How To Open A Truist Checking Account: Simple Steps to Follow

Opening a Truist checking account is straightforward. You can complete the process online in a few steps.

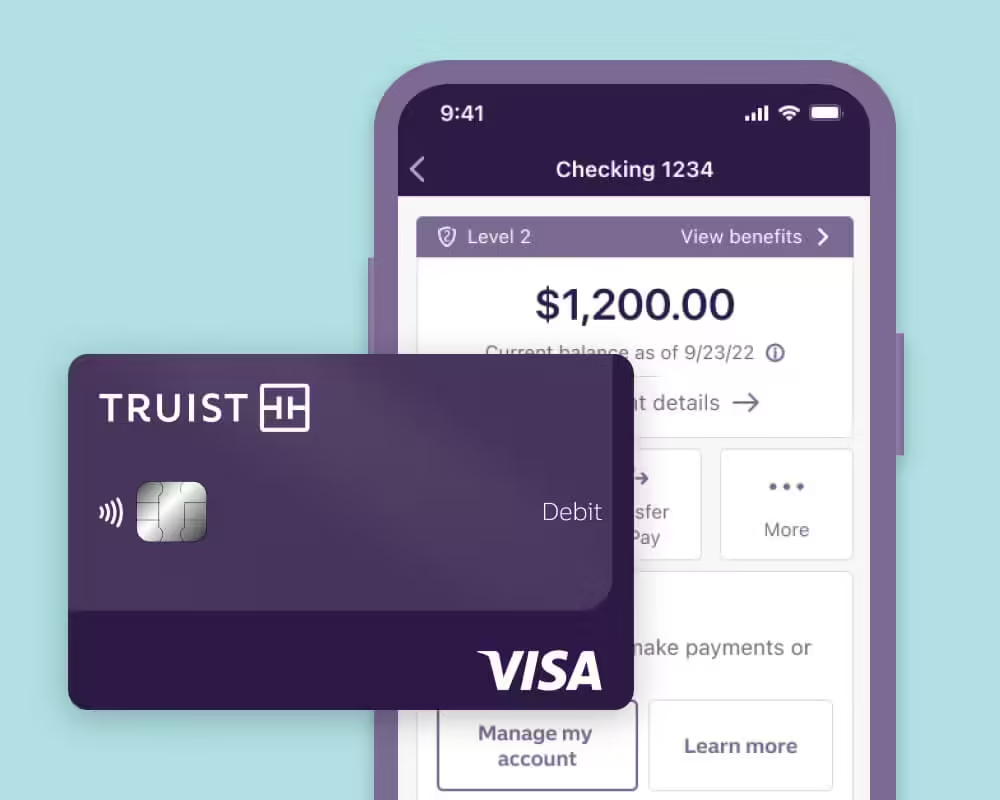

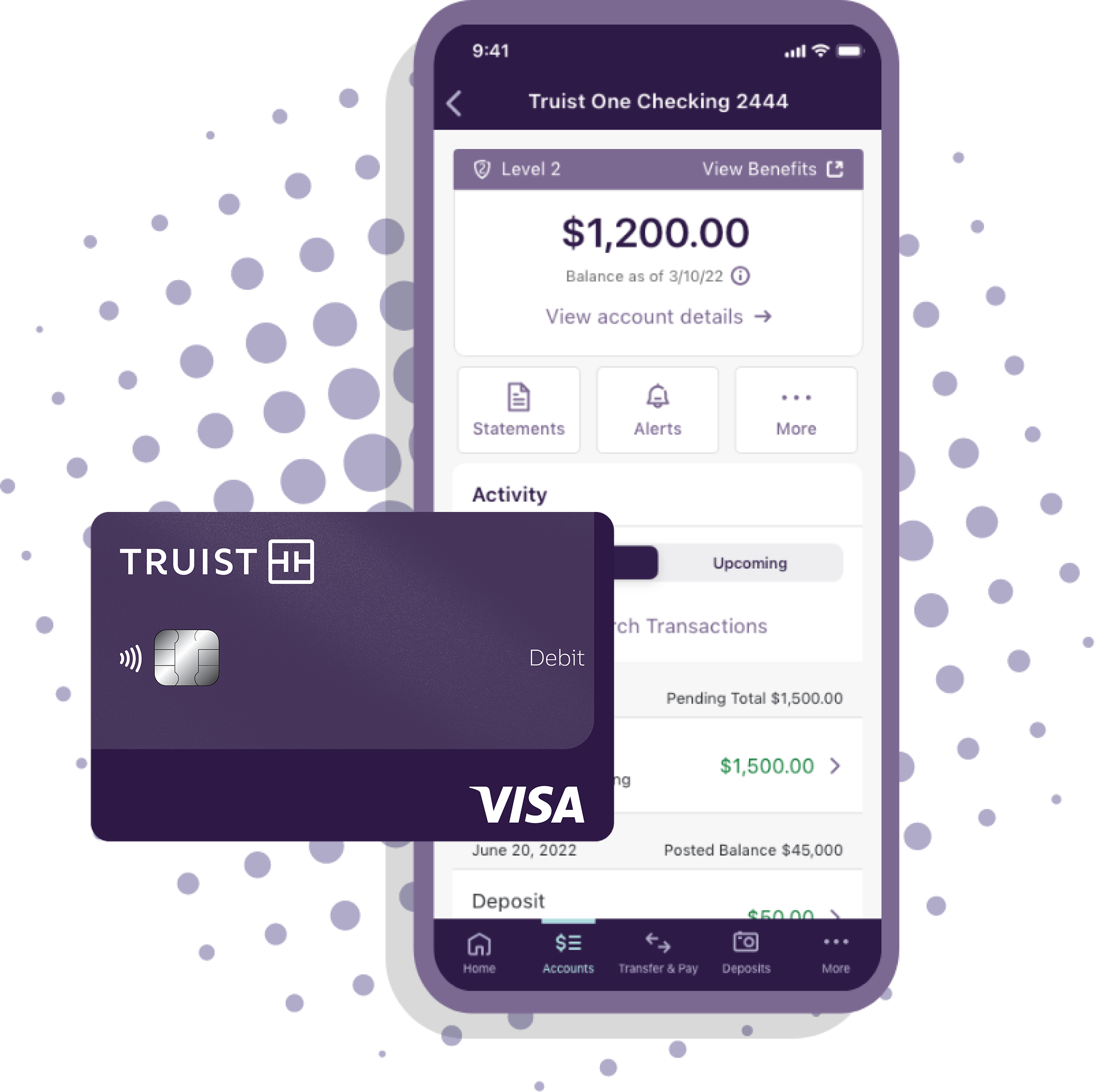

This guide will help you get started. Truist offers a flexible checking account known as the Truist One Checking Account. It’s designed to make your banking experience smooth and stress-free. With automatic upgrades and no overdraft fees, managing your money becomes easier. Plus, there’s a welcome offer of $400 if you meet the qualifying criteria. Whether you need easy account management through the Truist mobile app or access to various financial services, Truist has got you covered. Ready to enhance your banking experience? Let’s dive into the steps to open your Truist One Checking Account. For more details, visit the Truist website: Truist.

Introduction To Opening A Truist Checking Account

Opening a Truist One Checking Account can be a smart move for managing your finances. This flexible checking account offers automatic upgrades and no overdraft fees, designed to enhance your banking experience. Below, we’ll discuss why you should choose Truist, and provide an overview of the account opening process.

Why Choose Truist For Your Checking Account

Choosing Truist for your checking account comes with a host of benefits. Here are some compelling reasons:

- Automatic Upgrades: Your account enhances seamlessly over time.

- No Overdraft Fees: Avoid unexpected charges related to overdrafts.

- Qualifying Activities: Earn rewards by completing specific account-related actions.

- Welcome Offer: Earn $400 by opening an account online and meeting qualifying direct deposit criteria.

- Easy Management: Utilize the Truist mobile app for fast access and insights into your spending.

- Supportive Services: Access various Truist financial services, including loans, investments, and insurance.

Overview Of The Account Opening Process

Opening a Truist One Checking Account is straightforward. Here is an easy-to-follow guide:

- Visit the Truist Website: Go to Truist.

- Choose the Truist One Checking Account: Select the account that suits your needs.

- Enter Promo Code: Use promo code DC2425TR1400 during the account opening process.

- Complete the Application: Fill in your personal and financial information.

- Submit Minimum Deposit: Deposit a minimum of $50 to open the account.

- Set Up Direct Deposit: Ensure you meet the qualifying direct deposit criteria to earn the welcome offer.

Once your account is open, you can start enjoying the benefits and managing your finances with ease. Remember to keep your account in good standing to avoid forfeiture of rewards.

If you have any questions or need assistance, contact Truist customer service at 844-4TRUIST (844-487-8478).

Step 1: Research And Choose The Right Checking Account

Opening a Truist checking account starts with selecting the right one for your needs. This step ensures you get the best benefits and features that align with your financial habits. Let’s dive into the details.

Different Types Of Truist Checking Accounts

Truist offers various checking accounts, each tailored to different needs. The Truist One Checking Account is a flexible option that provides automatic upgrades and no overdraft fees. This account is designed to enhance your banking experience over time.

- Truist One Checking Account: Ideal for those who want seamless account enhancements and no surprise overdraft charges.

- Other checking accounts: Truist may offer additional options with varied features for different banking needs.

Comparing Features And Benefits

When choosing a checking account, compare the features and benefits that each account offers. Here is a quick comparison:

| Feature | Truist One Checking Account |

|---|---|

| Automatic Upgrades | Yes |

| No Overdraft Fees | Yes |

| Welcome Offer | $400 for new accounts with qualifying direct deposits |

| Minimum Opening Deposit | $50 |

| Easy Management | Truist Mobile App |

Understanding Fees And Requirements

It’s crucial to understand any fees and requirements associated with your chosen checking account. Here’s what you need to know about the Truist One Checking Account:

- Minimum Opening Deposit: $50

- Reward Eligibility: Account must be opened online using promo code DC2425TR1400

- Account Maintenance: Ensure the account remains in good standing to avoid reward forfeiture

- Residency Requirements: Available to US residents in specific states

By understanding these details, you can avoid any unexpected fees and ensure you meet all requirements to enjoy the full benefits of your Truist checking account.

Step 2: Gather Necessary Documentation

Before opening your Truist One Checking Account, it’s essential to gather all the required documentation. Proper preparation ensures a smooth and quick account opening process. Below, we detail the necessary documents and information you need to have ready.

Required Identification And Personal Information

To open a Truist One Checking Account, you need to provide valid identification and personal details. Here is what you should prepare:

- Government-Issued ID: This could be a driver’s license, state ID, or passport.

- Social Security Number: Your SSN is necessary for identity verification.

- Date of Birth: Ensure you have your exact birth date ready.

- Contact Information: Include your phone number and email address.

Proof Of Address And Other Required Documents

In addition to your ID and personal information, you must provide proof of your current address and other supporting documents. The following items are typically required:

- Utility Bill: A recent bill showing your name and address.

- Bank Statement: A statement from another bank account in your name, if available.

- Lease Agreement: If you rent, provide a copy of your lease agreement.

- Mortgage Statement: If you own your home, provide a recent mortgage statement.

Ensure all documents are current and display your full name and address clearly. Proper documentation ensures your Truist One Checking Account is set up without delays.

Step 3: Begin The Application Process

Now that you’ve gathered your information and chosen the right account, it’s time to start the application process for your Truist One Checking Account. There are three simple ways to do this: online, in-person at a branch, or with the help of customer service. Follow the instructions below to get started.

Starting Your Application Online

Applying online is the easiest and fastest way to open your Truist One Checking Account. Follow these steps to get started:

- Visit the Truist website.

- Click on “Open an Account” and select “Truist One Checking Account.”

- Enter the required personal information, such as your name, address, and Social Security number.

- Provide details for the initial deposit (minimum $50).

- Use the promo code DC2425TR1400 to qualify for the $400 welcome offer.

- Review and submit your application.

Once submitted, you’ll receive a confirmation email with further instructions.

Visiting A Truist Branch

If you prefer to apply in person, visit a nearby Truist branch. Here’s what you need to do:

- Locate a Truist branch using the branch locator on their website.

- Bring your identification documents, such as a driver’s license or passport.

- Have your initial deposit ready (minimum $50).

- Inform the branch representative that you want to open a Truist One Checking Account.

- Provide the promo code DC2425TR1400 to qualify for the $400 welcome offer.

The branch representative will guide you through the application process and answer any questions you may have.

Contacting Customer Service For Assistance

If you need help with your application, Truist customer service is ready to assist. Here’s how you can reach them:

| Contact Method | Details |

|---|---|

| Phone | Call 844-4TRUIST (844-487-8478) |

| Visit the Truist website and use the contact form |

Customer service representatives can guide you through the application process, answer questions, and help you use the promo code DC2425TR1400.

Step 4: Complete The Application Form

To open a Truist One Checking Account, follow these steps to complete the application form. This step is crucial and ensures your account setup process is smooth. Below, we will break down the steps to help you fill out the form accurately.

Filling In Personal Information

Start by entering your personal information. This includes:

- Full Name

- Date of Birth

- Address

- Contact Information (Phone Number and Email)

- Social Security Number

Ensure all details are accurate. Mistakes can delay your application.

Selecting Account Preferences

Next, choose your account preferences. You can select options such as:

- Account Type: Truist One Checking Account

- Initial Deposit Amount: Minimum $50

- Automatic Upgrades: Opt-in for seamless enhancements

These preferences help tailor your banking experience to your needs.

Reviewing And Submitting Your Application

Before submission, review your application. Double-check the following:

- Personal Information: Ensure accuracy

- Account Preferences: Confirm your selections

- Promo Code: DC2425TR1400 for a $400 welcome offer

After reviewing, submit your application. You will receive a confirmation email. Your reward will be processed within 4 weeks if you meet the requirements.

For any assistance, contact Truist customer service at 844-4TRUIST (844-487-8478).

Step 5: Fund Your New Checking Account

Now that you’ve set up your Truist One Checking Account, it’s time to fund it. You have several options to make your initial deposit and start using your new account. Let’s explore these options in detail.

Initial Deposit Options

To get started, you need to make an initial deposit of at least $50. You can do this in various ways:

- Cash Deposit: Visit a Truist branch or ATM and deposit cash directly into your account.

- Check Deposit: Write a check to yourself and deposit it using the Truist mobile app or at a branch.

- Online Transfer: Transfer funds from another bank account using the routing and account number provided by Truist.

Setting Up Direct Deposit

Setting up direct deposit can be a convenient way to fund your account regularly. Here’s how you can set it up:

- Contact your employer’s payroll department.

- Provide them with your Truist checking account number and routing number.

- Fill out any necessary direct deposit forms required by your employer.

Once set up, your paycheck will be automatically deposited into your Truist account, making it easier to manage your finances.

Transferring Funds From Another Account

If you have another bank account, you can transfer funds to your new Truist checking account. Follow these steps:

| Step | Action |

|---|---|

| 1 | Log in to your existing bank’s online banking platform. |

| 2 | Navigate to the transfer section. |

| 3 | Select the option to transfer funds to an external account. |

| 4 | Enter your Truist account details, including the routing and account numbers. |

| 5 | Specify the amount you wish to transfer and complete the transaction. |

Transferring funds this way ensures that your Truist account is funded quickly and efficiently.

Step 6: Finalize And Access Your Account

After completing the initial steps to open your Truist One Checking Account, the final step is to finalize and access your new account. In this step, you will receive your account details, set up online and mobile banking, and order your checks and debit cards. Let’s break down each part for a smooth transition.

Receiving Your Account Details

Upon approval, you will receive your account details via email. This email will contain your new account number and routing number. Make sure to store this information securely. You will need it for various banking activities.

Setting Up Online And Mobile Banking

To manage your account conveniently, set up online and mobile banking. Follow these steps:

- Visit the Truist website or download the Truist mobile app.

- Click on the registration link and enter your account details.

- Create a username and password.

- Verify your identity using the prompts provided.

- Complete the setup by confirming your email and phone number.

Once registered, you can easily access your account, check balances, transfer funds, and more.

Ordering Checks And Debit Cards

To order checks and debit cards, log in to your online account and navigate to the “Order Checks” or “Request Debit Card” section. Follow these steps:

- Select the design and quantity of checks you prefer.

- Provide the necessary delivery information.

- For debit cards, confirm your mailing address and choose any personalized options.

Your checks and debit cards will be mailed to your address within a few business days.

By completing these steps, your Truist One Checking Account will be fully operational. Enjoy the benefits of easy management, no overdraft fees, and potential rewards by meeting qualifying activities.

Common Issues And Troubleshooting

Opening a Truist One Checking Account is generally straightforward. But sometimes you may face issues. This section will help you understand common problems and how to resolve them.

Dealing With Application Rejections

If your application is rejected, check the following:

- Eligibility Criteria: Ensure you meet all the requirements, such as residency in specific states.

- Promo Code: Verify that you’ve used the correct promo code,

DC2425TR1400. - Minimum Deposit: Confirm that you’ve met the minimum opening deposit of $50.

Reapply after addressing these points. Always double-check all entered information.

Addressing Common Problems During Setup

During the setup of your Truist One Checking Account, you might encounter:

| Problem | Solution |

|---|---|

| Mobile App Issues | Ensure your app is updated to the latest version. |

| Verification Delays | Check your email for any required verification steps. |

| Deposit Issues | Ensure your funding source has sufficient funds. |

Contacting Support For Further Assistance

If you still face issues, contact Truist Customer Service:

- Phone: Call 844-4TRUIST (844-487-8478) for immediate help.

- Email: Reach out via their support email for detailed queries.

- Branch Visit: Visit a local branch for in-person assistance.

Keep your account details handy for faster resolution.

Pros And Cons Of Truist Checking Accounts

Opening a Truist One Checking Account can be a great decision for many. Understanding the advantages and drawbacks helps you make an informed choice.

Advantages Of Truist Checking Accounts

- Automatic Upgrades: Your account will improve over time without you having to do anything.

- No Overdraft Fees: Avoid unexpected charges related to overdrafts. This can save you money and give you peace of mind.

- Welcome Offer: Earn $400 when you open an account online and meet qualifying direct deposit criteria.

- Easy Management: The Truist mobile app offers fast access and insights into your spending. This makes managing your finances simpler.

- Supportive Services: Access various financial services, including loans, investments, and insurance.

Potential Drawbacks To Consider

- Minimum Opening Deposit: You need at least $50 to open an account. This might be a barrier for some.

- Eligibility Requirements: The welcome offer is only valid for new accounts opened online within specified states and dates.

- Reward Conditions: The $400 reward is deposited within 4 weeks after meeting requirements. Your account must be in good standing.

- Reward Forfeiture: You may lose the reward if the account type changes, the account is closed, or the balance is zero/negative when verified.

- Non-Transferable Offers: The welcome offer cannot be combined with other checking offers and may change or end at any time.

Who Should Consider A Truist Checking Account?

The Truist One Checking Account offers many benefits. It’s ideal for individuals seeking automatic upgrades and no overdraft fees. Let’s explore who might benefit the most from this account.

Ideal Users And Scenarios

This account is perfect for those who want a flexible banking experience. If you often worry about overdraft fees, this account eliminates that concern. It is also beneficial for individuals who value earning rewards through qualifying activities. New customers can earn a $400 welcome offer by meeting specific direct deposit criteria.

Young professionals and students might find the minimum opening deposit of $50 attractive. Additionally, the easy management via the Truist mobile app makes it convenient for those who prefer to handle their finances on the go.

Comparing Truist To Other Banks

| Feature | Truist One Checking | Other Banks |

|---|---|---|

| Minimum Opening Deposit | $50 | $100+ |

| Overdraft Fees | None | $35 (average) |

| Rewards | $400 Welcome Offer | Varies, often lower |

| Account Upgrades | Automatic | Manual/None |

Comparing Truist to other banks, the Truist One Checking Account stands out. Many banks require a higher minimum deposit. They often charge overdraft fees, usually around $35. Additionally, Truist’s automatic upgrades simplify account management. In contrast, other banks may offer minimal or no upgrades without manual intervention.

In conclusion, the Truist One Checking Account offers several advantages. It is a great choice for those seeking a flexible, fee-free banking experience with rewards.

Frequently Asked Questions

How Do I Start A Truist Checking Account?

To start a Truist checking account, visit the Truist website or a local branch. Follow their step-by-step application process.

What Documents Are Required?

You need a valid ID, Social Security number, and proof of address. Additional documents may be required based on your situation.

Can I Open An Account Online?

Yes, you can open a Truist checking account online. Visit their website and complete the online application form.

Are There Any Fees?

Truist checking accounts may have monthly maintenance fees. Check the specific account details to understand any applicable fees and how to waive them.

Conclusion

Opening a Truist One Checking Account is simple and beneficial. It offers automatic upgrades and no overdraft fees. Enjoy a $400 welcome offer, easy account management, and various financial services. Start your banking journey today with Truist Retail Checking.