for secure website indicators like HTTPS.

What Are The Benefits Of Online Credit Services?

Online credit services offer convenience, faster approvals, and often more competitive rates. They eliminate the need for physical paperwork and bank visits.

Conclusion

Explore online credit services for quick, hassle-free financial solutions. PersonalLoans.com offers a simple way to connect with lenders, providing loan amounts from $250 to $35,000. Enjoy a free service with no hidden fees, flexible loan terms, and secure transactions. Whether for emergencies, home improvements, or other needs, find the right lender easily. Visit PersonalLoans.com today for more details and to get started. Simplify your financial journey now.