No Interest Credit Card For Businesses: Boost Your Cash Flow

A no interest credit card for businesses can be a game-changer. It offers flexibility and helps manage cash flow efficiently.

For many business owners, finding the right financial tools is crucial. A no interest credit card can provide that much-needed support. Flex, a comprehensive financial platform, is designed to accelerate business growth. It integrates banking, credit, and treasury services into one seamless app. With Flex Credit Card, businesses get net-60 terms on all purchases and 0% interest for 60 days. This means you can manage your expenses without the burden of immediate interest. Additionally, Flex offers banking services with up to 2.99% APY on cash. This helps you maximize your idle funds. Flex ensures robust security with multi-factor authentication and encryption protocols. Explore more about Flex here.

Introduction To No Interest Credit Cards For Businesses

Businesses often face challenges in managing cash flow and expenses. A no interest credit card can offer a solution. These cards provide short-term financing without interest, making them attractive for managing business finances.

Overview Of No Interest Credit Cards

No interest credit cards, also known as zero APR cards, offer an interest-free period. This period can range from a few months to a year or more. For businesses, this feature can be a financial lifesaver.

Using a no interest credit card like the Flex Credit Card, businesses can make purchases and pay no interest for 60 days. This allows them to manage their cash flow better and invest in growth opportunities.

Additionally, these cards often come with other benefits. For example, Flex offers individual employee cards at no extra cost, along with robust security features.

Purpose And Benefits For Businesses

The primary purpose of no interest credit cards is to provide businesses with a flexible financing option. Here are some key benefits:

- Improved Cash Flow: With 0% interest for 60 days, businesses can manage their cash flow more effectively.

- High Credit Limits: Credit limits that grow with your business needs ensure you have access to funds when needed.

- Simplified Financial Management: Flex’s platform integrates banking, credit, and treasury services into one app, streamlining financial operations.

- Enhanced Security: Multi-Factor Authentication, automated fraud monitoring, and robust encryption protocols keep your financial data safe.

Moreover, the Flex Financial Platform offers a comprehensive solution. It includes simplified banking, payments, and expense management, making it easier to run your business.

By using a no interest credit card, businesses can focus on growth. They can invest in new projects without worrying about immediate interest costs. This financial flexibility is crucial for startups and small businesses.

Key Features Of No Interest Credit Cards

No interest credit cards provide several advantages for businesses. Understanding these features can help in leveraging their benefits effectively. Below are the key features to consider.

Interest-free Periods

One of the most appealing aspects of no interest credit cards is the interest-free periods. Flex Financial Platform offers a 0% interest for 60 days, provided the balance is paid within the grace period. This allows businesses to manage cash flow more effectively without incurring additional costs.

Rewards And Cashback Programs

Many no interest credit cards come with rewards and cashback programs. While Flex Financial Platform focuses on financial management and security, businesses can still benefit from other credit cards that offer rewards for purchases. These rewards can include cashback, travel points, or discounts on business-related expenses.

Flexible Payment Options

No interest credit cards often provide flexible payment options. With Flex, businesses can enjoy net-60 terms on all purchases. This flexibility allows companies to plan their finances better and avoid late fees. Additionally, businesses can issue individual employee cards at no extra cost, facilitating expense management.

Business-specific Perks

Flex offers several business-specific perks that are designed to enhance financial management. These include simplified banking, streamlined receipt capture, and the ability to earn up to 2.99% APY on cash on hand. Moreover, Flex provides advanced security features such as multi-factor authentication and automated fraud monitoring, ensuring the safety of financial data.

| Feature | Details |

|---|---|

| Interest-Free Period | 0% interest for 60 days |

| Credit Terms | Net-60 terms on all purchases |

| Reward Programs | Varies by card |

| Business Perks | High APY, enhanced security, simplified banking |

Understanding these features can help businesses select a no interest credit card that best suits their needs. Learn more about Flex Financial Platform here.

How No Interest Credit Cards Can Boost Your Cash Flow

Utilizing a no interest credit card, like the Flex Credit Card, can significantly enhance your business’s cash flow. This financial tool offers many benefits that can help streamline your operations and improve your bottom line.

Improved Cash Management

With the Flex Credit Card, businesses get net-60 terms on all purchases. This means you have 60 days to pay off your balance without any interest. Such generous terms provide ample time to manage your cash flow effectively. You can make essential purchases now and pay later, ensuring that your business operations run smoothly without immediate financial strain.

Additionally, Flex integrates banking, credit, and treasury services into one super app. This centralization simplifies financial operations, making it easier to track expenses and manage funds. The ability to issue individual employee cards at no extra cost adds another layer of convenience, allowing you to delegate spending while maintaining control over the budget.

Cost Savings On Interest

One of the most significant advantages of the Flex Credit Card is the 0% interest for 60 days. By paying off the balance within the grace period, your business can avoid interest charges altogether. This translates to substantial savings over time, especially for companies that rely heavily on credit for their day-to-day operations.

Saving on interest means more funds are available for reinvestment into the business. Whether it’s for purchasing new equipment, hiring additional staff, or expanding your marketing efforts, these savings can be redirected towards growth and development.

Enhanced Spending Power

The Flex Credit Card offers credit limits that grow with your business. As your business expands, so does your credit limit, providing you with the spending power needed to seize new opportunities. This dynamic credit limit ensures that your financial resources keep pace with your business needs.

Enhanced spending power means you can take on larger projects and make significant purchases without worrying about cash flow constraints. This flexibility is crucial for businesses looking to scale and capitalize on growth opportunities.

Streamlined Expense Tracking

The Flex Financial Platform simplifies expense management with features like streamlined receipt capture and detailed expense tracking. These tools help you keep a close eye on your spending, ensuring that every dollar is accounted for and utilized effectively.

Streamlined expense tracking not only saves time but also reduces the risk of errors. By having a clear and organized view of your expenses, you can make more informed financial decisions, leading to better overall financial health for your business.

In summary, the Flex Credit Card offers many benefits that can significantly boost your cash flow. From improved cash management and cost savings on interest to enhanced spending power and streamlined expense tracking, this tool is designed to support your business’s growth and financial well-being.

Pricing And Affordability Breakdown

The Flex Financial Platform offers a seamless way to manage business finances. A key highlight is the no interest credit card for businesses. Let’s break down the pricing and affordability aspects of Flex.

Annual Fees And Charges

The Flex Credit Card offers a 0% interest rate for 60 days, provided the balance is paid within the grace period. This makes it an ideal choice for businesses looking to optimize cash flow without incurring interest costs.

- No annual fees for the credit card.

- No extra cost for individual employee cards.

Flex Banking also allows businesses to earn up to 2.99% APY on idle cash, enhancing overall financial health.

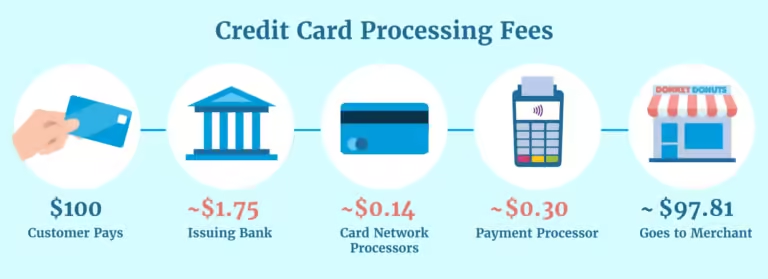

Comparison With Other Financing Options

| Feature | Flex Credit Card | Traditional Business Loan | Business Line of Credit |

|---|---|---|---|

| Interest Rate | 0% for 60 days | 5-15% | 8-24% |

| Annual Fees | None | Varies | Varies |

| Approval Time | Quick | 1-2 weeks | 1-2 weeks |

The Flex Credit Card offers competitive advantages in interest rates and annual fees, making it a cost-effective financing option for businesses.

Hidden Costs To Watch Out For

While the Flex Credit Card offers many benefits, businesses should be aware of potential hidden costs:

- Interest Accrual: Interest will accrue if the balance is not paid by the end of the 60-day grace period.

- Variable APY Rates: The APY rates are subject to change based on the Federal Funds Rate.

- Insurance Coverage: Deposits qualify for up to $3,000,000 in FDIC insurance coverage, with additional coverage up to $75M through the Treasury product.

Understanding these potential costs can help businesses make informed financial decisions.

Pros And Cons Of Using No Interest Credit Cards

Using no interest credit cards like the Flex Credit Card can be a strategic move for businesses. This section explores the pros and cons of using no interest credit cards, helping you make an informed decision.

Advantages For Business Cash Flow

One of the main benefits of the Flex Credit Card is its ability to enhance business cash flow. With Net-60 terms, you can make purchases and have 60 days to pay off the balance without incurring any interest.

- Improved Cash Flow Management: The 60-day grace period allows businesses to manage their cash flow better.

- Interest-Free Financing: You get to use funds without paying any interest, provided the balance is cleared within the grace period.

- Expense Management: Issue individual employee cards at no extra cost to streamline expense tracking and management.

Additionally, businesses can earn up to 2.99% APY on idle cash, further improving financial health.

Potential Drawbacks And Risks

While no interest credit cards offer significant advantages, there are potential drawbacks and risks to consider.

- Accrued Interest: If the balance is not paid within the 60-day period, interest will accrue, potentially leading to high costs.

- Credit Limit Management: Mismanagement of the credit limit could result in cash flow issues and impact credit scores.

- Dependence on Credit: Over-reliance on credit cards for financing can be risky and may affect long-term financial stability.

Businesses need to be mindful of these risks and ensure they have a solid repayment plan in place.

Real-world Usage Scenarios

Understanding how no interest credit cards can be used in real-world scenarios helps in leveraging their benefits effectively.

| Scenario | Description | Benefits |

|---|---|---|

| Seasonal Inventory Purchases | Using the Flex Credit Card to purchase inventory for peak seasons. | Manage cash flow better and avoid interest costs. |

| Employee Travel Expenses | Issuing individual cards for employee travel and business expenses. | Streamline expense tracking and manage budgets efficiently. |

| Large Equipment Purchases | Financing large equipment purchases with the 60-day interest-free period. | Spread the cost over a longer period without incurring interest. |

The Flex Financial Platform integrates banking, credit, and treasury services, making it a powerful tool for businesses.

For more information, visit the Flex website.

Ideal Users And Scenarios For No Interest Credit Cards

No interest credit cards, like the Flex Credit Card, offer unique advantages for businesses. They help manage cash flow and streamline financial operations. Who benefits most from these cards? Let’s explore ideal users and scenarios.

Best-suited Business Types

Different business types can benefit from no interest credit cards. Here are the best-suited ones:

- Startups: New businesses with tight budgets.

- Small to Medium Enterprises (SMEs): Need flexible payment options.

- E-commerce Companies: Require frequent purchases and inventory management.

- Service-Based Businesses: Benefit from streamlined expense management.

Scenarios Where They Shine

No interest credit cards excel in various scenarios. Here are key situations where they shine:

- Cash Flow Management: Use net-60 terms to balance expenses.

- Large Purchases: Spread the cost over two months interest-free.

- Employee Expenses: Issue individual employee cards at no extra cost.

- Seasonal Businesses: Manage fluctuating cash flows effectively.

Tips For Maximizing Benefits

Maximizing the benefits of no interest credit cards requires strategic use. Here are some tips:

- Pay Balances On Time: Ensure the balance is paid within the 60-day grace period.

- Track Expenses: Use the Flex platform to monitor all transactions.

- Utilize Employee Cards: Simplify expense management with individual cards.

- Leverage High Interest Earnings: Earn up to 2.99% APY on idle cash.

By following these tips, businesses can make the most of their no interest credit card and improve financial health. To learn more about the Flex Financial Platform, visit their website.

Frequently Asked Questions

What Is A No Interest Credit Card For Businesses?

A no interest credit card for businesses offers an introductory period with zero interest. This helps businesses manage cash flow and expenses effectively.

How Can Businesses Benefit From No Interest Credit Cards?

Businesses can save on interest costs, improve cash flow, and manage expenses better. It helps in making big purchases more affordable.

Are There Any Fees For No Interest Business Credit Cards?

Some no interest business credit cards may have annual fees. It’s essential to read the terms and conditions.

How Long Is The No Interest Period For Business Credit Cards?

The no interest period varies, typically ranging from 6 to 18 months. Check the card’s terms before applying.

Conclusion

Choosing a no interest credit card for your business can simplify finances. Flex offers the perfect solution with its comprehensive platform. Businesses can enjoy 0% interest for 60 days and flexible credit limits. Managing expenses becomes easier, enhancing cash flow. Explore the benefits of Flex and streamline your business finances with Flex Financial Platform. Make a smart choice today for a more efficient financial management system.