Instant Credit Decision: Get Approved in Minutes!

In today’s fast-paced business world, getting quick access to credit can be a game-changer. An instant credit decision can make a significant difference in seizing opportunities and managing cash flow effectively.

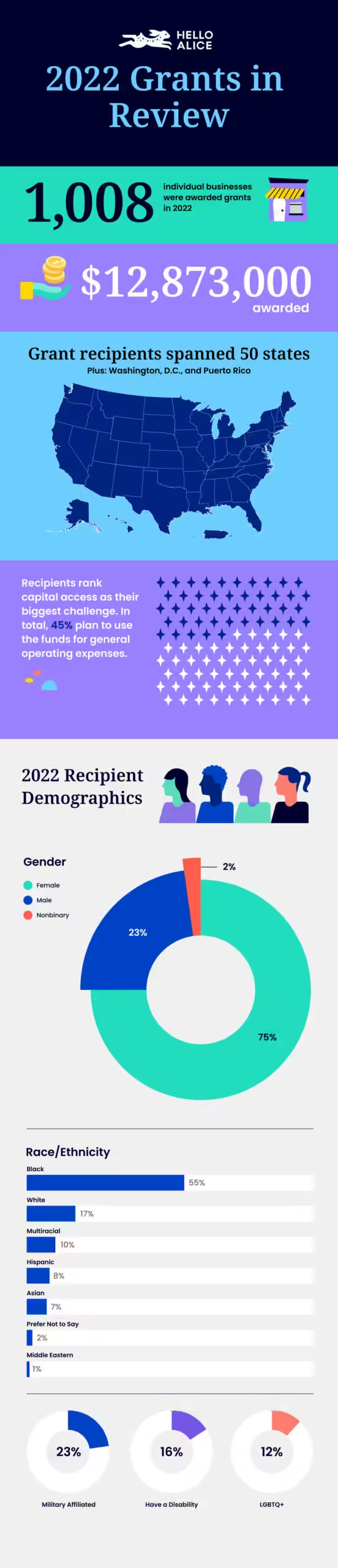

But what exactly is an instant credit decision, and how can it benefit your business? Understanding your business’s financial health is crucial for obtaining credit. The Hello Alice Business Health Score™ Assessment offers a comprehensive evaluation tool designed to help small businesses. This free tool provides insights into how banks and investors perceive your financial health. With personalized growth plans and improvement frameworks, you can optimize your operations and unlock opportunities for growth. Join a network of 1.4 million businesses focused on success and earn rewards as you improve your business health score.

Introduction To Instant Credit Decision

Small businesses often need quick access to credit. The Instant Credit Decision makes this possible. It helps evaluate creditworthiness quickly, enabling faster financial decisions. Let’s delve into what it means and why it matters.

What Is Instant Credit Decision?

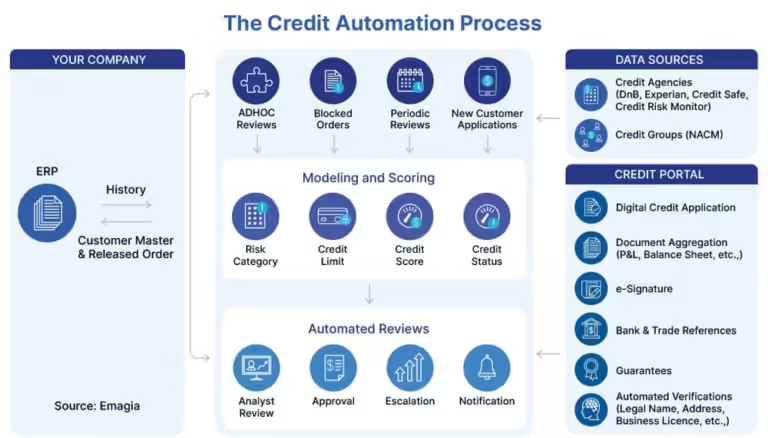

Instant Credit Decision is a process where businesses receive immediate feedback on their credit applications. This technology evaluates various financial factors in real-time.

The Hello Alice Business Health Score™ Assessment plays a crucial role in this process. It evaluates a business’s financial health and provides insights for growth.

Purpose And Benefits Of Instant Credit Decision

The main purpose of Instant Credit Decision is to save time. Traditional credit decisions can take days or weeks. Instant decisions can occur within minutes.

Benefits of Instant Credit Decision include:

- Speed: Get faster feedback on credit applications.

- Efficiency: Streamline the credit approval process.

- Financial Fitness: Use tools like the Hello Alice Business Health Score™ Assessment to understand your financial health.

- Growth Opportunities: Unlock new opportunities for business growth and optimization.

The Hello Alice Business Health Score™ Assessment offers personalized growth plans and step-by-step frameworks. It helps businesses improve their financial health and achieve better credit outcomes.

Additionally, businesses can access rewards for their progress. This includes grants, discounts, and other opportunities.

The Instant Credit Decision process, supported by tools like Hello Alice, is invaluable for small businesses. It provides the necessary insights and quick feedback to make informed financial decisions.

Key Features Of Instant Credit Decision

Instant credit decisioning has revolutionized the way businesses and individuals apply for and receive credit. The process is marked by several key features that ensure a seamless, efficient, and secure experience. Here are the core elements that make instant credit decisions stand out:

Speed And Efficiency

One of the most significant advantages of instant credit decisions is their speed and efficiency. Traditional credit applications can take days or even weeks to process. In contrast, instant credit decisions are made within minutes. This rapid response time is crucial for businesses needing quick access to funds. It allows them to seize opportunities without delay.

Automated Decision-making Process

The process relies heavily on an automated decision-making process. Advanced algorithms and machine learning analyze an applicant’s financial data in real-time. This automation reduces the likelihood of human error and ensures a fair and unbiased evaluation. Applicants receive immediate feedback on their credit status, which helps them plan accordingly.

Secure And Confidential Transactions

Security is a top priority in instant credit decisioning. The transactions are designed to be secure and confidential. Advanced encryption technologies protect sensitive data during the application process. This ensures that personal and financial information remains private and safeguarded against unauthorized access.

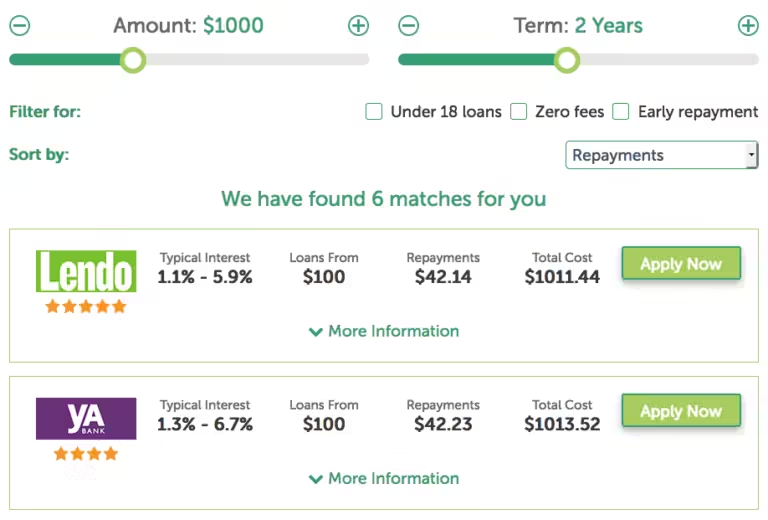

Wide Range Of Credit Options

Instant credit decisioning offers a wide range of credit options tailored to meet diverse needs. Whether you are a small business owner seeking a loan or an individual applying for a credit card, there are options available to suit your requirements. This flexibility makes it easier for applicants to find the right credit products that align with their financial goals.

Pricing And Affordability

When considering instant credit decisions, pricing and affordability are critical factors. Understanding the costs involved can help you make informed choices.

Cost Of Instant Credit Services

The cost of instant credit services can vary. Some providers offer free services, while others may charge a fee. For example, the Hello Alice Business Health Score™ Assessment is available at no cost. This free service provides small businesses with valuable insights into their financial health.

Comparison With Traditional Credit Application Processes

Traditional credit application processes often involve extensive paperwork and long waiting times. Instant credit services provide a faster alternative, which can be more affordable in the long run. Here’s a comparison:

| Aspect | Instant Credit Services | Traditional Credit Applications |

|---|---|---|

| Approval Time | Minutes to Hours | Days to Weeks |

| Cost | Varies (often free) | Varies (may include fees) |

| Paperwork | Minimal | Extensive |

| Convenience | High | Low |

Hidden Fees And Charges

It’s important to be aware of any hidden fees and charges associated with instant credit services. While some services are free, others may include hidden costs. Always read the fine print and understand the terms. For example, the Hello Alice Business Health Score™ Assessment is transparent with no hidden fees, ensuring small businesses can trust the service.

Pros And Cons Of Instant Credit Decision

Instant credit decision services offer quick approvals for credit applications. These services have both advantages and drawbacks. Understanding both sides helps consumers make informed choices.

Advantages Of Instant Credit Approval

Instant credit approval offers several benefits:

- Speed and Convenience: Quick approval means less waiting time. You get immediate access to funds.

- Streamlined Process: Minimal paperwork and faster decision-making improve the customer experience.

- Financial Flexibility: Immediate access to credit can help in emergencies or seizing business opportunities.

Potential Drawbacks And Risks

Despite its benefits, instant credit approval has potential risks:

- Higher Interest Rates: Fast credit approvals may come with higher interest rates compared to traditional loans.

- Limited Review Process: Quick decisions might lead to less thorough financial assessments.

- Potential for Over-Borrowing: Immediate access to funds can tempt users to borrow more than they need.

User Experiences And Feedback

Users have shared mixed experiences with instant credit decisions:

| Positive Feedback | Negative Feedback |

|---|---|

| Quick access to funds helped during emergencies. | Higher interest rates made repayments challenging. |

| Easy application process with minimal paperwork. | Approval process felt too fast, leading to poor financial choices. |

For more comprehensive assessments and growth plans, consider using tools like the Hello Alice Business Health Score™ Assessment. This tool offers personalized growth plans and rewards for improving your business health score.

Ideal Users And Scenarios For Instant Credit Decision

The Instant Credit Decision feature is a game-changer for many users. Understanding who benefits the most and when to use it can help you make the best decision for your business needs.

Best Situations To Use Instant Credit Decision

There are several scenarios where an instant credit decision can be particularly useful:

- Emergency Purchases: When you need to buy something urgently.

- Business Expansion: When you are ready to grow your business quickly.

- Cash Flow Issues: When you face a temporary shortage of funds.

- Time-Sensitive Opportunities: When a limited-time offer requires immediate funds.

Who Benefits Most From Instant Credit Approval?

Several types of users can benefit from instant credit approval:

- Small Business Owners: Quick access to funds can help manage operations smoothly.

- Entrepreneurs: Fast credit approval can support new business ventures.

- Freelancers: Ensures they have the capital needed for project expenses.

- E-commerce Businesses: Helps in managing inventory and other immediate needs.

Real-world Examples And Case Studies

Let’s look at some real-world examples where instant credit decisions made a significant impact:

| Business Type | Scenario | Outcome |

|---|---|---|

| Retail Store | Needed funds to restock before a major holiday | Secured credit instantly and increased sales by 20% |

| Freelance Designer | Required new equipment for a large project | Obtained credit quickly and completed the project on time |

| Online Boutique | Faced sudden inventory shortage due to high demand | Used instant credit to restock and met customer needs |

These examples show how the Instant Credit Decision feature can support various business needs effectively.

Conclusion And Recommendations

The Hello Alice Business Health Score™ Assessment offers valuable insights into your business’s financial health. This tool provides a personalized growth plan, health score measurement, and improvement frameworks. It’s essential to understand how to leverage these features for your business’s success.

Summary Of Key Points

- Personalized Growth Plan: Tailored strategies for your business.

- Health Score Measurement: Understand your business’s financial standing.

- Improvement Frameworks: Step-by-step plans to enhance your score.

- Rewards for Growth: Access to grants and discounts.

- Financial Fitness: Gain insights and open new opportunities.

Final Thoughts And Advice For Potential Users

The Hello Alice Business Health Score™ Assessment is a free tool that can greatly benefit small business owners. By evaluating your financial health and providing personalized frameworks, it helps you optimize your operations and unlock growth opportunities.

Potential users should take advantage of the community support, which includes 1.4 million businesses focused on growth. Additionally, the rewards for progress offer incentives that recognize and support your business’s efforts.

To get started, visit the Hello Alice website and take the free assessment. This tool can be a game-changer in understanding and improving your business’s financial health.

Frequently Asked Questions

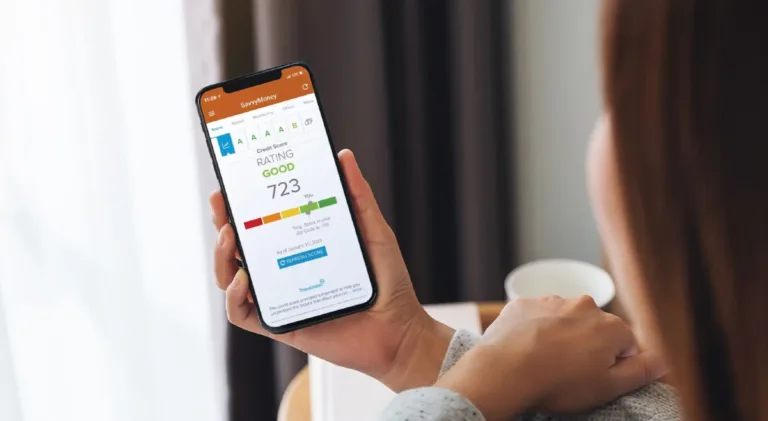

What Is An Instant Credit Decision?

An instant credit decision is a quick evaluation of your credit application. It uses automated systems to provide immediate approval or denial.

How Does Instant Credit Decision Work?

Instant credit decisions work by using algorithms to assess your creditworthiness. They analyze your credit history, income, and other factors instantly.

Are Instant Credit Decisions Reliable?

Yes, instant credit decisions are reliable. They use advanced technology and data to make accurate assessments quickly.

Can I Get An Instant Credit Decision Online?

Yes, many financial institutions offer instant credit decisions online. You can apply and receive a decision within minutes.

Conclusion

Instant credit decisions make managing finances easier for small business owners. With tools like the Hello Alice Business Health Score™ Assessment, you can evaluate your financial health. This assessment offers personalized growth plans and improvement frameworks. Plus, it provides rewards for progress. It’s a free tool that can help you optimize your business operations. If you want to learn more, visit the Hello Alice website. Start today and take control of your business’s financial future.