How to Use a Credit Card to Build Credit

Use a credit card responsibly by making timely payments and keeping the balance low. This helps build a positive credit history.

Credit cards can be powerful tools for building a strong credit score. By using them wisely, you can demonstrate financial responsibility to credit bureaus. Start by choosing a credit card with a low interest rate and no annual fee. Make small purchases each month and pay off the balance in full.

Consistently paying on time shows lenders you can manage credit effectively. Avoid maxing out your card to keep your credit utilization ratio low. Monitoring your credit report regularly helps you track progress. Building good credit takes time, but disciplined use of a credit card can lay a solid foundation.

Choosing The Right Credit Card

Choosing the right credit card can greatly impact your credit score. The right card helps you build credit effectively and avoid debt. Here’s how to make an informed choice.

Types Of Credit Cards

There are several types of credit cards available. Each type caters to different needs and credit histories.

- Secured Credit Cards: These require a cash deposit as collateral. They are ideal for those with no or poor credit history.

- Unsecured Credit Cards: No deposit is needed. These are suitable for those with a fair to good credit score.

- Student Credit Cards: Designed for college students. These often have lower credit limits and special features.

- Store Credit Cards: Issued by specific retailers. These can help build credit but often have higher interest rates.

Interest Rates And Fees

Interest rates and fees can significantly impact your overall costs. Pay attention to these details:

| Feature | Details |

|---|---|

| Annual Percentage Rate (APR) | The interest rate charged on your balance. Look for a lower APR to save on interest. |

| Annual Fees | Some cards charge yearly fees. Ensure the benefits outweigh these fees. |

| Penalty Fees | Late payment and over-limit fees can add up. Choose a card with reasonable penalty fees. |

When selecting a credit card, focus on the card type and cost. This helps you build credit without unnecessary expenses.

Understanding Your Credit Score

Understanding your credit score is essential to building credit. A credit score reflects your financial behavior. It affects your ability to get loans, rent apartments, and sometimes even job offers. Learning how credit scores work can help you use your credit card wisely.

Credit Score Components

Credit scores are made up of five main components. Each component has a different impact on your score.

| Component | Percentage of Score |

|---|---|

| Payment History | 35% |

| Amounts Owed | 30% |

| Length of Credit History | 15% |

| New Credit | 10% |

| Credit Mix | 10% |

Payment history is the most important component. Make all payments on time. Amounts owed refers to your credit utilization. Keep your credit utilization below 30% for a good score. The length of credit history considers how long your accounts have been open. Older accounts help your score. New credit looks at recent credit inquiries and new accounts. Credit mix involves the variety of credit types you have, such as credit cards, mortgages, and auto loans.

Impact Of Credit Card Usage

Using your credit card wisely can improve your credit score. Follow these tips to maximize your credit card benefits:

- Pay your bill on time: Late payments hurt your score.

- Keep balances low: High balances negatively impact your utilization rate.

- Use your card regularly: Regular usage shows active credit management.

- Don’t close old accounts: Older accounts contribute to your credit history length.

- Limit new credit applications: Too many applications can lower your score.

By following these practices, you can build a strong credit score. A good credit score opens many financial doors. Use your credit card responsibly to achieve your financial goals.

Setting Up Your Credit Card

Setting up your credit card correctly is crucial for building good credit. This process involves several steps that ensure you use your credit card wisely and responsibly.

Applying For A Credit Card

First, choose the right credit card. Look for cards with low fees and good rewards. Next, check your credit score. This helps you understand what cards you might qualify for.

Now, fill out the application form. Provide accurate information, including your income and employment details. Once submitted, wait for approval. This may take a few days.

Activating And Setting Limits

After approval, you’ll receive your card in the mail. The first step is to activate it. Follow the instructions provided by the issuer. Usually, this involves calling a phone number or visiting a website.

Once activated, set your spending limits. Decide on a monthly budget for your card. This helps prevent overspending. Some cards allow you to set alerts. These alerts notify you when you are close to your limit.

| Step | Action |

|---|---|

| 1 | Choose the right card |

| 2 | Check your credit score |

| 3 | Fill out the application |

| 4 | Activate your card |

| 5 | Set spending limits |

By following these steps, you can set up your credit card in a way that helps build your credit effectively and responsibly.

Using Your Credit Card Wisely

Building a good credit history is essential for financial success. Using your credit card wisely can help achieve this goal. Here, we will explore how to make small purchases and keep your credit utilization low.

Making Small Purchases

Start by making small purchases with your credit card. This approach helps you manage your spending effectively.

- Buy daily essentials like groceries or gas.

- Avoid large purchases that can lead to debt.

- Pay off your balance in full each month.

Paying off your balance on time shows you are responsible. This will boost your credit score.

Keeping Utilization Low

Keeping your credit utilization low is crucial. Credit utilization is the ratio of your credit card balance to your credit limit.

| Credit Limit | Recommended Balance |

|---|---|

| $1,000 | Below $300 |

| $2,000 | Below $600 |

Use less than 30% of your credit limit. This shows you manage credit well.

- Check your balance regularly.

- Set up alerts to avoid overspending.

Maintaining low utilization helps improve your credit score.

Paying Off Your Balance

Paying off your credit card balance is essential for building credit. It shows lenders you are responsible with money. This can improve your credit score over time.

Importance Of On-time Payments

On-time payments are crucial for a healthy credit score. Payment history makes up 35% of your credit score. Set reminders to pay your bill before the due date. Many banks offer automatic payment options. These can ensure you never miss a payment. Late payments can hurt your credit score and lead to fees.

Avoiding Interest Charges

Avoiding interest charges saves you money and helps manage debt. Pay your balance in full each month. This way, you won’t accrue interest. Credit card interest rates can be high, sometimes over 20%. Paying only the minimum can lead to debt accumulation. Here’s how to avoid interest charges:

- Pay your balance in full each month.

- Monitor your spending to stay within your budget.

- Set up automatic payments.

Following these tips can help you avoid paying extra money in interest. This keeps your finances healthy and your credit score strong.

Monitoring Your Credit Report

Monitoring your credit report is vital for building strong credit. Keeping an eye on your report helps you spot errors and take action. Let’s explore how to monitor your credit report effectively.

Checking For Errors

Errors on your credit report can harm your credit score. Regularly checking for mistakes helps you catch them early. Follow these steps to check for errors:

- Get a free credit report from each major bureau: Equifax, Experian, and TransUnion.

- Look for incorrect personal information.

- Check for accounts that you did not open.

- Verify the payment history on each account.

Disputing Inaccuracies

If you find errors, you need to dispute them. Correcting inaccuracies can boost your credit score. Here are the steps to dispute inaccuracies:

- Gather documents that support your claim.

- Write a dispute letter to the credit bureau.

- Include copies of the supporting documents.

- Send the letter by certified mail.

- Wait for the bureau to investigate and respond.

Disputing errors can take time. But it’s worth the effort for a better credit score.

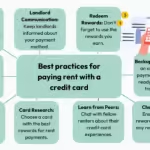

Handling Credit Card Rewards

Credit cards offer a great way to build credit. But they also come with rewards. Understanding how to handle credit card rewards can be very beneficial. This section will guide you through earning and redeeming points.

Earning Rewards

Most credit cards offer rewards for your spending. These rewards can be in the form of points, miles, or cashback. Here are some ways to earn rewards:

- Everyday Purchases: Use your card for groceries and gas.

- Bonus Categories: Some cards offer extra points on dining or travel.

- Welcome Bonuses: Spend a certain amount in the first few months.

Make sure to pay your balance in full each month. This helps you avoid interest charges. It also ensures you get the most value from your rewards.

Redeeming Points

Once you have earned rewards, you will want to redeem them. Here are some common ways to use your points:

| Redemption Option | Value |

|---|---|

| Travel | Often the best value |

| Cashback | Usually a fixed rate |

| Gift Cards | Good value for specific stores |

Check your card’s rewards program for the best options. Different cards offer different values for points. Choose the redemption option that suits your needs the best.

Avoiding Common Pitfalls

Using a credit card to build credit can be effective. But, there are common pitfalls you should avoid. This helps keep your credit score healthy. Let’s explore some of these common traps.

Overspending Risks

Overspending is a big risk with credit cards. It is easy to lose track of spending. Then, the bill comes, and it is more than expected. Here are some tips to avoid this:

- Set a monthly budget and stick to it.

- Track your spending regularly.

- Only buy what you can pay off in full.

Dealing With Debt

Debt can build up fast with credit cards. Interest rates are high, making it hard to pay off. Follow these steps to manage your debt:

- Pay your bill on time every month.

- Pay more than the minimum payment.

- Use automatic payments to avoid late fees.

By avoiding these pitfalls, you can use a credit card wisely. This will help you build a good credit score.

Frequently Asked Questions

How Can I Build Credit With A Credit Card?

To build credit, use your card responsibly. Pay off your balance in full every month. Keep your credit utilization low.

What Credit Card Is Best For Building Credit?

A secured credit card is great for building credit. It requires a deposit. This minimizes risk for lenders.

How Often Should I Use My Credit Card?

Use your credit card at least once a month. This shows regular activity. Always pay off your balance on time.

Does Paying My Credit Card In Full Help My Credit Score?

Yes, paying in full helps your credit score. It shows responsible use. It avoids interest charges.

Conclusion

Building credit with a credit card is simple with the right approach. Always pay on time and keep balances low. Monitor your credit score regularly. Use your card responsibly to establish a positive credit history. With these habits, you’ll see your credit score improve over time.