Limited Time Offer Flex Credit Card: Unlock Exclusive Benefits Today

Are you ready to take your business’s financial management to the next level? The Limited Time Offer Flex Credit Card might be just what you need.

This card offers incredible benefits designed to support and grow your business. Flex is more than just a credit card; it’s a comprehensive financial platform. It brings all back-office operations into one user-friendly space. With the Flex Credit Card, you get a 60-day interest-free period on all business purchases. Your credit limits grow with your business, ensuring you have the flexibility you need. Plus, the card comes with individual employee cards at no extra cost. Learn more about how the Flex Credit Card can benefit your business by visiting their site: Flex Financial Platform.

Introduction To Limited Time Offer Flex Credit Card

Are you a business owner seeking a credit card that supports your growth? The Limited Time Offer Flex Credit Card is designed with you in mind. This card offers unique benefits tailored to your business needs, helping you manage expenses and cash flow efficiently.

Overview Of The Flex Credit Card

The Flex Credit Card comes with features that make it a valuable tool for any business. It offers a net-60 payment term on all purchases, meaning you can pay your balance within 60 days without incurring interest. Additionally, the card provides 0% interest for the first 60 days if the full balance is paid within this period.

| Main Features | Details |

|---|---|

| Net-60 Payment Term | Pay your balance within 60 days with no interest. |

| 0% Interest for 60 Days | No interest charges if the balance is paid within 60 days. |

| Flexible Credit Limits | Credit limits that grow with your business. |

| Employee Cards | Individual employee cards at no extra cost. |

Purpose And Target Audience

The Flex Credit Card is aimed at businesses looking for a reliable and flexible credit solution. It supports better cash flow management through its interest-free period and adjustable credit limits. This card is ideal for small to medium-sized enterprises that need to streamline their expense management.

- Businesses seeking to improve their cash flow.

- Enterprises needing to manage employee expenses.

- Companies looking for a secure credit solution with robust protection features.

With proactive protection against phishing, device verification, and multi-factor authentication, the Flex Credit Card ensures your business stays secure. It’s issued by Patriot Bank, N.A., under licenses from Mastercard® International Incorporated, providing reliability and trust.

Key Features Of The Flex Credit Card

The Flex Credit Card offers a variety of features designed to support and grow your business. Each feature provides unique benefits, ensuring flexibility, security, and convenience for all cardholders.

Flexible Spending Limits

With the Flex Credit Card, your credit limit grows as your business grows. This means higher spending power when you need it most. The card also allows for individual employee cards at no extra cost, making it easier to manage expenses across your team.

Exclusive Rewards Program

Enjoy 0% interest for 60 days on all business purchases if the full balance is paid within the 60-day grace period. This gives you the flexibility to invest in growth without worrying about immediate interest charges.

Low-interest Rates

The Flex Credit Card offers competitive low-interest rates. This is especially beneficial if you need to carry a balance beyond the 60-day interest-free period. This feature helps in maintaining healthy cash flow for your business.

Comprehensive Fraud Protection

Security is a top priority with the Flex Credit Card. It includes proactive protection against phishing attempts, device verification, robust encryption, and Multi-Factor Authentication (MFA). Additionally, automated fraud monitoring and compliance ensure your transactions are safe.

Global Acceptance And Support

The Flex Credit Card is issued by Patriot Bank, N.A., under licenses from Mastercard® International Incorporated. This means you can use it globally, anywhere Mastercard is accepted. Plus, you have access to 24/7 support for any issues or questions, ensuring your business operations run smoothly.

Pricing And Affordability

The Flex Credit Card offers unique benefits tailored for businesses. Understanding its pricing and affordability is essential. Below, we break down the key aspects of its cost structure, including annual fees, interest rates, and transparency regarding hidden fees.

Annual Fees And Charges

Flex Credit Card stands out with its competitive fee structure. It has no annual fees, which is a significant advantage for businesses looking to minimize expenses. Individual employee cards are provided at no extra cost, making it easier for companies to manage team spending without additional charges.

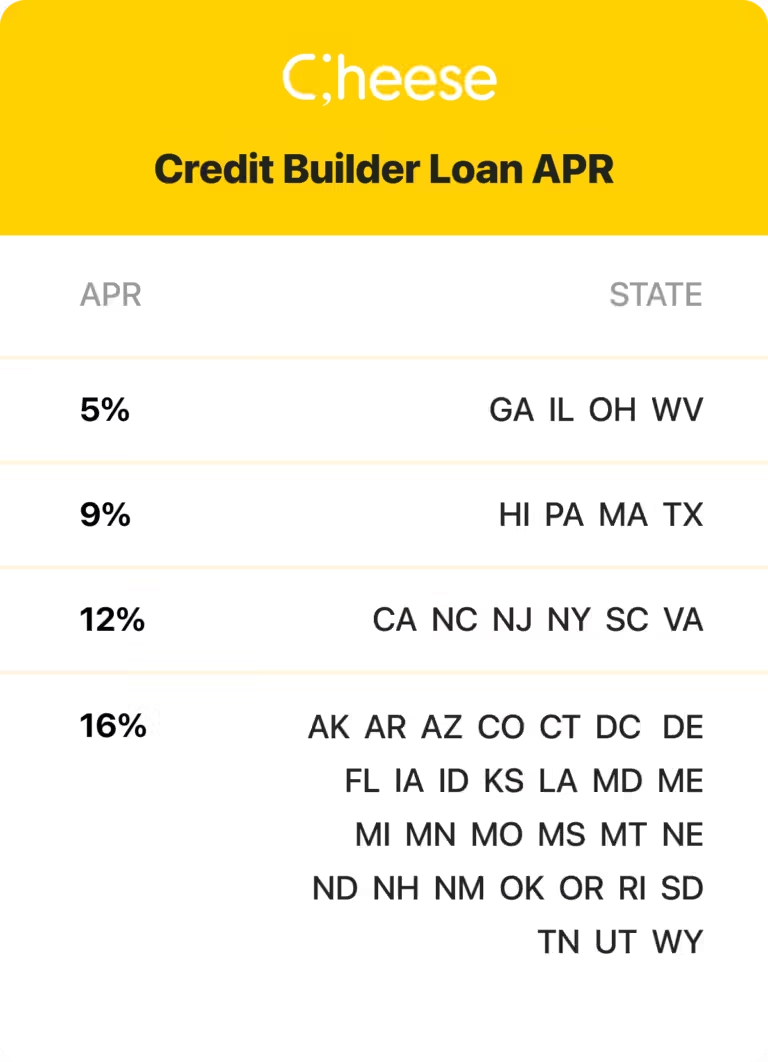

Interest Rates Comparison

One of the most attractive features of the Flex Credit Card is its 0% interest for 60 days. If the full balance is paid within the 60-day grace period, businesses enjoy interest-free financing. This can significantly aid in cash flow management. Compared to other business credit cards, which typically offer shorter interest-free periods or higher interest rates, Flex provides a clear advantage.

Here’s a quick comparison table:

| Card | Interest-Free Period | Standard APR |

|---|---|---|

| Flex Credit Card | 60 days | 0% (if paid within 60 days) |

| Competitor A | 30 days | 15.99% – 24.99% |

| Competitor B | 45 days | 14.99% – 22.99% |

Hidden Fees And Transparency

Flex prides itself on transparency. There are no hidden fees associated with the Flex Credit Card. All charges and fees are clearly outlined in the terms and conditions. This ensures businesses can plan their finances without unexpected costs.

Key points about fees:

- No annual fees

- No fees for individual employee cards

- Clear terms and conditions

By maintaining transparency, Flex builds trust with its users, making it a reliable choice for business financial management.

For more information about the Flex Credit Card, visit Flex Financial Platform.

Pros And Cons Based On Real-world Usage

Using the Flex Credit Card can offer businesses unique advantages but also comes with certain limitations. Here, we break down the pros and cons based on real-world usage to give you a comprehensive view.

Advantages Of Using The Flex Credit Card

Net-60 Payment Terms: The Flex Credit Card offers net-60 on all business purchases. This means you have 60 days to pay off your balance without incurring interest. It provides flexibility for managing cash flow.

0% Interest: If you pay off the full balance within the 60-day grace period, you won’t have to pay any interest. This can save your business a significant amount of money.

Individual Employee Cards: Flex allows you to issue individual cards to employees at no extra cost. It simplifies expense management and ensures better tracking of business spending.

Credit Limits Grow with Your Business: Flex offers credit limits that increase as your business grows. This ensures that your financing needs are met as you scale your operations.

Robust Security Features: The card includes proactive phishing protection, device verification, robust encryption, and Multi-Factor Authentication (MFA). These features ensure your financial data remains secure.

Seamless Expense Management: With features like receipt capture and streamlined payments, managing expenses becomes more straightforward and efficient.

Potential Drawbacks And Limitations

Geographical Restrictions: The Flex Credit Card is not available in California, North Dakota, South Dakota, Vermont, and Nevada. Businesses in these states cannot take advantage of this card.

Shorter Grace Period for Late Payments: The 60-day interest-free period is beneficial, but it requires full balance payment within this timeframe. Missing this window can lead to interest charges.

Dependent on Business Growth: The credit limits grow with your business, but this means that smaller or newer businesses might initially face lower credit limits.

Specific Conditions for APY: Earning up to 2.99% APY on cash requires meeting certain conditions, which might not be feasible for every business.

Potential for Fees: While many features are cost-effective, there might be fees associated with certain transactions or services, which should be reviewed in the account terms and conditions.

Overall, the Flex Credit Card offers significant benefits, especially for businesses focused on growth and efficient expense management. However, understanding its limitations is crucial for making an informed decision.

Ideal Users And Scenarios

The Flex Credit Card offers unique advantages tailored to various user needs. Whether you travel frequently, spend significantly, or prioritize security, this card can serve your business well.

Best Suited For Frequent Travelers

Frequent travelers benefit immensely from the Flex Credit Card. It offers 0% interest for 60 days, allowing you to manage travel expenses without immediate financial strain. Additionally, the card provides individual employee cards at no extra cost, simplifying expense management for your team.

- Free ACH/wire payments

- Issuance of new team cards

- Streamlined receipt capture

Ideal For High-spenders Seeking Rewards

High-spenders find the Flex Credit Card particularly rewarding. The credit limits grow with your business, offering flexibility and support as your spending increases. The card also features up to 2.99% APY on cash on hand, making it a lucrative option for businesses managing significant funds.

- Net-60 on all business purchases

- Flexible credit limits

- Interest-free periods supporting cash flow

Recommended For Security-conscious Users

Security-conscious users will appreciate the robust security features of the Flex Credit Card. It offers proactive protection against phishing attempts and device verification to prevent the use of compromised credentials. The card also includes multi-factor authentication (MFA) and automated fraud monitoring, ensuring your data remains safe.

- Proactive protection against phishing attempts

- Device verification and robust encryption

- Multi-Factor Authentication (MFA)

Conclusion: Is The Flex Credit Card Right For You?

Deciding on a credit card can be a crucial business decision. The Flex Credit Card offers unique advantages that cater to various business needs. Here, we provide a summary of key benefits and final recommendations to help you determine if the Flex Credit Card is the right fit for your business.

Summarizing The Key Benefits

The Flex Credit Card stands out due to its numerous features designed to support business growth:

- Net-60 on all business purchases: This allows for better cash flow management.

- 0% interest for 60 days: Pay the full balance within the grace period to avoid interest.

- Credit limits that grow with your business: Flexibility as your business expands.

- Individual employee cards at no extra cost: Simplify expense tracking and management.

- Robust security features: Including proactive phishing protection, device verification, and multi-factor authentication.

Final Recommendations And Considerations

Before deciding, consider the following:

| Factor | Details |

|---|---|

| Business Size | Ideal for small to mid-sized businesses looking to grow. |

| Cash Flow Needs | Perfect for businesses needing flexible credit limits and extended payment terms. |

| Security Requirements | Advanced security measures ensure your financial data remains safe. |

| Employee Management | Individual cards for employees at no extra cost help streamline expenses. |

Overall, the Flex Credit Card offers a comprehensive solution for managing business expenses efficiently. Evaluate your business needs and consider if the features provided align with your financial goals.

Frequently Asked Questions

What Is The Flex Credit Card Offer?

The Flex Credit Card offer is a limited-time promotion. It provides exclusive benefits and rewards to new cardholders.

How Long Is The Flex Credit Card Offer Valid?

The offer is valid for a limited period. Check the bank’s website for the exact expiration date.

What Are The Benefits Of The Flex Credit Card?

The Flex Credit Card offers cashback, rewards points, and no annual fees. It also includes travel insurance and purchase protection.

Who Is Eligible For The Flex Credit Card Offer?

Eligibility depends on credit score and income. Check the bank’s eligibility criteria for more details.

Conclusion

Don’t miss out on the Flex Credit Card. It offers incredible benefits for businesses. Enjoy 0% interest for 60 days and flexible credit limits. This card simplifies expense management and boosts financial security. Take advantage of this limited-time offer to enhance your business growth. Learn more and apply today by visiting the Flex website.