Interest-Free Payment Plans: Effortless Financing for Your Needs

Interest-Free Payment Plans can make managing your finances easier. Imagine buying what you need now and paying later without extra costs.

Sounds too good to be true? It’s not! Welcome to the world of interest-free payment plans. These plans let you pay for purchases over time without adding interest. This means you don’t pay more than the original price. One service offering this convenience is Perpay. Perpay provides a marketplace to shop for various items and a credit card option, both designed to help you manage your money better. Plus, it helps build your credit score. In this blog, we’ll explore how interest-free payment plans work and why they might be a good fit for you. Learn more about Perpay’s offerings here.

Introduction To Interest-free Payment Plans

Interest-free payment plans are a financial tool that allows consumers to make purchases and pay for them over time without incurring interest charges. This type of financing is gaining popularity, especially for those looking to manage their budgets effectively. One such service offering interest-free payment plans is Perpay.

Understanding The Concept

Interest-free payment plans enable consumers to buy products now and pay later without additional costs. For example, Perpay offers access to a marketplace where users can shop for various items, ranging from electronics to apparel, and pay over time directly from their paycheck. This ensures a seamless and stress-free shopping experience.

Purpose And Importance Of Interest-free Financing

The main purpose of interest-free financing is to provide financial flexibility. It allows consumers to make necessary purchases without the burden of immediate full payment. With Perpay, users can benefit from:

- No Interest or Fees: Users pay over time without incurring extra costs.

- Credit Building: Automatic payments help build a positive credit history, potentially increasing the credit score by an average of 36 points within three months.

- Rewards: Earn 2% rewards on purchases made with the Perpay Credit Card, redeemable in the Perpay Marketplace.

- Convenience: Automatic payments and easy access to a wide range of products.

Perpay’s interest-free payment plan is designed to make shopping more accessible and financially manageable. By offering a marketplace with various product categories and a credit card option, Perpay ensures users have the flexibility and convenience they need.

| Feature | Description |

|---|---|

| Perpay Marketplace | Access to $1,000 for shopping top brands. |

| Perpay Credit Card | Use anywhere Mastercard is accepted with 2% rewards. |

| Credit Building | Automatic payments to build positive credit history. |

| No Interest or Fees | Pay over time without incurring interest or fees. |

For more details, visit the Perpay website.

Key Features Of Interest-free Payment Plans

Interest-free payment plans offer numerous advantages for users. These plans enable you to manage your finances more effectively without the burden of additional costs. Below, we explore the key features that make these plans beneficial.

Flexible Payment Schedules

One of the standout features of interest-free payment plans is their flexible payment schedules. Users can choose from various payment intervals that best suit their financial situation. These plans often allow you to:

- Set up weekly, bi-weekly, or monthly payments.

- Adjust payment dates to align with your paycheck cycle.

- Split large purchases into smaller, manageable amounts.

This flexibility ensures you can keep up with payments without straining your budget.

No Hidden Fees Or Charges

Another major benefit is the absence of hidden fees or charges. With interest-free payment plans, what you see is what you get. Key points include:

- No interest added to your payments.

- No late fees or penalties for missed payments.

- No annual fees or maintenance costs.

This transparency helps you to plan your finances without worrying about unexpected expenses.

Wide Range Of Eligible Purchases

Interest-free payment plans typically cover a wide range of purchases. For instance, Perpay, a popular service in this niche, offers:

- Access to $1,000 for shopping top brands in electronics, home goods, apparel, and more.

- A credit card option that can be used anywhere Mastercard is accepted.

- The ability to earn 2% rewards on purchases made with the Perpay Credit Card.

This broad eligibility makes it easier to manage various expenses under one plan.

| Feature | Description |

|---|---|

| Flexible Payment Schedules | Set up weekly, bi-weekly, or monthly payments. |

| No Hidden Fees or Charges | No interest, late fees, or annual fees. |

| Wide Range of Eligible Purchases | Shop for electronics, home goods, apparel, and more. |

For more details, visit the Perpay website.

Benefits Of Interest-free Payment Plans

Interest-free payment plans allow you to spread the cost of a purchase over time without paying extra fees. They help manage your budget better, making expensive items more affordable. These plans provide a flexible and convenient way to handle big expenses.

Interest-free payment plans offer numerous advantages for consumers. They allow users to make purchases without the burden of interest charges. This can lead to significant savings and financial flexibility. Below are some key benefits of interest-free payment plans, focusing on their budget-friendly nature, ease of access, and enhanced purchasing power.Budget-friendly Financing Option

Interest-free payment plans provide a budget-friendly financing option. By spreading payments over time, you can manage your finances better without incurring additional costs. Here are some ways how:- No Interest or Fees: Pay over time without paying interest or extra fees.

- Flexible Payments: Align payments with your paycheck schedule for easier management.

- Avoid Debt: Make purchases without falling into debt due to interest charges.

Ease Of Access And Approval

These payment plans are designed for ease of access and approval. Here’s how they simplify the process:- Automatic Payments: Payments are automatically deducted from your paycheck, ensuring timely payments.

- No Hard Credit Check: Applying for accounts like Perpay does not affect your FICO® score.

- Wide Eligibility: Available to many consumers, increasing accessibility.

Enhances Purchasing Power

Interest-free payment plans can significantly enhance your purchasing power. They enable you to buy products that might otherwise be out of reach. Consider these points:- Increased Credit Limit: Access up to $1,000 for shopping top brands in various categories.

- Credit Building: Timely payments help build a positive credit history, improving your credit score.

- Rewards: Earn 2% rewards on purchases made with the Perpay Credit Card, which can be redeemed in the Perpay Marketplace.

| Benefits | Details |

|---|---|

| Budget-Friendly | No interest or fees, flexible payments, avoid debt |

| Ease of Access | Automatic payments, no hard credit check, wide eligibility |

| Purchasing Power | Increased credit limit, credit building, rewards |

Pricing And Affordability Of Interest-free Payment Plans

Interest-free payment plans, such as Perpay, offer a unique way to manage finances. These plans allow users to make purchases without the burden of interest. Understanding the pricing and affordability can help make informed decisions.

Comparison With Traditional Financing Options

Traditional financing options often come with interest rates and fees. Let’s compare these with Perpay:

| Feature | Traditional Financing | Perpay |

|---|---|---|

| Interest Rates | Variable, typically 15%-25% | 0% |

| Fees | Late fees, annual fees | No fees |

| Credit Impact | Hard inquiry, affects FICO® score | No FICO® score impact for application |

| Rewards | Limited, varies by card | 2% rewards on Perpay Credit Card |

Affordability Analysis

Affordability is key with interest-free payment plans. Here’s how Perpay stands out:

- No interest means you pay only the purchase price.

- No fees ensure clear, straightforward payments.

- Automatic payments from your paycheck help manage finances easily.

Perpay users can access up to $1,000 in credit for the marketplace. This is a significant amount for everyday purchases. Moreover, the Perpay Credit Card offers flexibility and rewards:

- Use it anywhere Mastercard is accepted.

- Earn 2% rewards on purchases.

The affordability and benefits of Perpay make it a viable option. It supports positive credit history through timely payments and helps improve credit scores. Users have reported an average increase of 36 points within the first three months.

Perpay’s approach, with no interest or fees, ensures that payments remain manageable. This is particularly beneficial for those seeking to build or improve their credit without additional costs.

Pros And Cons Of Interest-free Payment Plans

Interest-free payment plans, like those offered by Perpay, can be a great way to manage your finances. These plans allow you to make purchases and pay them off over time without incurring interest. While this can be very beneficial, there are also some potential drawbacks to consider. Below, we will explore the advantages and potential drawbacks of using interest-free payment plans.

Advantages Of Using Interest-free Payment Plans

- No Interest or Fees: You can make purchases and pay over time without paying extra in interest or fees. This helps you save money in the long run.

- Credit Score Improvement: Timely payments can help build a positive credit history. Perpay users can see an average credit score increase of 36 points within the first three months.

- Rewards: With the Perpay Credit Card, you earn 2% rewards on purchases. These rewards can be redeemed in the Perpay Marketplace.

- Convenience: Automatic payments from your paycheck make it easier to manage your finances. This reduces the risk of missing a payment.

- Product Variety: Access to $1,000 for shopping top brands in electronics, home goods, apparel, and more through the Perpay Marketplace.

Potential Drawbacks To Consider

- Eligibility: Only available to eligible consumers residing in the United States. The Perpay Credit Card is not available to residents of New Hampshire.

- Credit Profile Impact: While applying for a Perpay account does not affect your FICO® score, it may affect your credit profile with Clairity.

- Limited Access: Access to the Perpay Marketplace and credit card is subject to credit approval, which may not be granted to everyone.

- Potential Fees for Perpay+: The Perpay+ service may include a fee, and specific terms and conditions apply.

Interest-free payment plans like Perpay offer significant benefits, such as no interest or fees, credit score improvement, rewards, and convenience. However, it’s essential to consider eligibility, potential credit profile impacts, and other limitations before committing to such a plan.

Ideal Users And Scenarios For Interest-free Payment Plans

Interest-free payment plans offer a convenient way to manage purchases without the burden of additional costs. These plans are suitable for a wide range of users and scenarios. Let’s explore the best situations to utilize interest-free financing and the target audience for these plans.

Best Situations To Utilize Interest-free Financing

Big-Ticket Purchases: Interest-free financing is ideal for large purchases. For instance, electronics, home goods, and apparel. Users can shop with ease on platforms like Perpay, which offers access to up to $1,000 in credit for such items.

Building Credit: Those looking to build or improve their credit scores benefit significantly. Perpay users, for example, see an average credit score increase of 36 points in three months.

Flexible Spending: Interest-free plans are perfect for maintaining flexible spending. The Perpay Credit Card can be used anywhere Mastercard is accepted, earning 2% rewards on purchases.

Target Audience For Interest-free Payment Plans

Young Professionals: Many young professionals find these plans useful. They can manage their finances better while purchasing necessary items for work or personal use.

Families: Families can benefit from interest-free plans for buying essential household goods. This helps in spreading out the cost without incurring interest.

Students: Students need affordable ways to purchase study materials, electronics, and other essentials. Interest-free plans provide a manageable way to finance these needs.

Credit Builders: Individuals aiming to build or repair their credit history find these plans beneficial. Perpay’s automatic payments help users build a positive credit history.

Online Shoppers: Frequent online shoppers enjoy the convenience of buying now and paying later. They can shop top brands in various categories without the stress of immediate payment.

Conclusion: Making The Most Of Interest-free Payment Plans

Interest-free payment plans offer a valuable way to manage finances. By understanding their benefits, you can make the most of these plans and achieve financial stability.

Summary Of Key Takeaways

- Perpay Marketplace: Access to $1,000 for shopping top brands in various categories.

- Perpay Credit Card: Use anywhere Mastercard is accepted and earn 2% rewards on purchases.

- Credit Building: Automatic payments from your paycheck help build a positive credit history.

- No Interest or Fees: Pay over time without incurring extra costs.

- Credit Score Improvement: Potential increase in credit score by an average of 36 points within three months.

Final Recommendations

To make the most of interest-free payment plans, follow these recommendations:

- Stay On Top of Payments: Ensure timely automatic payments to build a positive credit history.

- Use Rewards Wisely: Take advantage of the 2% rewards on the Perpay Credit Card to maximize benefits.

- Monitor Your Credit Score: Track your credit score regularly to see the impact of timely payments.

- Utilize Marketplace Credit: Use the $1,000 credit wisely to make necessary purchases without overspending.

- Review Terms: Understand the Perpay Credit Card Rewards Program Terms and Marketplace Terms and Conditions.

Interest-free payment plans can be a powerful tool when used correctly. By following these tips, you can enjoy the benefits of Perpay and improve your financial health.

Frequently Asked Questions

What Are Interest-free Payment Plans?

Interest-free payment plans allow you to spread the cost of a purchase over time without paying interest. These plans are often offered by retailers or financial institutions, making large purchases more manageable.

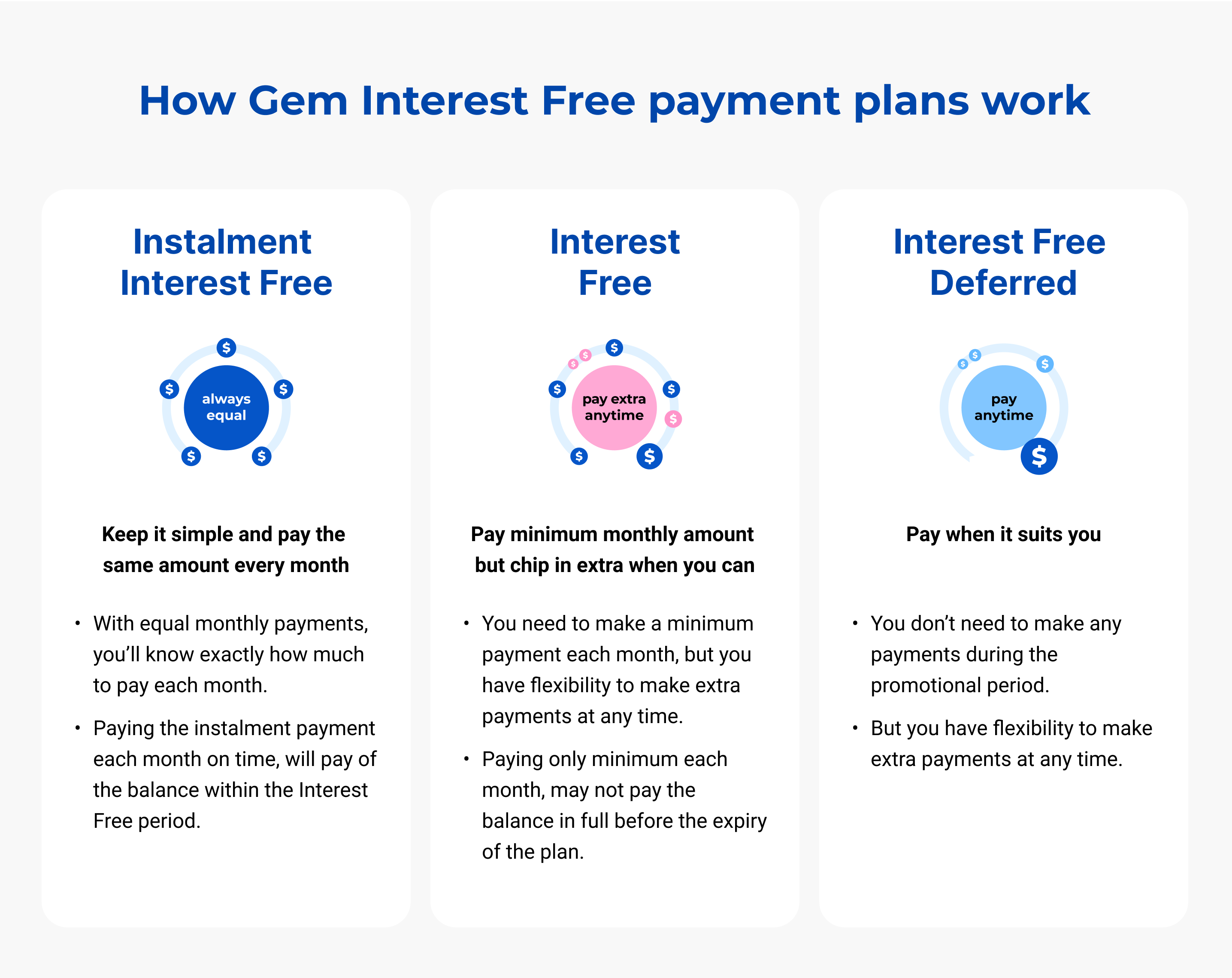

How Do Interest-free Payment Plans Work?

Interest-free payment plans divide your total purchase amount into equal installments. You pay these installments over a specified period without any interest charges, making the purchase more affordable.

Are There Fees For Interest-free Payment Plans?

Some interest-free payment plans may have fees, such as late payment or setup fees. It’s important to read the terms and conditions carefully to understand any potential costs.

Who Can Benefit From Interest-free Payment Plans?

Anyone looking to manage their budget and avoid interest charges can benefit from interest-free payment plans. They are especially helpful for making larger purchases more affordable.

Conclusion

Interest-free payment plans offer a smart way to manage your finances. Perpay provides a convenient solution for shopping and building credit. With automatic payments and no interest, it’s a stress-free option. Plus, you earn rewards on purchases. Interested in learning more about Perpay? Visit their website for detailed information. This platform could be the financial tool you need. Explore the benefits and start building your credit today.