No Annual Fee Credit Card: Maximize Your Savings Today

**No Annual Fee Credit Card** Are you tired of paying annual fees on your credit card? A no annual fee credit card can be a great solution.

These cards help you save money while still enjoying the perks of a credit card. Credit cards with no annual fee are perfect for budget-conscious individuals. They offer the convenience and benefits of a credit card without the added cost. By choosing a card with no annual fee, you can keep more money in your pocket. This type of card is especially useful for those who are new to credit or looking to rebuild their credit history. For example, the Cheese Credit Builder Account helps you build credit without the need for a traditional credit card. It reports to all three major credit bureaus, has no hidden fees, and offers flexible deposit options. Learn more about this option and start your credit-building journey with Cheese today. Click here for more information.

Introduction To No Annual Fee Credit Cards

No annual fee credit cards offer an excellent way to manage finances without the burden of yearly fees. These cards are particularly beneficial for those looking to save money while still enjoying the perks of a credit card. In this section, we will explore what no annual fee credit cards are and why they might be a smart choice for you.

What Are No Annual Fee Credit Cards?

No annual fee credit cards are exactly what they sound like: credit cards that do not charge an annual fee. This means you won’t have to pay a yearly fee just to keep the card active. These cards often come with various benefits, such as rewards programs, cashback offers, and other perks without the added cost.

Here are some key features of no annual fee credit cards:

- No Annual Cost: No yearly fees to maintain the card.

- Rewards and Benefits: Many offer rewards points or cashback.

- Credit Building: Helps in building or improving your credit score.

Why Consider A No Annual Fee Credit Card?

Choosing a no annual fee credit card can be a wise financial decision. Here are some reasons why:

- Cost Savings: Save money by avoiding annual fees.

- Flexibility: Ideal for those who use credit cards occasionally.

- Reward Opportunities: Enjoy perks and rewards without extra costs.

- Credit Building: Improve your credit score over time.

For example, the Cheese Credit Builder Account is a unique product that helps build credit history without a credit card. It reports to all three major credit bureaus and requires no credit check. This makes it a great option for those looking to build or rebuild their credit.

The Cheese Credit Builder Account offers:

| Feature | Details |

|---|---|

| Build with All 3 Credit Bureaus | Reports to Equifax, Experian, and TransUnion |

| No Admin or Membership Fee | Free from hidden charges |

| No Credit Check Required | Does not affect your credit score |

| Fixed and Low APR | Only a minimal annual percentage rate is charged |

| Credit Monitoring | Easily track your credit score |

| Deposit Flexibility | Choose deposit goals of $500, $1,000, or $2,000 |

| Term Length Options | Select between 12 or 24 months |

With over 48,000 users, the Cheese Credit Builder Account has received positive feedback for its low monthly payments and effectiveness in building credit while saving money.

Key Features Of No Annual Fee Credit Cards

No annual fee credit cards are a great option for those seeking to avoid extra charges while still enjoying the benefits of a credit card. These cards offer a range of features that make them an attractive choice for many users. Let’s explore the key features of no annual fee credit cards.

Interest Rates And Apr

One of the most important aspects to consider is the interest rates and Annual Percentage Rate (APR). No annual fee credit cards often provide competitive interest rates. The APR can vary, but many cards offer a fixed and low APR, making them cost-effective for everyday purchases. Always check the APR details to understand the cost of carrying a balance.

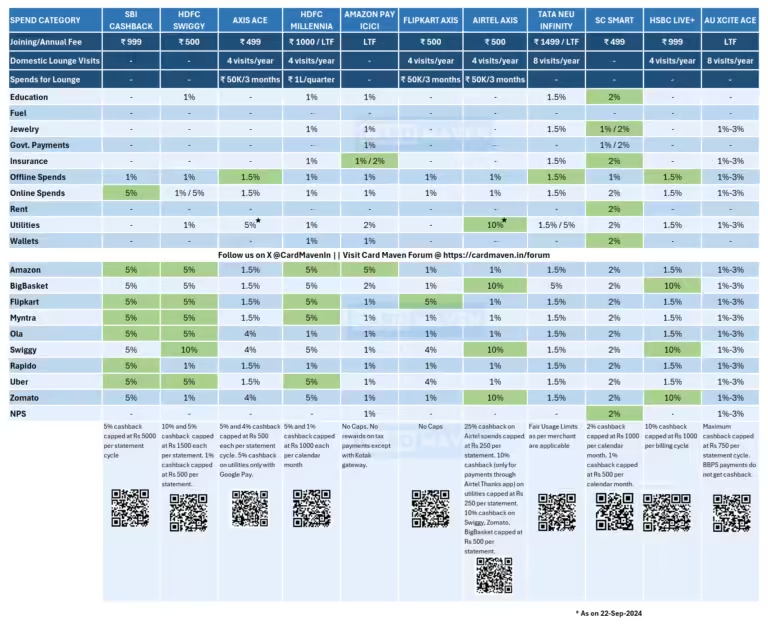

Rewards Programs And Cashback Offers

Many no annual fee credit cards offer enticing rewards programs and cashback offers. You can earn points on every purchase, which can be redeemed for travel, gift cards, or statement credits. Cashback cards provide a percentage back on your spending, allowing you to save money on regular expenses. Look for cards that align with your spending habits to maximize rewards.

Introductory Offers And Sign-up Bonuses

Attractive introductory offers and sign-up bonuses are common with no annual fee credit cards. These offers can include 0% APR for a specific period or bonus points after spending a certain amount within the first few months. These features can provide significant savings and benefits, especially if you plan to make large purchases soon after getting the card.

Balance Transfer Options

Some no annual fee credit cards offer balance transfer options. This feature allows you to transfer balances from other high-interest cards, potentially saving on interest. Look for cards with low or 0% introductory APR on balance transfers. This can be a smart way to manage existing debt and reduce financial stress.

Additional Perks And Benefits

No annual fee credit cards often come with additional perks and benefits. These can include credit monitoring, extended warranty protection, purchase protection, and travel insurance. While these features vary by card, they add significant value and peace of mind. Read the card’s terms to understand all the benefits available.

In summary, no annual fee credit cards offer numerous features that can help you save money while enjoying the conveniences and benefits of credit. Consider your financial needs and habits to choose the best card for you.

Pricing And Affordability

Choosing a no annual fee credit card can save you a lot of money. These cards offer various benefits without charging an annual fee. This makes them a great option for budget-conscious individuals. Let’s explore and compare no annual fee credit cards to understand their true cost of ownership.

Comparing No Annual Fee Credit Cards

Not all no annual fee credit cards are created equal. While they do not charge an annual fee, they may have other costs. Here are some features to consider:

- Interest Rates (APR): Check the annual percentage rate for purchases, balance transfers, and cash advances.

- Rewards Program: Some cards offer cashback, points, or travel rewards.

- Introductory Offers: Look for cards with 0% APR on purchases or balance transfers for a limited time.

- Additional Fees: Be aware of potential fees like late payment fees, foreign transaction fees, and balance transfer fees.

- Credit Monitoring: Some cards offer free credit score tracking and alerts.

| Credit Card | APR | Rewards | Intro Offer | Other Fees |

|---|---|---|---|---|

| Card A | 14.99% – 24.99% | 1.5% Cashback | 0% APR for 12 months | 3% Foreign Transaction Fee |

| Card B | 13.99% – 23.99% | 2x Points on Groceries | 0% APR for 15 months | No Foreign Transaction Fee |

Evaluating The True Cost Of Ownership

Even without an annual fee, you should evaluate the true cost of owning a credit card. Here are key factors to consider:

- Interest Charges: If you carry a balance, interest charges can add up quickly. Compare APRs to find the lowest rate.

- Late Payment Fees: Missing a payment can result in hefty late fees and penalty APRs.

- Foreign Transaction Fees: Frequent travelers should choose a card without foreign transaction fees.

- Balance Transfer Fees: Transferring a balance can incur a fee, typically 3%-5% of the amount transferred.

Cheese Credit Builder Account is a unique option that helps build credit without a credit card. It offers:

- No annual fee or membership fee

- Reports to all three major credit bureaus

- Fixed and low APR

- Credit monitoring

Monthly payments start at $24, with flexible deposit options. At the end of the term, you get your money back minus the interest. This makes it an affordable option for building credit.

Credit: www.instagram.com

Pros And Cons Of No Annual Fee Credit Cards

Choosing a credit card can be challenging, especially with so many options available. No annual fee credit cards are popular due to their cost-effective nature. Let’s explore their advantages and potential drawbacks.

Advantages Of No Annual Fee Credit Cards

No annual fee credit cards offer several benefits that make them appealing to many users:

- Cost Savings: You save money since there are no annual fees to pay.

- Accessibility: Easier for first-time credit card users to obtain.

- Flexibility: Great for those who don’t use credit cards frequently.

- Simple Financial Management: No need to worry about fee-related budgeting.

- Building Credit: Helps build or maintain a credit history without extra costs.

These cards are particularly beneficial for users who want to avoid additional financial burdens while managing their credit effectively.

Potential Drawbacks To Consider

Despite their benefits, no annual fee credit cards may have some limitations:

- Fewer Rewards: These cards often offer fewer rewards and benefits compared to those with annual fees.

- Higher Interest Rates: They may come with higher APRs, which can lead to more interest charges if balances are not paid in full.

- Limited Perks: You might miss out on exclusive perks such as travel insurance, concierge services, or higher cashback rates.

It’s essential to weigh these potential drawbacks against the benefits to determine if a no annual fee credit card suits your financial needs.

For those looking to build credit without a credit card, consider the Cheese Credit Builder Account. This product helps users build credit history with all three major credit bureaus without the need for a credit card. With no admin or membership fees and a low, fixed APR, it’s a flexible and cost-effective option for improving your credit score.

Ideal Users For No Annual Fee Credit Cards

No annual fee credit cards are perfect for specific users. These cards provide a cost-effective way to enjoy the benefits of credit without the burden of yearly fees.

Best Scenarios For Using A No Annual Fee Credit Card

There are several scenarios where a no annual fee credit card is ideal:

- Occasional Spend: If you do not use credit cards frequently, you avoid paying for unused benefits.

- Building Credit: Perfect for individuals building or rebuilding their credit history.

- Supplementary Card: Great for having as a backup card for emergencies.

- Student Use: Suitable for students who are new to credit and want to avoid extra costs.

Who Should Avoid No Annual Fee Credit Cards?

Not everyone benefits from a no annual fee credit card. Some individuals should consider alternatives:

- Frequent Travelers: If you travel often, cards with annual fees may offer better rewards and benefits.

- High Spenders: High expenditure can lead to more rewards with fee-based cards.

- Luxury Perk Seekers: Those seeking exclusive perks and services may find fee-based cards more rewarding.

Credit: m.youtube.com

Conclusion: Maximize Your Savings With No Annual Fee Credit Cards

Choosing a credit card without an annual fee can significantly enhance your savings. These cards offer various benefits without the burden of extra charges. This makes them an excellent choice for anyone looking to manage their finances effectively. Below, we summarize key points and provide final recommendations to help you make the most of your no annual fee credit card.

Summary Of Key Points

- No annual fee: Helps you save money annually.

- Variety of rewards: Earn cashback, points, or miles on purchases.

- Credit building: Improve your credit score with responsible use.

- Low interest rates: Some cards offer competitive APRs.

- Additional perks: Access to benefits like purchase protection and travel insurance.

Final Recommendations

To maximize your savings, select a card that aligns with your spending habits and financial goals. Consider the following tips:

- Compare different no annual fee credit cards to find the best rewards program.

- Ensure the card reports to all three major credit bureaus to build your credit effectively.

- Look for additional perks like purchase protection, travel insurance, or extended warranties.

- Monitor your spending and pay off your balance each month to avoid interest charges.

- Use the card responsibly to enhance your credit score and financial health.

For those looking to build or rebuild their credit, consider the Cheese Credit Builder Account. It reports to all three major credit bureaus, has no hidden fees, and offers flexible deposit goals and term lengths. This can be an excellent addition to your financial toolkit.

Credit: www.cincinnati.com

Frequently Asked Questions

What Is A No Annual Fee Credit Card?

A no annual fee credit card does not charge a yearly fee for card usage. It helps save money, especially for infrequent users.

Are No Annual Fee Credit Cards Worth It?

Yes, they are worth it for those who want to avoid yearly charges. They offer essential benefits without extra costs.

Do No Annual Fee Cards Have Rewards?

Many no annual fee cards offer rewards, like cashback or points. They provide perks without the annual fee burden.

Can I Build Credit With A No Annual Fee Card?

Yes, you can build credit with responsible use. Timely payments and low balances improve your credit score.

Conclusion

Choosing a no annual fee credit card can offer significant savings. It’s essential to compare features and benefits to find the right fit. Interested in building credit without a traditional credit card? Consider the Cheese Credit Builder. It reports to all major bureaus, charges no membership fees, and has flexible deposit options. Start improving your credit score today with Cheese. Make informed decisions and enjoy financial freedom.