Increase Credit Limit: Proven Strategies to Boost Your Spending Power

Increasing your credit limit can provide more financial flexibility. It can also improve your credit score if managed wisely.

Understanding how to increase your credit limit is crucial. A higher credit limit means you have more spending power and can manage large expenses better. It can also positively impact your credit utilization ratio, which is a key factor in your credit score. While it sounds beneficial, it’s essential to approach this wisely to avoid accumulating more debt. In this guide, we’ll explore effective strategies to request a higher credit limit, the benefits it offers, and how to ensure it contributes positively to your financial health. For more information on building your credit score and managing your finances, consider checking out Zable UK. Their services include credit cards and personal loans designed to help you improve your credit with ease.

Introduction To Increasing Your Credit Limit

Increasing your credit limit can provide you with more financial flexibility and improve your credit score. Understanding the process and benefits can help you make informed decisions. Zable UK offers credit cards and personal loans to help you build or improve your credit score. Here is what you need to know about increasing your credit limit.

Understanding Credit Limits

A credit limit is the maximum amount you can borrow on a credit card. It is set by the lender based on various factors, including your credit history, income, and current debt levels. A higher credit limit can be beneficial for several reasons, but it requires responsible management.

| Factor | Details |

|---|---|

| Credit History | Your past borrowing and repayment behavior. |

| Income | Your ability to repay based on your earnings. |

| Current Debt | The total amount of debt you currently have. |

The Importance Of Higher Credit Limits

Having a higher credit limit offers several advantages. Here are some key benefits:

- Improved Credit Score: A higher limit can reduce your credit utilization ratio, which positively impacts your credit score.

- Increased Purchasing Power: You have more available credit for emergencies or large purchases.

- Flexibility: It allows you to manage unexpected expenses without maxing out your card.

Zable UK provides tools to help manage your credit effectively. Their app offers features like spend tracking and free credit score access. With over 123,000 positive reviews, Zable is a trusted choice for improving credit limits.

For more details, visit the Zable UK website.

Assessing Your Current Credit Situation

Before increasing your credit limit, it is important to understand your current credit situation. This involves reviewing your credit report and evaluating your credit score. Knowing where you stand can help you make informed decisions about improving your creditworthiness.

Reviewing Your Credit Report

Start by accessing your credit report from a reputable credit bureau. Look for any inaccuracies or errors that may be affecting your credit. Zable UK offers a free credit score and insights through their app, making it easier to monitor your credit status.

- Check for incorrect personal information.

- Review account details for accuracy.

- Identify and dispute any errors.

Having accurate information on your credit report is crucial. It ensures lenders see a true reflection of your credit history, which can impact your ability to get a higher credit limit.

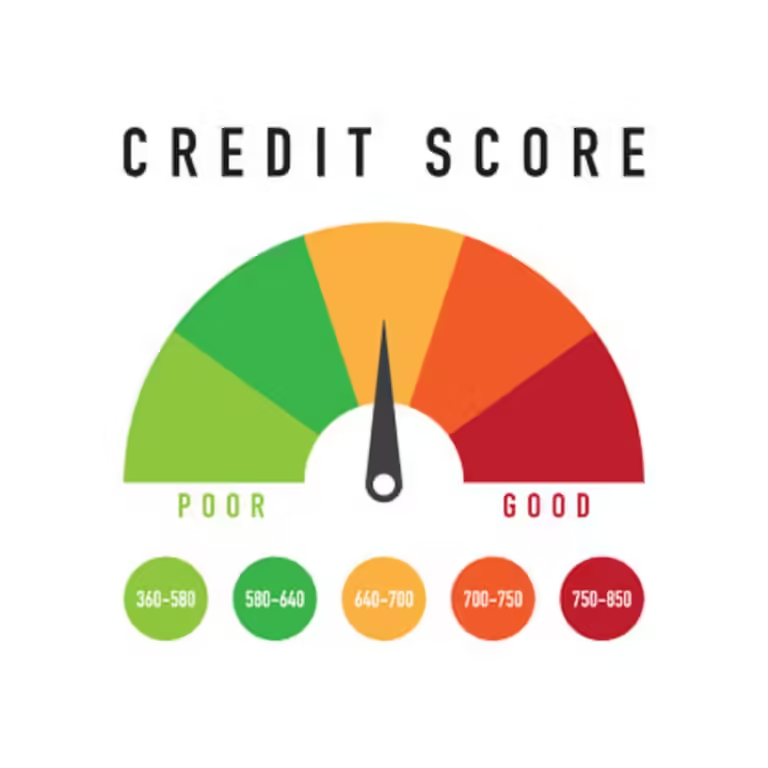

Evaluating Your Credit Score

Your credit score is a numerical representation of your creditworthiness. Zable UK provides access to your Equifax credit score, helping you understand where you stand. A higher credit score generally increases the likelihood of being approved for a credit limit increase.

| Credit Score Range | Rating |

|---|---|

| 800-850 | Excellent |

| 740-799 | Very Good |

| 670-739 | Good |

| 580-669 | Fair |

| 300-579 | Poor |

Understanding your credit score and its impact on your financial health is essential. Regularly checking your score and taking steps to improve it can help you qualify for a higher credit limit with Zable UK.

Proven Strategies To Increase Your Credit Limit

Increasing your credit limit can be a smart move to improve your financial flexibility. By adopting proven strategies, you can effectively boost your credit limit and enhance your credit score. Below are some effective methods to achieve this goal.

Building A Strong Credit History

A strong credit history is essential for increasing your credit limit. Regular use of your credit card and timely payments contribute to a positive credit history. Zable Credit Cards are designed to help you build your credit score with responsible use.

Consider the following steps:

- Use your credit card regularly, but keep balances low.

- Maintain old credit accounts open to show a longer credit history.

- Diversify your credit mix by using different types of credit like personal loans and credit cards.

Timely Payments And Their Impact

Timely payments are crucial for a healthy credit score. Zable offers rent reporting, allowing you to report rent payments to build your credit history. Making payments on time shows lenders that you are reliable.

Here’s how timely payments help:

- Improving your payment history, which is a significant factor in your credit score.

- Demonstrating financial responsibility to lenders.

- Potentially leading to automatic credit limit increases by your card issuer.

Reducing Existing Debt

Reducing existing debt can positively impact your credit score and increase your credit limit. Zable’s spend tracking feature helps you monitor all your accounts in one place, making it easier to manage and reduce debt.

Follow these tips:

- Pay down high-interest debt first to save money on interest.

- Consolidate multiple debts into a single loan with a lower interest rate.

- Create a budget to allocate extra funds towards debt repayment.

Increasing Your Income

Increasing your income can improve your debt-to-income ratio, making you more attractive to lenders. Zable’s eligibility check does not impact your credit score, allowing you to explore credit options without risk.

Consider these methods:

- Take on a part-time job or freelance work to boost income.

- Seek a raise or promotion at your current job.

- Invest in skills or education to qualify for higher-paying positions.

By implementing these strategies, you can effectively increase your credit limit and improve your overall financial health.

Approaching Your Credit Card Issuer

Requesting a credit limit increase from your credit card issuer can be a straightforward process. By understanding the right time and method to make your request, you can increase your chances of success. Below, we will explore the best practices for approaching your issuer, what to include in your request, and tips for negotiating effectively.

When And How To Request A Credit Limit Increase

Timing is crucial when requesting a credit limit increase. Consider the following:

- Have at least six months of consistent, timely payments.

- Ensure your credit score has improved since opening your account.

- Evaluate your current income and expenses.

To make the request:

- Log in to your online account or mobile app.

- Navigate to the “Credit Limit Increase” section.

- Fill out the required information.

- Submit your request.

What To Include In Your Request

When requesting a credit limit increase, include essential details that strengthen your case:

- Income: Provide accurate and up-to-date income information.

- Employment Status: Mention any stable job or recent promotion.

- Financial Obligations: Highlight your ability to manage current credit responsibly.

- Reason for Increase: Explain why you need a higher limit (e.g., increased expenses or improving credit score).

Negotiation Tips

Negotiating for a higher credit limit requires confidence and preparation. Here are some tips:

- Be Polite and Professional: Approach the issuer with a polite and professional tone.

- Know Your Credit Score: Have a clear understanding of your credit score and history.

- Present Supporting Documents: If needed, provide documents like pay stubs or bank statements.

- Be Prepared to Negotiate: Be ready to discuss and negotiate terms if the initial request is denied.

By following these steps, you can effectively approach your credit card issuer for a credit limit increase and improve your financial flexibility with Zable UK.

Utilizing A Higher Credit Limit Responsibly

Increasing your credit limit can offer significant benefits, such as improving your credit score and providing extra financial flexibility. However, it is crucial to manage this responsibly to avoid falling into debt. Here we discuss how to make the most of a higher credit limit.

Avoiding The Pitfalls Of Higher Spending

A higher credit limit can be tempting. Avoid the trap of increasing your spending just because you have more available credit. Stick to your budget and spend only what you can afford to pay off each month. This practice will help you avoid accumulating debt and paying high-interest rates.

- Create and follow a strict budget.

- Track your spending using tools like the Zable app.

- Set alerts for due dates to avoid late payments.

Maintaining A Low Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you use compared to your total available credit. Keeping this ratio low can positively impact your credit score. Aim to use no more than 30% of your available credit limit.

| Credit Limit | Recommended Utilization |

|---|---|

| £1,000 | £300 or less |

| £5,000 | £1,500 or less |

Use the Zable app to monitor your credit utilization and manage your spending effectively.

Monitoring Your Credit Regularly

Regularly checking your credit report can help you stay on top of your financial health. With Zable, you get access to your Equifax credit score and insights. This can help you identify any errors or fraudulent activity early.

- Check your credit score monthly.

- Review your credit report for inaccuracies.

- Report any suspicious activity immediately.

By following these steps, you can utilize your higher credit limit responsibly and enjoy the benefits that come with it.

Alternative Methods To Improve Spending Power

Increasing your spending power can enhance financial flexibility. It allows you to handle unexpected expenses or make larger purchases. There are several alternative methods to achieve this. Below, we explore various options to improve your spending power.

Applying For A New Credit Card

Applying for a new credit card can be an effective way to increase your available credit. This method can be beneficial if you have a good credit score. Zable Credit Cards are designed to help build credit scores with responsible use. They offer features like:

- Free Credit Score: Access to your Equifax credit score and insights.

- Spend Tracking: Monitor all your accounts in one place.

- Virtual Card Usage: Immediate spending with Apple Pay or Google Pay.

- Eligibility Check: Check if you qualify without impacting your credit score.

These features can help you manage your finances better and improve your credit score over time.

Considering Secured Credit Cards

If your credit score is less than perfect, secured credit cards can be a viable option. A secured credit card requires a cash deposit that serves as your credit limit. This deposit reduces the risk for the card issuer, making approval easier. Over time, using a secured credit card responsibly can help you build or improve your credit score.

Zable offers credit cards that are designed to help individuals build their credit scores. By making timely payments and managing your spending, you can gradually improve your creditworthiness.

Exploring Personal Loans

Another method to increase your spending power is by taking out a personal loan. Personal loans can provide you with a lump sum amount that you can use for various purposes, such as consolidating debt or funding a significant purchase.

Zable Personal Loans offer:

| Loan Amount | APR | Repayment Term |

|---|---|---|

| £1,000-25,000 | 9.9% to 49.9% | 1-5 years |

The approval process is quick, typically within an hour, and the funds are disbursed promptly. This can be a convenient option if you need immediate access to cash.

By exploring these alternative methods, you can improve your spending power and manage your finances more effectively. Whether through a new credit card, secured credit card, or personal loan, each option offers unique benefits tailored to different financial situations.

Pros And Cons Of Increasing Your Credit Limit

Increasing your credit limit can be a strategic move for improving your financial health. It offers several advantages and potential risks that should be carefully considered. Let’s explore the pros and cons of increasing your credit limit.

Advantages Of A Higher Credit Limit

A higher credit limit can provide several significant benefits:

- Improved Credit Score: A higher credit limit can lower your credit utilization ratio, which is a key factor in determining your credit score. Keeping your utilization below 30% is recommended.

- Financial Flexibility: With more available credit, you have greater flexibility to manage unexpected expenses or emergencies without maxing out your card.

- Better Rewards: If your credit card offers rewards, a higher limit can allow you to earn more points, miles, or cashback on your purchases.

- Increased Purchasing Power: A higher limit can enable you to make larger purchases without needing to worry about reaching your credit limit.

Potential Risks And Drawbacks

While increasing your credit limit has many benefits, it also comes with potential risks:

- Overspending: A higher credit limit might tempt you to spend more than you can afford to repay, leading to debt accumulation.

- Higher Interest Charges: If you carry a balance, the interest on a higher credit limit can add up quickly, increasing your overall debt burden.

- Credit Score Impact: Requesting a credit limit increase may result in a hard inquiry on your credit report, which could temporarily lower your credit score.

- Potential Fees: Some credit cards may charge fees for increasing your limit, which could outweigh the benefits if not managed properly.

Considering these factors can help you make an informed decision about whether to increase your credit limit.

Recommendations For Ideal Users

Increasing your credit limit can offer many benefits. It can boost your credit score and provide more financial flexibility. However, it’s crucial to understand if you are an ideal candidate for this change. Here are some recommendations for responsible credit limit management.

Best Practices For Responsible Credit Users

- Monitor Your Spending: Use Zable’s spend tracking feature to keep an eye on your expenses. This helps in avoiding overspending.

- Make Timely Payments: Always pay your credit card bills on time. Zable’s credit building benefits rely on timely payments.

- Use Credit Wisely: Avoid maxing out your credit card. Keep your utilization rate low to maintain a good credit score.

- Take Advantage of Financial Insights: Utilize Zable’s financial insights to make informed decisions about your spending and saving habits.

Following these best practices ensures you use your increased credit limit responsibly. It also helps in maintaining a healthy financial profile.

Who Should Avoid Increasing Their Credit Limit

Not everyone benefits from a higher credit limit. Here are some scenarios where it might be wise to avoid increasing your credit limit:

| Scenario | Reason |

|---|---|

| Frequent Overspending | If you struggle with managing your spending, an increased limit might lead to more debt. |

| Unstable Income | Without a steady income, it may be challenging to repay higher credit card bills. |

| High Existing Debt | Adding more credit to an already high debt load can be risky and lead to financial strain. |

If any of these situations apply to you, it might be best to first focus on stabilizing your finances.

Frequently Asked Questions

How Can I Increase My Credit Limit?

You can request a credit limit increase by contacting your credit card issuer. Provide them with your updated income information. Ensure you have a good payment history.

Does Increasing Credit Limit Affect Credit Score?

Yes, increasing your credit limit can positively affect your credit score. It lowers your credit utilization ratio. This shows responsible credit management.

When Should I Request A Credit Limit Increase?

Request a credit limit increase after six months of account opening. Ensure you have a good payment history. Avoid requesting during financial difficulties.

What Are The Benefits Of A Higher Credit Limit?

A higher credit limit can improve your credit score. It provides more financial flexibility. You can make larger purchases and manage emergencies better.

Conclusion

Boosting your credit limit can improve financial flexibility and credit score. Responsible usage and timely payments are key. For reliable credit cards and loans, consider Zable UK. They offer user-friendly tools and fast approval. Check out their offerings here. With Zable, managing and building your credit is simpler.