Loan Repayment Strategies: Master Your Debt with Ease

Paying off a loan can be challenging and stressful. But with the right strategies, it becomes manageable and less daunting.

Understanding different loan repayment strategies is crucial for anyone with debt. Effective repayment plans can save you money, reduce stress, and help you achieve financial freedom faster. Whether you are dealing with student loans, credit card debt, or a personal loan, having a clear strategy is essential. In this blog post, we’ll explore various loan repayment strategies to help you choose the best path for your situation. Let’s dive into practical tips that can make a significant difference in your financial journey. For those considering personal loans, Upstart Personal Loans offer a viable option. Learn more about their features and benefits on their official website: Upstart Personal Loans.

Introduction To Loan Repayment Strategies

Repaying loans can be a daunting task, but it is essential for maintaining financial health. Understanding different loan repayment strategies can help you manage debt effectively and avoid financial pitfalls. Let’s explore some of the crucial aspects of loan repayment.

Understanding The Importance Of Repayment

Repaying loans on time is crucial for several reasons:

- Maintains a good credit score

- Avoids late fees and penalties

- Reduces the overall interest paid

- Ensures financial stability

A good credit score opens doors to better financial opportunities. Late payments can negatively impact your credit, making it hard to get future loans. Timely repayment reduces the amount of interest you pay over the life of the loan, saving you money. It also helps you maintain a stable financial situation, reducing stress and improving your quality of life.

Overview Of Common Debt Types

Understanding the types of debt you have is the first step in creating a repayment strategy. Common debt types include:

| Debt Type | Description |

|---|---|

| Credit Card Debt | High interest revolving debt |

| Student Loans | Loans for education, often with lower interest rates |

| Auto Loans | Loans for purchasing a vehicle |

| Personal Loans | Unsecured loans for various personal expenses |

| Mortgage Loans | Secured loans for purchasing a home |

Each type of debt has its own characteristics and strategies for repayment. For instance, credit card debt typically has higher interest rates, so focusing on paying off this debt first can save you money. In contrast, student loans might have more flexible repayment options and lower interest rates.

By understanding your debt types, you can prioritize payments and develop a strategy that works best for your financial situation.

Key Features Of Effective Loan Repayment Strategies

Effective loan repayment strategies help manage debt efficiently. They reduce stress and improve financial health. Below are key methods to consider:

Debt Snowball Method

The Debt Snowball Method focuses on paying off the smallest debts first. This approach builds momentum. Here’s how it works:

- List all debts from smallest to largest.

- Pay minimum payments on all debts, except the smallest.

- Put extra money toward the smallest debt until it’s paid off.

- Move to the next smallest debt and repeat.

This method is effective for those who need quick wins to stay motivated.

Debt Avalanche Method

The Debt Avalanche Method targets debts with the highest interest rates first. This method minimizes the total interest paid. Here’s the process:

- List all debts by interest rate, from highest to lowest.

- Pay minimum payments on all debts, except the one with the highest interest rate.

- Direct extra money toward the debt with the highest interest rate until it’s paid off.

- Move to the next highest interest rate debt and repeat.

This method is ideal for those who want to save the most on interest.

Debt Consolidation

Debt Consolidation involves combining multiple debts into one. This can simplify payments and potentially lower interest rates. Consider these options:

- Personal loans

- Balance transfer credit cards

- Home equity loans

Debt consolidation works best for those with multiple high-interest debts.

Income-driven Repayment Plans

Income-Driven Repayment Plans adjust loan payments based on income and family size. They are beneficial for federal student loans. Common plans include:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

These plans are suitable for those with limited income and high student loan debt.

For more information on managing your loans effectively, check out Upstart Personal Loans.

Benefits Of Each Repayment Strategy

Understanding the benefits of each loan repayment strategy can help you choose the best option. Different strategies offer unique advantages. Let’s explore how each method can work to your advantage.

Debt Snowball: Quick Wins And Motivation

The Debt Snowball method involves paying off your smallest debts first. This approach creates quick wins, helping to build motivation. Here’s how it works:

- Pay off the smallest debt first.

- Use the money saved to pay the next smallest debt.

- Continue until all debts are cleared.

Benefits:

- Immediate sense of accomplishment.

- Increased motivation to tackle larger debts.

- Improved debt management skills.

Debt Avalanche: Long-term Savings On Interest

The Debt Avalanche method focuses on paying off debts with the highest interest rates first. This strategy saves money on interest in the long run. Here’s a breakdown:

- Identify the debt with the highest interest rate.

- Pay off that debt first while making minimum payments on others.

- Move to the next highest interest rate debt.

Benefits:

- Significant savings on interest payments.

- Faster overall debt repayment.

- Reduced financial stress over time.

Debt Consolidation: Simplified Payments

Debt Consolidation combines multiple debts into a single loan. This method simplifies payments and often reduces the interest rate. Here’s the process:

- Combine multiple debts into one loan.

- Make a single monthly payment instead of multiple payments.

- Potentially lower interest rates.

Benefits:

- Simplified payment process.

- Lower overall interest rates.

- Improved credit score with consistent payments.

Income-driven Plans: Flexibility With Income Fluctuations

Income-Driven Repayment Plans adjust your payments based on your income and family size. This approach offers flexibility. Here’s how it works:

- Payments are tied to your income and family size.

- Monthly payments can be adjusted as income changes.

- Potential for loan forgiveness after a set period.

Benefits:

- Payments become more manageable during income fluctuations.

- Reduced risk of default.

- Potential for loan forgiveness.

Evaluating Your Financial Situation

Before diving into loan repayment strategies, it’s crucial to evaluate your financial situation. Understanding your financial standing will help you create a feasible plan. Let’s break down the process into manageable steps.

Assessing Your Debt And Income

Start by gathering information about your debt. List all your loans and their respective balances. Include interest rates and monthly payments for each. A clear picture of your debt helps in prioritizing repayments.

| Loan Type | Balance | Interest Rate | Monthly Payment |

|---|---|---|---|

| Student Loan | $10,000 | 5% | $150 |

| Credit Card | $5,000 | 18% | $200 |

| Auto Loan | $12,000 | 4% | $300 |

Next, review your income sources. Include your salary, freelance work, or any other sources of income. This will help you understand how much money is available for loan repayments.

Setting Realistic Repayment Goals

Setting realistic repayment goals is essential. Start by determining how much you can afford to pay towards your loans each month. Factor in your monthly income and essential expenses. Aim to allocate a specific amount towards debt repayment without compromising on necessities.

- Calculate your total monthly income

- Subtract essential expenses (rent, utilities, groceries)

- Determine the amount left for loan repayments

Set short-term and long-term goals. For example, aim to pay off your smallest loan within six months. Gradually increase payments as your financial situation improves.

Creating A Budget

Creating a budget is a powerful tool for managing your finances. A budget helps you track spending and ensures you stay on track with your repayment goals.

- List all your monthly income sources

- List all your monthly expenses

- Allocate funds for loan repayments

- Track your spending and adjust as needed

Use budgeting tools or apps to simplify the process. Regularly review your budget to ensure you are meeting your repayment goals.

By assessing your debt and income, setting realistic repayment goals, and creating a budget, you can effectively manage your loan repayments. Remember, staying organized and proactive is key to financial success.

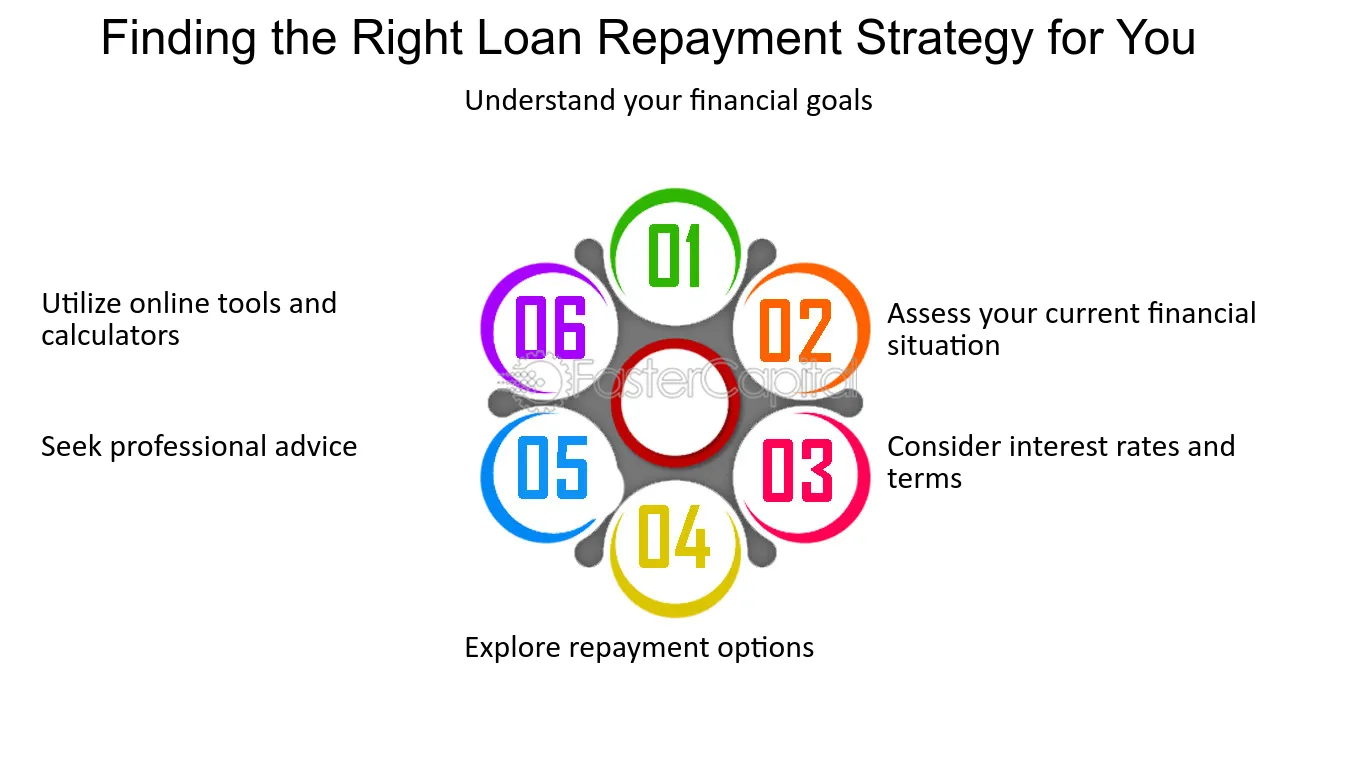

Steps To Implement Your Chosen Repayment Strategy

Implementing a successful loan repayment strategy involves a few critical steps. These steps help you stay on track and ensure timely repayment. Let’s dive into the essential steps that will guide you in managing your repayments effectively.

Organize And Prioritize Debts

Begin by listing all your debts. Include the loan amount, interest rates, and due dates. Use a spreadsheet or a financial app to keep track of this information.

| Debt Type | Loan Amount | Interest Rate | Due Date |

|---|---|---|---|

| Credit Card | $2,000 | 18% | 15th of Each Month |

| Personal Loan | $5,000 | 10% | 1st of Each Month |

Next, prioritize your debts. Focus on paying off high-interest loans first. This approach reduces the total interest paid over time.

Automate Payments

Set up automatic payments to ensure timely repayments. Most banks and loan providers offer this feature. Automating payments avoids late fees and protects your credit score.

- Log in to your bank account.

- Select the option to set up automatic payments.

- Choose the loan and specify the payment amount and date.

By automating, you can focus on other financial goals without worrying about missing payments.

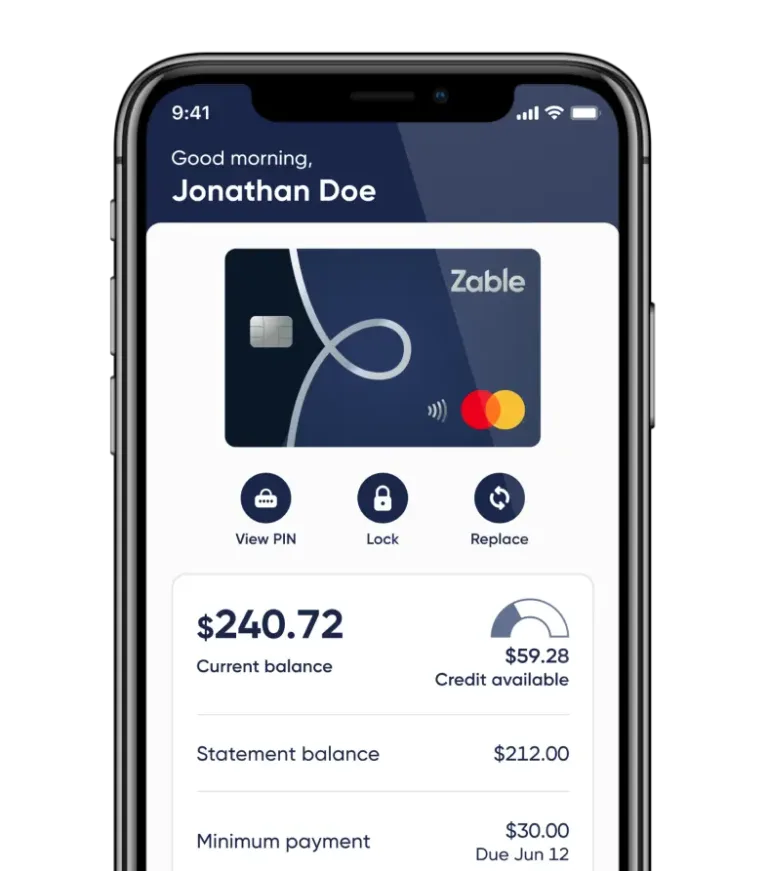

Track Progress Regularly

Consistently monitor your repayment progress. Check your loan balance and payment history at least once a month. Use financial tools and apps to help you stay updated.

- Review your bank statements.

- Check your loan account online.

- Adjust your budget if necessary.

Tracking progress helps you identify any issues early. It also keeps you motivated to continue your repayment plan.

Pricing And Affordability Of Repayment Options

Understanding the pricing and affordability of loan repayment options is crucial for managing your finances. It helps ensure you can comfortably meet your obligations without strain. Below, we delve into key aspects such as costs associated with debt consolidation, interest rates and fees, and the impact on your credit score.

Costs Associated With Debt Consolidation

Debt consolidation is a popular strategy for managing multiple debts. It involves combining several loans into one. This can simplify payments and may reduce the overall interest rate. However, there are costs to consider:

- Origination Fees: Some lenders charge fees to process the new loan.

- Balance Transfer Fees: If consolidating credit card debt, fees may apply.

- Administrative Costs: Additional costs for setting up and managing the new loan.

Interest Rates And Fees

Interest rates and fees significantly affect the total cost of your loan. With Upstart Personal Loans, you may benefit from competitive rates:

| Type | Details |

|---|---|

| Interest Rates | Varies based on credit score and loan amount. |

| Loan Fees | Potential origination fee, depending on the lender. |

Understanding these rates and fees helps you make informed decisions about your loan options.

Impact On Credit Score

Your credit score can be affected by how you manage your loan repayment. Here’s what to consider:

- Payment History: Timely payments improve your score.

- Credit Utilization: Consolidating debt can lower your utilization ratio.

- New Credit Inquiries: Applying for a new loan results in a hard inquiry, which can temporarily lower your score.

Effective management of your loan repayment can lead to a healthier credit profile. This is essential for future borrowing needs.

Pros And Cons Of Different Repayment Strategies

Choosing the right loan repayment strategy is crucial. Each method has its unique advantages and disadvantages. Understanding these can help you make an informed decision. Let’s explore the pros and cons of popular repayment strategies.

Debt Snowball: Pros And Cons

The Debt Snowball method focuses on paying off your smallest debts first. This approach can boost your morale and keep you motivated.

| Pros | Cons |

|---|---|

|

|

Debt Avalanche: Pros And Cons

The Debt Avalanche method targets debts with the highest interest rates first. This can save you money on interest over time.

| Pros | Cons |

|---|---|

|

|

Debt Consolidation: Pros And Cons

Debt Consolidation combines multiple debts into a single loan. This can simplify payments and potentially lower your interest rate.

| Pros | Cons |

|---|---|

|

|

Income-driven Plans: Pros And Cons

Income-Driven Plans adjust your monthly payments based on your income. This can make payments more manageable if you have a lower income.

| Pros | Cons |

|---|---|

|

|

Recommendations For Ideal Users

Finding the right loan repayment strategy can make a significant difference in managing personal finances. Different strategies work better for different financial situations. This section provides tailored recommendations for various types of borrowers. Whether you have high-interest debt, a low income, or multiple loans, the right approach can help you manage your repayments effectively.

Best Strategies For High-interest Debt

High-interest debt can quickly spiral out of control if not managed properly. Here are some strategies to tackle it:

- Debt Avalanche Method: Focus on paying off the highest interest rate debt first. This method saves the most money on interest over time.

- Balance Transfer Credit Cards: Transfer high-interest balances to a card with a lower interest rate. This can reduce the amount of interest you pay.

- Personal Loans: Consider consolidating your high-interest debt with a personal loan. Upstart Personal Loans offers competitive rates that might be lower than your current debt.

Tailored Plans For Low-income Earners

For those with a limited income, managing loan repayments can be challenging. Here are some tailored strategies:

- Income-Driven Repayment Plans: Federal student loans offer plans that adjust your payments based on your income.

- Budgeting: Create a strict budget to ensure you can make your minimum payments. Cut unnecessary expenses where possible.

- Seek Financial Counseling: A financial advisor can help you create a manageable repayment plan tailored to your income.

Options For Those With Multiple Loans

Managing multiple loans can be overwhelming. Here are some strategies to simplify your repayments:

- Debt Consolidation Loans: Combine multiple loans into a single loan with one monthly payment. Upstart Personal Loans can be a good option for this.

- Debt Snowball Method: Pay off the smallest debt first, then move to the next smallest. This method can provide quick wins and motivation.

- Automatic Payments: Set up automatic payments to ensure you never miss a payment. This helps avoid late fees and keeps you on track.

Finding the right loan repayment strategy depends on your specific financial situation. By choosing the appropriate method, you can manage your debt more effectively and work towards financial freedom.

Conclusion: Mastering Your Debt With The Right Strategy

Managing your debt can seem daunting. With the right strategies, you can regain control and financial peace.

Summarizing Key Takeaways

To effectively manage your debt, it’s crucial to understand the different strategies available. Here are key points to remember:

- Debt Snowball Method: Pay off smaller debts first to build momentum.

- Debt Avalanche Method: Focus on debts with the highest interest rates.

- Debt Consolidation: Combine multiple debts into one for easier management.

- Budgeting: Track your income and expenses to allocate funds for debt repayment.

- Automated Payments: Ensure timely payments and avoid late fees.

Encouragement To Take Action

Now that you know the strategies, it’s time to take action. Start by assessing your current financial situation. Choose the strategy that best fits your needs. Commit to your plan and stay consistent.

For personalized loan options, consider Upstart Personal Loans. They offer tailored solutions to help you manage and repay your debts efficiently.

Remember, every small step counts. Stay focused and keep moving forward towards financial freedom.

Frequently Asked Questions

What Is The Best Loan Repayment Strategy?

The best loan repayment strategy depends on your financial situation. Common strategies include the debt snowball and debt avalanche methods. Prioritize loans with the highest interest rates.

How Can I Repay Loans Faster?

To repay loans faster, make extra payments whenever possible. Cut unnecessary expenses and increase your income. Consider refinancing for better rates.

Should I Consolidate My Loans?

Consolidating loans can simplify payments and possibly lower interest rates. However, it may extend the repayment period. Evaluate all terms before deciding.

Is It Better To Pay Off High-interest Loans First?

Yes, paying off high-interest loans first can save you money in the long term. It reduces the total interest paid over time.

Conclusion

Effective loan repayment strategies can simplify your financial journey. Prioritize your debts wisely. Explore options like Upstart Personal Loans for better management. Taking small, consistent steps helps in the long run. Remember, being proactive is key. Stay committed to your repayment plan. This reduces stress and improves financial health. Start today and see the difference. For more details, visit Upstart Personal Loans.