Improve Credit Rating: 7 Proven Strategies for Quick Success

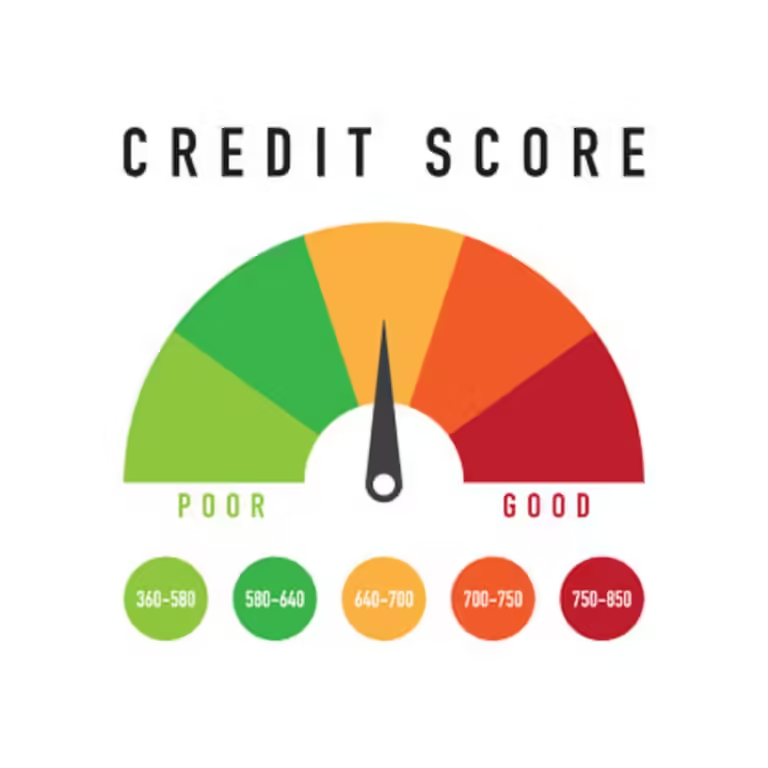

Improving your credit rating can open doors to better financial opportunities. Whether you’re planning to buy a home, get a loan, or secure a credit card, a good credit score is key.

Many struggle with low credit scores, often due to past financial mistakes. But there’s hope. You can take steps to improve your credit rating. In this blog post, we’ll explore practical ways to boost your credit score. We’ll also introduce tools like the Zable Credit Card and Personal Loans from Zable UK. These tools can help you build or rebuild your credit. Let’s dive in and start your journey towards a better credit rating.

:max_bytes(150000):strip_icc()/HowtoImproveYourCreditScoreFast-e6a122aee5ed42449761e7c6aafed868.jpg)

Introduction To Improving Your Credit Rating

Improving your credit rating can open many financial doors. Whether you want to buy a house, get a loan, or secure a credit card, a good credit rating is essential. Let’s explore the importance of a good credit rating and how a better credit rating can benefit you.

Understanding The Importance Of A Good Credit Rating

A good credit rating shows lenders that you are responsible with credit. It influences the interest rates you receive and your ability to get approved for loans or credit cards. With a high credit rating, you can access better financial products and more favorable terms.

| Credit Rating | Impact |

|---|---|

| Excellent | Lower interest rates, higher loan amounts |

| Good | Moderate interest rates, decent loan amounts |

| Fair | Higher interest rates, lower loan amounts |

| Poor | Limited access to credit, highest interest rates |

How A Better Credit Rating Can Benefit You

Improving your credit rating offers numerous benefits. Here are some key advantages:

- Better Loan Terms: Lower interest rates and higher loan amounts.

- Credit Card Offers: Access to better credit card options with rewards.

- Rental Applications: Easier approval for rental homes or apartments.

- Employment Opportunities: Some employers check credit scores for job applications.

Using tools like the Zable UK credit card and personal loans can help. The Zable app provides insights into your credit score, tracks spending, and helps build your credit history through responsible use.

1. Review Your Credit Report Regularly

Regularly reviewing your credit report is a vital step in maintaining a healthy credit score. It helps you stay informed about your credit status and identify any discrepancies that may affect your score. By keeping an eye on your credit report, you can take proactive measures to address issues before they become significant problems.

How To Obtain Your Credit Report

Obtaining your credit report is simple and can be done through several means. In the UK, you are entitled to a free copy of your credit report from the three main credit reference agencies: Equifax, Experian, and TransUnion. You can request your report online through their websites or by contacting them directly.

- Equifax: www.equifax.co.uk

- Experian: www.experian.co.uk

- TransUnion: www.transunion.co.uk

Additionally, some financial services, like the Zable app, offer free access to your Equifax credit score. This allows you to monitor your credit status regularly without additional cost.

Identifying And Correcting Errors On Your Report

Carefully review your credit report for any errors or inaccuracies. Common errors include incorrect personal details, accounts that do not belong to you, and outdated information. Identifying these errors early can prevent them from negatively impacting your credit score.

- Check Personal Information: Ensure your name, address, and other personal details are correct.

- Review Account Information: Verify all listed accounts are yours and the details are accurate.

- Look for Discrepancies: Identify any discrepancies in your payment history or outstanding balances.

If you find any errors, contact the credit reference agency immediately. Provide evidence to support your claim and request a correction. Once the error is corrected, your credit report and score should reflect the accurate information.

By regularly reviewing your credit report and addressing any errors, you can maintain a healthy credit profile and improve your credit rating.

2. Pay Your Bills On Time

Paying your bills on time is crucial for maintaining a good credit score. It shows lenders that you are reliable and can manage your finances responsibly. Using a service like Zable UK can help you build or rebuild your credit score by ensuring timely payments.

Setting Up Reminders And Automatic Payments

Setting up reminders and automatic payments can help ensure you never miss a due date. The Zable app offers features that can assist with this:

- Reminders: The app can send notifications to remind you when a payment is due.

- Automatic Payments: You can set up automatic payments through the app to make sure your bills are paid on time.

| Feature | Description |

|---|---|

| Reminders | Notifications for upcoming payments |

| Automatic Payments | Automatically debits your account to pay bills |

Impact Of Timely Payments On Credit Score

Timely payments have a significant impact on your credit score. Here’s how:

- Payment History: Timely payments build a positive payment history, which is a major factor in your credit score.

- Credit Utilization: Regular payments help manage your credit utilization ratio, which also affects your score.

Using a credit card like the Zable Credit Card can help you manage timely payments effectively. With the Zable app, you get free access to your Equifax credit score and tips for improving it.

3. Reduce Your Debt-to-income Ratio

Reducing your debt-to-income (DTI) ratio is crucial for improving your credit rating. A lower DTI ratio indicates to lenders that you manage your debts well. It shows you have a good balance between your debt and income.

Strategies To Pay Down Debt Quickly

- Create a budget: Start by listing all your monthly income and expenses. Identify areas where you can cut back.

- Use the snowball method: Pay off your smallest debt first, then move to the next. This method gives you quick wins and keeps you motivated.

- Consider a balance transfer: Move your high-interest debt to a credit card with a lower interest rate. This reduces the overall interest you pay.

- Make extra payments: Whenever possible, make extra payments on your debt. This can significantly reduce the principal amount and interest over time.

Balancing Income And Expenses Effectively

Balancing your income and expenses is key to managing your DTI ratio. Here are some tips to help you:

- Track your spending: Use an app or a spreadsheet to monitor your spending habits. This helps you identify and eliminate unnecessary expenses.

- Increase your income: Consider side jobs or freelance work to boost your income. Even small additional earnings can make a difference.

- Automate savings: Set up automatic transfers to your savings account. This ensures you save a portion of your income before spending it.

- Review your bills: Regularly check your bills for any errors or unnecessary services. Negotiate lower rates where possible.

By following these strategies, you can effectively reduce your debt-to-income ratio. This will lead to a better credit rating and financial stability.

4. Avoid New Credit Inquiries

New credit inquiries can negatively impact your credit rating. Understanding the difference between hard and soft inquiries and timing your credit applications wisely can help you avoid unnecessary dips in your credit score. This strategy is crucial for maintaining a healthy credit profile.

Understanding Hard Vs. Soft Inquiries

Credit inquiries come in two forms: hard inquiries and soft inquiries. A hard inquiry occurs when a lender checks your credit report to make a lending decision. This type of inquiry can slightly lower your credit score. Examples include applying for a mortgage, car loan, or a new credit card.

On the other hand, a soft inquiry does not affect your credit score. Soft inquiries occur when you check your own credit report or when companies check your credit for pre-approval offers. For example, checking eligibility for a Zable Credit Card or Personal Loan does not impact your credit score.

| Type of Inquiry | Impact on Credit Score | Examples |

|---|---|---|

| Hard Inquiry | Can lower score | Applying for a mortgage, car loan, or new credit card |

| Soft Inquiry | No impact | Checking your own credit, pre-approval offers |

Timing Your Credit Applications Wisely

Planning your credit applications can help you maintain a better credit score. Avoid applying for multiple credit products in a short period. Each hard inquiry can lower your score slightly, and multiple inquiries can have a compounding effect.

Here are some tips to time your credit applications:

- Space out applications: Apply for new credit only when necessary and try to space out your applications by several months.

- Check eligibility first: Use tools like the Zable app to check your eligibility without impacting your credit score.

- Plan major purchases: If you plan to apply for a mortgage or car loan, avoid applying for other credit products in the months leading up to your application.

By understanding the types of credit inquiries and timing your applications wisely, you can better manage your credit score. Tools like the Zable app provide insights and help you keep track of your credit status.

5. Keep Old Credit Accounts Open

Maintaining old credit accounts can significantly boost your credit rating. Many people close old accounts, thinking it helps, but it can actually hurt your score. Here, we explore why keeping old credit accounts open benefits your credit rating.

Benefits Of Long Credit History

A long credit history shows lenders that you have experience managing credit. This can make you appear more reliable. The age of your oldest credit account, the age of your newest credit account, and the average age of all your accounts are important factors.

| Account Age | Impact |

|---|---|

| Oldest Account | Shows long-term reliability |

| Newest Account | Shows recent activity |

| Average Age | Balances between old and new accounts |

Keeping old credit accounts open can help you maintain a strong credit history. This history can improve your chances of getting approved for loans, credit cards, and even renting an apartment.

Managing Older Accounts Responsibly

It is essential to manage your older accounts responsibly. Here are some tips:

- Regular Activity: Use the account occasionally to keep it active.

- Timely Payments: Always make payments on time to avoid late fees.

- Low Balances: Keep balances low to improve your credit utilization rate.

Responsible management of older accounts can have a positive impact on your credit score. Zable Credit Card offers features such as spend tracking and timely payment reminders. These can help you manage your accounts more effectively.

For example, the Zable app provides free access to Equifax credit score and spend tracking across all your accounts. This makes it easier to keep an eye on your credit activities and make informed financial decisions.

By keeping old accounts open and managing them responsibly, you can maintain a strong credit history. This can lead to better financial opportunities in the future.

6. Diversify Your Credit Mix

Improving your credit rating involves several strategies. One effective method is to diversify your credit mix. This means having different types of credit accounts. A varied credit portfolio can positively impact your credit score. Let’s explore how.

Different Types Of Credit Accounts

Credit accounts come in various forms. Here are some common types:

- Credit Cards: These include general credit cards, like the Zable Credit Card, which helps build credit scores with timely payments.

- Personal Loans: Loans such as those offered by Zable, with flexible terms and amounts.

- Retail Credit Accounts: Store credit cards for specific retailers.

- Installment Loans: Loans for car purchases, mortgages, and student loans.

Each type of account serves a different purpose. Managing them well shows lenders you can handle various credit forms.

How A Varied Credit Portfolio Helps Your Score

A diverse credit mix can boost your credit score. Here’s how:

| Benefit | Explanation |

|---|---|

| Demonstrates Responsibility | Managing different credit types shows responsible borrowing behavior. |

| Reduces Risk | A varied credit mix reduces the risk for lenders, indicating balanced credit management. |

| Improves Credit Utilization | Using different credit types helps maintain low credit utilization rates. |

Maintaining a mix of credit accounts, like the Zable Credit Card and personal loans, can significantly improve your credit rating. Each type adds value to your credit profile, reflecting a well-rounded financial management.

Remember, timely payments and responsible use are crucial. Ensure you keep track of all accounts and never miss a payment. This strategy not only diversifies your credit mix but also strengthens your overall credit health.

7. Use Credit Monitoring Tools

Keeping a close eye on your credit score is essential for improving your credit rating. One effective way to do this is by using credit monitoring tools. These tools provide real-time updates and alerts, helping you stay informed about any changes to your credit report.

Top Credit Monitoring Services

There are several credit monitoring services available that can help you track your credit score and report. Here are a few popular options:

- Experian: Offers daily credit report updates and alerts for any significant changes.

- Equifax: Provides credit score tracking and alerts for new accounts or inquiries.

- TransUnion: Includes identity theft protection along with credit monitoring.

- Zable Credit Card & Personal Loans: Offers free access to your Equifax credit score through the Zable app.

Each of these services has unique features, so choose one that best fits your needs.

How These Tools Can Help You Stay On Track

Credit monitoring tools offer several benefits that can help you maintain or improve your credit score:

- Real-Time Alerts: Receive notifications for any changes to your credit report, such as new accounts or inquiries.

- Identity Theft Protection: Some services offer identity theft protection, helping you detect and address fraudulent activities quickly.

- Credit Score Tracking: Regular updates on your credit score allow you to see how your actions impact your rating.

- Financial Insights: Tools like the Zable app provide insights into your spending and credit status, helping you make informed financial decisions.

Using these tools can help you stay on top of your credit health and take proactive steps to improve your credit rating.

For instance, the Zable Credit Card & Personal Loans offers a comprehensive app that includes free access to your Equifax credit score, spend tracking, and rent reporting. This can be particularly helpful for those looking to build or rebuild their credit score.

Frequently Asked Questions

How To Improve Your Credit Rating Fast?

Pay bills on time, reduce debt, and avoid new credit applications. Check your credit report for errors.

What Affects My Credit Rating?

Payment history, credit utilization, length of credit history, new credit, and credit mix impact your credit rating.

How Often Should I Check My Credit Report?

Check your credit report at least once a year. Monitoring helps identify errors and potential fraud.

Can Paying Off Debt Improve My Credit Score?

Yes, paying off debt can improve your credit score. It reduces your credit utilization rate.

Conclusion

Improving your credit rating takes time and consistent effort. Make timely payments. Monitor your credit report regularly. Tools like the Zable Credit Card and Personal Loans can help. They offer insights and flexible borrowing options. Check eligibility without impacting your credit score. Visit Zable UK for more details. Start building your credit today.