Loan Comparison Websites: Find the Best Loan Rates Online

Navigating the world of loans can be overwhelming. Loan comparison websites simplify this process.

They allow you to compare different loans quickly and efficiently. In today’s digital age, finding the best loan is easier than ever. Loan comparison websites provide a valuable service by laying out your options in an easy-to-understand format. These platforms can help you save time and money by highlighting the best deals based on your unique needs and financial situation. By using these websites, you can make informed decisions with confidence. Whether you need a personal loan, a mortgage, or a car loan, these tools can guide you toward the best choice. Ready to explore your options? Discover how Upstart Personal Loans can assist you in finding the right loan for your needs.

Introduction To Loan Comparison Websites

Loan comparison websites have become essential tools for borrowers. These platforms provide a clear view of various loan options available. They help users find the best loan deals with ease and efficiency. Understanding how these websites work can save time and money.

Understanding Loan Comparison Websites

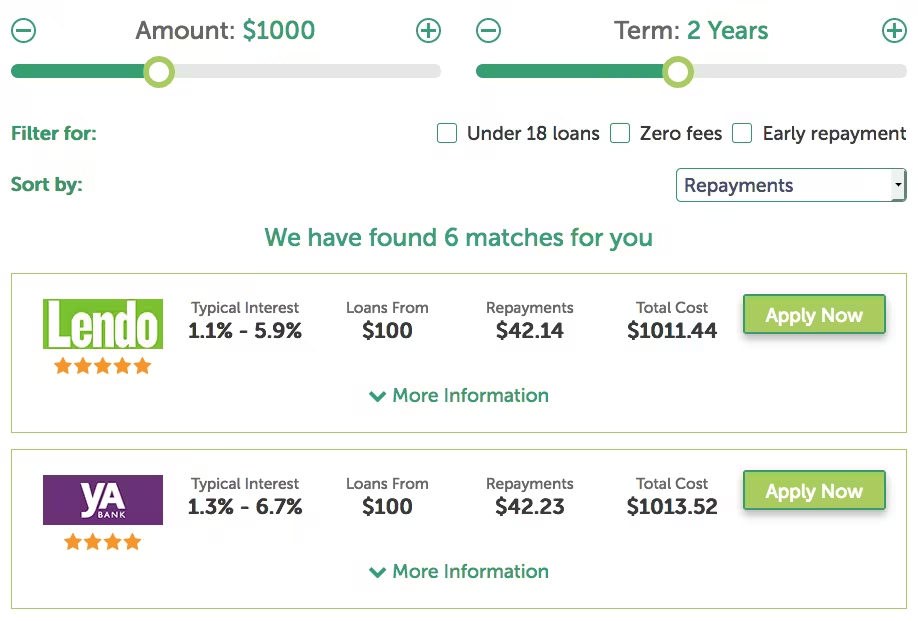

Loan comparison websites gather information from multiple lenders. They present this information side by side for easy comparison. Users can see different loan terms, interest rates, and fees. This transparency helps borrowers make informed decisions.

These websites often provide filters. Users can customize their search based on loan amount, term length, and other criteria. This customization makes it easier to find loans that meet specific needs.

Purpose And Benefits Of Using Loan Comparison Websites

The primary purpose of loan comparison websites is to simplify the borrowing process. They offer several benefits:

- Time-Saving: No need to visit multiple lender websites.

- Cost-Efficient: Easily compare interest rates and fees to find the best deal.

- Transparency: Clear information on loan terms, helping to avoid hidden costs.

- Convenience: Access from anywhere with an internet connection.

These benefits make loan comparison websites a valuable resource for anyone looking to borrow money. They streamline the search process and enhance decision-making.

Key Features Of Loan Comparison Websites

Loan comparison websites offer many features to help users find the best loan options. These platforms make the process simple and efficient, saving time and money. Let’s explore the key features that make these websites valuable for anyone seeking a loan.

Comprehensive Loan Listings

Loan comparison websites provide extensive lists of loan options from various lenders. Users can view different loan types, including personal loans, mortgage loans, and auto loans. This comprehensive listing ensures that users have access to a wide range of choices.

User-friendly Interface

A user-friendly interface is crucial for an enjoyable experience. These websites offer intuitive designs that are easy to navigate. Clear menus, search bars, and straightforward layouts help users find information quickly.

Real-time Rate Comparisons

Real-time rate comparisons are another essential feature. Loan comparison websites update interest rates and terms continuously. Users can see the most current rates and select the best deal available.

Customizable Search Filters

Customizable search filters allow users to narrow down their options. Filters include loan amount, interest rate, loan term, and lender type. These options help users find loans that meet their specific needs.

Customer Reviews And Ratings

Customer reviews and ratings provide valuable insights into the experiences of other borrowers. These reviews help users assess the reliability and service quality of different lenders. Loan comparison websites often feature ratings and detailed reviews to guide users.

Loan Calculators And Tools

Loan calculators and tools are essential for informed decision-making. These tools allow users to calculate monthly payments, interest costs, and loan affordability. Loan comparison websites offer various calculators to help users understand the financial implications of their choices.

Pricing And Affordability

Understanding the pricing and affordability of loan comparison websites is crucial. This ensures you get the best deal without unexpected costs. Below, we explore various aspects of the costs associated with these platforms.

Cost Of Using Loan Comparison Websites

Most loan comparison websites offer a range of pricing models. Some platforms are free, while others charge a fee. The cost can depend on the features offered. Free platforms might have basic services, whereas paid versions often provide more comprehensive comparisons and additional tools. It is essential to understand what you are paying for and if it aligns with your needs.

Are There Hidden Fees?

Hidden fees can be a concern when using loan comparison websites. Always check the terms and conditions. Look for any mention of additional charges. Some platforms might include fees for advanced features or premium services. It is wise to be aware of these potential costs to avoid surprises.

Free Vs. Paid Services

| Feature | Free Service | Paid Service |

|---|---|---|

| Basic Comparison | Included | Included |

| Advanced Tools | Limited | Comprehensive |

| Customer Support | Basic | Priority |

| Additional Resources | Few | Extensive |

Free services are great for simple comparisons. Paid services offer more detailed analysis and better support. Choose based on your requirements and budget. If you need advanced tools and resources, investing in a paid service could be beneficial.

Pros And Cons Of Using Loan Comparison Websites

Loan comparison websites have become popular tools for those seeking financial products. They help users compare different loans based on various factors. But like every tool, these websites have their own set of advantages and potential drawbacks.

Advantages Of Loan Comparison Websites

Using loan comparison websites offers several benefits:

- Time-Saving: Users can compare multiple loan options in one place, saving time and effort.

- Comprehensive Information: These websites provide detailed information about interest rates, fees, and terms.

- Better Decision-Making: With all the information at hand, users can make more informed decisions.

- Accessibility: Loan comparison websites are accessible 24/7, providing convenience for users.

Potential Drawbacks And Limitations

Despite the many advantages, there are some limitations to using loan comparison websites:

- Inaccurate Information: Sometimes, the data may not be updated in real-time, leading to inaccurate comparisons.

- Limited Options: Not all lenders are listed on comparison websites, which might limit choices.

- Biased Listings: Some websites may have sponsored listings that appear more prominently.

- Security Concerns: Users need to ensure the website is secure to protect their personal information.

Overall, while loan comparison websites like Upstart Personal Loans offer significant benefits, it’s essential to be aware of their limitations. Users should cross-check information and consider multiple sources before making any financial decisions.

Specific Recommendations For Ideal Users

Loan comparison websites can be a game-changer for many users. To maximize their benefits, it’s crucial to know which platform suits your specific needs. Below are tailored recommendations for various types of borrowers.

First-time Borrowers

First-time borrowers often need clear guidance and simple processes. Upstart Personal Loans is an excellent choice. It offers an intuitive interface and educational resources that make borrowing easy. The platform simplifies the loan application process with straightforward steps, ensuring you understand each phase.

Individuals With Bad Credit

People with bad credit may struggle to find favorable loan terms. Some loan comparison websites specialize in options for those with less-than-perfect credit scores. Upstart Personal Loans considers factors beyond credit scores, such as education and employment history. This holistic approach can result in better loan offers for individuals with poor credit.

People Seeking The Lowest Interest Rates

Finding the lowest interest rates is crucial for minimizing loan costs. Many comparison sites provide detailed interest rate comparisons. Upstart Personal Loans offers competitive rates and transparent fee structures. Use their platform to compare interest rates from various lenders and find the most cost-effective option for your needs.

Those Looking For Fast Loan Approval

Fast loan approval can be critical in emergencies. Some comparison websites specialize in quick processing and approval times. Upstart Personal Loans is known for its efficient approval process. Borrowers can receive decisions within minutes and funds shortly after approval, making it ideal for urgent financial needs.

Frequently Asked Questions

What Are Loan Comparison Websites?

Loan comparison websites help you compare different loan options. They provide details on interest rates, terms, and conditions. This helps you make an informed decision.

How Do Loan Comparison Websites Work?

These websites collect data from various lenders. They display loan options side by side for easy comparison. Users can filter results based on their needs.

Are Loan Comparison Websites Reliable?

Yes, most are reliable and updated regularly. They provide accurate information from multiple lenders. Always verify details directly with lenders for assurance.

Do Loan Comparison Websites Charge Fees?

Most loan comparison websites are free to use. They earn through partnerships with lenders. You are not charged for using the service.

Conclusion

Comparing loans online saves time and helps find better deals. Loan comparison websites provide clear, easy-to-understand information. This helps users make informed financial decisions. For a reliable option, consider Upstart Personal Loans. They offer a secure, efficient service for your loan needs. Make the smart choice. Use these tools to find the best loan for you.