Instant Credit Card Approval: Get Approved in Minutes

In today’s fast-paced world, getting instant credit card approval can be a game-changer. It’s a convenient solution for those needing quick access to credit for various needs.

Navigating the world of credit cards can be tricky, especially when you need one fast. Instant credit card approval offers a quick and easy way to get the credit you need without the long wait times. Whether you’re looking to make a big purchase, improve your credit score, or simply want a convenient payment method, instant approval can be a lifesaver. In this blog, we’ll explore the benefits of instant credit card approval and how Nemo Money can help you achieve financial freedom. Get ready to unlock the potential of quick and hassle-free credit approval! For more information, visit Nemo Money.

Introduction To Instant Credit Card Approval

In today’s fast-paced world, waiting for credit card approval can be frustrating. Instant credit card approval offers a quick solution, allowing users to get approved in minutes. This post delves into what instant credit card approval is and its numerous benefits.

What Is Instant Credit Card Approval?

Instant credit card approval refers to the process where credit card applications are reviewed and approved almost immediately. This means applicants do not need to wait for days or weeks to know if they are approved.

The process typically involves a quick credit check and verification of basic information. Once approved, the credit card can be used instantly for online purchases while the physical card is mailed to the user.

The Purpose And Benefits Of Instant Approval

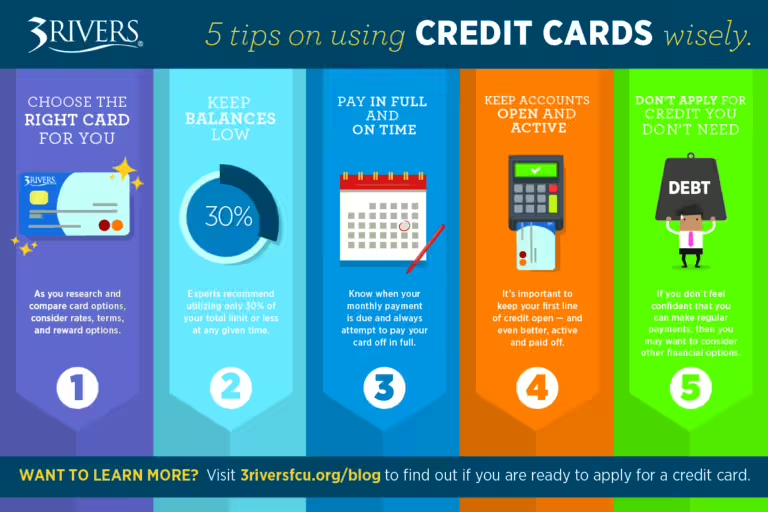

Instant approval credit cards serve several purposes and come with various benefits:

- Convenience: Get approved and start using your credit card in minutes.

- Immediate Access: Use your new credit card for online purchases before the physical card arrives.

- Quick Decisions: Receive a prompt decision on your application, reducing waiting times.

- Build Credit: Start building or improving your credit score immediately upon approval.

- Emergency Use: Ideal for situations where you need access to credit quickly.

The benefits of instant approval credit cards are clear. They offer a seamless experience for users needing quick access to credit.

Key Features Of Instant Credit Card Approval

Instant credit card approval offers a hassle-free way to get a new credit card. It benefits those who need quick access to credit. Here are the key features:

Speed And Convenience

Instant credit card approval emphasizes speed and convenience. Applicants get approval within minutes. This rapid process eliminates long waits. It’s ideal for emergencies or immediate purchases.

Convenience is another highlight. The entire process can be completed online. No need to visit a bank or fill out lengthy paperwork. This feature saves time and effort.

Online Application Process

Applying for an instant credit card is simple. Here’s a step-by-step guide:

- Visit the Website: Go to the credit card issuer’s site.

- Fill Out the Form: Complete the online application form. Provide personal and financial details.

- Submit Documents: Upload necessary documents. This may include ID proof, address proof, and income proof.

- Get Approval: Receive approval within minutes. Some issuers offer instant virtual cards for immediate use.

This online application process is user-friendly and fast. It allows applicants to apply from anywhere, anytime.

Eligibility Criteria And Requirements

Eligibility criteria vary by issuer. However, common requirements include:

- Age: Applicants must be at least 18 years old.

- Income: A minimum income level is often required. This ensures repayment ability.

- Credit Score: A good credit score improves approval chances. Some issuers may accept lower scores with higher interest rates.

- Residency: Applicants must be residents of the country where the card is issued.

Meeting these criteria improves the chances of instant approval. Always check specific requirements before applying.

How Instant Credit Card Approval Works

Instant credit card approval is a convenient process that allows you to get approved for a credit card quickly. The entire procedure is streamlined, ensuring you can start using your new card almost immediately. Let’s break down how this process works step-by-step.

Application Submission

To begin, you need to submit an application for the credit card. This can be done online through the Nemo Money website. You will need to provide:

- Personal information (name, address, date of birth)

- Contact details (email, phone number)

- Financial information (income, employment status)

Ensure all the information is accurate to avoid delays.

Real-time Decision Making

Once you submit your application, the system immediately begins processing it. Nemo Money uses advanced algorithms to evaluate your application in real time. This involves:

- Verifying your identity

- Assessing your creditworthiness

- Checking for any inconsistencies

This rapid evaluation allows for a quick decision, often within minutes.

Credit Check And Verification

During the evaluation, a credit check is performed. This check helps determine your credit score and history. Nemo Money uses secure systems to ensure your data is protected. The verification process includes:

- Checking your credit report

- Ensuring your financial stability

- Confirming your identity with provided documents

Once the credit check is complete, you will receive an instant decision. If approved, your credit card details will be sent to you, and you can start using your new card right away.

Popular Instant Approval Credit Cards

Instant approval credit cards offer a quick and convenient way to access credit. These cards are designed for individuals who need immediate access to funds. Here, we explore some of the most popular options available.

Top Credit Card Options With Instant Approval

Several credit cards offer instant approval. These cards can be a great choice for those who want to start using their credit line immediately. Below are some top choices:

- Nemo Money Credit Card: Known for its unique benefits for investors.

- Instant Approval Platinum Card: Offers a high credit limit and rewards program.

- Quick Access Gold Card: Provides cash back on everyday purchases.

Comparing Features And Benefits Of Popular Cards

Choosing the right instant approval credit card depends on your needs. Here is a comparison of features and benefits:

| Card | Key Features | Benefits |

|---|---|---|

| Nemo Money Credit Card |

|

|

| Instant Approval Platinum Card |

|

|

| Quick Access Gold Card |

|

|

Each of these cards offers unique features and benefits. Consider your spending habits and financial goals when choosing the right card for you.

Pricing And Affordability

When considering instant credit card approval, understanding pricing and affordability is crucial. This includes factors like annual fees, interest rates, introductory offers, and rewards programs. Let’s delve into these aspects to help you make an informed decision.

Annual Fees And Interest Rates

One of the first things to look at is the annual fees. Some credit cards come with no annual fee, while others may charge a fee ranging from $25 to $500. It’s essential to evaluate if the benefits offered justify the annual fee.

Interest rates, often referred to as the Annual Percentage Rate (APR), are another critical factor. Typically, APRs can range from 12% to 24%. A lower interest rate means you pay less if you carry a balance month to month. Always check the card’s terms to understand the interest rate you’ll be charged.

Introductory Offers And Rewards Programs

Many cards offer introductory offers to attract new customers. These can include 0% APR on purchases and balance transfers for an initial period, often 12 to 18 months. This can be beneficial if you plan to make large purchases or transfer a balance from a higher-interest card.

Rewards programs are another key feature. Look for cards that offer rewards on your spending. Common rewards include cashback, travel points, and discounts on future purchases. Choose a card with a rewards program that aligns with your spending habits to maximize your benefits.

Here’s a quick comparison table to summarize these points:

| Feature | Description |

|---|---|

| Annual Fees | Ranges from $0 to $500 |

| Interest Rates (APR) | Ranges from 12% to 24% |

| Introductory Offers | 0% APR for 12-18 months |

| Rewards Programs | Cashback, travel points, discounts |

By understanding these elements, you can choose a credit card that best fits your financial needs and lifestyle.

Pros And Cons Of Instant Credit Card Approval

Instant credit card approval offers the convenience of immediate decision-making. This feature can be a double-edged sword. Let’s explore the advantages and drawbacks of instant credit card approval.

Advantages Of Instant Approval

Instant credit card approval has several benefits:

- Quick Access to Credit: Get a decision within minutes, which is ideal in emergencies.

- Convenience: Apply online and receive an immediate response without visiting a bank.

- Immediate Use: Some issuers provide instant card numbers for immediate purchases.

- Reduced Stress: No waiting for days to know if you are approved.

Potential Drawbacks And Considerations

While instant approval is convenient, it comes with potential drawbacks:

- High-Interest Rates: Instant approval cards may carry higher interest rates and fees.

- Limited Selection: Fewer options compared to traditional credit cards.

- Credit Impact: Multiple applications can harm your credit score.

- Approval Criteria: Instant approval often requires good to excellent credit.

Understanding the pros and cons of instant credit card approval helps make informed decisions. This ensures you get the best card for your needs.

Specific Recommendations For Ideal Users

Instant credit card approval offers a quick way to access credit. While it provides convenience, it is essential to understand who benefits the most from these cards and the best scenarios for their use. Here are some specific recommendations for ideal users of instant approval credit cards.

Who Should Consider Instant Approval Credit Cards?

- Individuals with good credit scores: People with a strong credit history are more likely to receive instant approval.

- Those needing urgent credit: If you need a credit card immediately, instant approval cards can be a good choice.

- Frequent travelers: Many instant approval cards offer travel rewards and benefits.

- People looking to build credit: Some instant approval cards cater to those looking to improve their credit score.

Best Scenarios For Using Instant Approval Cards

Instant approval credit cards shine in specific scenarios. Here are some of the best use cases:

- Emergency expenses: Unexpected costs can be managed efficiently with quick access to credit.

- Travel bookings: Secure bookings with travel rewards credit cards instantly.

- Online shopping: Take advantage of discounts and cashback offers.

- Initial credit building: Young adults or those new to credit can start building their credit history.

Consider these recommendations and scenarios to determine if instant approval credit cards suit your needs. Always review the terms and conditions before applying.

Frequently Asked Questions

What Is Instant Credit Card Approval?

Instant credit card approval means you receive a decision quickly, often within minutes. It streamlines the application process.

How To Qualify For Instant Credit Card Approval?

To qualify, you need a good credit score and financial stability. Meeting the issuer’s requirements is crucial.

Which Banks Offer Instant Credit Card Approval?

Many major banks offer it, including Chase, American Express, and Capital One. Check their websites for details.

Does Instant Approval Affect My Credit Score?

Applying can cause a temporary dip in your credit score. It’s a result of a hard inquiry.

Conclusion

Instant credit card approval offers quick financial solutions. It’s convenient and time-saving. Finding the right card ensures benefits and rewards. For those interested in investing, consider exploring options like Nemo Money. Nemo provides access to global stocks and ETFs. It’s user-friendly and secure, making it a solid choice. Always evaluate your financial needs and choose wisely. Quick approvals and secure investments can enhance your financial flexibility. Ready to explore more? Visit Nemo Money today for more details.