Improve Financial Standing: Proven Strategies for Success

Improving your financial standing is essential for a stable and stress-free life. It allows you to handle unexpected expenses and plan for the future.

Managing finances can be challenging, especially with multiple debts. Many struggle to keep up with various payments, often at high-interest rates. This is where Mitigately comes in. Mitigately offers a debt consolidation service that combines your debts into one manageable payment, often at a lower interest rate. This can help you save money and become debt-free faster. With features like an AI-powered agent and a debt repayment calculator, Mitigately ensures you find the best solution for your financial needs. Start your journey to financial freedom by exploring Mitigately’s services today at Mitigately.

Introduction To Improving Financial Standing

Improving your financial standing is crucial for long-term financial health. It involves understanding your current financial situation, why it matters, and implementing proven strategies to enhance your financial status.

Understanding Financial Standing

Financial standing refers to your overall financial health and stability. It includes factors such as credit score, debt levels, income, and savings. Knowing where you stand financially is the first step towards improvement.

Here are some key components of financial standing:

- Credit Score: A numerical representation of your creditworthiness.

- Debt Levels: The amount of money you owe to creditors.

- Income: Your earnings from various sources.

- Savings: Money set aside for future use.

Why It Matters

Maintaining a good financial standing is essential for several reasons:

- Loan Approvals: A good financial standing increases your chances of getting loan approvals.

- Lower Interest Rates: Better financial health can lead to lower interest rates on loans and credit cards.

- Financial Security: It ensures you have a safety net for emergencies.

Improving your financial standing can reduce stress and provide more opportunities. It allows you to make informed financial decisions and plan for a secure future.

Overview Of Proven Strategies

Several strategies can help improve your financial standing. Here is an overview:

| Strategy | Description |

|---|---|

| Debt Consolidation | Combine multiple debts into one manageable payment. Mitigately offers this service with AI-powered agent assistance. |

| Budgeting | Create a budget to track and manage your expenses effectively. |

| Increase Savings | Set aside a portion of your income regularly to build a savings buffer. |

| Improve Credit Score | Pay bills on time, reduce debt, and avoid opening unnecessary credit accounts. |

Mitigately can assist with debt consolidation, making it easier to manage and reduce debt. Their AI-powered agent matches users to suitable debt solutions quickly and efficiently.

By understanding your financial standing, recognizing its importance, and applying proven strategies, you can significantly improve your financial health. Consider using services like Mitigately to consolidate debt and achieve financial freedom.

Assessing Your Current Financial Situation

Understanding your financial standing is crucial for improving it. Assessing your current financial situation involves examining various aspects such as income, expenses, debts, and assets. This process helps you set realistic financial goals and create a plan to achieve them.

Evaluating Income And Expenses

Begin by evaluating your monthly income. This includes your salary, freelance earnings, and any other sources of income.

- Calculate your total monthly income

- List all fixed expenses like rent, utilities, and loan payments

- Identify variable expenses like groceries, entertainment, and dining out

Subtract your total expenses from your total income to determine your net income. This figure will reveal how much money you have left each month.

Analyzing Debts And Assets

Next, analyze your debts and assets. This step is essential for understanding your overall financial health.

| Debts | Assets |

|---|---|

| Credit card balances | Savings accounts |

| Student loans | Investments |

| Mortgages | Real estate |

Calculate your total debts and total assets. This information will help you make informed decisions on debt management and asset allocation.

Setting Financial Goals

Once you have a clear picture of your income, expenses, debts, and assets, it’s time to set financial goals.

- Identify short-term goals, such as reducing expenses by 10% or saving $500 in an emergency fund

- Establish mid-term goals, like paying off a credit card or consolidating debt with Mitigately

- Set long-term goals, such as saving for a down payment on a house or investing for retirement

Setting clear, achievable goals will provide direction and motivation as you work towards improving your financial standing.

Creating A Realistic Budget

Creating a budget is essential for improving your financial standing. A realistic budget helps you manage your money effectively, ensuring you spend within your means and save for the future. Here, we’ll explore the importance of budgeting, steps to create a budget, and tips for sticking to it.

The Importance Of Budgeting

Budgeting allows you to track your income and expenses. This helps in identifying unnecessary spending and areas where you can save. A well-planned budget helps you avoid debt and plan for long-term financial goals. It also gives you control over your finances, reducing stress and financial uncertainty.

Steps To Create A Budget

- Calculate Your Income: List all sources of income, including your salary, freelance work, and other earnings.

- Track Your Expenses: Monitor your spending for a month. This includes bills, groceries, entertainment, and other expenses.

- Categorize Your Expenses: Divide your expenses into fixed (rent, utilities) and variable (food, entertainment) categories.

- Set Your Goals: Define short-term and long-term financial goals. These could be saving for a vacation or building an emergency fund.

- Create a Plan: Allocate your income to cover your expenses and savings goals. Ensure your spending does not exceed your income.

- Review and Adjust: Regularly review your budget. Adjust it as your financial situation or goals change.

Tips For Sticking To Your Budget

- Use Budgeting Tools: Utilize apps or spreadsheets to track your spending and stay within your budget.

- Set Reminders: Schedule reminders for bill payments and savings contributions to avoid missing them.

- Limit Discretionary Spending: Reduce spending on non-essential items. Focus on needs over wants.

- Automate Savings: Set up automatic transfers to your savings account. This ensures you save consistently.

- Stay Motivated: Regularly review your progress towards your financial goals. Celebrate small victories to stay motivated.

Effective Debt Management

Improving financial standing starts with effective debt management. Managing debt well can reduce stress and improve credit scores. Below are some strategies to help manage your debt more efficiently.

Identifying High-interest Debts

High-interest debts can drain your finances quickly. Identifying these debts is the first step to managing them.

| Debt Type | Interest Rate |

|---|---|

| Credit Card | 15% – 25% |

| Personal Loan | 10% – 20% |

| Payday Loan | 300% – 400% |

Focus on debts with the highest interest rates first. These usually include credit cards and payday loans. Paying off these debts quickly can save money in the long run.

Debt Repayment Strategies

There are several strategies to pay off debts. Choose the one that suits your situation best.

- Snowball Method: Pay off the smallest debts first. This builds momentum and motivation.

- Avalanche Method: Focus on debts with the highest interest rates. This saves money on interest.

- Debt Consolidation: Combine multiple debts into one payment. Often at a lower interest rate.

Using a combination of these methods can also be effective. For example, start with the snowball method and then switch to the avalanche method.

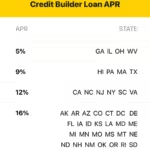

Consolidation And Refinancing Options

Debt consolidation and refinancing can simplify debt management.

One option is using services like Mitigately. Mitigately offers:

- AI-Powered Agent: Matches users to a suitable debt solution in minutes.

- Debt Consolidation: Combines multiple debts into one manageable payment.

- Debt Repayment Calculator: Estimates potential savings and compares monthly payments.

- Fresh Start Loan Program: Provides an opportunity to clear debts and improve credit scores.

Mitigately’s process is quick, efficient, and secure. Users can save an average of 35% on their debts through consolidation. The service is free until your account is settled, making it a low-risk option.

By using these strategies, you can take control of your debt and improve your financial standing.

Building An Emergency Fund

Creating an emergency fund is crucial for improving your financial standing. This fund serves as a financial buffer, helping you cover unexpected expenses without going into debt. Here’s how you can build an effective emergency fund.

The Role Of An Emergency Fund

An emergency fund acts as a safety net in financial crises. It covers unexpected expenses like medical bills, car repairs, or sudden job loss. Without it, you might rely on credit cards or loans, leading to more debt.

How Much To Save

The amount to save depends on your monthly expenses. Most financial experts recommend saving three to six months’ worth of living expenses. This range provides a comfortable cushion for most emergencies.

| Monthly Expenses | Emergency Fund Target |

|---|---|

| $2,000 | $6,000 – $12,000 |

| $3,000 | $9,000 – $18,000 |

| $4,000 | $12,000 – $24,000 |

Strategies For Building Your Fund

Follow these strategies to build your emergency fund:

- Set a monthly savings goal: Decide how much you can save each month. Start with a small amount and increase it over time.

- Automate your savings: Set up automatic transfers to your savings account. This ensures you save consistently.

- Cut unnecessary expenses: Review your budget and eliminate non-essential spending. Redirect these funds to your emergency fund.

- Use windfalls wisely: Allocate any extra money, like bonuses or tax refunds, to your emergency fund.

Building an emergency fund takes time and discipline. But the peace of mind it provides is well worth the effort. Start small, stay consistent, and watch your fund grow. Remember, having a solid emergency fund is a crucial step in achieving financial stability.

Investing For The Future

Investing is a powerful tool to build wealth and secure a financially stable future. By putting your money to work in various investment options, you can grow your savings and prepare for life’s uncertainties. Let’s explore the different aspects of investing for the future.

Understanding Different Investment Options

Investments come in many forms, each with its own set of risks and potential returns. Here are some common options:

- Stocks: Buying shares in a company. Stocks can offer high returns but come with higher risk.

- Bonds: Loans to governments or corporations. Bonds are generally safer than stocks but offer lower returns.

- Mutual Funds: Pooled funds from many investors to buy a diversified portfolio of stocks and bonds.

- Real Estate: Investing in property. Real estate can provide rental income and potential appreciation.

- Certificates of Deposit (CDs): Time deposits offered by banks. CDs are low-risk with fixed interest rates.

The Importance Of Diversification

Diversification means spreading your investments across different asset types to reduce risk. By not putting all your eggs in one basket, you protect yourself from significant losses if one investment performs poorly.

Consider this simple analogy: If you invest solely in tech stocks and the tech market crashes, your entire portfolio suffers. But if you diversify with bonds, real estate, and other assets, a loss in one area can be offset by gains in another.

How To Start Investing

Starting to invest may seem daunting, but breaking it down into simple steps can help:

- Set Clear Goals: Determine what you want to achieve with your investments. This could be saving for retirement, buying a home, or funding education.

- Create a Budget: Assess your financial situation and decide how much you can afford to invest regularly.

- Research Options: Learn about different investment options and their risks and returns.

- Choose an Investment Platform: Select a brokerage or investment platform that fits your needs.

- Start Small: Begin with a small amount to get comfortable. You can increase your investment as you gain confidence.

- Monitor and Adjust: Regularly review your portfolio and make adjustments as needed to stay aligned with your goals.

Investing is a journey that requires patience and discipline. By understanding your options, diversifying wisely, and starting with clear goals, you can create a solid foundation for your financial future.

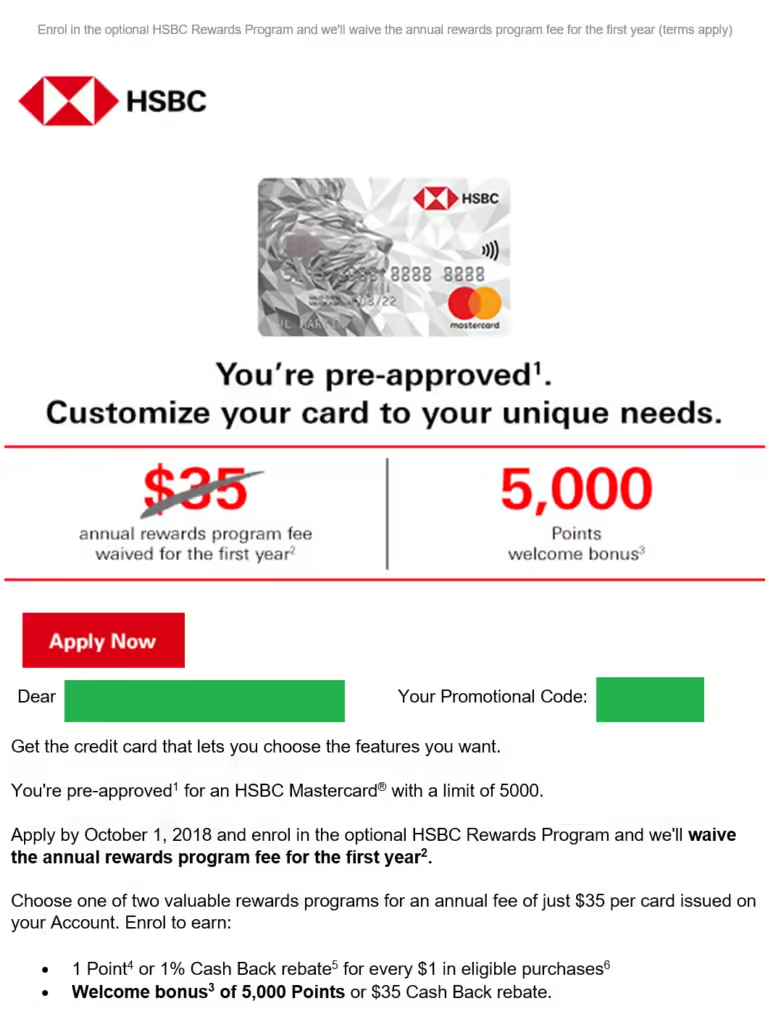

Improving Your Credit Score

Improving your credit score is crucial for better financial health. A good credit score opens doors to better loan rates, credit card offers, and more. Let’s explore the factors that affect your credit score, steps to improve it, and the benefits of maintaining a good score.

Factors Affecting Your Credit Score

Several factors influence your credit score. Understanding these can help you make informed decisions:

- Payment History: Timely payments positively impact your score.

- Credit Utilization: Keep your credit card balances low.

- Credit History Length: Longer histories can improve scores.

- New Credit Inquiries: Frequent inquiries can lower scores.

- Credit Mix: A mix of credit types can be beneficial.

Steps To Improve Your Credit Rating

Follow these steps to boost your credit score:

- Pay Bills on Time: Set reminders for due dates.

- Reduce Debt: Use services like Mitigately for debt consolidation.

- Limit New Credit Applications: Apply only when necessary.

- Check Credit Reports: Regularly review for errors and correct them.

- Maintain Low Balances: Keep credit card balances below 30% of the limit.

Benefits Of A Good Credit Score

A good credit score offers numerous advantages:

- Lower Interest Rates: Qualify for better loan terms.

- Higher Credit Limits: Access to more credit if needed.

- Better Insurance Rates: Many insurers offer lower rates.

- Rental Approval: Easier approval for rental applications.

- Employment Opportunities: Some employers check credit scores.

Improving your credit score can enhance your financial standing. Using tools like Mitigately can simplify debt management and help you achieve a better score.

Increasing Your Income

Improving your financial standing often starts with increasing your income. Whether through additional jobs, career advancements, or passive income, there are several strategies to boost your earnings. By exploring these options, you can find the best ways to supplement your current income.

Exploring Side Hustles

Side hustles can be a great way to earn extra money. Many people find success by taking on freelance work, driving for ride-share services, or selling handmade goods online. Here are a few popular side hustle ideas:

- Freelancing (writing, graphic design, web development)

- Ride-sharing (Uber, Lyft)

- Online selling (Etsy, eBay)

- Teaching or tutoring (online platforms)

- Pet sitting or dog walking

Advancing In Your Career

Career advancement can significantly increase your income. Consider these steps to move up the ladder in your current job:

- Seek additional training or certifications relevant to your field.

- Take on more responsibilities to demonstrate your capabilities.

- Network with industry professionals to learn about new opportunities.

- Ask for a raise or promotion based on your performance.

- Update your resume and LinkedIn profile to reflect your achievements.

By focusing on these areas, you can position yourself for higher-paying roles within your industry.

Passive Income Opportunities

Generating passive income can provide a steady stream of money with minimal effort. Consider these popular passive income ideas:

| Opportunity | Description |

|---|---|

| Rental Properties | Earn rental income from real estate investments. |

| Dividend Stocks | Invest in stocks that pay regular dividends. |

| Peer-to-Peer Lending | Earn interest by lending money to others. |

| Digital Products | Create and sell e-books, courses, or software. |

| Affiliate Marketing | Earn commissions by promoting products online. |

These opportunities can diversify your income sources and help you build wealth over time.

Smart Spending Habits

Improving your financial standing starts with adopting smart spending habits. Making informed decisions about your expenses can help you save money and reduce debt. Let’s explore some effective strategies.

Distinguishing Needs Vs. Wants

Understanding the difference between needs and wants is crucial. Needs are essential for survival, such as food, shelter, and healthcare. Wants are non-essential items, like dining out or luxury gadgets.

- Needs: Basic groceries, rent, utilities, medical care.

- Wants: Eating at restaurants, latest smartphones, designer clothes.

By focusing on needs and limiting wants, you can allocate more funds towards debt repayment and savings.

Ways To Save On Everyday Expenses

There are many ways to cut costs on daily expenses. Here are a few tips:

- Create a budget: Track your income and expenses to identify areas for savings.

- Cook at home: Preparing meals at home is often cheaper than dining out.

- Use public transport: Save on gas and parking fees by using buses or trains.

- Buy in bulk: Purchase non-perishable items in bulk to save money.

Implementing these tips can lead to substantial savings over time.

The Impact Of Lifestyle Inflation

Lifestyle inflation occurs when your spending increases as your income grows. This can make it harder to save money and pay off debt. To avoid lifestyle inflation:

| Strategy | Description |

|---|---|

| Set savings goals | Allocate a portion of any income increase to savings or debt repayment. |

| Maintain current living standards | Resist the urge to upgrade your lifestyle with every pay raise. |

| Track expenses | Regularly review your spending to ensure it aligns with your financial goals. |

By managing lifestyle inflation, you can enhance your financial stability and achieve long-term goals.

Seeking Professional Financial Advice

Improving your financial standing requires careful planning and informed decisions. Seeking professional financial advice can make a significant difference. Financial advisors offer expert guidance on managing debts, investments, and savings. This can lead to better financial health and peace of mind.

When To Consult A Financial Advisor

There are several instances when consulting a financial advisor is beneficial:

- Major Life Changes: Events like marriage, divorce, or having a child.

- Financial Goals: Planning for retirement, buying a home, or funding education.

- Debt Management: Struggling with multiple debts and looking for consolidation options.

- Investment Planning: Wanting to diversify your investment portfolio.

What To Look For In A Financial Advisor

Choosing the right financial advisor is crucial. Here are key factors to consider:

- Credentials: Look for certifications like CFP (Certified Financial Planner).

- Experience: An advisor with a proven track record in financial planning.

- Services Offered: Ensure they provide services that match your needs, such as debt consolidation.

- Fee Structure: Understand their pricing model to avoid hidden costs.

- Client Reviews: Check for positive feedback and high customer satisfaction.

Benefits Of Professional Guidance

Engaging a financial advisor can offer numerous benefits:

- Personalized Plans: Tailored strategies to achieve your financial goals.

- Debt Management: Expert advice on consolidating and managing debts.

- Investment Advice: Guidance on making informed investment decisions.

- Stress Reduction: Reduced financial stress and increased confidence in your financial future.

- Time Savings: Allows you to focus on other important aspects of your life.

For example, using Mitigately, an AI-powered debt consolidation service, can simplify your debt management process. It consolidates multiple debts into one manageable payment. This often comes with a lower interest rate, helping you save money and become debt-free faster. Plus, their service is free until your accounts are settled, ensuring significant savings without upfront costs. Mitigately’s high customer satisfaction, with an average rating of 4.9 stars, speaks volumes about its efficiency and reliability.

Seeking professional financial advice can be a game-changer. It provides the expertise and support needed to navigate complex financial situations and achieve financial stability.

Conclusion: Long-term Financial Health

Achieving long-term financial health requires consistent effort and strategic planning. By following a structured approach, individuals can improve their financial standing and work towards a secure future. Mitigately offers tools and services to help consolidate debt and manage finances effectively.

The Importance Of Consistency

Consistency is crucial in financial planning. Regularly monitoring and adjusting your budget ensures you stay on track. Using Mitigately’s AI-powered agent, you can get matched to suitable debt solutions quickly. This consistency in approach can help in reducing debts faster.

Adjusting Strategies As Needed

Financial strategies need to be flexible. As your financial situation changes, adjust your strategies accordingly. Mitigately’s debt repayment calculator helps estimate potential savings and compare monthly payments. This allows you to make informed decisions and adjust your repayment plans as needed.

Celebrating Financial Milestones

Celebrating financial milestones is important for motivation. Each milestone, like paying off a significant portion of debt or improving your credit score, deserves recognition. Mitigately’s Fresh Start Loan Program can help achieve these milestones, providing a sense of accomplishment and progress.

By staying consistent, adjusting strategies, and celebrating milestones, you can achieve long-term financial health. Mitigately’s services support you in this journey, making debt management more manageable and effective.

Frequently Asked Questions

How Can I Improve My Financial Standing?

To improve your financial standing, create a budget, reduce expenses, and increase your income. Regularly monitor your financial progress and adjust as needed.

What Are Effective Ways To Save Money?

Effective ways to save money include creating a budget, cutting unnecessary expenses, and setting financial goals. Automate your savings and track your spending to stay on target.

How Can I Reduce My Debt Quickly?

To reduce debt quickly, prioritize high-interest debts, make extra payments, and avoid new debt. Consolidate debts if possible and consider professional advice for debt management.

Why Is Having An Emergency Fund Important?

An emergency fund is crucial for unexpected expenses like medical bills or car repairs. It provides financial security and prevents reliance on credit cards or loans.

Conclusion

Improving your financial standing takes time and effort. Stick to your budget. Pay off debts. Save consistently. These small steps lead to big changes over time. Need help managing debt? Consider Mitigately for a streamlined solution. Their service can make debt repayment simpler and faster. Start your journey to financial freedom today.