Low-Interest Personal Loans: Save Big on Borrowing Costs

Low-interest personal loans can be a smart way to manage your finances. They offer lower rates compared to many other types of credit.

Finding the right personal loan can save you money and reduce stress. With so many options available, it’s crucial to choose wisely. Low-interest personal loans from trusted providers like Upstart can help you meet your financial needs without the burden of high-interest rates. Whether you need funds for unexpected expenses, debt consolidation, or a major purchase, these loans provide a flexible and affordable solution. Understanding how they work and where to find the best deals can make a big difference. Explore the benefits of low-interest personal loans and make informed decisions to secure your financial future. Apply for an Upstart Personal Loan today and take control of your finances.

Introduction To Low-interest Personal Loans

Low-interest personal loans can be a financial lifesaver. They help manage unexpected expenses without high costs. This section will explain what they are and their benefits.

What Are Low-interest Personal Loans?

Low-interest personal loans are loans offered at a reduced interest rate. They are designed for individuals seeking affordable financing options. These loans are often unsecured, meaning no collateral is required.

They are suitable for various needs such as debt consolidation, medical expenses, or home improvement. The key feature is the lower interest rate, which makes them more affordable over time.

Purpose And Benefits Of Low-interest Personal Loans

The primary purpose of low-interest personal loans is to provide financial relief with minimal interest costs. They help individuals manage their finances more effectively.

Here are some benefits:

- Cost Savings: Lower interest rates mean less money spent on interest over the life of the loan.

- Debt Consolidation: Combine multiple debts into one, easier-to-manage payment.

- Flexibility: Use the loan for various purposes, from medical bills to home repairs.

- Improved Credit Score: Making timely payments can boost your credit score.

Overall, low-interest personal loans offer a practical solution for those in need of financial assistance without the burden of high-interest rates.

Key Features Of Low-interest Personal Loans

Low-interest personal loans offer significant advantages for borrowers. They not only help reduce overall debt but also make managing finances easier. Let’s explore the key features of low-interest personal loans.

Competitive Interest Rates

One of the main benefits of low-interest personal loans is the competitive interest rates. These rates are generally lower compared to traditional loans, helping you save money over the loan’s life. For instance, Upstart Personal Loans offer attractive rates to qualified borrowers.

Flexible Repayment Terms

Another standout feature is the flexible repayment terms. Borrowers can choose from a range of repayment options that suit their financial situation. This flexibility ensures you can manage your monthly payments without straining your budget.

No Hidden Fees

Transparency is crucial. Low-interest personal loans often come with no hidden fees. This means no surprise charges, making it easier to understand the total cost of your loan. Upstart Personal Loans are known for their clear and straightforward fee structure.

Quick And Easy Application Process

Time is valuable. The quick and easy application process of low-interest personal loans makes borrowing convenient. Many lenders offer online applications, allowing you to apply from the comfort of your home. For example, Upstart Personal Loans can be applied for online, simplifying the entire process.

How Low-interest Personal Loans Save You Money

Low-interest personal loans can be a great way to manage your finances. They offer significant savings compared to high-interest options. Understanding how these loans save money is essential for making informed decisions.

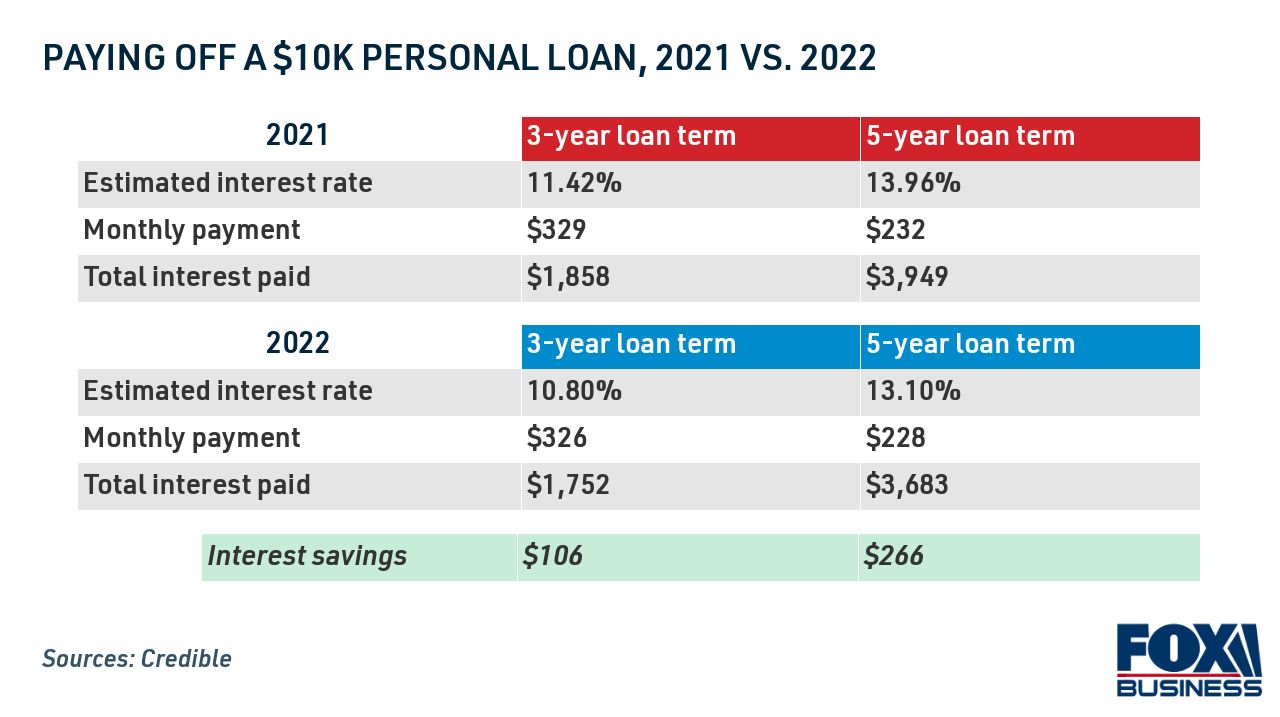

Lower Monthly Payments

One of the biggest advantages of low-interest personal loans is lower monthly payments. With a reduced interest rate, the amount you pay each month decreases. This makes it easier to manage your budget and allocate funds to other expenses.

| Loan Amount | Interest Rate | Monthly Payment |

|---|---|---|

| $10,000 | 5% | $188 |

| $10,000 | 15% | $237 |

The table above shows that a lower interest rate results in a lower monthly payment. This reduction frees up cash for other needs, making life more comfortable.

Reduced Total Interest Paid Over Time

Low-interest personal loans also mean you pay less in total interest over time. The lower the interest rate, the smaller the overall cost of the loan. This is crucial for long-term financial health.

- A loan with a 5% interest rate costs less over its term.

- Higher rates lead to more money paid in interest.

Paying less in interest means keeping more money in your pocket. This can help you save for future goals or emergencies.

Avoiding High-interest Debt

High-interest debt can quickly become overwhelming. Credit card debts often have very high interest rates, which can trap you in a cycle of debt. Low-interest personal loans can help you avoid high-interest debt by offering a more affordable alternative.

- Consolidate high-interest debts into one low-interest loan.

- Reduce the total amount paid in interest.

- Make debt repayment more manageable.

By consolidating debts, you simplify your financial obligations and reduce the stress associated with multiple high-interest payments.

To learn more about low-interest personal loans, visit Upstart Personal Loans.

Pricing And Affordability

Understanding the pricing and affordability of low-interest personal loans is crucial. It can help you manage your finances effectively. This section will explore key factors such as interest rates, comparing lenders, and additional costs.

Understanding Interest Rates And Apr

Interest rates and Annual Percentage Rates (APR) are vital in evaluating loan affordability. The interest rate is the cost of borrowing the principal amount. APR includes interest and other fees, giving a comprehensive cost of the loan.

For instance, a loan with a 5% interest rate might have an APR of 6% when fees are included. Knowing both rates helps you understand the true cost of borrowing.

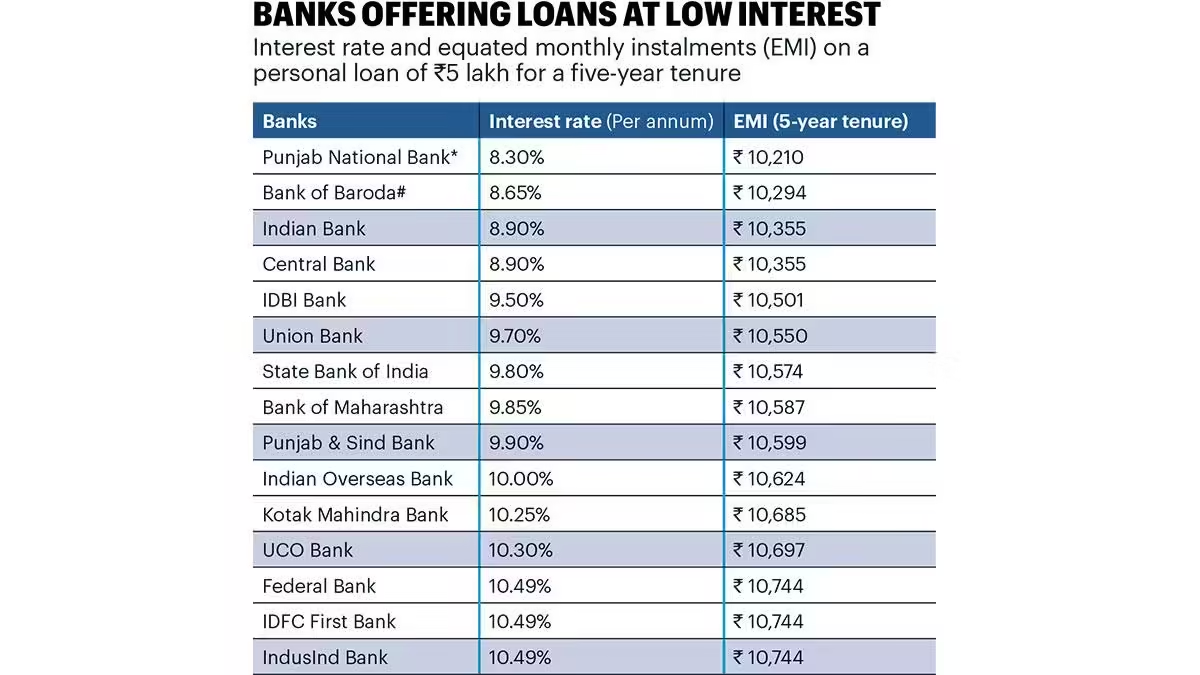

Comparing Different Lenders

Different lenders offer varying interest rates and terms. Comparing them ensures you get the best deal. Here is a table to help with comparison:

| Lender | Interest Rate | APR | Loan Terms |

|---|---|---|---|

| Bank A | 4.5% | 5.2% | 24-60 months |

| Bank B | 5.0% | 5.8% | 12-48 months |

| Upstart Personal Loans | 4.7% | 5.5% | 36-60 months |

By comparing lenders, you can identify the most affordable loan option tailored to your needs.

Additional Costs To Consider

Low-interest personal loans may have additional costs. These can include:

- Origination fees: Charged for processing the loan application

- Late payment fees: Applied if you miss a payment deadline

- Prepayment penalties: Fees for paying off the loan early

Understanding these costs can help you avoid unexpected expenses and choose a more affordable loan.

For example, if a loan has a 3% origination fee on a $10,000 loan, you will pay $300 upfront. Knowing this helps you plan your finances better.

Pros And Cons Of Low-interest Personal Loans

Low-interest personal loans can be a great way to manage your finances. They offer many benefits but also come with some potential drawbacks. Understanding these can help you make an informed decision.

Advantages Of Low-interest Personal Loans

Lower Interest Rates: The most obvious advantage is the lower interest rate. This can save you a significant amount of money over the life of the loan.

Cost-Effective Borrowing: With reduced interest rates, your monthly payments are generally lower. This makes it easier to manage your budget.

Improved Credit Score: Timely payments on a low-interest loan can improve your credit score. This can open up more financial opportunities in the future.

Flexible Use: These loans can be used for various purposes. Whether you need to consolidate debt, make a big purchase, or cover unexpected expenses, they offer flexibility.

Potential Drawbacks To Consider

Eligibility Requirements: Low-interest personal loans often come with stricter eligibility criteria. You may need a good credit score to qualify.

Additional Fees: Some lenders charge additional fees, such as origination fees or prepayment penalties. These can add to the overall cost of the loan.

Variable Interest Rates: Some loans have variable rates, which can increase over time. This could make your monthly payments more expensive.

Debt Accumulation: If not managed properly, taking out a loan can lead to more debt. Ensure you have a solid repayment plan in place.

Ideal Users And Scenarios For Low-interest Personal Loans

Low-interest personal loans can be a great financial tool. They are best suited for those who need quick access to funds without high-interest rates. Understanding who can benefit the most and the best situations to use these loans can help you make informed decisions.

Who Can Benefit Most From Low-interest Personal Loans?

Several groups of people can greatly benefit from low-interest personal loans:

- Individuals with Good Credit: Those with a high credit score can often secure lower interest rates.

- Debt Consolidators: People looking to consolidate high-interest debts into a single, lower-interest loan.

- Home Renovators: Homeowners planning renovations who need affordable financing options.

- Students: Those needing to cover education-related expenses without resorting to high-interest credit cards.

Best Situations To Use Low-interest Personal Loans

Low-interest personal loans are ideal for various situations:

- Debt Consolidation: Combining multiple debts into one loan with a lower interest rate.

- Home Improvement Projects: Financing renovations that add value to your home.

- Unexpected Expenses: Covering emergencies like medical bills or urgent repairs.

- Major Purchases: Financing big-ticket items such as appliances or furniture.

- Special Events: Funding weddings or large family gatherings.

By understanding the ideal users and scenarios for low-interest personal loans, you can better assess if this financial product fits your needs. For more details on personal loans, visit Upstart Personal Loans.

Conclusion And Final Recommendations

Low-interest personal loans can be a great financial tool when used wisely. Let’s recap the key points and provide some final tips to help you make the best borrowing decisions.

Summary Of Key Points

- Low-interest personal loans are ideal for consolidating debt, funding large purchases, or covering emergency expenses.

- Ensure you compare different lenders to find the best rates and terms.

- Check your credit score as it plays a crucial role in getting a low-interest rate.

- Read the loan agreement carefully to avoid hidden fees and charges.

- Use a loan calculator to understand your monthly payments and total interest costs.

Final Tips For Borrowing Wisely

- Assess Your Needs: Determine if a personal loan is the best option for your financial situation.

- Shop Around: Compare offers from multiple lenders to find the most favorable terms.

- Understand the Terms: Read and understand all terms and conditions before signing the loan agreement.

- Maintain a Good Credit Score: Pay your bills on time and keep your credit utilization low to qualify for better rates.

- Borrow Only What You Need: Avoid the temptation to borrow more than necessary to keep your debt manageable.

| Action | Reason |

|---|---|

| Compare Lenders | Find the best rates and terms |

| Check Credit Score | Qualify for lower interest rates |

| Read Loan Agreement | Avoid hidden fees |

| Use Loan Calculator | Understand payments and interest |

| Borrow Wisely | Manage your debt efficiently |

Frequently Asked Questions

What Are Low-interest Personal Loans?

Low-interest personal loans are loans with a lower annual percentage rate (APR). They are ideal for minimizing borrowing costs and saving money.

How Can I Get Low-interest Personal Loans?

To get low-interest personal loans, maintain a good credit score. Compare lenders, apply through reputable banks, or credit unions.

Are Low-interest Personal Loans Unsecured?

Yes, most low-interest personal loans are unsecured. They don’t require collateral, but lenders assess your creditworthiness.

What Factors Affect Personal Loan Interest Rates?

Credit score, loan amount, repayment term, and lender policies affect personal loan interest rates. Better credit scores get lower rates.

Conclusion

Low-interest personal loans can simplify your financial life. They offer lower rates. They also provide flexible terms. This makes managing your finances easier. Interested in a reliable option? Consider Upstart Personal Loans. They offer competitive rates and quick approvals. Check them out today. Make the smart choice for your financial future.