Online Credit Reports: Unlock Your Financial Potential Today

Online credit reports are crucial for managing your financial health. They provide insights into your credit score and financial history.

Understanding these reports can help you make informed financial decisions. In today’s digital age, accessing your credit report online is easier than ever. Businesses, in particular, can benefit greatly from regular credit monitoring and building tools. FairFigure offers an excellent solution with their FairFigure Capital Card. This tool not only helps improve your business credit scores but also provides real-time monitoring and potential funding access without personal credit checks. By leveraging these resources, businesses can enhance their financial standing and secure necessary capital. Explore more about FairFigure and how it can benefit your business here.

Introduction To Online Credit Reports

Online credit reports have become an essential tool in today’s financial landscape. Understanding your credit report is crucial for managing your personal and business finances. With services like FairFigure, you can now access and monitor your credit reports in real-time. This empowers you to make informed financial decisions and improve your credit scores.

Understanding The Importance Of Credit Reports

Credit reports provide a detailed overview of your credit history. They include information on your credit accounts, payment history, and any outstanding debts. Lenders use this information to assess your creditworthiness. A good credit report can help you secure loans, credit cards, and better interest rates.

For businesses, having a strong credit report is equally important. It can help you secure funding, negotiate better terms with suppliers, and build trust with partners. Tools like the FairFigure Capital Card offer real-time credit monitoring and reporting, which can significantly improve your business credit scores.

How Online Credit Reports Have Revolutionized Financial Awareness

Online credit reports have transformed how individuals and businesses manage their finances. They provide immediate access to your credit information, allowing you to stay on top of your credit status. This real-time access can help you identify and correct errors quickly, preventing potential issues that could affect your credit score.

With the advent of tools like FairFigure, you can monitor your credit scores from all three major bureaus. This comprehensive monitoring helps you understand the factors influencing your scores and take proactive steps to improve them. For example, FairFigure’s Credit Building feature reports your payment history to commercial bureaus, potentially boosting your scores by up to 60%.

| Features | Benefits |

|---|---|

| Credit Monitoring | Real-time tri-bureau score tracking with detailed insights. |

| Credit Building | Reports payment history, potentially boosting scores by up to 60%. |

| Funding Access | Same-day funding with no personal credit checks or personal guarantees. |

| Business Credit Correct Tool | Identify and correct incorrect information on credit reports. |

| Foundation Report | Comprehensive report providing insights into business credit and commercial scores. |

Online credit reports also provide enhanced security. Platforms like FairFigure use PCI compliance and Plaid integration to ensure your data is secure and accurate. This gives you peace of mind knowing your financial information is protected.

Key Features Of Online Credit Reports

Online credit reports provide essential insights into your credit history and current standing. Understanding these features helps you manage your credit more effectively.

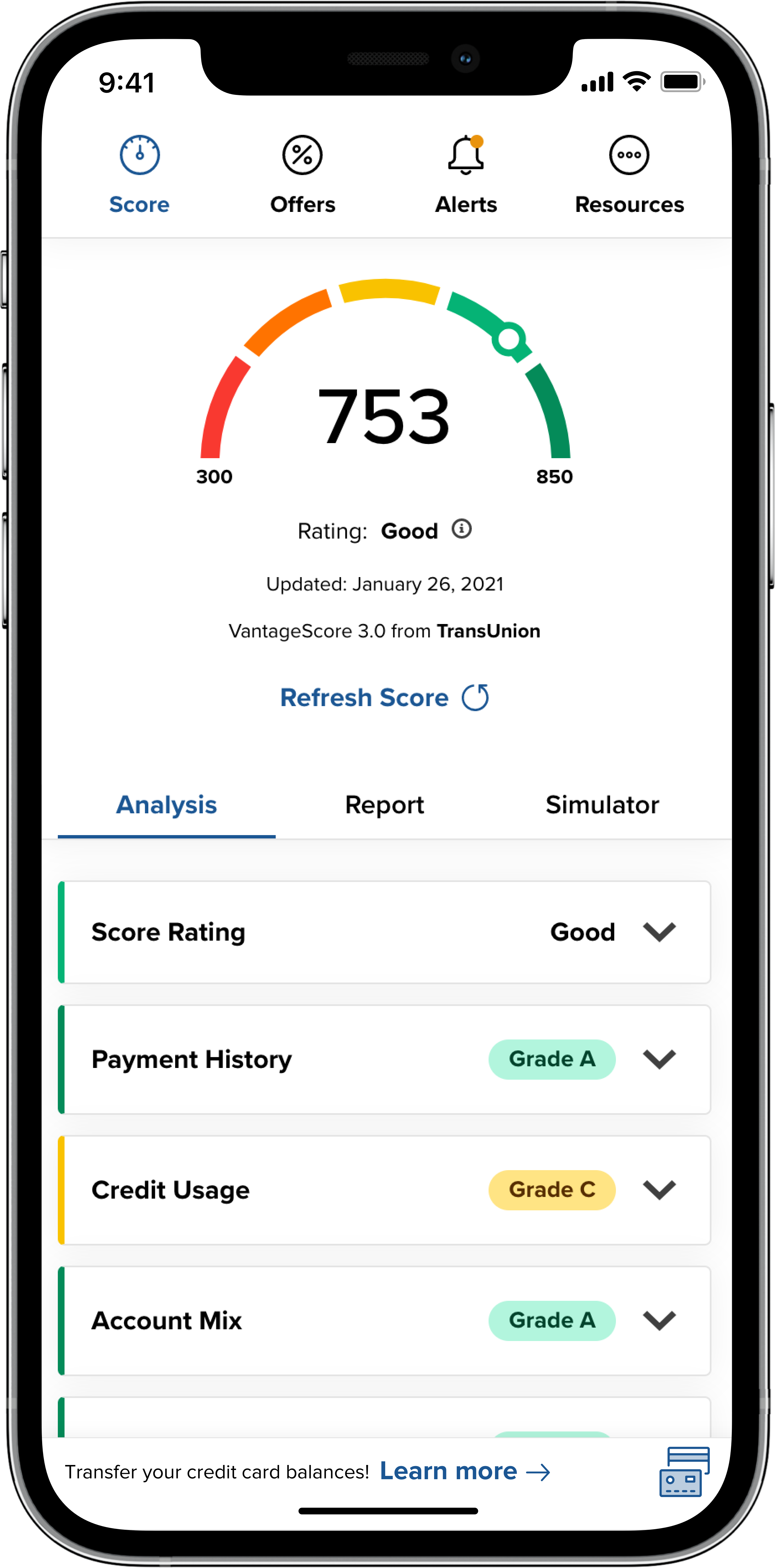

Real-time Access To Credit Scores

One of the most important features of online credit reports is real-time access to credit scores. You can instantly view your updated scores and understand your creditworthiness.

This is crucial for making informed financial decisions and monitoring any changes in your credit status.

Comprehensive Credit History Tracking

Online credit reports offer comprehensive credit history tracking. You can see your credit activities, including loans, credit cards, and payment history.

This detailed tracking helps identify patterns and manage your credit more effectively.

Alerts And Notifications For Changes

Stay informed with alerts and notifications for any changes in your credit report. This feature ensures you are aware of new accounts, credit inquiries, or potential fraud.

Timely alerts help you respond quickly to any suspicious activities.

User-friendly Dashboard And Interface

A user-friendly dashboard and interface make navigating your credit report easy. Clear and simple layouts ensure you find the information you need without confusion.

This ease of use is essential for effectively managing your credit.

Integration With Financial Planning Tools

Many online credit reports offer integration with financial planning tools. This allows you to align your credit management with your broader financial goals.

Such integrations provide a holistic view of your financial health.

| Feature | Benefit |

|---|---|

| Real-Time Access to Credit Scores | Instant creditworthiness updates |

| Comprehensive Credit History Tracking | Detailed view of credit activities |

| Alerts and Notifications for Changes | Immediate awareness of credit changes |

| User-Friendly Dashboard and Interface | Easy navigation of credit information |

| Integration with Financial Planning Tools | Holistic financial health management |

Visit FairFigure for more information on how their services can help you manage your business credit efficiently.

Benefits Of Using Online Credit Reports

Online credit reports offer numerous advantages. They empower users with critical financial knowledge, enable proactive credit management, improve loan and credit approval rates, and enhance security and fraud detection.

Empowering Users With Financial Knowledge

Online credit reports provide detailed insights into your credit history. This information helps users understand their financial standing better. Knowing your credit score and its components can guide better financial decisions.

The FairFigure Capital Card offers real-time tri-bureau score tracking. Users receive detailed insights into their business credit, enabling smarter financial choices.

Proactive Credit Management

Regular monitoring of credit reports allows users to manage their credit proactively. Spot and correct errors promptly to avoid negative impacts on your credit score.

FairFigure’s Business Credit Correct Tool helps identify and correct incorrect information on credit reports. This feature ensures your credit report remains accurate.

Improving Loan And Credit Approval Rates

Good credit scores are crucial for loan and credit approvals. Online credit reports help users maintain and improve their scores.

With FairFigure, businesses can potentially boost their credit scores by up to 60%. Improved scores increase the chances of securing funding and other credit opportunities.

Enhanced Security And Fraud Detection

Online credit reports enhance security and help detect fraud. Regular checks make it easier to spot suspicious activities early and take action.

FairFigure ensures data accuracy and security with PCI compliance and Plaid integration. Users can trust that their financial data is well-protected.

By using online credit reports, individuals and businesses can benefit significantly. FairFigure’s features, such as real-time tracking and error correction, provide added value and peace of mind.

Pricing And Affordability

Understanding the pricing and affordability of online credit reports is essential. The FairFigure Capital Card offers various plans and services to meet diverse business needs. Let’s explore the differences between free and paid services, analyze the cost-benefit of subscription plans, and uncover special offers and discounts.

Comparing Free Vs. Paid Services

FairFigure provides both free and paid services for credit monitoring and building. Free services typically offer basic credit report access and limited insights. In contrast, paid services like the FairFigure Premium Monitor include detailed insights, real-time tri-bureau score tracking, and additional tradelines. Paid plans also offer comprehensive tools such as the Business Credit Correct Tool.

| Feature | Free Services | Paid Services |

|---|---|---|

| Basic Credit Report | ✔ | ✔ |

| Detailed Insights | ✘ | ✔ |

| Real-Time Tracking | ✘ | ✔ |

| Business Credit Correct Tool | ✘ | ✔ |

Cost-benefit Analysis Of Subscription Plans

Analyzing the cost-benefit of subscription plans is crucial for making informed decisions. The FairFigure Capital Card offers a premium subscription that includes the Foundation Report and additional tradelines. This subscription can boost credit scores by up to 60% within three months. The same-day funding feature with no personal credit checks also adds significant value.

Consider the benefits:

- Improved credit scores by up to 60%

- Access to business capital without personal credit checks

- Comprehensive credit monitoring and correcting tools

Special Offers And Discounts

FairFigure occasionally provides special offers and discounts to new and existing customers. Businesses with at least $2,500 in deposits and three months of operation can apply for the FairFigure Capital Card. Higher funding options are available for businesses with monthly revenues of $5,000 or more. Always check FairFigure’s website or contact their support for the latest offers.

Special offers may include:

- Discounted subscription rates for new customers

- Limited-time promotions on premium services

- Exclusive deals for businesses meeting specific criteria

Pros And Cons Of Online Credit Reports

Understanding the pros and cons of online credit reports is essential for informed financial decisions. Online credit reports provide a mix of advantages and limitations. Knowing these can help you make better choices.

Advantages Of Instant Access

One key benefit of online credit reports is instant access. With tools like the FairFigure Capital Card, you can monitor your business credit in real-time.

- Real-time monitoring: Get immediate updates on your credit status.

- Detailed insights: Understand the factors affecting your credit score.

- Convenience: Access your credit report anytime, anywhere.

| Feature | Benefit |

|---|---|

| Credit Monitoring | Real-time tri-bureau score tracking with detailed insights. |

| Credit Building | Potential boost of up to 60% in business credit scores. |

| Funding Access | Same-day funding with no personal credit checks. |

Potential Drawbacks And Limitations

While online credit reports offer many advantages, they also have some drawbacks. Understanding these limitations can help you use these tools more effectively.

- Data accuracy: Incorrect information can appear on reports, impacting your score.

- Security concerns: Ensuring your data is secure is crucial.

- Cost: Premium services may come with a fee.

User Experiences And Testimonials

Hearing from other users can provide valuable insights. Many users have shared their positive experiences with the FairFigure Capital Card.

“Using FairFigure helped us secure funding quickly without a personal credit check.”

“Our business credit score improved by 50% in three months thanks to their monitoring tools.”

These testimonials highlight how the FairFigure Capital Card can provide significant benefits to businesses.

Ideal Users And Scenarios For Online Credit Reports

Online credit reports serve various needs. They help individuals, business owners, and families understand their financial standing. Below, we explore specific users and scenarios where online credit reports are highly beneficial.

For Individuals Seeking To Improve Their Credit Score

Individuals wanting to improve their credit score can benefit from online credit reports. These reports provide detailed insights into your credit history. By identifying negative items, you can take steps to correct inaccuracies. Monitoring your credit regularly helps you understand the impact of your actions on your score.

- Identify and correct errors in your report.

- Track changes in your credit score over time.

- Receive alerts for new credit inquiries.

For Small Business Owners Monitoring Business Credit

Small business owners need to keep a close eye on their business credit. Tools like the FairFigure Capital Card offer real-time tri-bureau score tracking. This helps in understanding your business’s credit standing. By reporting payment history to commercial bureaus, you can potentially boost your score by up to 60%.

- Monitor credit with real-time updates.

- Access same-day funding without personal credit checks.

- Identify and correct incorrect information on credit reports.

For Families Planning Major Purchases Or Loans

Families planning to make major purchases, like a home or car, benefit from online credit reports. Understanding your credit score is crucial for securing favorable loan terms. Regular monitoring can help you maintain a healthy credit profile. This ensures you are ready when the time comes to apply for a loan.

- Check your credit score before applying for loans.

- Identify areas for improvement to get better loan terms.

- Ensure your credit report is accurate and up-to-date.

Conclusion: Unlock Your Financial Potential With Online Credit Reports

Understanding and utilizing online credit reports can significantly impact your financial health. They provide real-time insights, enabling businesses to make informed decisions. Here we will review the key benefits, encourage proactive financial management, and outline next steps for leveraging these tools effectively.

Recap Of Key Benefits

Online credit reports offer numerous advantages for businesses. Here are the main benefits:

- Improved Credit Scores: Potential 60% improvement in business credit scores within 3 months.

- Same-Day Funding: Fast access to business capital without personal credit checks.

- Credit Control: Manage the amount and payment plan with flexible repayment terms.

- Increased Funding Options: Use just your EIN to unlock new funding opportunities.

- Secure and Accurate Reporting: Ensures data accuracy and security with PCI compliance and Plaid integration.

Encouraging Proactive Financial Management

Proactive financial management is crucial for business growth. By using tools like the FairFigure Capital Card, businesses can:

- Monitor credit scores in real-time with detailed insights.

- Report payment history to commercial bureaus, boosting scores.

- Identify and correct incorrect information on credit reports.

These steps help businesses stay on top of their credit health and secure necessary funding.

Final Thoughts And Next Steps

To maximize the benefits of online credit reports, consider the following actions:

- Regularly check your credit reports for accuracy.

- Use a reliable credit-building tool like FairFigure Capital Card.

- Take advantage of fast funding options for immediate financial needs.

By following these steps, businesses can ensure they are well-positioned for financial success. For more information, visit FairFigure.

Frequently Asked Questions

What Is An Online Credit Report?

An online credit report is a digital record of your credit history. It includes details about your credit accounts, payment history, and current debts.

How Can I Get My Online Credit Report?

You can get your online credit report from credit bureaus. Websites like AnnualCreditReport. com offer free annual reports from major bureaus.

Why Is An Online Credit Report Important?

An online credit report helps you monitor your financial health. It shows your credit score, which lenders use to assess your creditworthiness.

How Often Should I Check My Online Credit Report?

You should check your online credit report at least once a year. Regular monitoring helps you spot errors and prevent identity theft.

Conclusion

Understanding online credit reports is crucial for financial health. Regular monitoring can prevent potential issues. Consider using tools like the FairFigure Capital Card. It helps businesses build credit and access funding. Stay informed and proactive about your credit. This ensures better financial decisions and opportunities.