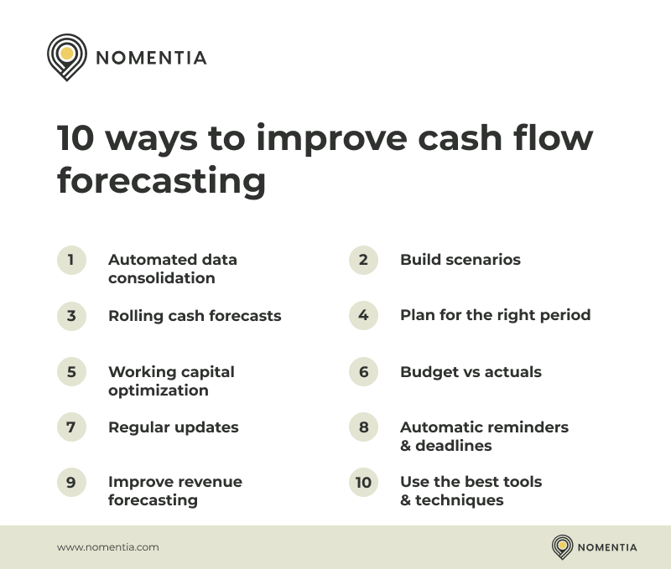

Improve Cash Flow: 10 Effective Strategies for Small Businesses

Managing cash flow is crucial for any business. It ensures operations run smoothly and payments are made on time.

In this blog, we’ll explore practical ways to improve cash flow, helping your business stay financially healthy. Cash flow management involves tracking money coming in and going out. Proper management can prevent cash shortages and help you plan for future expenses. Implementing effective cash flow strategies can lead to better financial stability and growth for your business. One way to enhance cash flow is by using tools like Melio Payments. Melio Payments is an online solution designed to streamline accounts payable and receivable. It offers features such as bill pay, invoice management, and QuickBooks integration. By using Melio Payments, businesses can manage their finances efficiently and maintain a steady cash flow. Check out Melio Payments here for more details.

Introduction To Improving Cash Flow

Efficient cash flow management is crucial for the success of any business. Many small businesses struggle to maintain a healthy cash flow, which can lead to financial difficulties. Understanding and improving cash flow can ensure your business runs smoothly and sustainably.

Understanding The Importance Of Cash Flow

Cash flow refers to the movement of money in and out of your business. Positive cash flow means more money is coming in than going out. This is essential for covering expenses, paying employees, and investing in growth. Negative cash flow can result in missed payments, accumulating debt, and potential business failure.

Effective cash flow management helps you:

- Ensure timely payments to vendors and suppliers, maintaining strong relationships.

- Avoid financial shortfalls that could disrupt operations.

- Plan for future expenses and investments with confidence.

Common Cash Flow Challenges For Small Businesses

Small businesses often face unique cash flow challenges. Understanding these can help you take proactive steps to mitigate them:

| Challenge | Description |

|---|---|

| Late Payments | Clients not paying on time can disrupt your cash flow. |

| High Overheads | Fixed costs and overheads can drain cash reserves. |

| Seasonal Fluctuations | Businesses with seasonal sales may struggle during off-peak periods. |

| Inventory Management | Excess inventory ties up cash that could be used elsewhere. |

Using tools like Melio Payments can help manage cash flow more effectively. Melio Payments offers features like bill pay, invoice management, and multiple payment methods. These features streamline payment processes, save time, and reduce manual errors. With no subscription fees, businesses can pay as they go, ensuring flexibility and efficiency.

For more information about Melio Payments, visit their website.

Strategy 1: Enhance Invoicing Processes

Improving cash flow starts with effective invoicing. Streamlining your invoicing process can ensure timely payments and reduce delays. Here, we will explore how to enhance your invoicing processes with efficient software and clear payment terms.

Implementing Efficient Invoicing Software

Using Melio Payments can greatly improve your invoicing efficiency. Melio Payments offers features like:

- Invoice Management: Simplifies sending and tracking invoices.

- Multiple Payment Methods: Accepts various payment methods, including bank transfers and credit cards.

- QuickBooks Integration: Integrates with QuickBooks for streamlined accounting.

- Approval Workflow: Ensures proper authorization of payments.

- Scheduled Payments: Allows scheduling payments in advance.

Implementing Melio Payments can save time and reduce manual errors. It streamlines your payment processes and enhances cash flow management. The user-friendly interface ensures easy adoption without extensive training.

Setting Clear Payment Terms

Clear payment terms are crucial for timely payments. Here are some tips to establish effective payment terms:

- Specify Due Dates: Clearly state when the payment is due.

- Early Payment Discounts: Offer discounts for early payments to incentivize promptness.

- Late Payment Penalties: Define penalties for late payments to encourage timely settlements.

- Payment Methods: List all acceptable payment methods to avoid confusion.

- Contact Information: Provide clear contact details for any payment-related queries.

Clear and concise payment terms help avoid misunderstandings and ensure that clients know exactly what is expected. This clarity can speed up the payment process and improve cash flow.

Strategy 2: Optimize Inventory Management

Optimizing inventory management can significantly improve cash flow for businesses. By ensuring the right amount of stock, businesses can reduce costs and avoid tying up capital in unsold inventory. Here, we’ll discuss two key aspects of inventory management: utilizing inventory tracking systems and reducing excess inventory.

Utilizing Inventory Tracking Systems

Effective inventory management begins with accurate tracking. Utilizing inventory tracking systems can help businesses maintain optimal stock levels. These systems provide real-time data on stock availability, helping businesses make informed decisions.

Benefits of Inventory Tracking Systems:

- Real-time Tracking: Keep track of inventory levels in real-time.

- Data Insights: Gain insights into sales trends and stock movement.

- Prevent Stockouts: Avoid stockouts and meet customer demand.

- Reduce Manual Errors: Minimize human errors in inventory management.

Many systems also integrate with accounting software like QuickBooks, ensuring seamless financial management. This integration can further streamline processes and improve accuracy.

Reducing Excess Inventory

Excess inventory can tie up capital and increase storage costs. Reducing excess inventory is essential for improving cash flow. Here are some strategies to achieve this:

- Regular Audits: Conduct regular audits to identify slow-moving items.

- Discounts and Promotions: Offer discounts and promotions to clear out excess stock.

- Just-In-Time Inventory: Adopt a just-in-time inventory approach to minimize excess stock.

- Supplier Collaboration: Work closely with suppliers to adjust order quantities as needed.

By implementing these strategies, businesses can reduce holding costs and free up capital for other uses. This approach not only improves cash flow but also ensures a leaner, more efficient operation.

Strategy 3: Negotiate Better Payment Terms

Improve cash flow by negotiating better payment terms. Ask suppliers for extended payment deadlines or early payment discounts. This helps manage expenses more effectively.

Negotiating better payment terms can significantly enhance your cash flow. This strategy involves working with suppliers and customers to create mutually beneficial agreements. Below are two key tactics to consider.Extending Payment Terms With Suppliers

Extending payment terms with suppliers gives you more time to pay your bills. This can free up cash for other business needs. Here’s how to approach it:- Communicate Clearly: Talk to your suppliers about your cash flow needs.

- Build Trust: Show your suppliers that you are a reliable partner.

- Negotiate Terms: Ask for longer payment terms, such as 60 or 90 days.

Early Payment Discounts

Taking advantage of early payment discounts can also improve your cash flow. Many suppliers offer discounts for paying invoices early. Here’s how to make the most of this opportunity:- Identify Discounts: Check if your suppliers offer early payment discounts.

- Calculate Savings: Determine if the discount is worth the early payment.

- Use Melio: Melio Payments can help you schedule early payments to capture discounts.

Strategy 4: Improve Sales Forecasting

Effective sales forecasting can dramatically enhance cash flow management. Accurate forecasts help businesses plan for future expenses and revenue. They also enable businesses to make informed decisions on inventory, staffing, and other critical areas. This strategy focuses on utilizing historical data and adjusting strategies based on market trends.

Using Historical Data For Accurate Forecasts

Historical data provides a solid foundation for accurate sales forecasts. By analyzing past sales data, businesses can identify patterns and trends. This information helps predict future sales more reliably. Here are some steps to use historical data effectively:

- Collect Data: Gather sales data from previous years. Include details like product types, quantities sold, and sales periods.

- Analyze Patterns: Look for trends in the data. Identify peak sales periods and slow seasons.

- Forecast Future Sales: Use identified patterns to estimate future sales. Adjust predictions based on recent market conditions.

Melio Payments can assist in managing this data efficiently. Features like Invoice Management and QuickBooks Integration simplify tracking past sales and financial records. This makes data collection and analysis more streamlined.

Adjusting Strategies Based On Market Trends

Market trends can impact sales forecasts. Staying informed about industry changes and consumer behavior is crucial. Consider these steps to adjust strategies based on market trends:

- Monitor Trends: Regularly review industry reports and market research. Identify emerging trends that could affect sales.

- Adapt Tactics: Modify marketing and sales strategies to align with current trends. For example, if online sales are increasing, invest more in digital marketing.

- Reevaluate Forecasts: Continuously update sales forecasts based on new data and market insights. This ensures that predictions remain accurate.

Using Melio Payments, businesses can manage cash flow more effectively. Features like Scheduled Payments and Approval Workflow help maintain financial stability. This is especially important when adapting to changing market conditions.

By leveraging historical data and staying attuned to market trends, businesses can improve their sales forecasting. This leads to better cash flow management and more informed decision-making.

Strategy 5: Control Operating Expenses

Improving cash flow involves a variety of strategies, and one essential approach is to control operating expenses. By carefully managing these costs, businesses can ensure they are not overspending, thus maintaining a healthier cash flow. This strategy involves identifying non-essential expenses and implementing cost-cutting measures.

Identifying Non-essential Expenses

The first step in controlling operating expenses is to identify non-essential costs. These are expenses that do not directly contribute to the business’s core operations or revenue generation. To identify these costs, you can:

- Review monthly financial statements

- Analyze spending patterns over the last year

- Consult with department heads to identify unnecessary expenditures

Using tools like Melio Payments can help track and categorize your spending. This makes it easier to pinpoint areas where cuts can be made.

Implementing Cost-cutting Measures

Once non-essential expenses are identified, the next step is to implement cost-cutting measures. Here are some effective ways to reduce costs:

- Negotiate with vendors: Use Melio’s Bill Pay feature to ensure timely payments and leverage better terms with suppliers.

- Reduce office supplies: Go digital where possible to save on paper, ink, and other office materials.

- Limit travel expenses: Use video conferencing tools to cut down on travel costs.

- Outsource non-core activities: Consider outsourcing tasks like payroll or IT support to reduce overhead.

- Schedule payments wisely: Utilize Melio’s Scheduled Payments feature to manage cash outflows better.

Implementing these measures can help reduce operating expenses significantly. This, in turn, improves the cash flow, ensuring that your business remains financially healthy.

Strategy 6: Leverage Technology Solutions

In today’s digital age, leveraging technology solutions can significantly improve your cash flow. By implementing advanced tools and software, businesses can streamline financial processes, reduce errors, and make more informed decisions. Below, we discuss two key areas where technology can make a substantial difference: automating routine financial tasks and utilizing cash flow management tools.

Automating Routine Financial Tasks

Automating routine financial tasks can save time and reduce human errors. For instance, using Melio Payments for bill pay and invoice management simplifies these processes. Businesses can easily pay vendors and track invoices, ensuring timely payments and improved vendor relationships.

- Bill Pay: Pay vendors and suppliers with ease.

- Invoice Management: Simplify the process of sending and tracking invoices.

- Scheduled Payments: Schedule payments in advance to manage cash flow better.

With Melio Payments, businesses can also benefit from a user-friendly interface and robust security measures that protect financial data and transactions. The platform’s integration with QuickBooks further streamlines accounting processes, making it easier to keep financial records up-to-date.

Utilizing Cash Flow Management Tools

Effective cash flow management is crucial for business sustainability. Technology solutions like Melio Payments offer several features that aid in managing cash flow:

| Feature | Description |

|---|---|

| Multiple Payment Methods | Support for bank transfers and credit cards. |

| Approval Workflow | Customizable approval processes for proper payment authorization. |

| No Subscription Fees | Pay-as-you-go model without subscription costs. |

By using these tools, businesses can ensure they have the flexibility to manage outgoing payments according to their cash flow status. This reduces the risk of late payments and enhances financial stability. Additionally, the ability to schedule payments ensures that cash flow is maintained without manual intervention.

Overall, leveraging technology solutions like Melio Payments can lead to increased efficiency, better cash flow management, and improved vendor relationships, all of which are vital for the growth and success of a business.

Strategy 7: Diversify Revenue Streams

Improving cash flow is vital for business success. Diversifying revenue streams can provide a stable income. This strategy reduces the risk of relying on a single source of revenue. Here are two effective ways to diversify revenue streams.

Exploring New Markets

Exploring new markets can open up new opportunities. Businesses can tap into different customer bases. This can be done by expanding geographically or targeting different demographics. For instance, if your business is local, consider expanding to other regions. Researching and understanding the new market is essential. It helps in identifying potential customers and tailoring your offerings to meet their needs.

Offering New Products Or Services

Offering new products or services can attract a broader customer base. Diversifying your product line can cater to different customer needs. For example, if you sell physical products, consider adding digital services. Melio Payments offers various features to help manage your finances efficiently. Their features include:

| Feature | Description |

|---|---|

| Bill Pay | Allows businesses to pay vendors and suppliers easily. |

| Invoice Management | Simplifies the process of sending and tracking invoices. |

| Multiple Payment Methods | Supports various payment methods including bank transfers and credit cards. |

| QuickBooks Integration | Seamlessly integrates with QuickBooks for streamlined accounting. |

| Approval Workflow | Customizable approval processes to ensure proper authorization of payments. |

| Scheduled Payments | Ability to schedule payments in advance. |

| No Subscription Fees | Pay as you go without any subscription costs. |

By leveraging tools like Melio Payments, businesses can streamline operations. This efficiency can provide the bandwidth to explore new revenue streams. It can also help in cash flow management by allowing flexible payment scheduling. Additionally, timely payments can improve vendor relationships.

Strategy 8: Improve Collection Processes

Improving cash flow is crucial for any business. One effective method is to enhance your collection processes. This involves ensuring timely payments from clients and reducing overdue invoices. By implementing effective collection strategies and using collection agencies wisely, businesses can maintain a healthy cash flow.

Implementing Effective Collection Strategies

Effective collection strategies are essential for prompt payment. Here are some steps to consider:

- Set Clear Payment Terms: Ensure that your clients understand your payment terms. Specify due dates and late fees clearly in contracts and invoices.

- Send Regular Reminders: Use automated systems to send payment reminders before and after the due date. This keeps your invoices top of mind for your clients.

- Follow Up Promptly: Follow up with clients as soon as a payment is overdue. A polite email or phone call can often resolve the issue quickly.

- Offer Multiple Payment Options: Make it easy for clients to pay by offering various payment methods. Melio Payments, for instance, supports bank transfers and credit cards, which can expedite the payment process.

- Maintain Good Relationships: Establish and maintain good relationships with your clients. This encourages timely payments and open communication.

Using Collection Agencies Wisely

Sometimes, despite your best efforts, some invoices remain unpaid. In such cases, using collection agencies can help. Here are some tips:

- Choose Reputable Agencies: Select collection agencies with a good track record. Look for agencies that specialize in your industry.

- Understand Their Fees: Collection agencies typically charge a percentage of the collected amount. Ensure you understand their fee structure before signing a contract.

- Communicate Clearly: Provide the collection agency with all necessary information. This includes invoices, contracts, and any communication with the client.

- Monitor Progress: Keep track of the agency’s efforts. Regular updates can ensure that the collection process is on track.

- Negotiate Settlements: Sometimes, negotiating a lower amount can be more beneficial than waiting for full payment. Agencies can often facilitate these negotiations.

By improving your collection processes, you can enhance your business’s cash flow. Use tools like Melio Payments to streamline these processes and ensure timely payments.

Strategy 9: Secure Short-term Financing

Securing short-term financing can significantly improve your cash flow. It provides immediate funds to cover operational costs and manage unexpected expenses. This strategy ensures your business remains solvent during cash crunches.

Understanding Different Financing Options

There are various short-term financing options available for businesses. Each has its benefits and drawbacks. Understanding these options helps in making informed decisions.

| Financing Option | Benefits | Drawbacks |

|---|---|---|

| Business Line of Credit | Flexible use of funds | Variable interest rates |

| Invoice Financing | Quick access to cash | Fees on unpaid invoices |

| Short-Term Loan | Fixed repayment schedule | Higher interest rates |

| Credit Card | Immediate funds available | High-interest rates |

Choosing The Right Financing For Your Business

Selecting the right financing option is crucial for your business. Consider the following factors:

- Cost: Evaluate the interest rates and fees associated with each option.

- Repayment Terms: Understand the repayment schedule and terms.

- Funding Speed: How quickly do you need the funds?

- Flexibility: Can you use the funds as needed, or are there restrictions?

Melio Payments offers a solution that integrates with various financing options. It provides flexible payment scheduling and no subscription fees. This helps manage cash flow efficiently. Melio’s features like bill pay and invoice management can streamline your financial operations. This reduces manual errors and saves time.

Using a service like Melio Payments can improve vendor relationships. It ensures timely payments and offers a user-friendly interface. The platform also integrates with QuickBooks, which simplifies accounting tasks. With robust security measures, your financial data stays protected.

Short-term financing can be a powerful tool to keep your business running smoothly. Choose the right option that fits your needs and leverage tools like Melio Payments to manage your finances effectively.

Strategy 10: Maintain A Cash Reserve

Maintaining a cash reserve is essential for improving cash flow. It provides a safety net for unexpected expenses and ensures smooth business operations. A well-managed cash reserve helps businesses stay afloat during lean periods and take advantage of sudden opportunities.

Setting Up An Emergency Fund

Establishing an emergency fund is the first step in maintaining a cash reserve. This fund should cover at least three to six months of operating expenses. Begin by calculating your average monthly expenses, including rent, salaries, utilities, and other essential costs.

| Expense Type | Monthly Cost |

|---|---|

| Rent | $2,000 |

| Salaries | $10,000 |

| Utilities | $500 |

| Other Costs | $1,500 |

Once you have the total, multiply it by the number of months you want to cover. Set aside this amount in a separate account. This will ensure the funds are available when needed.

Regularly Reviewing And Adjusting Cash Reserves

Regular reviews are vital to maintain an effective cash reserve. Schedule quarterly reviews to assess your cash flow and expenses. Adjust your emergency fund based on changes in your business or market conditions.

- Track changes in expenses and income

- Analyze financial statements

- Identify seasonal trends

Use these insights to adjust your cash reserve. Increase or decrease the fund as necessary to ensure it meets your current needs. Staying proactive helps in managing cash flow effectively.

Frequently Asked Questions

What Is Cash Flow?

Cash flow refers to the movement of money in and out of your business. It indicates financial health and liquidity.

How To Improve Cash Flow?

Improve cash flow by managing expenses, increasing sales, and optimizing inventory. Regularly review financial statements for better control.

Why Is Cash Flow Important?

Cash flow is crucial for daily operations, paying bills, and funding growth. It ensures your business remains solvent and sustainable.

What Affects Cash Flow?

Factors include sales volume, expenses, credit terms, and seasonal fluctuations. Effective management can mitigate negative impacts on cash flow.

Conclusion

Effective cash flow management is crucial for business success. Using tools like Melio Payments can simplify your financial operations. It offers bill pay, invoice management, and multiple payment methods. These features enhance efficiency and improve vendor relationships. Melio Payments also integrates seamlessly with QuickBooks, streamlining your accounting processes. You can schedule payments and customize approval workflows, ensuring proper authorization. With no subscription fees, Melio Payments is a cost-effective solution for your business needs. To learn more, visit Melio Payments. Improve your cash flow today!