Mobile Expense Tracking: Simplify Your Budget Management

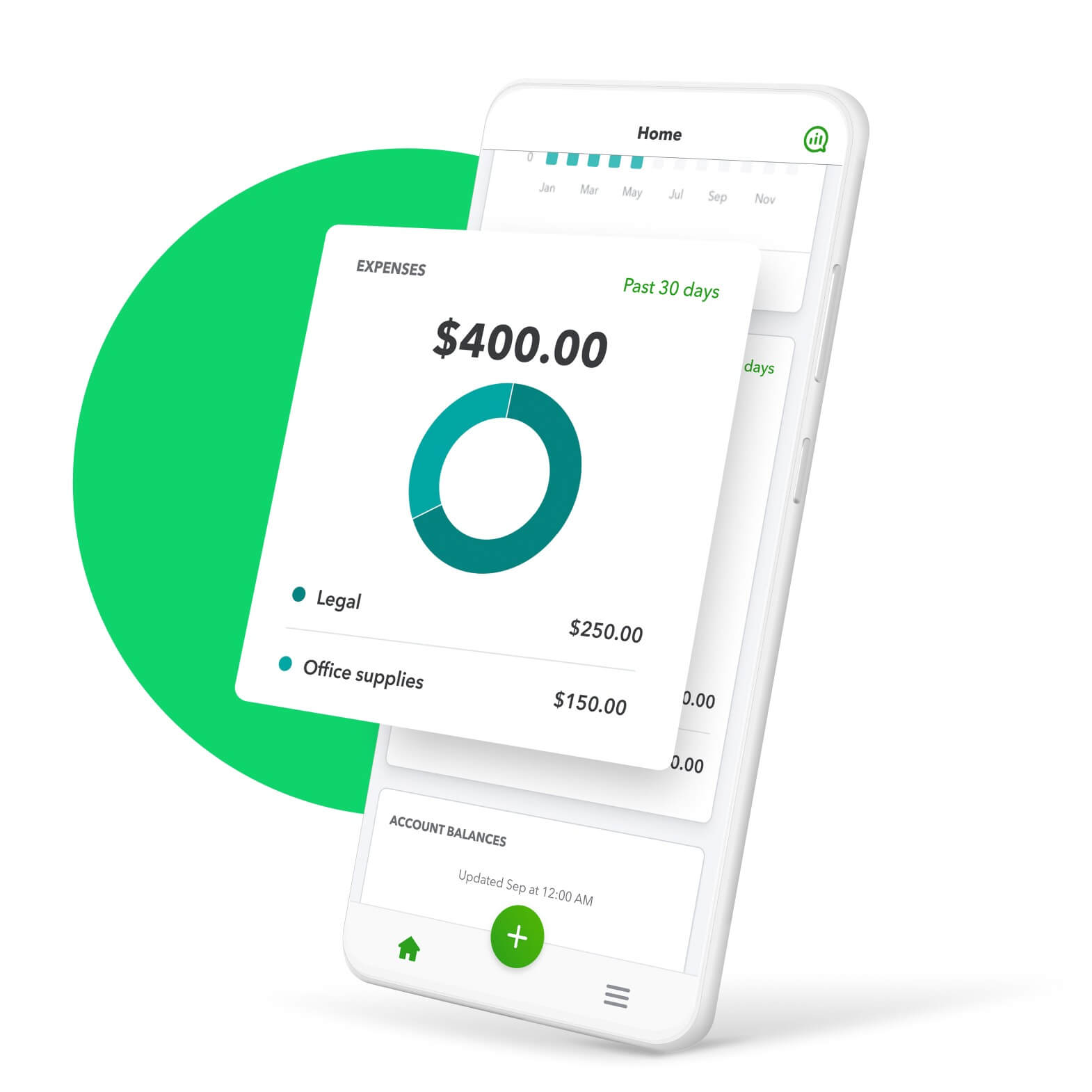

Managing expenses can be challenging, especially when on the go. Mobile expense tracking simplifies this by allowing you to monitor your spending anytime, anywhere.

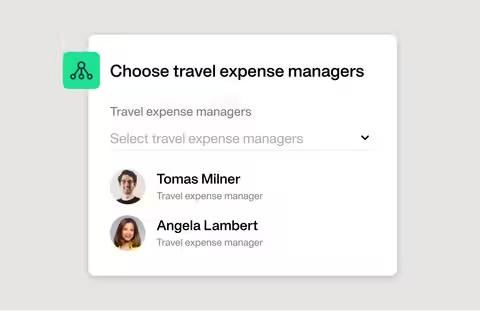

In today’s fast-paced world, keeping track of expenses can be a daunting task. Whether for personal finance or business purposes, effective expense management is crucial. Mobile expense tracking apps provide a convenient solution. These tools offer real-time monitoring, categorization, and reporting features right at your fingertips. With mobile expense tracking, you can easily stay within budget, ensure compliance, and gain valuable insights into your spending habits. Discover how mobile expense tracking can transform your financial management and help you make informed decisions effortlessly. Emburse offers innovative travel and expense management solutions. Emburse helps businesses streamline financial processes, ensure compliance, and gain insights into their spending.

Introduction To Mobile Expense Tracking

Managing expenses on the go has never been easier. With mobile expense tracking, individuals and businesses can monitor and control their finances from their smartphones. This method of tracking expenses offers a seamless and efficient way to ensure financial stability.

What Is Mobile Expense Tracking?

Mobile expense tracking is a digital solution that allows users to record and manage their expenses using a mobile device. It involves the use of apps that can track spending, categorize expenses, and provide insights into financial habits.

These apps offer features such as:

- Real-time expense recording

- Receipt scanning

- Expense categorization

- Budget setting

- Financial reports

One such solution is Emburse Travel and Expense Management Software. Emburse provides innovative solutions for expense management, helping businesses streamline their financial processes and gain insights into their spending.

The Importance Of Budget Management

Effective budget management is crucial for financial stability. Mobile expense tracking helps users adhere to their budgets by providing real-time insights into their spending patterns.

Here are some key benefits:

- Cost Control: Automates payment processes to control costs and improve cash flow visibility.

- Data-Driven Decisions: Provides actionable insights to uncover savings and make informed decisions.

- Compliance and Convenience: Ensures compliance with travel policies through user-friendly solutions.

By using tools like Emburse, businesses can not only save time but also make better financial decisions, ultimately leading to improved financial health.

Key Features Of Mobile Expense Tracking Apps

Mobile expense tracking apps have become essential tools for managing personal and business finances. They offer a variety of features that make tracking expenses easier, more accurate, and highly efficient. Here are some of the key features that make these apps indispensable:

Automated Expense Categorization

One of the standout features of mobile expense tracking apps is automated expense categorization. The app automatically sorts expenses into predefined categories such as food, travel, and utilities. This feature saves time and ensures that all expenses are accurately recorded. Users can also create custom categories to better align with their specific needs.

Real-time Expense Updates

Real-time expense updates allow users to see their spending as it happens. This feature provides instant notifications for each transaction. It helps users stay on top of their finances and avoid overspending. Real-time updates also ensure that all data is current and accurate.

Multi-device Synchronization

Multi-device synchronization enables users to access their expense data across multiple devices. Whether on a smartphone, tablet, or computer, users can view and manage their expenses seamlessly. This feature is crucial for those who need to monitor their spending on the go.

Customizable Budgeting Tools

Customizable budgeting tools help users set and achieve their financial goals. These tools allow users to create personalized budgets based on their income and expenses. Users can track their progress and make adjustments as needed. The flexibility of customizable budgeting tools makes it easier to manage finances effectively.

Expense Report Generation

Expense report generation is a valuable feature for both individuals and businesses. This feature allows users to generate detailed reports of their spending. The reports can be exported in various formats, such as PDF or Excel. This makes it easier to analyze spending patterns and prepare financial statements.

Overall, mobile expense tracking apps, like Emburse, provide a comprehensive solution for managing finances. They offer automated categorization, real-time updates, multi-device synchronization, customizable budgeting tools, and expense report generation. These features help users save time, maintain accuracy, and achieve their financial goals.

Pricing And Affordability

Understanding the pricing and affordability of mobile expense tracking solutions is crucial. Emburse offers various plans to cater to different needs. This section will detail the options available and their value for money.

Free Vs. Paid Versions

Emburse provides both free and paid versions of their expense tracking software. The free version offers basic features, suitable for small businesses or individual use. On the other hand, the paid versions unlock advanced features essential for larger organizations.

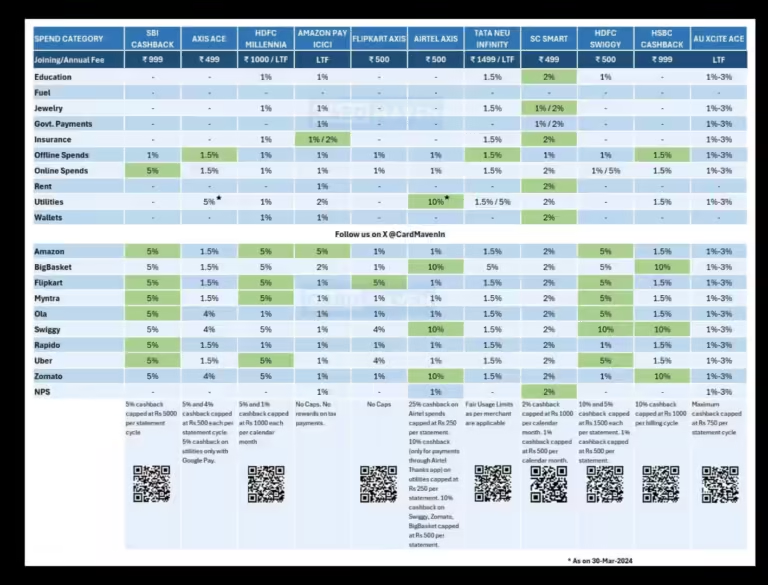

Here’s a comparison table:

| Feature | Free Version | Paid Version |

|---|---|---|

| Expense Management | Basic | Advanced with insights |

| Travel Management | Limited | Comprehensive |

| Payments & Invoice Management | Not available | Automated |

| Insights & Analytics | Basic reports | Data-driven insights |

Subscription Plans

Emburse offers flexible subscription plans tailored to different business needs. Customers can choose from monthly or annual plans. The pricing details are not explicitly mentioned. Interested customers should contact sales for specific pricing information.

Key subscription benefits include:

- Customizable solutions to meet evolving business needs

- Mobile-friendly design for on-the-go management

- Comprehensive support and resources

Value For Money

Emburse provides significant value for money through its expense tracking solutions. The automation of accounts payable and improved cash flow management help control costs. Additionally, the actionable insights allow businesses to make informed decisions and uncover savings.

Benefits of investing in Emburse include:

- Time Efficiency: Save time and focus on future planning

- Compliance and Convenience: Ensure adherence to travel policies

- Cost Control: Automate payment processes and improve visibility

- Data-Driven Decisions: Gain insights to reduce wasteful spending

Overall, Emburse’s pricing plans aim to deliver significant value, making it a worthwhile investment for businesses looking to streamline their expense management processes.

Pros And Cons Of Using Mobile Expense Tracking Apps

Mobile expense tracking apps have become essential tools for managing personal finance and business expenses. These apps offer a range of features that can simplify financial management, but they also come with some drawbacks. Understanding the pros and cons can help you decide if a mobile expense tracking app is right for you.

Advantages

Using mobile expense tracking apps like Emburse comes with numerous benefits:

- Time Efficiency: These apps save time by automating expense tracking and reporting. This allows finance teams to focus on future planning.

- Compliance and Convenience: Ensures adherence to travel policies with user-friendly solutions.

- Cost Control: Automates payment processes, helping to control costs and improve cash flow visibility.

- Data-Driven Decisions: Provides actionable insights to uncover savings and make informed decisions.

- Customizability: Configurable to meet evolving business needs with a mobile-capable design.

Disadvantages

Despite the many advantages, there are also some disadvantages to using mobile expense tracking apps:

- Privacy Concerns: Storing sensitive financial data on a mobile app can be risky if the app lacks robust security measures.

- Cost: Some apps may have high subscription fees, which can be a barrier for small businesses or individuals.

- Complexity: The learning curve for some apps might be steep, making it challenging for non-tech-savvy users.

- Dependency on Technology: Relying on mobile apps means you need a stable internet connection and a compatible device.

- Customization Limitations: Some apps may not offer enough customization options to meet specific business needs.

By weighing these pros and cons, you can make an informed decision about integrating mobile expense tracking apps like Emburse into your financial management routine.

Specific Recommendations For Ideal Users

Emburse offers versatile solutions for various user groups. It caters to individuals, families, and small business owners. Each group can benefit from its unique features. Here are specific recommendations based on user needs.

Best For Individuals

Individuals managing personal finances will find Emburse helpful. It offers expense management and travel management tools. These tools help users track expenses and adhere to travel policies.

- Expense Management: Track personal expenses effortlessly.

- Travel Management: Manage travel expenses with ease.

- Data-Driven Insights: Gain insights into spending patterns.

Emburse simplifies the process of managing personal finances. It helps users save time and make informed decisions.

Best For Families

Families can benefit from Emburse’s comprehensive features. It offers cost control and compliance with policies. Families can manage household budgets and travel expenses efficiently.

- Cost Control: Automate payment processes to control household costs.

- Compliance: Ensure adherence to family travel policies.

- Customizability: Tailor the software to meet family needs.

Emburse helps families manage their finances better. It ensures compliance and promotes cost-saving.

Best For Small Business Owners

Small business owners will find Emburse invaluable. It offers payments & invoice management and insights & analytics. These features help in streamlining financial processes and managing cash flow.

- Payments & Invoice Management: Automate accounts payable and improve cash flow management.

- Insights & Analytics: Use data-driven insights to reduce wasteful spending.

- Compliance and Convenience: Ensure compliance with business travel policies.

Emburse supports small businesses in financial planning and decision-making. It helps save time and uncover savings.

For more information, visit the official website: Emburse.

Frequently Asked Questions

What Is Mobile Expense Tracking?

Mobile expense tracking is managing your expenses using a smartphone app. It helps you monitor spending, budget, and save money. These apps often offer features like receipt scanning, expense categorization, and financial reports.

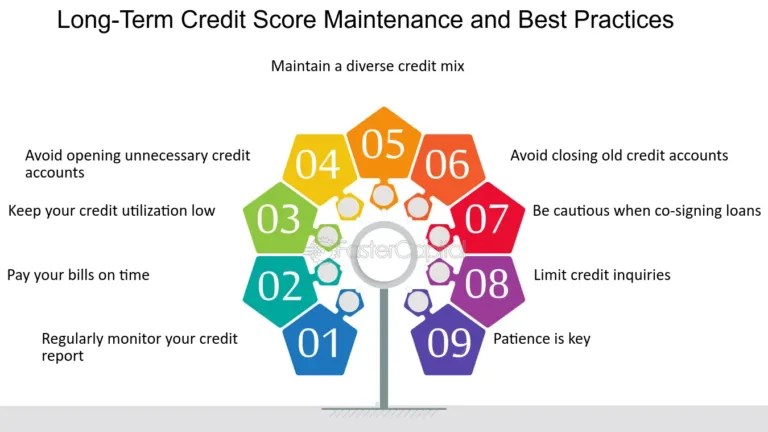

How Do Mobile Expense Trackers Work?

Mobile expense trackers allow users to input and categorize expenses. They often sync with bank accounts and credit cards for automatic updates. Users can generate reports to review spending patterns and adjust budgets accordingly.

Are Mobile Expense Tracking Apps Secure?

Yes, reputable mobile expense tracking apps use encryption to protect your data. Always choose apps with good reviews and trusted developers. Regularly update your apps and devices to maintain security.

Can Mobile Expense Trackers Help Me Save Money?

Yes, mobile expense trackers can help you save money by identifying spending patterns. They allow you to set budgets and track progress. By seeing where your money goes, you can make informed financial decisions.

Conclusion

Tracking your expenses on mobile devices is crucial today. It simplifies managing your finances. With tools like Emburse, you can streamline your expense management. Emburse offers flexible solutions tailored to various industries. It provides insights, automates processes, and ensures compliance. Save time, improve cash flow, and make informed decisions with Emburse. Easy-to-use, mobile-friendly, and efficient. Explore more on their website. Keep your finances in check effortlessly.