Instant Approval Personal Loans: Get Funds in Minutes

Getting a personal loan with instant approval can be a real lifesaver. It provides quick financial support when you need it most.

Imagine facing an urgent financial need and not knowing where to turn. With instant approval personal loans, you can get the funds you need quickly and without hassle. These loans offer a simple application process, often requiring minimal documentation. They are ideal for dealing with unexpected expenses or consolidating debt. In this blog post, we will explore the benefits of instant approval personal loans and how Upstart Personal Loans can be a great option for you. Get ready to learn about a fast, convenient way to handle your financial needs. To learn more, visit Upstart Personal Loans.

Introduction To Instant Approval Personal Loans

Instant approval personal loans offer a quick and easy way to get funds. They have become popular due to their fast processing time. You can access these loans without lengthy paperwork. This is ideal for urgent financial needs. Let’s explore what these loans are and why you might consider them.

What Are Instant Approval Personal Loans?

Instant approval personal loans are financial products designed for speed. They provide quick access to funds upon application. The approval process is automated and often requires minimal documentation. You can receive a decision within minutes. Once approved, funds can be transferred to your bank account quickly.

- Quick Processing: Automated systems review your application swiftly.

- Minimal Documentation: Less paperwork is required compared to traditional loans.

- Fast Fund Transfer: Receive money in your bank account in a short time.

Why Consider Instant Approval Personal Loans?

There are several reasons to consider instant approval personal loans. They are a lifesaver in emergencies. You don’t have to wait long for approval. This quick access to funds helps in urgent situations. Additionally, the process is simple and user-friendly.

- Emergency Situations: Ideal for urgent financial needs.

- Quick Approval: Get approved within minutes.

- Simple Process: Easy application with minimal paperwork.

Instant approval personal loans are also flexible. You can use the funds for various purposes. Whether it’s medical bills or home repairs, these loans can help. They provide a convenient solution for immediate financial needs.

By considering instant approval personal loans, you can manage unexpected expenses with ease. The fast processing and minimal requirements make them a practical choice.

Key Features Of Instant Approval Personal Loans

Instant approval personal loans offer unique benefits for borrowers. They are designed to be quick, convenient, and accessible. Below are the key features that make these loans a popular choice:

Speedy Application Process

One of the standout features is the speedy application process. Applying for an instant approval loan is fast and straightforward. Borrowers can complete the application online in minutes. The quick process ensures you get the funds you need without delays.

Minimal Documentation Required

With these loans, minimal documentation is required. Traditional loans often require extensive paperwork. Instant approval loans simplify this by asking for only essential documents. This makes the process less cumbersome and more accessible.

Flexible Loan Amounts And Terms

Flexible loan amounts and terms are another key feature. Borrowers can choose loan amounts that fit their needs. The terms are also flexible, allowing you to select a repayment plan that suits your financial situation. This flexibility makes it easier to manage repayments.

24/7 Accessibility

Another advantage is the 24/7 accessibility. You can apply for an instant approval loan at any time. There are no restrictions on when you can apply. This round-the-clock accessibility ensures you can get financial support whenever you need it.

How Instant Approval Personal Loans Work

Understanding how instant approval personal loans work is essential for anyone looking to get funds quickly. These loans offer a fast and straightforward process, making them an attractive option for many.

Application Process Overview

The application process for instant approval personal loans is simple. Here’s a quick guide:

- Online Application: Fill out a short form on the lender’s website.

- Personal Information: Provide details like name, address, and employment status.

- Loan Amount: Specify how much you need to borrow.

- Submit: Send the application for review.

Completing the online application usually takes just a few minutes. After submission, the system processes your information almost instantly.

Approval Criteria

To get approved for an instant personal loan, you must meet certain criteria:

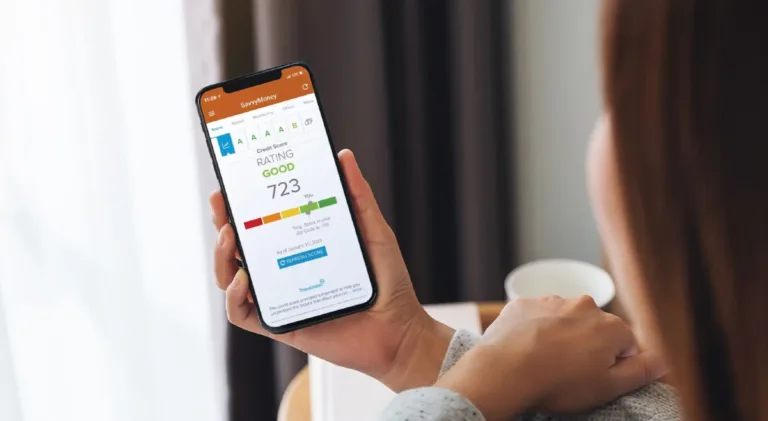

- Credit Score: A good credit score improves your chances of approval.

- Income Verification: Proof of steady income is required.

- Employment Status: Lenders prefer borrowers with stable jobs.

- Debt-to-Income Ratio: A low ratio indicates financial stability.

Meeting these criteria ensures a higher probability of receiving instant approval.

Disbursement Of Funds

Once approved, the loan funds are disbursed quickly:

| Disbursement Method | Timeframe |

|---|---|

| Bank Transfer | Within 24 hours |

| Check | 3-5 business days |

Most borrowers receive their funds through a bank transfer, which is the fastest method.

For more information, visit the Upstart Personal Loans website.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of Instant Approval Personal Loans is essential. This section breaks down the costs, terms, and how these loans compare to traditional loans.

Interest Rates And Fees

Interest rates for Instant Approval Personal Loans can vary. They are often higher than traditional loans. This is due to the quick approval process and minimal documentation required. Fees may include:

- Origination Fees: A percentage of the loan amount.

- Late Payment Fees: Applied if payments are not made on time.

- Prepayment Penalties: Charged for paying off the loan early.

Make sure to review all fees before applying for a loan. This ensures that you understand the total cost.

Repayment Terms

Repayment terms for these loans are usually shorter. They range from a few months to a couple of years. The shorter terms mean higher monthly payments. This can be challenging for some borrowers.

Here are some common repayment term lengths:

| Term Length | Description |

|---|---|

| 6 months | Short-term, higher payments |

| 12 months | Moderate-term, moderate payments |

| 24 months | Longer-term, lower payments |

Choose a term that aligns with your financial situation. Always consider your ability to repay within the chosen term.

Comparison With Traditional Loans

Comparing Instant Approval Personal Loans with traditional loans highlights key differences:

- Approval Time: Instant loans are approved quickly, often within minutes. Traditional loans can take days or weeks.

- Documentation: Minimal documentation is needed for instant loans. Traditional loans require extensive paperwork.

- Interest Rates: Instant loans typically have higher interest rates due to the convenience and speed.

- Repayment Terms: Instant loans usually offer shorter repayment terms. Traditional loans provide longer, more flexible terms.

Consider these factors when deciding between instant approval and traditional loans. Your choice should reflect your need for speed versus cost and repayment flexibility.

Pros And Cons Of Instant Approval Personal Loans

Instant approval personal loans offer quick access to funds. They can be a lifesaver during emergencies. But like all financial products, they come with their pros and cons. Understanding these can help you make an informed decision.

Advantages Of Instant Approval Loans

Instant approval personal loans have several benefits:

- Speed: You get approval within minutes. Funds are often available within a day.

- Convenience: The application process is usually online. This saves time and effort.

- Flexibility: These loans can be used for various purposes. This includes medical bills, car repairs, or other emergencies.

- Accessibility: Instant approval loans are available to a wide range of credit scores. This makes them accessible to many people.

Potential Drawbacks To Consider

Despite the benefits, there are some drawbacks:

- Higher Interest Rates: Instant approval loans often have higher interest rates. This can increase the cost of borrowing.

- Shorter Repayment Terms: These loans may have shorter repayment periods. This can lead to higher monthly payments.

- Risk of Debt: Easy access to funds can lead to impulsive borrowing. This increases the risk of falling into debt.

Ideal Users And Scenarios For Instant Approval Personal Loans

Instant Approval Personal Loans are a quick financial solution for many. They cater to specific users and situations where speed and convenience are crucial. This section delves into who benefits the most and the common use cases for these loans.

Who Benefits The Most?

Instant Approval Personal Loans are perfect for individuals needing quick cash. Here are the main beneficiaries:

- Individuals with urgent financial needs: Those facing sudden expenses like medical bills.

- People with fluctuating incomes: Freelancers or gig workers waiting for payments.

- Applicants with poor credit scores: Easier access compared to traditional loans.

- First-time borrowers: Those without a borrowing history can benefit.

These loans provide a lifeline when traditional loans are not an option.

Common Use Cases And Situations

Instant Approval Personal Loans are versatile. They can be used in various scenarios:

| Scenario | Description |

|---|---|

| Emergency Expenses | Covering unexpected costs like car repairs or medical bills. |

| Debt Consolidation | Combining multiple debts into a single manageable payment. |

| Home Improvements | Funding renovations or essential home repairs. |

| Special Occasions | Financing weddings, vacations, or other significant events. |

These loans provide financial flexibility, ensuring you can handle life’s surprises with ease.

Tips For Choosing The Right Instant Approval Personal Loan

Choosing the right instant approval personal loan can be challenging. With many options available, it’s crucial to make an informed decision. Below are some tips to help you find the best loan for your needs.

Evaluating Lenders

It’s essential to evaluate different lenders before making a decision. Consider the following:

- Reputation: Check online reviews and ratings to see what other customers say.

- Interest Rates: Compare the interest rates offered by different lenders. A lower rate will save you money.

- Fees: Look for any hidden fees or charges that might increase the cost of the loan.

Understanding Terms And Conditions

Understanding the terms and conditions of a loan is crucial. Pay attention to:

- Repayment Period: Know how long you have to repay the loan. Longer periods might mean lower monthly payments but higher overall cost.

- Prepayment Penalties: Some loans have penalties for paying off the loan early. Ensure you understand these terms.

- Eligibility Requirements: Check if you meet the lender’s criteria before applying to avoid unnecessary rejections.

Avoiding Common Pitfalls

Many borrowers make mistakes when choosing a loan. Here are some common pitfalls to avoid:

- Ignoring Credit Score: Your credit score can affect your loan terms. Try to improve it before applying.

- Not Comparing Offers: Always compare multiple offers to find the best deal.

- Overborrowing: Only borrow what you need to avoid unnecessary debt.

By following these tips, you can choose the right instant approval personal loan that fits your needs and budget. Remember to do your research and make informed decisions.

Frequently Asked Questions

What Are Instant Approval Personal Loans?

Instant approval personal loans are loans that get approved quickly, often within minutes. They offer quick access to funds. This is ideal for urgent financial needs.

How Do I Apply For Instant Approval Personal Loans?

You can apply online by filling out a simple form. Provide necessary documents and await approval. Ensure you meet the eligibility criteria.

What Are The Benefits Of Instant Approval Loans?

They provide quick access to funds. The application process is fast and straightforward. Approval is often within minutes.

Are Instant Approval Loans Safe?

Yes, they are safe if you choose a reputable lender. Always check reviews and verify their credentials before applying.

Conclusion

Finding instant approval personal loans can be a hassle-free process. Upstart Personal Loans offer a quick and simple solution. They provide fast approval, helping you meet urgent financial needs. With an easy application process, you can receive funds swiftly. Upstart ensures a smooth experience for genuine users. Consider exploring Upstart Personal Loans for your financial requirements. Click here to learn more about their offerings and apply today.